24K-Production

Introduction

It’s been almost 6 months since I wrote a bearish article on SA about alcoholic and non-alcoholic beverages company Splash Beverage Group, Inc. (NYSE:SBEV), in which I said that it was far from profitability and that a capital increase in the near future was likely.

Well, the company raised $8.1 million in February through its shelf registration statement, but I think that more stock dilution in the near future is inevitable as the loss from operations keeps expanding despite strong sales growth. Splash Beverage has an asset-light business model and I think it could run out of cash before the end of September. Let’s review. The company is expected to report second-quarter earnings on or about August 15.

Overview of the recent developments

Splash Beverage specializes in acquiring and expanding undervalued beverage brands and it sells its products through offline and online retailers as well as directly to consumers. The company has a vertically integrated B2B and B2C e-commerce distribution platform named Qplash, which sells products on both Amazon (AMZN) and Shopify (SHOP). Splash Beverage currently has four brands in its portfolio – TapouT (high-performance sports drinks), Salt Tequila (blanco agave tequila), Copa Di Vino (premium wine by the glass), and Pulpoloco (Spanish sangria).

Splash Beverage

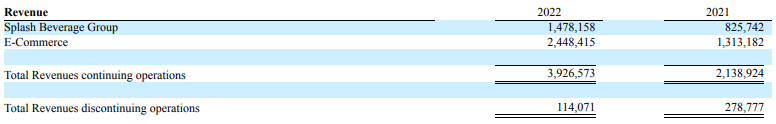

The aim of Splash Beverage is to expand its sales through distribution agreements, and it signed 12 of them in Q1 2022 alone. Yet, its forte seems to be e-commerce sales as those grew by 86% in the period to $2.45 million.

Splash Beverage

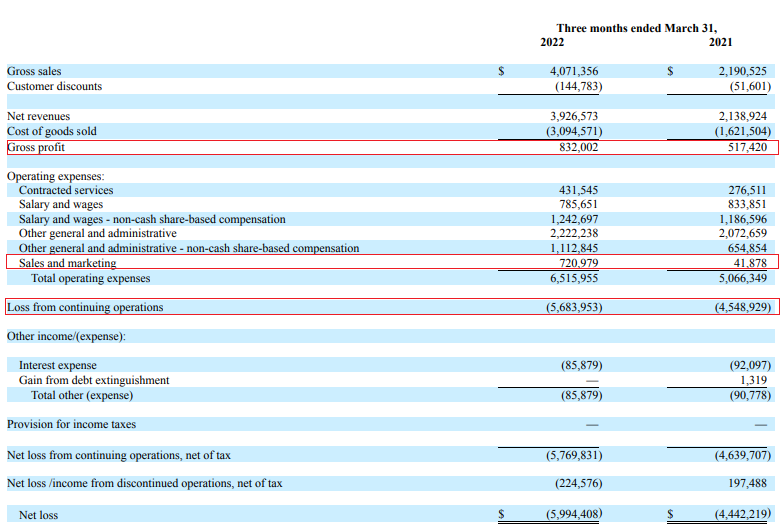

Unfortunately for investors, it seems that the online sales margins are slim as the gross profit margin of the company slipped to 20.4% in Q1 2022 compared to 23.6% a year earlier. And with sales and marketing expenses ramping up, the loss from operations rose by 25% year on year to $5.68 million. It seems that each dollar spent on marketing brought in about three dollars of additional sales, but this just isn’t worth it when you have a business with low margins.

Splash Beverage

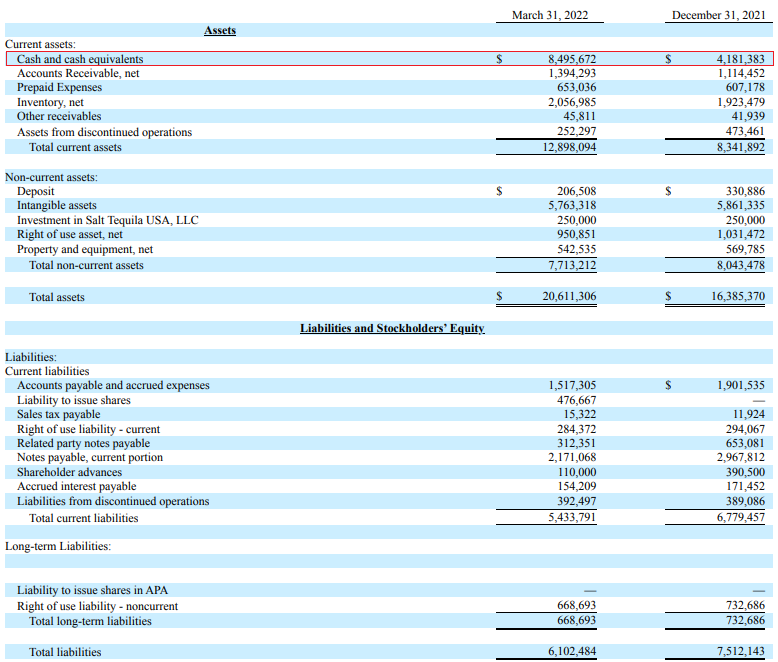

Net cash used in operating activities came in at $4.68 million in Q1 2022 which means that at this rate those $8.1 million raised in February will be exhausted in less than 6 months. Turning our attention to the balance sheet, Splash Beverage has $8.5 million in cash as of June and another factor that is set to accelerate the cash burn is the purchase of an 80% stake in Pulpoloco Sangria. This transaction was announced in June and is expected to be completed by the end of August, and I think that at this point we can expect another capital increase very soon. Depending on the price paid, this could be a good deal, as Splash Beverage is currently just a distributor of Pulpoloco, and ownership of the producing company should allow it to improve margins through vertical integration as well as expanded sales. At the moment, Splash Beverage is the exclusive importer of Pulpoloco for the USA.

However, Splash Beverage is currently losing about three dollars for every two dollars of sales, and it seems that any synergies from the purchase of Pulpoloco Sangria will be inconsequential in the grand scheme of things. In my view, Splash Beverage just doesn’t have a good business model, as its margins are nowhere near where they need to be for the company to be profitable. And if Splash Beverage decides to raise the prices of its products, I think it’s likely that sales could drop off a cliff as this is a very competitive market. And with cash accounting for the majority of the value of tangible assets, there isn’t much that can be sold when Splash Beverage runs into liquidity issues again.

Splash Beverage

In my view, the most likely scenario for the near future is that revenues continue to grow thanks to new distribution agreements and expanding marketing expenses but operating losses continue to increase. This means that a new capital increase and more stock dilution in the near future are all but certain.

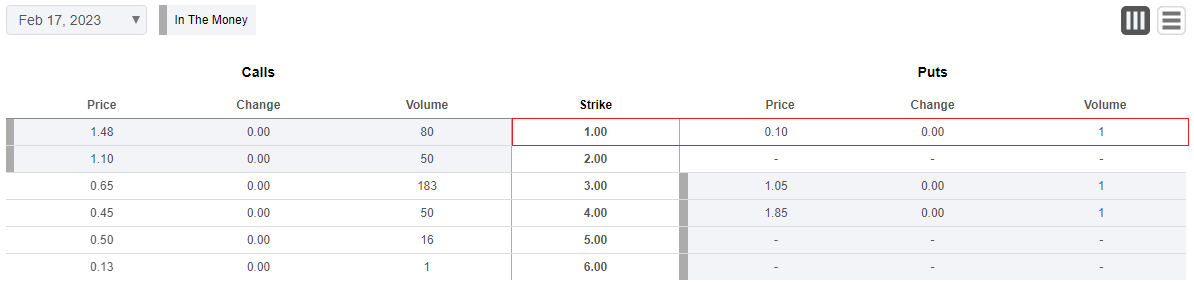

Overall, I’m bearish on Splash Beverage and I think that its share price is likely to return to its 2022 low of $0.99 over the coming months. However, data from Fintel shows that the short borrow fee rate stands at 38.08% as of the time of writing. In addition, it currently takes 4.88 days to cover so it could be best for risk-averse investors to avoid this stock. In case you have strong risk tolerance, I think it could be worth buying a small amount of February put options with a strike price of $1.00 as those are trading at just $0.10 at the moment.

Seeking Alpha

So, what are the risks for the bear case? Well, I think there are two major ones. First, I could be underestimating the positive effects of the purchase of Pulpoloco Sangria and that this acquisition significantly improves the margins of the business. Second, sometimes the share prices of microcap companies can increase for spurious and unknown reasons, and it’s possible that this will happen again here in the future.

Investor takeaway

Splash Beverage booked an impressive revenue growth in Q1 2022 thanks to higher marketing investment, but the gross margin fell, and the operating losses are expanding. In my view, the business model seems to be flawed and I doubt that the acquisition of Pulpoloco Sangria will turn things around.

With the current cash burn rate, Splash Beverage is likely to run out of funds in the next month or two and I think that more stock dilution is inevitable. Overall, I think the business is close to worthless and I’m bearish. However, the short borrow fee rate stands close to 40% so it could be best to avoid this stock for now. Yet, if you have high risk tolerance, I think that buying a very small amount of February put options with a strike price of $1.00 could be worth a shot.

Be the first to comment