onurdongel

In the energy sector, Southwestern Energy Company (NYSE:SWN) appears to have significant growth potential thanks to a portfolio of highly profitable assets that can provide the cash to execute projects for many years ahead of fossil fuels production, while reducing debt reliance.

Essentially, the investor should monitor these management aspects, in addition to the company’s program of share buybacks, as these are the future developments that will affect the share price. Of course, a favorable environment for commodity prices will greatly assist the company in pursuing its growth goals and contribute to a greater chance of a stock price rising to new heights.

Favorable environment for commodity prices

International geopolitical turmoil, with the war in Ukraine at its heart, continues to put tremendous pressure on commodity prices, particularly oil and natural gas.

The market is desperate for more oil as supply is insufficient, even after OPEC’s decision last week to pump an additional 100,000 barrels starting in September.

Natural gas prices also remain under strong upward pressure due to supply concerns after Russia cut gas shipments to European countries in response to US-led Western countries’ sanctions over the war in Ukraine.

Based on the factors just mentioned, analysts expect sharp increases in oil and natural gas prices from the current levels, as the below table illustrates. Price forecasts are from tradingeconomics.com.

|

Contract Future |

Price at the time of this writing |

Expected price in a year |

Expected positive price change |

|

West Texas Intermediate (WTI) crude oil due September 2022 |

$90.60 per barrel (/bbl) |

≈$103/bbl |

≈13.6% |

|

Brent oil futures due October 2022 |

$96.45/bbl |

≈$110/bbl |

≈13.6% |

|

Natural gas futures due September 2022 (NYMEX) |

$7,828 per metric million British Thermal Unit (/MMBtu) |

≈$10.24/MMBtu |

≈30.8% |

With prices of these commodities rising rapidly, Southwestern Energy Company appears well positioned to benefit from the expected tailwinds of the next oil and natural gas bull market.

What does Southwestern Energy Company do?

Headquartered in Spring, Texas, Southwestern Energy Company is a leading US producer and marketer of natural gas, oil and liquefied natural gases (NGLS) through the development of large fossil fuel deposits in a highly productive area of shale gas basins in the United States.

These unconventional natural gas and oil reservoirs are located on a net area of over 768,000 acres in the Appalachian Mountains of Pennsylvania, West Virginia, Ohio, and Louisiana.

As of December 31, 2021, Southwestern Energy Company was operating 1,527 wells and had approximately 21.15 trillion cubic feet of natural gas equivalent stored in proven natural gas, oil and NGL reserves.

It also deals with the marketing and transportation of these goods.

High Return Operations: A look at relevant results for the second quarter and first half of 2022

For the second quarter of 2022, Southwestern Energy’s Adjusted net income grew 185.3% year over year to $368 million, from $129 million in the same quarter of 2021. In other words, the company saw adjusted earnings per share (EPS) up 73.7% year over year to $0.33 from $0.19 a year ago. Southwestern Energy outperformed analysts by $0.03 on average.

|

Item |

Q2 2022 |

Q2 2021 |

YOY |

|

Adjusted net income |

$368 million |

$129 million |

≈+185.3% |

|

Adjusted EPS |

$0.33 |

$0.19 |

≈+73.7% |

|

Revenue |

$4.14 billion |

$1.05 billion |

≈+294.3% |

|

Adjusted EBITDA |

$822 million |

$300 million |

≈+174% |

Revenue came in at $4.14 billion, up more than 294% year over year, beating the average analyst forecast by $2.27 billion. Adjusted EBITDA shot up 174% to $822 million in the second quarter of 2022, from $300 million in the second quarter of 2021.

As a result, Southwestern Energy Company, which benefited from higher oil and natural gas prices while running strong operations, also reported an adjusted EBITDA margin of 20%.

As higher commodity prices positively impact Southwestern Energy’s top and bottom lines over a longer period than just the most recent quarter, adjusted EBITDA for the first half of 2022 was $1.73 billion (up 57.7% sequentially), while total revenue was $7.08 billion (up 55.8% sequentially).

|

Item |

H1 2022 |

H2 2021 |

Positive Change |

|

Adjusted EBITDA |

$1.73 billion |

Nearly $1.1 billion |

≈57.7% |

|

Revenue |

$7.08 billion |

$4.55 billion |

≈55.8% |

|

Adjusted EBITDA margin |

24.44% |

24.11% |

≈33 bps up |

These two items led to an adjusted EBITDA margin of 24.44% in the first half of 2022, an improvement of 33 basis points (bps) from 24.11% in the second half of 2021.

These numbers show that the company’s asset portfolio has responded very well to the increase in weighted average gross price per thousand cubic feet equivalent (Mcfe) due to the increase in commodity prices. The NYMEX rose 153% year on year, while the WTI rose year on year by 64%.

The company’s net production in the quarter was 438 billion cubic feet equivalent (Bcfe), or 4.8 Bcfe per day, up 58.7% year over year.

