Sky_Blue/iStock via Getty Images

Previously, I marked shares of Spirit AeroSystems a short-term hold with a lot of long-term potential and the stock’s performance as well as the Q3 2022 results and outlook reflect that. In my previous report, I marked shares of Spirit AeroSystems a long-term buy, but a near-term hold due to slow recovery in ramp up for the Boeing 737 MAX shipset deliveries. Shares have significantly underperformed the market, losing more than 18% compared to a 5% loss for the broader markets. So, Spirit AeroSystems is not a name that has thrived particularly well in recent months.

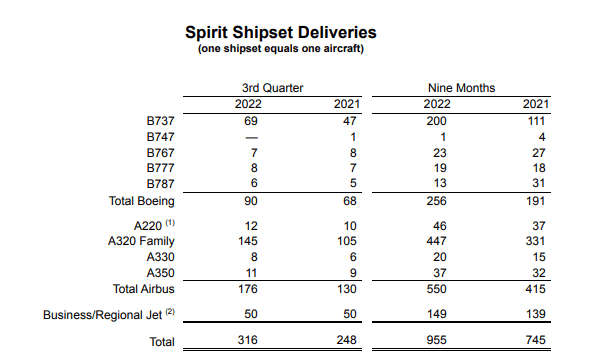

Improvement In Ship Set Deliveries

Shipset deliveries Q3 2022 Spirit AeroSystems (Spirit AeroSystems)

Looking at the number of shipset deliveries, there’s one thing that actually becomes clear: Things are actually not bad. Boeing 737 shipset deliveries were up 22 units during the quarter or nearly 50% and the nine-months ended numbers even show shipset deliveries for the Boeing 737, up 80%. Boeing 747 deliveries were down, and that really is no surprise given that the program is winding down. For the Boeing 767, deliveries were down one unit but up a unit for the Boeing 777 program. For the Boeing 787 program, deliveries were up during the quarter but still lacking significantly compared to last year. For the quarter, Boeing shipset deliveries were up 32 percent and 34 percent for the year.

Airbus A220 shipset deliveries were up 2 units or 20 percent and Airbus A320 were up 40 units or 38%. For the nine months ended, these numbers were up 24 percent and 35%. Furthermore, we saw improvement in Airbus A330 and Airbus A350 deliveries.

The first reason why shares have not performed strongly can already be seen in the delivery numbers. On the Boeing 737 platform, we’re looking at average monthly deliveries of 23, while the communicated production rate for the Boeing 737 MAX is 31 per month. During the quarter, the inventory that Spirit holds grew by six units. So, what we’re seeing is that not all shipsets are shipped to Boeing pointing at some stabilization challenges around the 31 per month production rate for Boeing.

For the Airbus A220 and Airbus A320, the shipset numbers do look good, but Spirit AeroSystems noted that on request of Airbus some shipset deliveries have slipped and also that indicates that there are challenges keeping that rate up. On a normal day, those shipsets cannot come in quickly enough and right now we’re seeing that Spirit AeroSystems is asked to delay the deliveries of those shipsets at Boeing as well as Airbus.

Spirit AeroSystems Books Profit As Revenues Increase

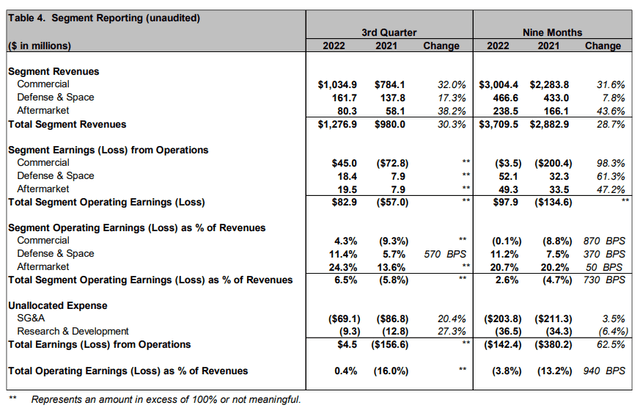

Results Q3 2022 Spirit AeroSystems (Spirit AeroSystems)

While the elements that should support improvement are most definitely there, we also see that schedules are sliding to the right. Earlier, I already observed in an order and delivery report for Airbus that there was a disjoint between delivery rate and production rate leading me to question whether the effective production rate is as high as what Airbus communicates. On Airbus’ request, we have seen some A220 and A320 shipment slides which suggest that the communicated production rates are not stable and the same holds for the Boeing 737 MAX program.

Nevertheless, there’s material improvement in the numbers. Commercial revenues grew 32% in line with the nine-months ended figures. Commercial segment earnings were positive $45 million, marking the first profitable quarter since 2019, and for the nine-months ended, the company is near break-even levels. Important to consider is that Spirit AeroSystems is carrying excess capacity costs each quarter because the company has a footprint to hike MAX production rates to 52 shipsets a month. During the quarter those excess costs were $29.9 million compared to $55 million in the same quarter last year. At the start of the year, excess capacity costs for the Commercial segment were $46.8 million. So, what we’re seeing is that the rate break from 21 MAX aircraft per month to 31 per month significantly brings down the excess capacity costs and improves the unit costs.

