Just_Super

The unusual aspect to IBES by Refinitiv data is that it cuts off incorporating new earnings data as of Thursday night each week, so this data is as of Thursday night, October 13th, 2022, and doesn’t include any of the bank reporting that happened on Friday, October 14, 2022 or any changes to EPS and revenue estimates for the financial companies that reported last Friday.

In the last several quarters, what has been noticed is that Refinitiv will update subscribers with reports during the heaviest parts of the earnings season, which for readers today mean beginning this week through early to mid-November ’22.

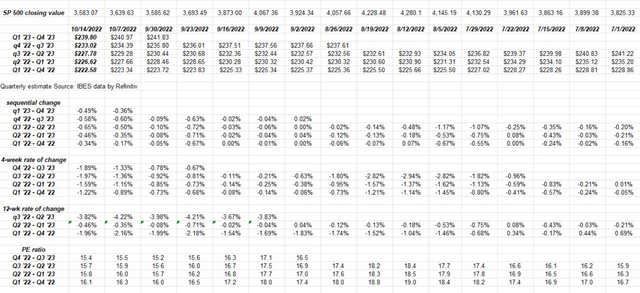

S&P 500 data:

- The forward four-quarter estimate (FFQE) fell to $233.02 this week from last week’s $234.39 for a sequential drop of roughly 1/2 of 1%;

- The P/E ratio this week is 15.4x vs 15.5 last week and 15.6x at the start of the 3rd quarter;

- The S&P 500 earnings yield is now 6.5%, a 2022 high, surpassing the peak of 6.42% the week of June 17th, 2022, and one of the highest earnings yields seen since January ’19;

Rates of change:

This rate-of-change analysis shows that the 4-week rate-of-change is accelerating to the downside. In terms of predictive applications for the stock market or the S&P 500 in particular, and what this portends for “expected forward returns” is unknown, but at the very least, it’s not a positive.

Judging by the stock price reactions of JPMorgan (JPM), Citigroup (C), and Wells Fargo (WFC) on Friday, October 14th, post earnings, perhaps forward EPS estimates work higher, but the heavier volume on a day where the stock was higher could be an oversold bounce, short covering, or new buying at these levels, without the estimates changing very much.

We’ll know more after this week when a much broader section of the stock market reports their Q3 ’22 financial results. Even Netflix (NFLX) and Tesla (TSLA) report this coming week, which will give us insight into higher-multiple growth stocks, and with Tesla a name residing among the top 10 market cap names in the S&P 500.

Summary/conclusion:

Coming into the financial sector earnings releases, I thought the sector was in better shape than the trading levels portended since the consumer was still in relatively good shape from a credit perspective, but we will see what the forward earnings and revenue revisions hold in the next few days.

2022 has been all about “P/E compression” as the S&P 500 P/E started at around 20x the FFQE, while today, it’s 15x the FFQE with some slight degradation in the forward estimate. Many expect – given the constant litany of opinions – that S&P 500 EPS is poised to drop sharply, but those opinions are never supported by anything concrete other than said opinion.

As this blog has written before, many consider S&P 500 EPS estimates to be a “correlated” indicator with the S&P 500, but I suspect it’s coincidental more than leading, and more importantly, like many predictions, one can get the direction right but be very wrong on magnitude.

When the S&P 500 bottomed in March 2009, prepping this blog every week, the S&P 500’s forward 4-quarter EPS estimate didn’t start to trend upward until well into May 2009. There was an 8- to 10-week lag before the FFQE stopped falling. However, what are the odds that a 2008 scenario is repeated in 2022 or 2023?

Ed Yardeni is widely thought to be the dean of S&P 500 EPS forecasters and his expectation is that 2022’s S&P 500 EPS estimate will be $215, versus the current estimate of $222 of Friday, October 14, 2022. It’s a decline, but hardly worth a 25% drop in the S&P 500.

Bespoke’s quarterly earnings outlook has always put a big weight on the sentiment around earnings heading into reporting season, and again coming into Q3 ’22 it was very negative, and it’s typically been a good contrarian indicator in terms of predicting actual earnings. (To be clear that’s not the same thing as saying that the stocks will perform well after earnings, but the actual financial results relative to the estimates pre-earnings.)

2022 is all about the Treasury market, interest rates, and Fed funds expectations, and with Thursday’s September CPI, it doesn’t look like anything has changed yet. Some are actually expecting October CPI to start to reflect the slowing in the various weights across the economic indicator. We’ll see.

The S&P 500 “earnings yield” actually hit a 2022 high this week, which means that the S&P 500 has been declining faster than the S&P 500 forward estimate itself. That’s what P/E compression means. Looking at the earnings yield history, the 6.50% this week was only exceeded by the first few weeks of 2019, after Powell had pivoted away from Fed funds rate increases towards a less hostile monetary policy.

Truly I don’t know what’s going to happen in the next week or month (or months) as the “gloom and doom” today seems as bad as 2008. (The headlines and market chatter always follow price action.) The anomaly in 2022 is the Treasury market as investors are looking at the worst year for Treasury returns since – well – ever, going back to the 1930s but the bond market of today is far, far different than any bond market prior to the 1970s.

Take everything you read here with substantial skepticism and a serious grain of salt. Past performance is no guarantee of future results. This information may or may not be updated in a timely fashion. Capital markets can change quickly for both better and worse.

Thanks for reading.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment