Petmal

Investment Thesis

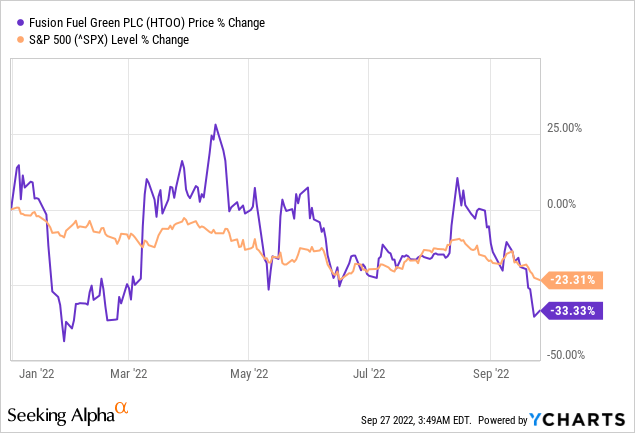

Fusion Fuel Green PLC (NASDAQ:HTOO) is a pre-revenue Ireland-based small-cap hydrogen energy sector company that has lost half its value in the previous year and a third of its value YTD. The high systemic risks in the market have dragged down this stock because of its low, ~$70 million, market cap and high beta.

However, this also means that if the industry uptrends, the macro-economy will likely carry its stock price upwards, given that the company exhibits a healthy financial position and performance backed by operational leverage.

Hydrogen economy is not a new concept, and many investors have historically lost fortunes investing in promising hydrogen technologies. This is because the sector is still immature and couldn’t economically compete with the available energy sources, making the previously available securities speculative at best.

The global technological advancements in the renewable energy sector, fueled by the green movement and stoked by rising energy prices, have changed the market dynamics. Viable investments operating in this segment have to prove two things to garner a positive market sentiment and shareholder confidence:

- The industry has a bullish long-term trajectory; and

- The company can produce economically viable and practically usable fuel.

Going down the article, it appears the answer to these questions falls in favor of the company, making me rate it as a buy. However, as with any young growth stock, the execution risks must be closely monitored.

Why Isn’t Hydrogen Mainstream?

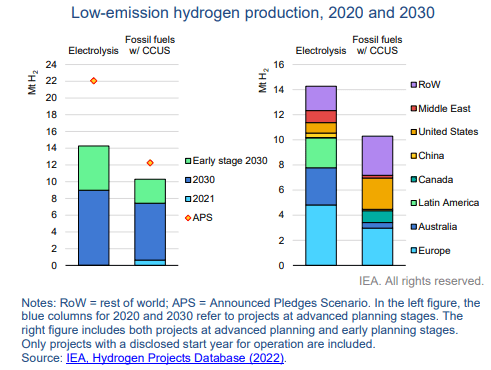

Hydrogen is the most abundant element in the world, and naturally, innovators have eyed hydrogen as a potential source of sustainable energy for centuries. First off, Hydrogen fuel is practically used by space agencies to launch rockets, producing no waste products except water. The fuel is practically usable, but we still struggle to see any hydrogen-powered machinery around us because cost and efficiency have made it economically unfeasible. In fact, low-emission hydrogen production in 2021 was less than 1 Mt globally.

One of the key reasons that hydrogen is so hard to convert efficiently into fuel is that it is extremely reactive. Since most of the hydrogen fuel is produced from natural gas through steam methane reforming or water electrolysis, it either generates enough carbon during production to deplete its own carbon-neutral footprint or ends up consuming more power than it produces.

Currently, hydrogen is almost entirely produced using fossil fuels, generating around 830 million tonnes of carbon dioxide per year (MtCO2/yr), equivalent to the annual CO2 emissions of Indonesia and the UK combined.

IEA

Green hydrogen or zero-emission hydrogen can be produced by splitting water molecules through electrolysis from solar energy using electrolyzers. However, the economic viability remains questionable since the solar energy market in itself is still immature.

Similarly, hydrogen as a vehicle fuel is also expensive because it either needs to be compressed in expensive high-pressure tanks by using other forms of energy or converted from chemical energy to power through fuel cells, which are very expensive because of their complex engineering and expensive materials like platinum.

Will it Ever Be Economically Viable?

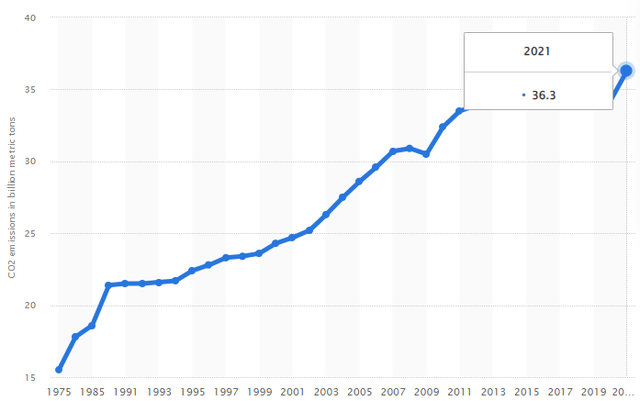

Decarbonization has become a critical issue for the world, with governments scouring for viable solutions as global energy-related CO2 emissions reached an all-time high in 2021. This has been a critical global issue for decades, generating strong interest from governments, companies, and individuals.

Energy-related carbon dioxide emissions (Statista)

