designer491

The Fund

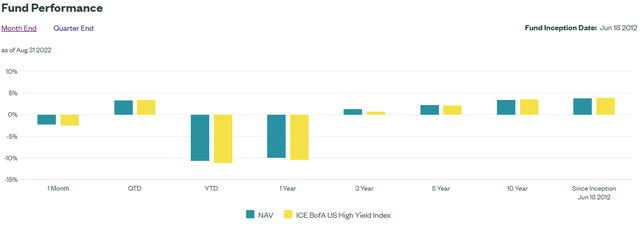

With three quarters of a billion dollar in assets under management, the SPDR Portfolio High Yield Bond ETF (NYSEARCA:SPHY) aims to mirror the performance of its benchmark, the ICE BofA US High Yield Index. Since the ETF, unlike the index, has expenses, an under performance to that extent by the ETF is not unexpected.

With a 0.10% expense ratio, the difference is not material, and we can see that the ETF has done slightly better over some timeframes. It could also mean luck of the draw since the fund does not hold ALL the securities included in the index. The ETF is also free to invest in securities that are not part of their benchmark, but have the same economic characteristics of the securities that are in the index, cash and cash equivalents and money market instruments. In either case, the performance difference between the two is not material enough to continue waxing ineloquently on it. Let us move on.

Composition

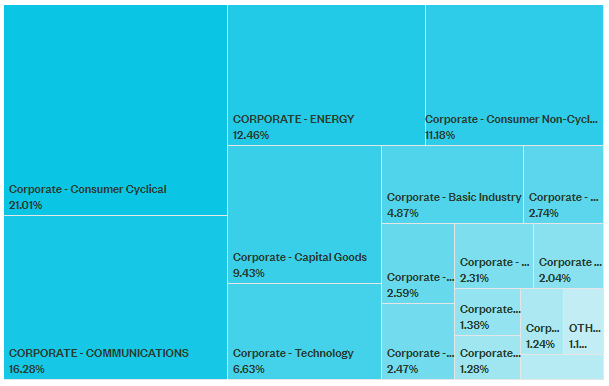

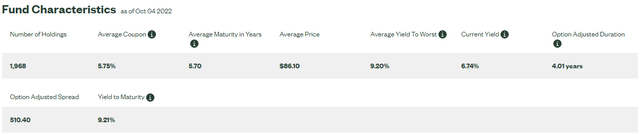

Like the ETF name suggests, the portfolio is made up of high yield bonds, also known as below investment grade or junk bonds. Within that universe, SPHY picks up bonds with at least one year remaining to maturity at the time of inclusion in the portfolio, those that have a fixed coupon and a minimum outstanding issuance of $250 million. The most recent numbers show that SPHY holds 1,968 securities with about 70% of them concentrated in five sectors, consumer cyclicals being the highest concentration.

SPHY

With close to 2,000 holdings however, the diversification at the security level is more than adequate. Based on the current published numbers, their top holding makes up 0.36% of the portfolio. SPHY is also sticking close to the upper echelon of the high yield world with most of its holdings either BB or B rated.

SPHY

While SPHY holds securities with maturities varying from under a year to greater than 30 years, most of them fall between 2 to 10 years.

While the average coupon of the holdings is 5.74%, with the prices beaten down (note the $86.10 average price), the yield to maturity for incoming investors is well over 9%, providing an over 500 basis point spread over the risk-free rate.

The yield to worst is almost the same as the yield to maturity. No surprises there as with the current interest rate environment, no one is in a hurry to call or redeem their existing bonds. One thing to note is the option-adjusted duration of 4 years. This is indicative of the interest rate sensitivity of the portfolio i.e., how much the portfolio value is expected to change with a corresponding change in the interest rates. While not exactly linear, what this broadly tells us about this portfolio’s interest rate sensitivity is that with every 100 basis point increase in the interest rates, the portfolio value will drop by 400 basis points and vice versa.

Distributions

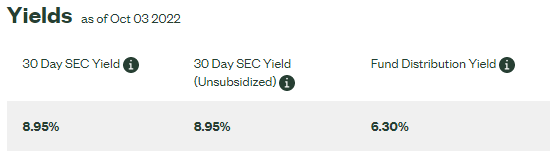

The fund earned close to 9% on its holdings over the last 30 days (at the time of writing this piece), and that is reflected under the published 30-Day SEC Yield.

Fund Website

The 6.30% distribution yield is indicative of the trailing 12 months and not what the extrapolation should be based on the current earnings. We expect the distribution yield to catch up to the fund’s earnings (net of expenses) and we can see the progress in the higher monthly distributions.

Verdict

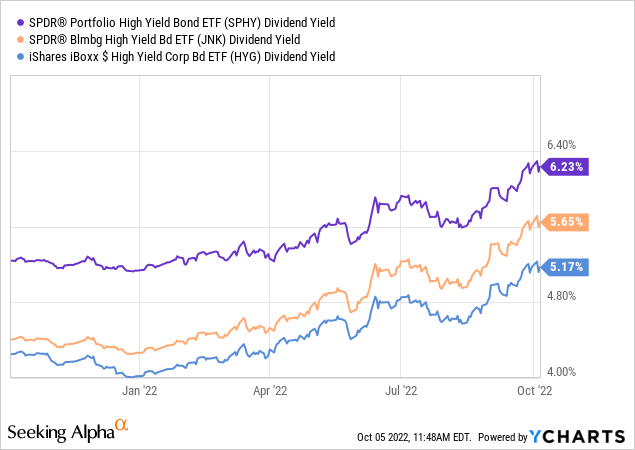

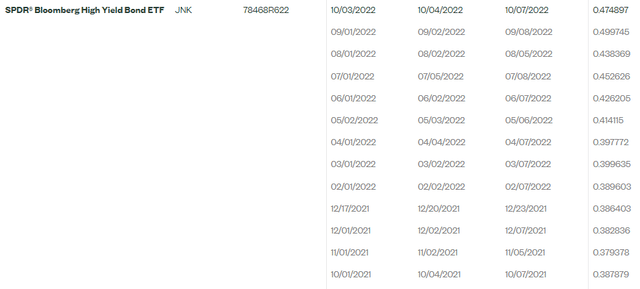

We compared SPHY’s yield with that of iShares iBoxx $ High Yield Corporate Bond ETF (HYG) and SPDR Bloomberg Barclays High Yield Bond ETF (JNK), and it comes out ahead both in terms of yield and expenses (around 0.40% for the latter two).

YCharts

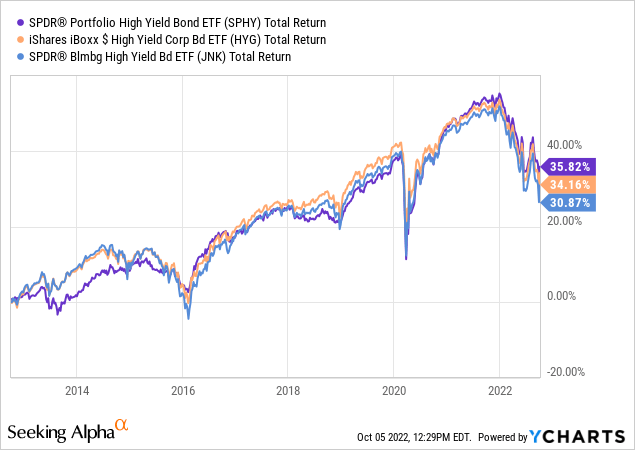

We also went ahead and did the same with the performance of the three and SPHY comes out ahead in this instance too. Point to note is that all three are similar in effective durations i.e., 4 years and will move more or less in line with each other. A good deal of the performance difference likely comes from SPHY having the lowest expense ratio of the three.

While SPHY can serve the income purpose as a small position in a diversified portfolio, with the smorgasbord of opportunities available to us thanks to the recent volatility and market downturn, we are hard pressed to make a “buy” case for this one for ourselves. Just yesterday we took advantage of an almost risk-free way to park cash in our marketplace service. We have also started taking advantage of the mispricings within the fixed income world to swap into more profitable opportunities. When you have the whole gamut of quality investments ready to provide you with the returns of a high yield bond fund, we choose the former. We go with a “hold” rating on this one.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment