Joshua Olson/iStock Editorial via Getty Images

Shares of Southwest Airlines (NYSE:LUV) have lost around 7% of their value since reporting second quarter results. That’s of course rather unfortunate and I believe it doesn’t reflect management execution. Over the course of the past few months, I have listened to my earnings calls from airlines and aerospace suppliers and there are just a handful companies that I found have somewhat of a good execution path ahead and Southwest Airlines is one of those airlines.

In this report, I will be analyzing the second quarter results. I will do so using the company’s 8K filing, since the 10-Q filing is not yet available, and management comments from the earnings call.

Southwest Airlines Performance Is Excellent

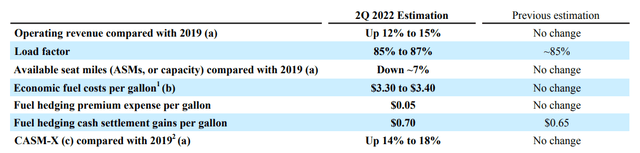

Southwest Airlines Operating Statistics (Southwest Airlines )

As a starting point for the analysis, we take the guidance for the second quarter that Southwest Airlines provided. The airline expected revenues to be up 12% to 15% and actually saw up 13.9% so the company met that target. The load factor was 87.1%, meeting and exceeding the guided range, while capacity was guided to be down 7%. The company performed slightly better with capacity down 6.7%. Unit costs had been guided to be up 14% to 18% and in fact was up 13.1% due to favorable items and favorable timing events as maintenance costs slipping into the second half of the year. On fuel, fuel costs per gallon were $3.36 compared to the $3.30-$3.40 range that had been guided for.

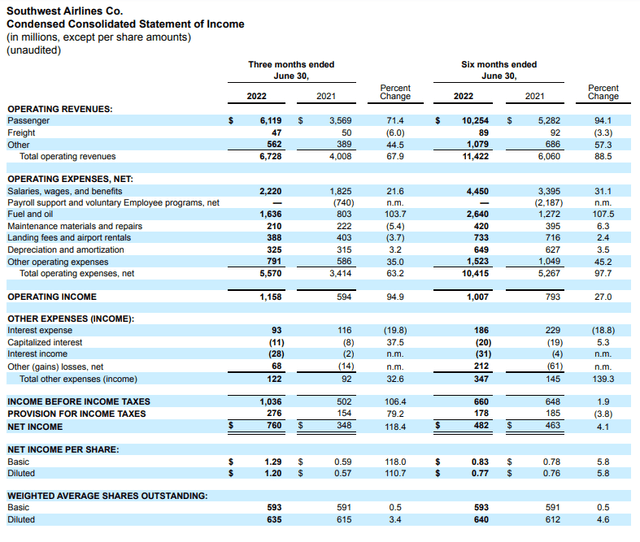

Southwest Airlines Results (Southwest Airlines)

So, Southwest Airlines performed better than it guided for. It’s also interesting to take a deeper look at revenues and cost development. Southwest Airlines provided a year-over-year comparison which I’m not extremely interested in as year-over-three comparisons (comparing results to pre-pandemic levels) is more meaningful. The year-over-year improvements are clear. Southwest Airlines reported revenues of $6.7 billion which is an all-time record for the low-cost carrier. Revenues did beat the consensus by $40 million.

Operating costs almost doubled, reflecting a bigger operation footprint and higher fuel costs leaving the company with record-breaking $825 million profit excluding special items. The non-GAAP EPS of $1.30 beat analyst estimates by $0.12 driven by better-than-expected cost performance during the quarter. Interesting to note is that the results were achieved with system business revenues recovered only 76% and capacity was down 7% compared to 2019. This gives some sense that there’s some room for improvement in revenues or for recovery in business travel demand to offset some softening in leisure yields while deploying more capacity would improve unit costs figures.

Southwest’s Guidance Shows Confidence in Recovery Trajectory

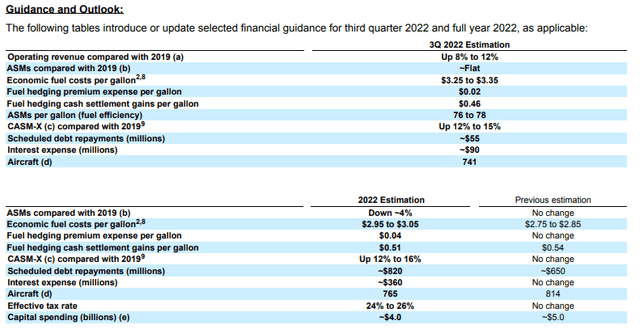

Guidance and Outlook Southwest Airlines (Southwest Airlines)

About the operating results, there isn’t much that needs to be analyzed. The company performed better than expected, and given the solid management focus on improving operational reliability on the short term while also preparing for the longer term, this should not come as a big surprise. More interesting is to look at how the company is positioning itself for the future starting with the guidance.

For the third quarter, seemingly Southwest Airlines is guiding for a deceleration in revenue growth but what is baked into this is around 5 percentage point pressure from a change in Southwest Airlines’ decision to eliminate the expiry date on flight credits. Excluding this impact, you would see stellar growth in revenues in the quarter. Capacity is going to be nearly recovered, which also is seen in the unit cost efficiency as CASM-X will be up 12% to 15% in the quarter while the average fuel costs should drop somewhat. So, there’s some easing on energy prices which should Southwest Airlines which is 63% hedged for the year including 59% in Q3 and 62% in Q4.

Full year capacity is going to be down around 4% with 85% of the network being restored and CASM-X is going to be up around 12% to 16% driven by inflationary pressure, suboptimal performance and accruals for future increases in wages. Furthermore, capital spending will come in approximately one $1 billion lower this year due to delays and Boeing and CFM which shifts some deliveries into 2023 and even 2024.

What I liked about the forward look from Southwest Airlines is that they’re not just looking a quarter a head or at the numbers by year-end, but they’re looking into 2023 as well which is what airlines should be doing. Many airlines made things sound last quarter as if what they would be hiring and planning in Q1 would be affecting summer season in an unprecedented way while it would actually not be the case. If you would hire or plan in Q1, you will see the full effect of that including proficiency gains in the subsequent year and Southwest Airlines is also keeping that in mind like no other. While Q3 capacity will be flat, Q4 capacity will be down around 1% and January and February will be flat again with full network restoration being completed by the end of 2023.

Southwest Airlines Sees Possible Flip In Capacity Constraints

Southwest Airlines training facility (BOKA Powell)

In the report analyzing Q1 2022 results, I dedicated a section to Southwest Airlines’ plan to hire enough staff. What I liked was the detail that the airline provided. The airline was one of the few that made it extremely clear that if you hire today, it’s not going to add to the ability to increase capacity tomorrow. It’s a very simple thing to mention, but Southwest Airlines was one of the few that actually shared this reality. What I liked about details on the hiring was that Southwest didn’t just look at how many pilots they needed to hire, they also provided details on how many flight instructors they would need to operate their simulators to full capacity and how many simulators they had coming in to expand capacity. That really gives an idea what’s needed to put a pilot in the cockpit. It’s not a plug-and-play procedure and Southwest Airlines was the only airline that provided details on the supporting elements required.

In the discussion of the first quarter results, Southwest Airlines shared that it had to hire 35 to 38 flight instructors to meet its needs and 50 to 60 flight instructors to get ahead of its plan while its training facility would be expanded with three simulators. By May 2022, Southwest Airlines had hired all flight instructors to operate their training facilities at full capacity.

Interesting to note is that currently throughout the industry, pilot shortages are providing a constraint to the ability to expand capacity, but if delays carry on in 2023, the limiting factor could become the delivery of new aircraft.

Should You Buy LUV Stock?

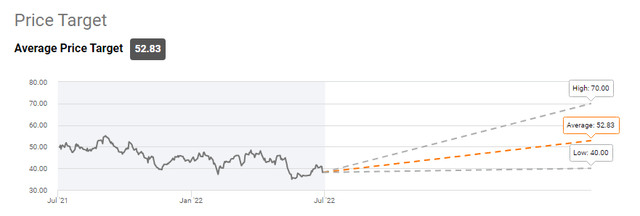

Wall Street price target Southwest Airlines (Seeking Alpha)

As I mentioned earlier, Southwest Airlines stock lost 7% of its value since reporting but Wall Street analysts see roughly 40% upside to current prices and I can see why analysts would be bullish on the prospects of Southwest Airlines. I believe Southwest Airlines is currently being dragged down by the simple comment that it provided on the subject of yield being off-peak. A lot of emphasis is put on that, but it fails to appreciate that yields are still very strong and Q3 traditionally is a quarter where business travel should drive the revenues and that’s an area where we see recovery year-over-year as well as sequentially with a lot of room to grow. So, I don’t see a proper reason for the share price weakness and I believe that the company remains a strong buy among airline stocks.

Conclusion: Solid Executions Makes Southwest Airlines Shares Attractive For Investment

Looking at the second quarter results we saw strong results. Where some airlines missed expectations, Southwest Airlines exceeded expectations and I think that strong performance is not just caused by the strong demand environment witnessed today but the strong management execution which I highlighted last quarter. Ironically, Southwest Airlines has progressed with building capacity in their training facilities to get the pilots into the cockpit to execute its 2023 summer schedule but shareholders were overly focused on a realistic assessment that yields were off-peak. That means that while management is executing well on hiring, capacity restoration and navigates the tough energy market well share prices didn’t reflect this and actually declined while progress was made. I believe that continues to make Southwest Airlines stock a buy on strong management execution and divergent stock price development.

Be the first to comment