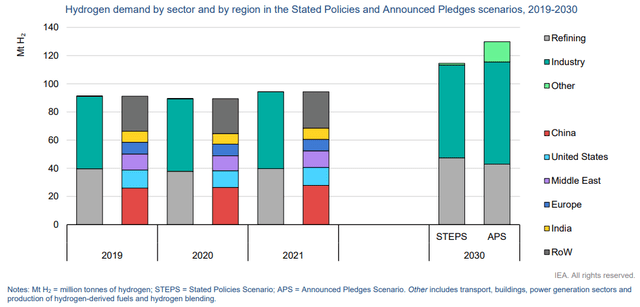

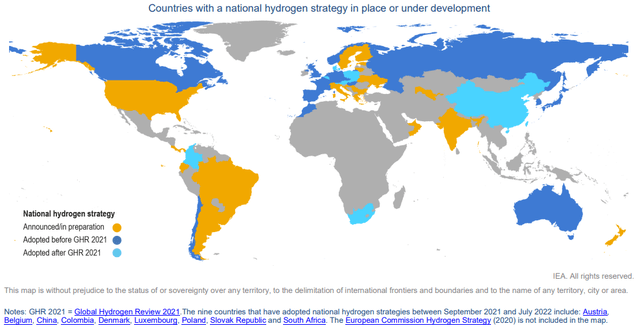

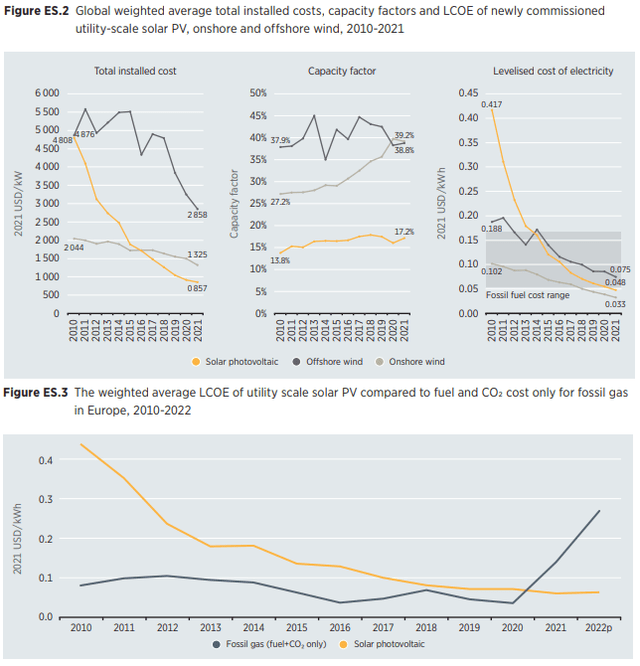

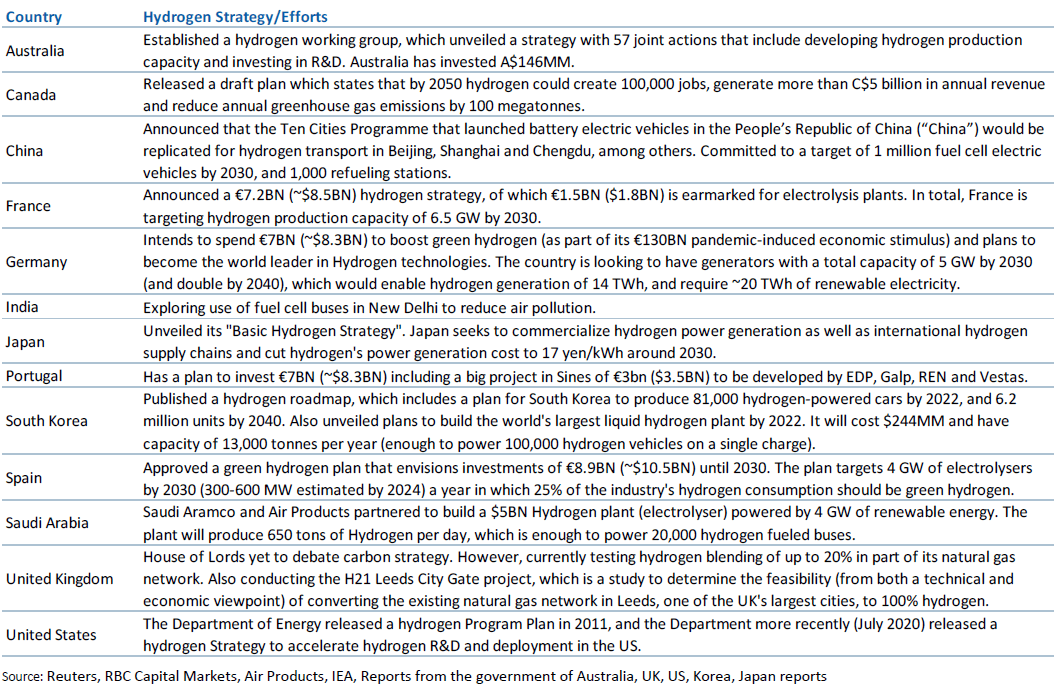

As solar and wind-based renewable energy becomes cheaper, their expected share of the future primary energy mix will rise, as evident by the support for hydrogen projects in the IRA, the Infrastructure Investment and Jobs Act, and the bipartisan infrastructure law in the US and the 2050 objective of 80–95% emissions reduction compared to the 1990s in Europe. Over a longer-term horizon, these declining costs and zero-emission targets will be a driving factor for the hydrogen sector.

IEA

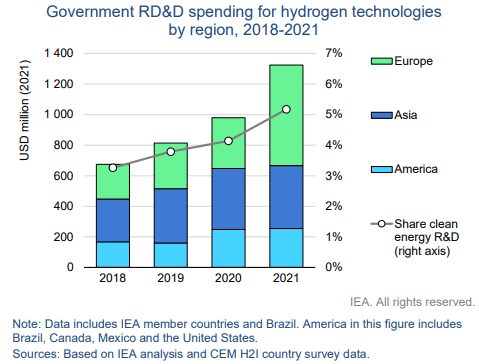

In the short-term, green hydrogen projects remain capital cost-intensive as R&D plays an integral role in making this sector economically efficient and viable, and first-movers face substantial risks. To de-risk the technology deployment, governments are supporting renewable energy suppliers by introducing policies that incentivize the market, attract private investments, reduce costs, upscale supply chains, and increase efficiency and utilization.

IEA

IEA

According to International Renewable Energy Agency, the utility-scale solar photovoltaic capital costs were 88% lower in 2021 than in 2010. Similarly, the cost of solar PV modules decreased by 90% from 2010 to 2020.

In Europe, the recent surge in energy prices has led to a significant advantage for solar energy as its levelized cost of energy (“LCOE”) is significantly lower than fossil fuels. This has made the investment case for green hydrogen much more attractive than it was a decade ago, leading to a renewed interest in the sector, especially in the use of electrolyzers for green hydrogen generation.

IRENA

Accordingly, IEA stipulates that the hydrogen production costs from renewable electricity could fall by 30% by 2030 due to the declining costs of renewables and scalability of hydrogen production. Nel, the world’s largest producer and manufacturer of electrolyzers, believes that green hydrogen production cost parity with fossil fuels could be achieved as early as 2025.

This has led to a worldwide increase in large-scale hydrogen investments and projects.

RBC Capital

In light of the recent solar photovoltaic, wind, batteries, and EV policy and technological successes, highlighting the game-changing innovation and power to establish a global clean energy economy, investors are urged to see past the previous failures of the hydrogen economy, seeing it as a viable step toward a carbon neutral future.

Fusion Fuel Green PLC

Fusion Fuel Green plc, an Ireland-based company, produces zero-emissions or “green” hydrogen with a modular solar-to-hydrogen solution through its proprietary micro-electrolyzer. It is essentially intended to develop, own and operate green hydrogen facilities and sell the hydrogen to end-users through long-term offtake agreements. The company is currently in discussions with prospective off-takers. The management currently hasn’t disclosed any specific counterparts, but these development projects are tied to grants for which it has already been approved (e.g., POSEUR, C-14, C-5).

It also sells this equipment to other hydrogen producers to build alliances, expand the project portfolio, and generate short-term cash. The management has iterated that it has quite a few potential customers in the pipeline, as stated in its Q2 deck. Even though many of them remain confidential at the moment; the management expects to disclose several of these customers in the near term / as the fourth quarter progresses.

It operates in Southern Europe, Portugal, and Morocco, serving natural gas grids and networks, ammonia producers, oil refineries, regulators, and government departments.

The management has also emphasized establishing a “meaningful commercial presence” in North America to leverage the Inflation Reduction Act (IRA). Still, it is currently focused on its biggest market, Portugal, where it has recently received a sizable grant for its Benavente facility.

Given that the company and the industry are still young, investors would be paying for future growth rather than historical reliability, which barely exists. This growth will almost entirely depend on the company’s future ability to produce and sell the underlying product at a profit commercially. This, in turn, is underpinned by the efficiency and cost-effectiveness of its electrolyzer technology and the company’s execution of technology deployment.

HEVO-Solar Technology

Most of the hydrogen production in the world is either “grey” (from natural gas) or “brown” (from coal), emitting about 9 kg of CO2 emissions for every kg of hydrogen produced. The envisioned zero-emission world of the future does not encompass this.

It includes “Blue hydrogen,” the natural gas-based hydrogen with carbon capture and storage to offset the CO2 emissions, and more prominently, “Green hydrogen,” the renewable power-based zero-emission hydrogen produced by water electrolysis.

Water electrolysis accounted for only around 0.1% of global hydrogen production. But the installed capacity of electrolyzers is expanding quickly and has reached 510 megawatts (“MW”) by the end of 2021, an increase of 210 MW, or 70% relative to 2020… In 2021, almost 70% of the installed capacity was alkaline electrolysis, followed by proton exchange membrane (“PEM”) electrolyzers accounting for one-quarter.

HEVO is Fusion Fuel Green plc’s proprietary miniaturized PEM electrolyzer for producing green hydrogen, designed to be small, lightweight, and scalable. HEVOs are affixed to the back of concentrated photovoltaic (“CPV”) panels to make HEVO-Solar generators. You may watch the below company video for an easier understanding.

This HEVO-Solar takes about 100m2 space and weighs about 4 tons. The company claims that these generators can leverage 100% solar energy to improve the electrochemical reaction efficiency, reducing the LCOE.