Simultaneously, the improvement was fully offset by $47.4 million in forward losses related to the Boeing 787, Airbus A350 and RB3070 programs as well as unfavorable catchup adjustments of $6.9 million brining the Commercial segment changes to estimates to $54.6 million offsetting the $25.1 million improvement in capacity excess costs. That’s disappointing of course, but also does show that absent of these changes the margins that the Commercial segment is producing are quite a bit stronger. For Spirit AeroSystems, the challenge will be to keep those forward losses on wide body programs limited. However, once the rates on wide body programs go up, the forward losses should also slim, and as Spirit AeroSystems will continue producing at a rate of 31 Boeing 737 shipsets per month for the foreseeable future, they have initiate a cost reduction initiative that should cement profitability at that rate. That means that Commercial is improving, not as fast as we would like to see, but once the industry stabilizes we will see Spirit AeroSystems profits snap back in what would look like an almost effortless way.

Defense and Space revenues grew 17% while posting significant margin improvement of 5.7 percentage points. This was driven by higher P-8 and CH-53K production and higher classified program wins that should start adding more to revenues in the future so things are looking good for Defense which has room for growth on strong margins.

Aftermarket sales were up, obviously driven by higher flight activity and that is a strength we are seeing with all companies offering aftermarket solutions.

Overall segment margins stood at 6.5% and a 0.4% operating margin for the quarter. It might not seem much and it also isn’t, but what we see is that despite the challenges that Spirit AeroSystems faces, profitability improved by over $160 million.

A Challenging Path Ahead For Spirit AeroSystems

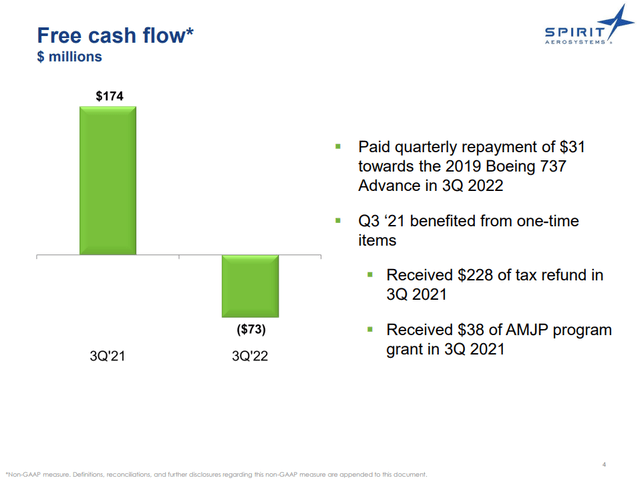

Free cash flow Q3 2022 (Spirit AeroSystems)

For Spirit AeroSystems, we do see the improvement but we also do see the challenges it faces. The cash flow performance during the quarter would seemingly be testimony to those challenges. In some way they’re because if the supply chain would be stable we would be seeing more efficient use of working capital and higher output, but the numbers are also impact by one-off items. In Q3 2021, Spirit AeroSystems did benefit from $266 in one-off items. Adjusting for this, the Q3 2021 cash flow would have been negative $72 million while the adjusted free cash flow for Q3 2022 is negative $41 million. So, we do see that while cash flow is not yet positive, there is improvement. Next year Spirit AeroSystems expects to be cash flow positive even before it receives $120 million to $150 million related to pension plan terminations.

So, where’s the challenge? The challenging part is that deliveries are slipping into 2023 and that’s significantly affecting the free cash flow guidance, and as big as a supplier Spirit AeroSystems is, they’re not able to prevent that. The result is at the start of the year, Spirit AeroSystems was targeting a breakeven free cash flow dependent on how much 737 shipsets would be flowing to Boeing. The suggested number would be likely around 370 shipsets for the 737. However, the most recent guidance puts the free cash flow guidance at cash flow usage of $450 million to $525 million driven by deliveries slipping into 2023 and higher cash costs on the wide body programs and that is another step up in cash flow usage from Q2 where the number of shipsets was revised to 300 as Boeing would stay on the rate of 31 aircraft per month longer than anticipated. So, as big as Spirit AeroSystems is and as much insight the company should have the reality is they cannot deliver on their Q1 guidance and from their wording in the Q3 earnings call, they might not be able to make the target of 100 shipsets for the fourth quarter putting further stress on the cash flow. This is baked into their most recent guidance, but it is somewhat disappointing that the company is essentially not able to deliver as production plans are changing frequently.

Conclusion: Spirit AeroSystems Remains A Long Term Buy

What I find somewhat worrisome for Spirit AeroSystems is that their free cash flow guidance has been largely inconsistent. In Q3 2021, the company guided for free cash flow in 2022 to breakeven before returning some money that it received from Boeing throughout the pandemic. A quarter later it became after payment, which obviously is a positive but it seems the company confused their free cash flow targets with the repayment to Boeing causing a $130 million swing and from there lower delivery numbers kept pressuring the free cash flow guidance. It seems that while Spirit AeroSystems is sitting close to the fire, it only is able to see the smoke and that is a bad thing.

Despite the challenges and the rather slow snap back to previous rates which layer on top of deliveries shifting into 2023, I do believe that Spirit AeroSystems is showing significant improvement in its results and next year will be a full year of supporting a production rate of 31 aircraft per month, meaning that compared to this year Boeing 737 shipsets should increase by another 20% to 25% which should further reduce excess capacity costs. Other positives are the company’s attempt to diversify on commercial program and extract more value from aftermarket sales and Defense while running a cost reduction initiative on the Boeing 737 program. So, there are positives, and with continued strength in the narrowbody market Spirit AeroSystems should see its results improve in the same way they are showing significant improvements even though delivery numbers are still underwhelming. One thing that the company really needs to improve on is in the way it provides guidance. Overall, I do believe that the current share price mostly reflects the pressured deliveries, without appreciating the actual improvement in performance and future performance. In some way, with failing guidance that’s something that Spirit AeroSystems can only blame itself for but it does create a nice entry point for long-term investment.

Be the first to comment