The Balance Sheet

Net cash flow, which grew 2.8x year over year to $754 million in the second quarter of 2022 helped the company shrink another portion of its balance sheet.

The cash flow growth was accompanied by a further reduction of the revolving credit facility and the allocation of $45 million to repurchase senior corporate bonds with maturities in 2027 and 2028.

The performance has been recognized by rating agencies, with Moody’s upgrading Southwestern Energy Company’s rating to Ba1 as a long-term debt issuer in May 2022. Now the company is slightly below the investment-grade rating of Moody’s and S&P.

As of June 30, 2022, Southwestern Energy’s balance sheet was burdened with total debt of nearly $5.1 billion, while the ratio of net debt to adjusted 12-month EBITDA, a measure of financial leverage, was 1.6 times, which is an improvement from 1.7x in the previous quarter.

|

Item |

As of Q2 2022 |

As of Q1 2022 |

|

Cash on hand |

$50 million |

$21 million |

|

Total debt |

$5.067 billion |

$4.932 billion |

|

Adjusted ttm EBITDA |

$3.225 billion |

$2.940 billion |

|

Net debt to adjusted EBITDA |

≈ 1.6 times |

≈ 1.7 times |

While the company must maintain its share repurchase program (up to $1 billion through December 2023), further reduce debt and support investments, its current financial position should allow the company to easily meet its next production targets.

The company calls for higher production in Q3 and the full year of 2022

Looking ahead to the third quarter of 2022, Southwestern Energy is targeting total production of between 429 Bcfe and 444 Bcfe, while looking ahead to the full year, the company expects total production to be between 1,715 Bcfe and 1,745 Bcfe.

Second-quarter production is expected to increase 38.4% to 43.2% year on year, while full-year 2022 production is expected to increase 38.3% to 40.7% year on year. This, coupled with the expected rise in commodity prices, would lead to continued balance sheet strengthening and share buyback activity, resulting in a potentially large share price appreciation.

Analyst growth estimates

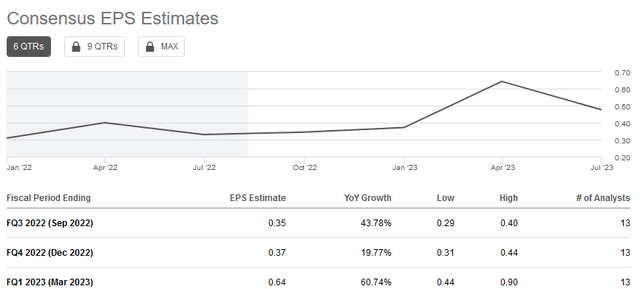

13 sell-side analysts have expectations for higher EPS for the third and fourth quarters of 2022.

seekingalpha.com

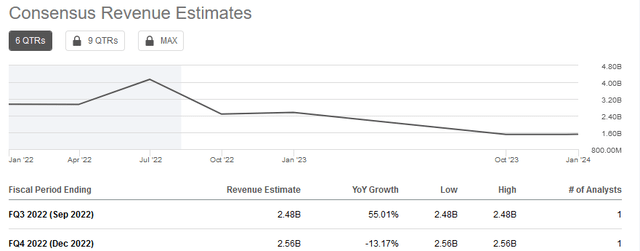

13 Sell-side analysts have expectations for higher Q3 2022 sales and likely higher Q4 2022 profit margins, should FQ4 sales decline when FQ4 EPS increases.

seekingalpha.com

Assuming expectations are met, the stock price could potentially get a strong boost.

The share price of Southwestern Energy Company and analysts’ recommendations

Following the release of the company’s second quarter and first-half 2022 results after the market close last Thursday, the share price rose by 2.4%.

seekingalpha.com

Still, the stock appears affordable as the $6.77 share price as of this writing is roughly in the middle of the 52-week range of $3.81 to $9.87. Also, the share price is well below the 50-day simple moving average of $7.26. Another indicator of the affordability of the current market valuation comes from the expected P/E ratio of 4.43. The stock’s market cap hovers at around $7.3 billion.

As of August, the stock has 33 recommendation ratings on Wall Street, including 4 strong buys, 5 buys, 22 hold ratings and just 2 underperform ratings. The average price target is at $10.82, which implies a 60% increase in the share price from the current level.

Conclusion

Geopolitical and macroeconomic factors will drive oil and natural gas prices higher in the coming months.

As the bull market for energy stocks looks set to continue, it would be advisable to add shares to positions in fossil fuel companies.

Southwestern Energy Company is among the companies that appear to be best positioned to benefit from the next anticipated upturn in commodity prices.

The US oil and natural gas operator will be able to utilize a portfolio of mining activities taking place in the most productive area in the entire United States.

With both manufacturing and commodity prices rising, the company now has more opportunities to strengthen its balance sheet and return value to shareholders by buying back its own shares. The future impact on the stock price should lead to this stock being added to the portfolio today.

Be the first to comment