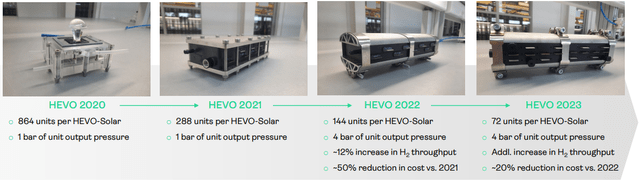

Fusion Fuel Investor Presentation

The HEVO-Solar combines 144 HEVOs mounted to a specially-designed CPV solar tracker, which concentrates solar radiation 1,400 times onto a series of III-V multijunction solar cells to yield a solar-to-electric conversion efficiency of about 40%, with the balance given off as thermal energy. It can also use this “lost” thermal energy to preheat the feed water, improving the conversion efficiency by about 10%.

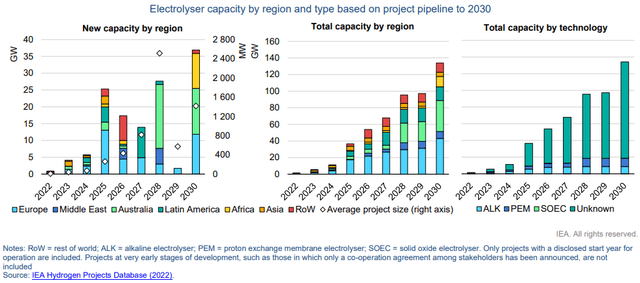

The current global pipeline for electrolyzer capacity stands at about 134 GW for 2030, almost 1.5x higher than the 2021 pipeline for 2030. However, only 9.5 GW or 7% are currently under construction or have reached FID status, with others at a less advanced development stage. This gives Fusion Fuel the first-mover advantage at a very opportune time.

IEA

Black & Veatch, a global construction engineering firm, completed an independent assessment of Fusion’s technology and manufacturing process, validating it. Similarly, TUV SUD, a technical assessment and certification firm, is performing field tests of the first generation HEVO, showing a sustained 10% increase in hydrogen output vs. nameplate module capacity. Both studies can be found in the company’s latest filings.

In terms of realizable short and long-term benefits from the tech, I quote the company chairman from the latest earnings call,

Grid independence and scalability make our solution unique and ideal for the high-value-added mobility market, which is a key near-term target for Fusion. Grid independence eliminates exposure to highly volatile electricity and natural gas prices in the production of green hydrogen, a benefit very much in focus during this time of historically high energy prices in Europe. The benefit of eliminating this form of uncertainty is quite straightforward. The fact that our HEVO-Solar generators can produce low-cost green hydrogen at even very modest production levels eliminates risk in a less obvious but potentially more important way.

The technology and its associated benefits, if materialized, appear solid, with the technology validations bolstering investor confidence.

Small-scale & modular: Scale is viewed as the only viable path to reducing the CapEx per kW of electrolysis capacity, and Fusion Fuel’s HEVO-Solar units represent only 25 kW of electrolysis capacity, making it a uniquely attractive use-case with the current modest demand for hydrogen (e.g., mobility, synthetic fuels) or for customers who want exposure to green hydrogen but are reluctant to invest tens or hundreds of millions in a multi-megawatt scale electrolyzer. The modularity of this solution allows customers to scale into demand over time and add additional HEVO-Solar units to the facility as the market develops.

Grid-independent: The European energy crisis is a protracted dislocation with no signs of abating in the near future. As a result, energy prices across the board are not only elevated but incredibly volatile, creating a challenging environment for green hydrogen producers. Given the CapEx required for large-scale centralized electrolyzers, operators want to run those systems at a very high-capacity factor – no one wants to pay for idle time – so this environment of price spikes and volatility significantly challenges the economics of centralized production.

Putting the energy crisis aside, grid independence is also quite valuable from a cost-reduction perspective. Connecting to the grid is expensive; large-scale electrolyzers consume so much energy that they require a fair bit of new infrastructure (e.g., HVDC lines, transformers, rectifiers, converters, depending on the setup) to be built before the first molecule is even produced, adding meaningful time and cost to the project. By contrast, because HEVO-solar generates its own energy from the integrated CPV system, not only does it not require the same amount of infrastructure, but it also has a known and consistent levelized cost of electricity, meaning that it can offer certainty of hydrogen cost to customers.

