GMVozd/E+ via Getty Images

The past several months have been particularly hard for investors in the stock market. The market, broadly speaking, has tanked amidst fears related to inflation, rising interest rates, supply chain concerns, and the prospect of a real economic downturn. Very few companies have performed well in this environment. But one company that has held up better than most is Sovos Brands (NASDAQ:SOVO). This enterprise owns a portfolio of food brands such as Rao’s, Birch Benders, and Michael Angelo’s. Even though some of its financial performance has been somewhat mixed, the overall trajectory for the company looks positive. And with how far shares have fallen, upside potential from here likely is positive. Due to these factors, I have decided to keep my ‘buy’ rating on the company, with the understanding that market conditions should cause investors to be diligent in assessing changes to the underlying business as more data comes out.

Growth continues

Back in December of 2021, I wrote my first article discussing whether or not Sovos Brands made sense for investors to consider buying into. In that article, I acknowledged that the company had done well to expand at a rapid pace over the prior few years. Its overall financial picture had been getting better year after year, though it was also true that there was still plenty of room left for improvements to be made. The only thing that turned me off about the company was that its stock looked rather pricey. But given how rapidly the company was growing, I felt the firm could grow into its valuation. This led me to rate the company a ‘buy’, reflecting my belief that it would generate returns that would outperform the broader market for the foreseeable future. So far, that company has delivered. While the business has generated a loss for investors of 14.5%, that loss is considerably smaller than the 24% hit that investors would have received owning the S&P 500.

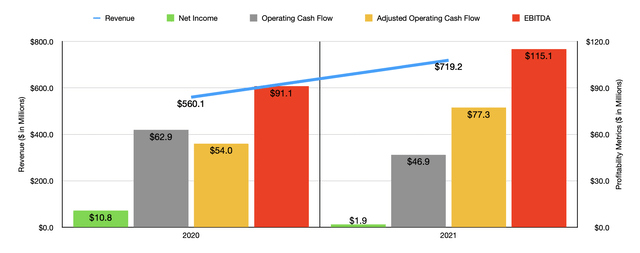

Despite the pricey shares, the company was aided by strength on both its top and bottom lines. For instance, during the 2020 fiscal year, revenue came in at $560.1 million. In 2021, sales shot up to $719.2 million. This 28.4% increase was driven largely by a 34% rise associated with sales of the Rao’s brand. Although companies have been raising prices and such price increases could cause sales to rise in a way that looks rather deceptive, management asserted that the majority of the increase under this brand was because of higher sauce and frozen shipments to key customers. The company ended its 2021 fiscal year with household penetration for its sauce business of 10.9%. That was up 2.6% compared to the 2020 fiscal year. And exiting the final quarter of 2021, Rao’s had become the number two pasta and pizza sauce brand as measured by dollar consumption in the markets in which the company operates. The firm also benefited from increased revenue associated with its spoonable yogurt and it also saw a $47.3 million increase in sales associated with the purchase of the Birch Benders brand that was acquired in October of 2020.

Bottom line results for the company have been slightly mixed. For instance, net income fell from $10.8 million to $1.9 million. But if we make certain adjustments, then profits would have risen from $44.1 million to $54.3 million. Operating cash flow for the company also fell, dropping from $62.9 million to $46.9 million. But if we adjust for changes in working capital, it would have risen from $54 million to $77.3 million. Over that same window of time, we also saw EBITDA for the company expand, climbing from $91.1 million to $115.1 million.

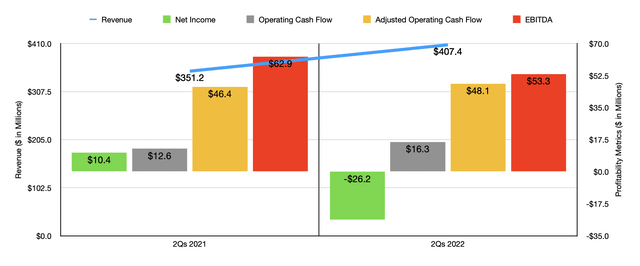

As was the case with the 2021 fiscal year, the 2022 fiscal year seems to be somewhat mixed but generally favorable. Revenue in the first half of the 2022 fiscal year totaled $407.4 million. That’s 16% higher than the $351.2 million generated the same time one year earlier. This increase in revenue was driven primarily by higher volumes and, to a lesser extent, by product pricing and improved product mix. Once again, the Rao’s brand was a key driver of growth, with revenue surging by 29.6% year-over-year thanks to higher sauce sales. Other brands also improved for the most part.

