shaunl

Shipping companies have taken a beating in recent weeks, with investors clearly concerned about a cyclical economic decline.

ZIM Integrated Shipping Services Ltd. (NYSE:ZIM) is one such company, with its stock price plummeting precipitously in September. I am not concerned about ZIM’s dividend payout; rather, I believe that the shipping company represents a very appealing value proposition today, as fears of a cyclical decline in the shipping industry are likely exaggerated.

Importantly, I believe the company’s 2.3x P/E ratio reflects an extremely high margin of safety, and because the stock is oversold, investors have a contrarian buying opportunity.

ZIM Integrated Shipping: Oversold And Dirt Cheap

Massive market and stock selloffs always present an opportunity to invest in a contrarian manner, and I believe ZIM Integrated Shipping, a container shipping company that draws attention primarily due to its whopping dividend yield, is a good case study.

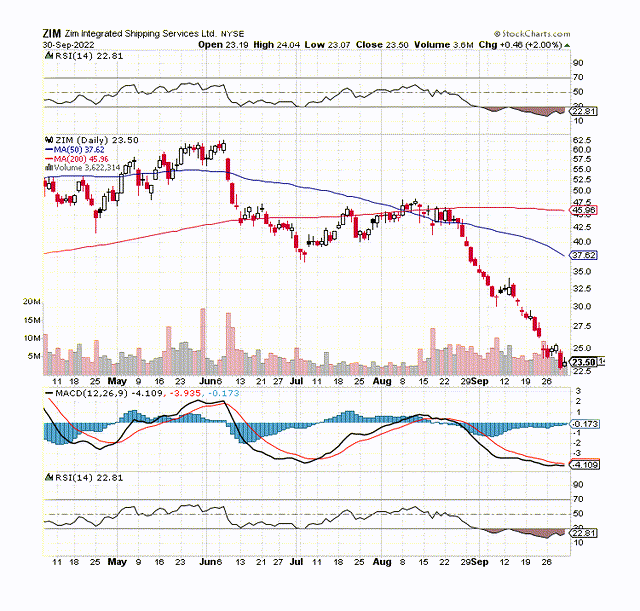

ZIM’s chart situation has deteriorated in recent weeks, especially since I last covered the shipping company, but I believe a buying opportunity has arisen because ZIM is now both oversold and cheap.

The Relative Strength Index, or RSI, which is frequently used to measure both bullish and bearish sentiment, indicates that ZIM is now oversold. A drop in the RSI value below 30 is typically associated with overly bearish market sentiment towards a company and could be interpreted as a contrarian signal that the current selloff has gone too far. ZIM is currently oversold according to the Relative Strength Index, with an RSI of 22.81.

Furthermore, ZIM Integrated Shipping is priced at an unreasonably low earnings multiple. Earnings are expected to fall 75% YoY next year, according to the market, as part of a broader correction in the shipping industry.

However, I believe the market overestimates the impact of a downturn on the shipping company. Despite a 75% expected decline in earnings per share in 2023, ZIM has a P/E ratio of only 2.3x, indicating a significant margin of safety.

Earnings Estimate (Yahoo Finance)

If there is one company in the shipping industry that can weather the storm, it is ZIM Integrated Shipping, simply because the company has built a fortified balance sheet with very few debt commitments that will protect the business from deteriorating fundamentals.

ZIM Integrated Shipping’s Earnings Upsurge

The earnings recovery at ZIM Integrated Shipping is as deep as it is profound. As a result of the Covid-19 pandemic, the company’s earnings began to rise in 2021, coinciding with a global economic upswing.

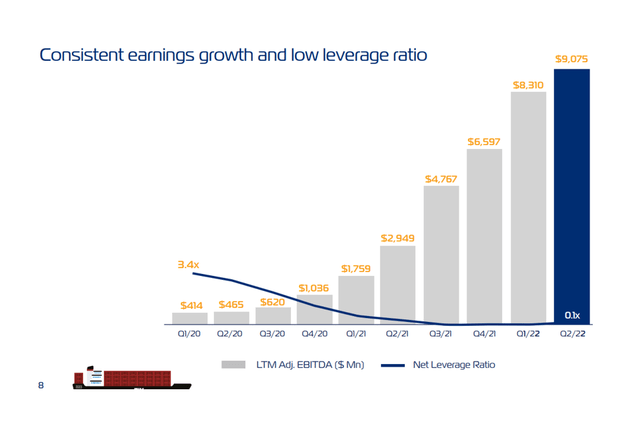

In the second quarter, ZIM’s adjusted EBITDA increased to $9.1 billion on a year-over-year basis. ZIM also had only $630 million in net debt on its balance sheet, which is so small in comparison to the company’s earnings power that it could pay off its entire net debt with a fraction of a quarter’s worth of free cash flow or adjusted EBITDA.

ZIM’s net debt of $630 million equated to 38% free cash flow and 30% adjusted EBITDA in 2Q-22. The company’s net debt is completely negligible, and its strong balance sheet is a valuable asset to have in the event that the economy tanks and average freight rates fall.

Consistent Earnings Growth And Low Leverage Ratio (ZIM Integrated Shipping)

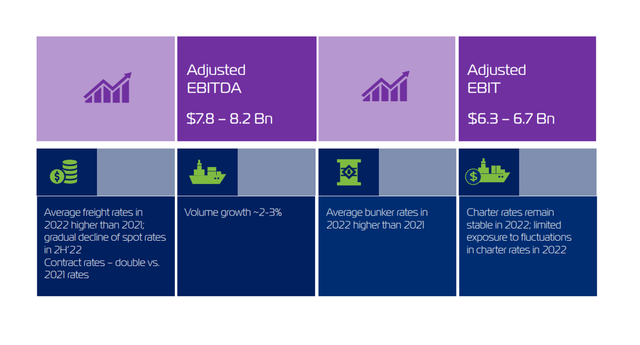

What keeps me optimistic about ZIM Integrated Shipping is that management raised its adjusted EBITDA outlook for the full year after a strong first quarter, implying that the company can not only deal with declining shipping rates but also maintain high margins.

The company did not reduce its EBITDA forecast in the second quarter, indicating that management believes its guidance is achievable. Management’s confidence in its outlook was encouraging, and unless management changes its guidance, investors have every reason to expect ZIM Integrated Shipping to maintain its earnings momentum.

Adjusted EBITDA (ZIM Integrated Shipping)

Why ZIM Integrated Shipping May See A Lower Valuation

Clearly, the market is not fond of shipping companies at the moment, but I believe this is precisely where the opportunity to generate alpha lies.

On the other hand, if the shipping industry and ZIM Integrated Shipping experience a prolonged correction in the container market, the stock is likely to face additional headwinds and may not return to the $40+ region where it was recently trading.

Having said that, ZIM Integrated Shipping’s earnings trajectory remains positive, and I don’t buy into the general doom-and-gloom attitude that has recently taken over the container shipping industry.

My Conclusion

While I understand some investors’ concerns about the global economy’s trajectory, a shipping company like ZIM Integrated Shipping, with very little debt and strong profitability, could withstand a deteriorating operating environment.

ZIM Integrated Shipping has the fundamentals needed to weather a market downturn, and the stock is trading at an absurd valuation.

I think ZIM Integrated Shipping’s stock has an extremely high margin of safety, with a P/E ratio of only 2.3x.

Because the stock is so cheap, I took advantage of the oversold condition to increase my position in ZIM Integrated Shipping.

Be the first to comment