Distributed/Co-located production: Transporting hydrogen is expensive, and in some ways, it’s a hidden cost that many don’t consider when thinking about the levelized cost of hydrogen. In its Q2 results, Fusion Fuel estimated the average logistics and distribution cost for hydrogen to be +/- $2/kg (with other factors like distance, volumes, and compression/liquefaction either increasing or decreasing that figure). The industrial gasses business is a mature industry, so it can absolutely be done, but for customers who are highly price-sensitive or only have modest demand, that incremental cost can be prohibitive.

Due to the small-scale/modular nature of the solution, the company is able to co-locate its solution either on-site or adjacent to sources of demand (e.g., refueling stations, natural gas hubs, industrial customers), meaning that it can deliver green hydrogen to the need for last-mile distribution, avoiding that added cost.

Financial Viability

Presently, the company has a €2 million project with Exolum in Madrid, which will likely be completed later this year, as well as the €5 million equipment sale agreement announced with Gedisol, a Spanish developer. The company intends to build a committed order book for 100% of its production capacity in 2023 and 2024, amounting to 2,500 and 4,700 HEVO-Solar units, respectively.

In terms of liquidity, the company held €10.6 million in cash at the end of the MRQ, while its operating cash burn is roughly €3-4 million per quarter, making the cash sufficient for at least the next 2 quarters. The company has also successfully raised over $2.06 million between July and August through “At the Market” sales, which still remains a usable facility to ensure a sufficient cash position.

At the end of the MRQ, it had also submitted repayment requests for €1.2 million of VAT refunds and €3.5 million of grant reimbursements from the Portuguese government, with additional repayment requests submitted since June. The company is also exploring other potential sources of interim financing across debt and equity capital markets, which have yet to be finalized.

Investment Risks

Despite all the hype, only a handful of green hydrogen projects have been commercially successful, mostly because these projects present eccentric risks like challenging project finances, nescience of the technology, production and transformation, storage, segmentation of energy input, and transportation to end-users. As may be apparent, Fusion Fuel’s HEVO-solar addresses many of these issues, de-risking the execution at its core. However, due to the lack of a track record, the scalability and commercial viability of the project remains to be seen, carrying significant execution risk.

The company is highly reliant on continued government grants and funding and has recently secured substantial resources, including EUR 3.5 million out of the approved grants of EUR 19 million. However, since the company is not self-sufficient, in the case of abatement of this government support, it will be forced to either negotiate debt financing at unfavorable terms or raise equity finance, leading to severe share dilution.

Additionally, even though the company is making meaningful strides in establishing a footprint in its core geographical arenas, especially in Portugal, a growth company in an infancy stage sector operates with inherent risks. This includes significant exposure to market sentiments, where the performance of the security might start performing completely detached from its financial and fundamental performance.

As recently seen, a nosediving market is likely to drag the stock price down with it, making the stock extremely risky for short-term investors. Stocks like HTOO are long-term investments, where the macroeconomics & the company fundamentals dictate the long-term trajectory.

Conclusion

Historically, a major hurdle for hydrogen has been the reluctance of consumers to switch toward it because of the energy security provided by the fossil fuel industry. However, as current circumstances have uncovered, Europe’s energy reliance on Russia has shunned it to an unprecedented energy crisis, making the countries realize the importance of switching to alternative sources at the earliest.

Similarly, in the US, the Defense Production Act strives to invest in companies that can manufacture and install key energy technologies, including fuel cells and electrolyzers, and the IRA offers various tax credits and grant funding to support hydrogen technologies.

The global energy crisis is instigating green hydrogen technologies growth through governmental support and incentives, making it appear to be a viable multi-sectoral renewable energy solution, contrary to the previously failed hypes. As such, I am bullish on the stock’s long-term trajectory and rate it as a buy.

Be the first to comment