From a profitability perspective, the picture is more complicated. Net income fell from $10.4 million in the first half of the 2021 fiscal year to negative $26.2 million the same time this year. This was driven in part by the company’s gross profit margin declining from 31.7% to 26.7% as a result of higher raw material, packaging, labor, logistics, and energy costs. The company was also somewhat affected by higher slotting fees aimed at supporting its launch of noosa frozen Gelato. Although this change in gross profit margin may not seem material, such a change spread across the revenue the company generated in the first half of the 2022 fiscal year would have impacted bottom line results by $20.4 million. Other profitability metrics have been rather volatile as well. For instance, operating cash flow rose from $12.6 million to $16.3 million. But if we adjust for changes in working capital, it would have risen more modestly from $46.4 million to $48.1 million. Meanwhile, EBITDA for the company worsened, dropping from $62.9 million to $53.3 million.

When it comes to the 2022 fiscal year as a whole, management now anticipates revenue coming in near the low end of its guidance. That range was between $825 million and $835 million. Also near the low end of the guidance should be EBITDA, with that range being between $116 million and $122 million. For the purpose of my analysis, I decided just to use the very bottom of that range. No guidance was given when it came to other profitability metrics. However, if we assume that adjusted operating cash flow will increase this year at the same rate that EBITDA should, then we should anticipate a reading of $77.9 million. It’s also worth noting that valuing the company is complicated by the fact that management just issued 9.775 million additional shares in exchange for gross proceeds of $136.85 million. In my analysis, I factored in these changes.

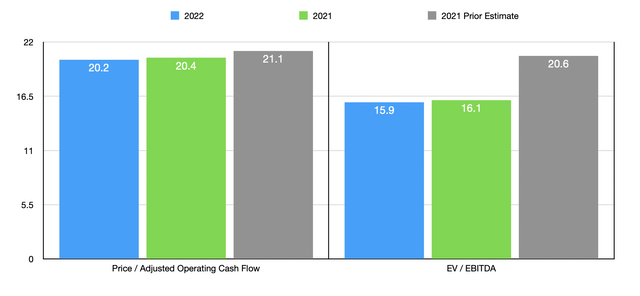

Based on the data provided, Sovos Brands is trading at a forward price to adjusted operating cash flow multiple of 20.2 and at a forward EV to EBITDA multiple of 15.9. These numbers are similar to the 20.4 and 16.1, respectively, that we get using data from 2021. And as the chart above illustrates, the pricing for the company for the 2021 fiscal year is lower than it was when I last wrote about the firm. As part of my analysis, I also compared the company to five similar firms. On a price to operating cash flow basis, these companies ranged from a low of 21.5 to a high of 73.6. In this case, Sovos Brands was the cheapest of the group. Using the EV to EBITDA approach, the range was between 13.2 and 45.7. In this scenario, two of the five companies were cheaper than our prospect.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Sovos Brands | 20.4 | 16.1 |

| SunOpta (STKL) | 24.8 | 21.6 |

| The Hain Celestial Group (HAIN) | 26.3 | 21.8 |

| B&G Foods Inc. (BGS) | 21.5 | 14.2 |

| Dole (DOLE) | 73.6 | 45.7 |

| Mission Produce (AVO) | 23.7 | 13.2 |

Takeaway

Although we are dealing with an uncertain market and Sovos Brands has been posting some mixed financial results, the overall picture for the company remains quite strong. Management has done well to build a portfolio of quality brands that have the potential for attractive growth and will likely continue to demonstrate this growth for the foreseeable future. I wouldn’t exactly call the company a value prospect, but for investors who want a growth enterprise at a reasonable price, this particular business makes sense to seriously consider.

Be the first to comment