designer491/iStock via Getty Images

The VIX: More Than An Index

The S&P VIX Index (VIX) as an investment vehicle is one of the most underutilized tools by the retail investor. This is primarily due to its structural makeup being an index rather than an actual security. No investor can simply buy a share of the VIX outright. The retail investor must purchase options or future derivative contracts which are often daunting to the average retail buyer and rightfully so as the implied volatility of these contracts can cause massive losses if not exercised correctly. Luckily, there have been a few relatively unknown securities that have been created to allow the retail investor an opportunity to gain portfolio exposure to the market volatility index. A few of these will be highlighted at the end of the article.

I am assuming most reading this article have a relative idea of what the VIX is and what it accomplishes from a market intelligence perspective, but to ensure all reading possess the same basic understanding, here is the formal definition: “The CBOE Volatility Index is a real-time index that represents the market’s expectations for the relative strength of near-term price changes in the S&P 500 index”.

In other words, the VIX provides intelligence to the investor on perceived market sentiment within the near term. For this reason, most do not view the VIX as an opportunity to unlock value within the market.

However, this notion is incorrect. If used correctly, the VIX can allow an investor tap into returns anywhere between 30-100% with some investors with some investors recently realizing trades upwards of 400% (VXX) during March of 2020.

Investment Thesis

At the time writing this article, the VIX sits at 18.30 and given the current operating environment, the VIX is at a prime position to unlock a 30%+ ROI. At 18.30, the index has “reverted below the mean”. There is an argument that the VIX will always revert back to its mean at around 20. Please reference an excellent opinion article providing analysis on driving the VIX to an equilibrium point and establishing that 20.00 is the natural resting place for the VIX – the mean.

The VIX experienced a recent 2022 high of 36.45 on March 7, 2022, ~100% increase from levels experienced as I began writing. At this time, the US economy was at the brink of a series of tumultuous events. Not only was inflation heating up and in response the federal reserve was expected to hike interest rates in the coming days, Russia had recently invaded the Ukraine and the US economy had only started to begin feeling the economic pressures of this geopolitical upheaval. These events rocketed the VIX to 2022 highs in a matter of days.

Since its recent peak in early March, the VIX has subsided and reverted towards the mean. This was in response to the recent March market rally in which the S&P 500 experienced ~11% gain in just over two weeks. This was the largest 15-day percentage gain since June 2020, led by the bounce back of the high-growth stocks that had been beaten down much of 2022 before the rebound.

However, while the market rally shows signs of life for long investors the aforementioned issues driving the VIX to 2022 highs are still fueling the current operating environment. The hawkish fed reserve is still seeking to raise rates numerous times and is even considering marks above the standard 25bps raise, geopolitical unrest does not appear to show signs of subsiding in the near term, and as a result the bond market screams signs of an incoming recession. Therefore, at 18 the VIX poised to rise again, and I’d argue could compete with the recent early march highs. “High inflation, rising rates and slowing growth is a potentially poisonous mix for equity investors” said Erik Knutzen, Chief Investment Officer at Neuberger. These three coupled with the geopolitical unrest is a very strong recipe for bear territory in the near future and as usual, the bond market is already ahead of the curve.

Bond Market Implies Volatility Ahead

On March 31, 2022, the yield curve inverted. This implies that short-term borrowing (2-year treasury bond) is more expensive than long-term (10-year treasury bond). This phenomenon happens when the implied risk in the near term outweighs the long term driving the price of the 2-year bond (trading at 2.337% on March 31st) higher than the 10-year bond (trading at 2.331% on March 31). Historically, this event has often preceded a recessionary state in the economy and has presented itself as a beacon for volatility ahead. However, it is important to note that while these inversions signal for incoming volatility, a recessionary economy has a laggard timeline.

According to MUFG Securities, the yield curve inverted 422 days ahead of the 2001 recession, 571 days ahead of the 2007-to-2009 recession and 163 days before the 2020 recession.

Now that the bond market has given investors a strong indication of volatility ahead, in response the VIX will likely become magnified by investment community within the coming months.

How does the VIX Work?

At a basic form, most consider that VIX values greater than 30 are generally linked to large volatility resulting from increased uncertainty, risk, and investors’ fear. VIX values below 20 generally correspond to stable, stress-free periods in the markets.

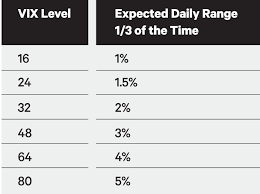

To take this even further, the VIX has been linked to the theory of the rule of 16 that suggests that the VIX volatility increases 100bps on multiples of 16 1/3 of time.

ThinkMoney – The Rule of 16

A VIX at 32 implies a 2.00% move in the S&P 500 daily over the next 30 days. That’s a high expectation, and if the S&P 500 fails to see that type of volatility, it could lead to the VIX falling, thus pushing the value of the S&P 500 higher as implied volatility levels drop.

Investing in the VIX

Now while this article was first drafted while the VIX was at ~18, the index has recently run up to 22-24 and offers a few data points. First, given the recent yield inversion paired with heightened inflation driving a weak macroeconomic outlook, the VIX hovering around 18 was simply too low and the thesis is correct. Monday’s (April 11, 2022) run up to 24 illustrated a strong reaction by the economy to a poor underlying macroeconomic environment. Second, anytime the VIX rises above 20 the investor must proceed with caution as the index is already indicating volatility ahead, leaving less room for the investor to profit from economic uncertainty.

For that reason, this is what makes the VIX an unique investment tool and a rare opportunity to realize gains as a retail investor for predicting a soft equities market without buying options contracts.

It is important to remember, obtaining portfolio exposure to the VIX is never for the long-term. There is no profit to be realized as the index will always “revert to the mean”.

However, what reverting to a mean does allow for is an ample amount of opportunity for an investor to tap into returns without risking losing a strong entry point. On the other hand, this optionality comes at a price as the VIX is very volatile and forces one to proceed with caution anytime the index rises above the mean and encroaches 30. While there is still a strong play on the VIX at 20-22, once the VIX rises into the 23-26+ range, the risk/reward is arguably not strong enough to warrant an investment call. At this time, the Index becomes very volatile with a stronger than not likelihood of reverting to the mean than continuing the upward trajectory.

Update as of April 13, 2022

On April 13, 2022, the VIX had declined ~10% from the open to 21.82 at market close, highlighting how cautious the investor needs to be when obtaining exposure to the VIX. This large intra-day market decline supports the thesis of caution when adding exposure in the 22-24 range. If a savvy investor does not possess a strong conviction in short-term volatility increasing exponentially in the coming days, then most likely the VIX will begin reverting towards the mean. For the record, scenarios of this magnitude that qualify for these extreme VIX behaviors are saved for the true market shifters such as November 2008 and March 2020 when the VIX reached all-time highs, breaking 80. Even less volatile events such as the recent Russian Invasion of the Ukraine can provide some value at a 22-24 entry providing access to a potentially strong upside, but again the risk/reward scenario varies drastically from entering at 18. This is why it is important to understand the mechanics behind the VIX and its desire to revert to the mean.

To relate this to the referenced rule of 16, and to provide an additional layer of clarity, given the rule of 16, the VIX at 24 implies ~37.5% increase in volatility expectations from the 18 level experienced a few days ago, illustrating the already shifting market sentiment.

The VIX Moving Forward

The VIX saw some intriguing swings over the last week moving from 18 to 24 and then back down to 20-21 levels. While these swings are daunting taken out of context, it is important to highlight that this is not unexpected and the purpose of this article is to prove that the VIX is a viable option to gain exposure to profit from in the ever-so-shifting operating environment.

Google Finance – The VIX

The graph above illustrates how the VIX performed over the last year. As the investor community witnessed this past week, every time after a large run the VIX would revert to the mean and gear up for the next run. This highlights the extreme volatility of the index itself within the current operating environment. This is why it is important to add exposure after the VIX has had a large run and begins retracting back down towards the mean.

As mentioned earlier, the VIX has proved to allow an investor multiple opportunities to gain exposure. No investor wants to get caught holding the bag buying into the volatility if the VIX will naturally move to equilibrium in the coming days.

While this kind of volatility begs the question, why obtain exposure to the VIX at all, as it appears to be too risky. Draw your attention to the 5-year chart of the VIX. Prior to March 2020, the index would maybe push the 30 level once a year before reverting to an equilibrium in the 15 range.

Google Finance – The VIX

The US macro economy has changed. Between the Federal Reserve, inflation on the rise, and geopolitical unrest, the US economy is poised for a volatile road ahead.

Note the apparent volatility uptick on the graph within the last year compared to the years prior to March 2020. In the last year there has been about 4 major run-ups of the VIX nearing 30 and 2 times where the index surpasses. This is highlighted by the natural mean settling in around 18 compared to 15 prior to March 2020, and proves that the operating environment has in fact shifted. Furthermore, the new developments and indications from the bond market and the Fed Reserve possess the power to send the economy over the edge and into bear territory within the near future.

This is why it is important to start adding portfolio exposure to the VIX. The time of reckoning for the economy is on the horizon. Again, to reiterate, MUFG securities stated “the yield curve inverted 422 days ahead of the 2001 recession, 571 days ahead of the 2007-to-2009 recession and 163 days before the 2020 recession”. If there truly is a recession on the way, it won’t be immediate, but this is why the investor should take advantage of these signals now and tap into the ample opportunities the VIX provides to obtain exposure. If exercised correctly, it will allow the investor to tap into returns of 30%-100% ROI, and maybe even more.

Even if an investor does not believe that the macroeconomy is due for a decline, it is still important to acknowledge inflationary data, bond market signals, and geopolitical events to set themselves up appropriately. Everyone can agree that these events are in fact out of the ordinary and have the potential to spur some economic rarities in the near future.

Anytime there are changes or rarities, the VIX provides a strong opportunity to profit if done so correctly.

Securities to consider to gain VIX exposure

(VXX) iPath Series B S&P 500 VIX Short-Term Futures ETN – Tracks an index with exposure to futures contracts on the COBE Volatility Index with average one-month maturity.

(VIXY) ProShares VIX Short-Term Futures ETF – Tracks an index with exposure to futures contracts on the CBOE Volatility index with average one-month maturity

(UVXY) ProShares Ultra VIX Short-Term Futures ETF – Provides 1.5x leveraged exposure to an index comprising first- and second-month VIX futures positions with a weighted average maturity of one month.

This is just a sample of the securities that can provide VIX exposure. Reminder: complete your own research on each before investing.

Be the first to comment