Editor’s note: Seeking Alpha is proud to welcome Atlas Equity Research as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Photon-Photos

The push toward greener economy is expected to create strong demand for metals in the coming decades. Picking individual miners, especially juniors, is risky due to the risk of their deposit being worse than expected. On the other hand, mineral drilling companies don’t face this risk and are less sensitive to short-term metals’ price fluctuations, because of their long-term contracts. As one such company, Geodrill (TSX:GEO:CA) (OTCQX:GEODF) is well positioned to benefit from increased exploration spending by the miners. The company has a strong balance sheet with a net cash position and is priced at only 2.6x FY EV/EBITDA.

Market Overview

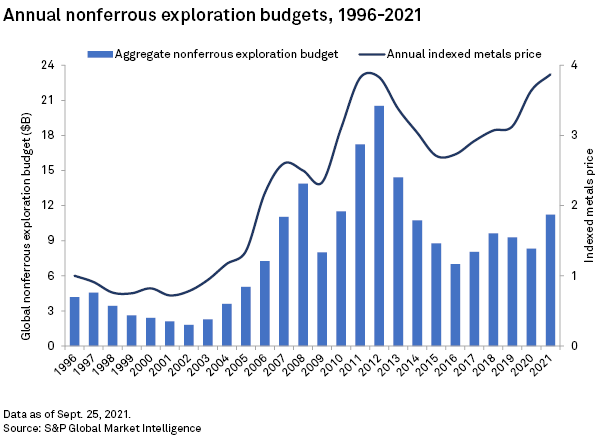

Following a couple of years of depressed prices, non-ferrous metals’ prices have begun to climb. While the COVID-19 lockdowns reduced demand for a few months, supply was also hit hard. The record high government spending around the world led to fast demand recovery and prices took off again. However, on the supply side, things are yet to catch up. According to data from S&P Global Intelligence, annual non-ferrous metals’ exploration budgets had a strong year, reaching US$11.2B from US$8.3B a year ago. While in 2022 another notable increase is expected, the figures remain well below the record 2012, when it was at US$21.5B.

Annual non-ferrous metals’ exploration budgets (S&P Global Market Intelligence)

Another signal toward increased exploration activity could be observed on the financial markets. According to S&P Global Market Intelligence, junior and intermediate mining companies have raised US$21.55B in 2021, up from US$12.13B in 2020. That increase led to 68.9k drill holes in 2021, up nearly 70% from the 41.0k reported the year before.

In light of these reasons, the business environment for exploration drilling companies looks bright in the foreseeable future.

Company Overview

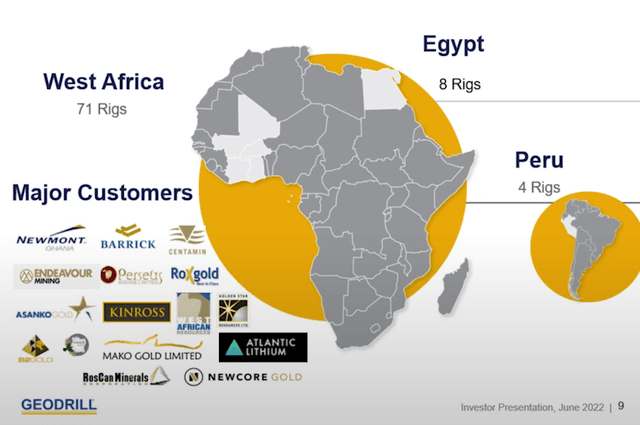

Geodrill is a leading exploration drilling company with a fleet of 75 own rigs and 6 rentals. While the company’s business has been primarily concentrated in West Africa (Ghana, Burkina Faso, Cote d’Ivoire and Mali), recently operations began in Egypt and Peru, and are expected to begin soon in Brazil. The vast majority of clients (95% as of June 2022) are exploring for gold and include the likes of Barrick Gold (GOLD), Newmont (NEM), Kinross Gold (KGC) and Endeavour Mining (OTCQX:EDVMF). Geodrill CEO Dave Harper, who founded the company in 1998 with just one rig and one contract, controls 37.4% of the shares through The Harper Family Settlement as of June 2022. He has over 35 years of experience in the drilling industry, 30 of those years in management and 28 of those in West Africa. The company is listed on the Toronto Stock Exchange under the ticker symbol “GEO” and in August 2022 has upgraded to trade shares on the OTCQX under the ticker symbol “GEODF.”

