freemixer/E+ via Getty Images

Investment Thesis

SP Plus Corporation (NASDAQ:SP) provides mobility solutions, parking management, ground transportation, and baggage. The company is experiencing strong demand in both segments after the pandemic. Recently, it acquired KMP Associates, which can significantly expand its addressable market. I believe the company can experience significant revenue and earnings boost in the coming years.

About SP

SP offers mobility solutions, baggage, ground transportation, parking management, facility maintenance, and other ancillary services across North America. The company provides services to clients from the aviation, hospitality, commercial, government, and healthcare industries. The reportable segments of the company are the Commercial Segment and Aviation Segment. The Commercial Segment of the company offers online & mobile application consumer platforms, on-street parking meter collection, remote monitoring, shuttle bus vehicles, ground transportation, valet services, comprehensive security, and multi-platform marketing. Baggage services, remote airline check-in services, wheelchair assist services, and baggage repair & replacement services are part of the Aviation segment. The company earns 73% of its total revenue from the Commercial Segment, while the Aviation segment generates 27% of its total sales. The company operates its business under two arrangements: Management Type Contracts and Lease Type Contracts. It generally receives a fixed or variable monthly fee for services rendered under management-type contracts. In addition, it may be eligible for an incentive fee based on accomplishing specific performance goals. Under lease-type contracts, the company typically pays the client or owner of the property a fixed base rent or fee, a percentage rent based on the business’s financial performance, or a combination of the two. Management-type contracts generate 64% of the total revenue, and lease-type contracts comprise 36% of the total revenue.

Acquisition of KMP Associates

Recently, the company announced the acquisition of KMP Associates, a provider of software & technology supporting clients in the aviation and commercial parking industries across North America and Europe. Over 35 airports in the USA & Europe and more than 100 commercial parking lots in Europe are presently using KMP’s market-leading SaaS platform. Running under the AeroParker & MetroParker brands, KMP offers dynamic pricing, e-commerce capabilities, online parking reservations, and other travel services to ease traffic, facilitate frictionless transactions, and deliver a first-rate customer experience. I think the integration of KMP Associates synergizes perfectly with the company’s organic growth strategy as it can strengthen SP’s technology capabilities, primarily in sectors that aid digital transactions and smart city development. The acquisition of KMP Associates might be a growth platform for the company as it can help the company to offer parking-related services to external parking operations in North America and Europe. The addition of the KMP can expand the company’s customer base as it improves SP’s existing Sphere suite of technology, which can offer customers flexible & efficient mobility demands and enhance their parking assets. After considering all these factors, I believe acquiring KMP can significantly expand SP’s addressable market.

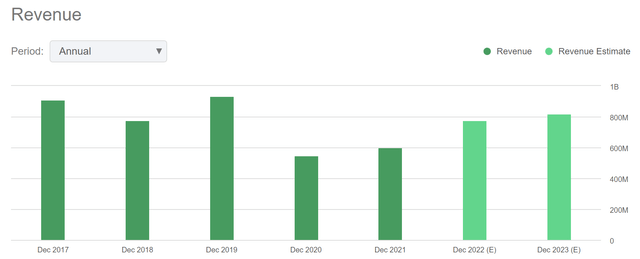

Financial Trend

As we can see in the above chart, the company has experienced a significant revenue decrease in FY2022 due to the adverse effect of Covid-19. In FY2022, the revenue decreased by 41.2% compared to the revenue of FY2019. The company is slowly recovering from the negative effects of Covid-19, and it has reported a revenue of $601.5 million in FY2021, which is still 36% below its pre-pandemic levels. I think the revenue recovery can accelerate in the coming years as the company is experiencing strong demand in both segments after the pandemic. The management has stated in a recent conference call that the demand can become more intense in the coming years. The company can get the maximum benefit from this rising demand as it has a first-mover advantage and technology that enables efficient mobility. SP’s investment in technology has expanded the addressable market, enabling the company to provide its services to external parking operations.

Even the company’s EPS has not recovered from the adverse effects of Covid-19. In FY2021, the company reported a full-year EPS of $1.93, which is 44% lower compared to the EPS of FY2019. After considering the expanded addressable market with the acquisition of KMP Associates and rising demand in both segments, I think Seeking Alpha’s EPS estimates of SP are accurate. According to Seeking Alpha, the company can achieve an EPS of $3.28 in FY2023.

What is the Main Risk Faced by SP?

Dependency on Information Technology

The company’s dependency on automated information technology solutions to support and manage various commercial operations is rising. Additionally, since a portion of SP’s business operations is carried out electronically, there is a higher risk of attack or interception that could result in data loss or misuse, system malfunctions, business interruption, unauthorized malware, and computer or system viruses. The controls and processes the organization has in place may not be enough to shield it from security breaches, even while it continues to invest resources in monitoring and updating its systems and putting information security measures to protect systems in place. A future penetration or breach of SP’s networks, payment card terminals, or other payment systems could be caused by improper actions by third parties, the use of encryption technology, new data hacking tools, discoveries, and other events or developments. The methods that thieves employ to acquire unauthorized access to sensitive data, in particular, are constantly changing and frequently go undetected until they have been utilized against a victim. As a result, SP might be unable to foresee these strategies or take appropriate preventive action.

Additionally, system upgrades, power outages, computer or telecommunications malfunctions, malicious computer attacks, security breaches, and catastrophic occurrences might all cause damage to or halt service to SP’s systems. The damage or improper operation of SP’s systems could result in high repair and replacement costs, data loss or theft, and difficulties managing client transactions, all of which could have a negative impact on the company’s operations and financial performance. The occurrence of cyberterrorism acts could have a materially negative impact on SP’s business. The SP’s financial situation and operational results could suffer if there are any disruptions to its information technology systems, breaches, or data compromises that lead to lost sales, bad press, lawsuits, violations of privacy laws, business interruptions, or reputational harm.

Valuation

The rising demand and expanded addressable market can drive the company’s growth in the coming years. After considering these factors, I believe Seeking Alpha’s EPS estimates are accurate. According to Seeking Alpha, the company’s EPS in FY2023 might be $3.28, which gives the forward P/E ratio of 10.65x. After comparing the forward P/E ratio of the company with the sector median P/E ratio of 15.57x, I think the company is undervalued. The company’s rising dependency on information technology has exposed it to the risk of cyberattacks which can damage its financial condition. SP has insurance coverage that can cover a certain part of cyber risk. Hence, I think the company can trade at a 5-year average P/E ratio of 17.85x in the coming years. The EPS of $3.28 and P/E ratio of 17.85x gives the price target of $58.54, representing a 67.5% upside from the current share price of $34.95.

Conclusion

SP is experiencing strong demand in both segments after the pandemic. The company is able to get the maximum benefit from this rising demand as it has a first-mover advantage and technology that enables efficient mobility. Also, SP has announced the acquisition of KMP Associates, which can significantly expand its addressable market. The company’s rising dependency on information technology has exposed it to the risk of cyberattacks, damaging its financial condition. SP has insurance coverage that can cover a certain part of cyber risk, but there is no remedy for reputation damage. After comparing the forward P/E ratio of the company with the sector median P/E ratio of 15.57x, I think the company is undervalued. After considering all these factors, I assign a buy rating for SP.

Be the first to comment