Geodrill’s operations (Investor Presentation)

Since the beginning of 2022, Geodrill has made three announcements regarding significant contracts. The first one is for multi-rig long-term drilling contracts with Perseus Mining (OTCPK:PMNXF) for exploration drilling in Ghana and Côte d’Ivoire with a term to August 2023 and expected revenue in excess of US$45M over the term of the contracts. The second one is with Centamin (OTCPK:CELTF) for their Sukari Gold Mine in Egypt with a term of 5 years and is anticipated to generate revenues in excess of US$54M over the term of the contract, which makes it the biggest deal for Geodrill to date. The third one is for multi-rig long-term drilling contracts with Endeavour Mining in their operations in West Africa with a two-year term and expected revenue of more than US$31M over the term of the contracts.

Strong Financials

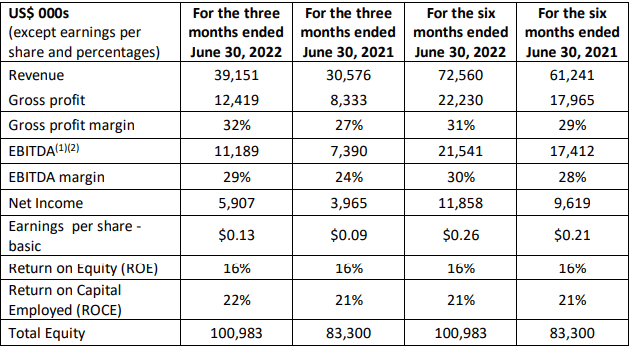

The financial results of the company are starting to reflect the favorable business environment. Q2 2022 revenue increased 28% YoY to US$39.2M, while EBITDA jumped 51.4% YoY to US$11.2M. This led to significant improvement of the respective margin to 28.6%, demonstrating the ability of Geodrill to pass through inflation pressure on opex to its customers. Increases in rig fleet utilization also supported the increase in efficiency as it reached 78% as of Q2 2022, compared to 70% a year ago. Net income for the quarter amounted to US$5.9M (EPS of US$0.13), which is 49% YoY increase.

For H1 2022, total revenue reached US$72.6M (+18.5% YoY) and EBITDA amounted to US$21.5M (+23.7% YoY). Six-month net profit increased 23.3% YoY to US$11.8M (EPS of US$0.26). On the balance sheet, the company enjoys a net cash position of US$2.9M, reflecting the conservative style of the management, which prefers organic growth financed through self-generated funds. In 2021, the company implemented a dividend policy by paying two CAD$0.01 semi-annual dividends and later raised the amount to CAD$0.03 in 2022.

Financial results (Geodrill)

Q3 2022 results are probably going to be below the ones from Q2 2022, due to work disruptions, related to the wet season in West Africa (primarily Mali and Burkina Faso). However, Geodrill has historically taken advantage of this seasonality and has scheduled the third quarter for maintenance and rebuild programs for drill rigs and equipment. That said, I expect the company to have a record 2022 year both in terms of revenue and profitability, reflecting the increase in exploration spending of the miners.

Ambitious Expansion Plans

For the past few years, Geodrill has put more focus on the geographical diversification of its business. The efforts are starting to bear fruit, as in 2021 the company began operating in Egypt and already managed to secure a significant contract there, as mentioned above. Management is trying to also expand into South America in order to benefit from the increase in exploration activity there. Operations were established in 2020 in Peru and a corporate entity has been formed in Brazil, with operations expected to follow in the near future.

The expansion in markets outside West Africa would allow the company to mitigate to an extent the seasonality, related to the wet season in Mali and Burkina Faso and establish its presence as a global player in the drilling space.

Valuation

For the purposes of valuation, I will use the comparable transaction method. In March 2021m, the Australian mineral drilling company DDH1 (ASX:DDH) went public, raising AUD$150M at an FY EV/EBITDA of 5.3x. In October 2021, DDHI acquired its competitor Swick Mining Services at an FY EV/EBITDA of 3.9x. Both companies are of comparable size of Geodrill, as DDH1 had a fleet of 96 rigs as of the IPO date, while Swick had 72 rigs as of the moment of acquisition. These two transactions will be used as upper and lower bands in the fair value estimation process.

For the purposes of valuation, I apply Geodrill’s actual H1 2022 YoY revenue growth (+18.5%) over the entire 2022 and end up with forecasted revenue of US$130.5M. As rig fleet utilization grows, the EBITDA margin improves, therefore, I assume a slight improvement of the EBITDA margin, which stands at 26.5% at a TTM basis to 27.0% for 2022. As a result, projected 2022 EBITDA comes at US$36.9M.

| EV/FY EBITDA | 3.9x | 5.3x |

| FY EBITDA (US$M) | 36.9 | 36.9 |

| EV (US$M) | 143.7 | 195.3 |

| Net Debt (US$M) | -2.9 | -2.9 |

| Equity FV (US$M) | 146.6 | 198.2 |

| number of shares (M) | 46.8 | 46.8 |

| FV/share (US$) | 3.13 | 4.23 |

| Current price (US$) | 2.07 | |

| Upside | 51.2% | 104.4% |

There could be a few reasons for what appears to be a significant undervaluation of Geodrill. For one, the company is quite small for some institutional investors with a market cap shy of US$100M. On top of that, the ownership of the majority shareholder is quite big and further limits the free float. Another reason could be the current risk-off mode of the overall market, which is deep in the red since the beginning of the year. However, I believe that such rationale is less relevant in a potential M&A transaction as Geodrill’s majority owner might use the current upcycle for an exit, after more than 35 years in the industry.

Risks to the Thesis

Political risk – Due to the business being still concentrated primarily in West Africa, political risk easily comes to mind. Events such as political unrest and terrorist attacks are not uncommon for the region. In my opinion, such risks are not as relevant for a driller as one might think. First, the mining sites where the company operates are usually away from cities, where unrest may be taking place. In a recent interview, Geodrill’s CEO Dave Harper noted, that despite being in West Africa for almost 25 years, the company has never lost a rig. Second, unlike miners who are pretty much stuck in a country due to their static assets, a driller’s main assets are movable, so they could just pick up their rigs and leave if the business environment becomes too hostile.

Commodities prices risk – Although the company doesn’t hold mineral rights itself, its clients do. So a decline of metals prices below economically feasible values will likely lead to reduced demand for drilling services. However, due to drilling companies usually signing contracts for a few years ahead, there’s a revenue predictability to a certain extent, so short-term fluctuations of metals prices should not be of high importance.

Currency risk – Geodrill has some exposure to the Central African CFA franc, which is linked to EUR. Since the beginning of the year, the EUR and therefore the CFA has depreciated against the dollar. However, the nature of this FX exposure is mixed – both on the revenue and on the expense side – so the effects cancel out to a certain extent.

Competition – The nature of the drilling industry doesn’t allow for any single player to have much pricing power, and therefore competition is a relevant risk. Regarding the threats of other players taking Geodrill’s market share, I believe the company’s long history and established reputation could help in mitigating this risk to a certain extent.

Conclusion

Geodrill offers an indirect exposure to the metals’ prices upcycle while minimizing some of the risks faced by a typical miner. The company has a strong balance sheet with a net cash position, which would allow for rapid rig fleet expansion if demand is present. Geodrill has growing revenue and expanding margins, which I expect to continue in the face of higher exploration spending by miners. Based on my estimates, Geodrill offers upside between 51.2% and 104.4%.

Be the first to comment