Mohamad Faizal Bin Ramli/iStock via Getty Images

Earnings of SouthState Corporation (NASDAQ:SSB) will most probably dip this year because of higher provisioning amid rapidly rising interest rates. On the other hand, the recent acquisition of Atlantic Capital Bancshares, subdued organic loan growth, and significant margin expansion will likely support the bottom line. Overall, I’m expecting SouthState Corporation to report earnings of $6.41 per share in 2022, down 4% year-over-year. The year-end target price suggests a small upside from the current market price. Therefore, I’m adopting a hold rating on SouthState Corporation.

Higher Interest Rates to Lead to Higher Provisioning

SouthState Corporation has reversed some of its previous provisionings for loan losses in the last five consecutive quarters. This trend is set to sharply reverse in the year ahead due to economic threats on the horizon. The Federal Reserve’s most recent increase in the Federal Funds rate exceeded my expectations for this time of the year. Further, the Federal Reserve projects the Fed Funds rate to almost double from the current level of 1.75% to around 3.5% by the end of this year. Such high rates will hurt borrowers’ ability to service their debts.

Although the chances of a recession are low, if a recession comes to pass, then it could further weaken the asset quality. Considering these factors, I’m expecting the provision expense to remain above normal for the last three quarters of the year. For the full year, I’m expecting the net provision expense to make up 0.14% of total loans. In comparison, the net provision expense averaged 0.13% of total loans in the last five years.

Acquired Loans to Lift Earnings

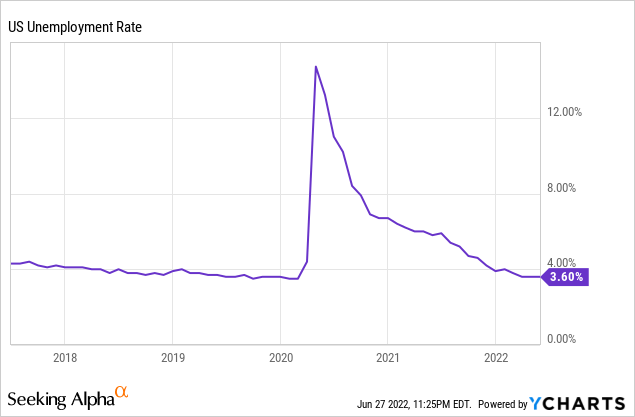

Thanks to the acquisition of Atlantic Capital Bancshares, Inc. (ACBI) in March 2022, the loan balance jumped by a remarkable 11% in the first quarter of 2022. Loan growth will likely return to a low-single-digit range for the year ahead, mostly driven by economic factors. The unemployment rate is at a remarkably low level, which bodes well for loan growth, especially for consumer and residential mortgage loans. (Note: although SouthState Corporation is not a nationwide lender, I’m using national economic metrics because the company operates in several southeastern and eastern states with economies that are quite different from each other. Therefore, the national average is appropriate to gauge loan demand.)

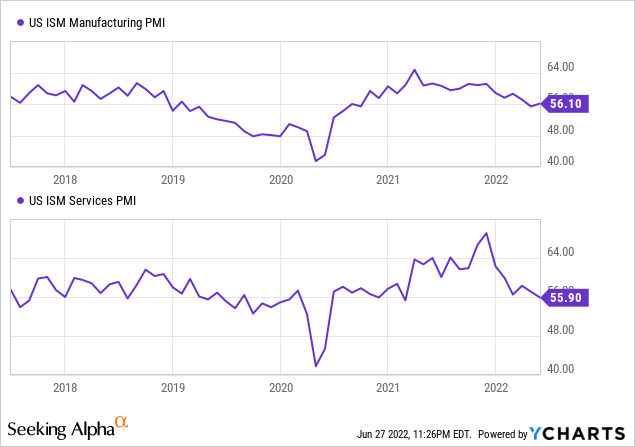

Further, the purchasing managers’ index is still well in the expansionary territory, which bodes well for commercial loans.

Considering these factors, I’m expecting the loan portfolio to increase by 2.3% in the last nine months of 2022, leading to full-year loan growth of 13.6%. Meanwhile, deposits will likely grow in line with loans for the remainder of the year. The following table shows my balance sheet estimates.

| FY17 | FY18 | FY19 | FY20 | FY21 | FY22E | |

| Financial Position | ||||||

| Net Loans | 10,575 | 10,962 | 11,313 | 24,207 | 23,626 | 26,851 |

| Growth of Net Loans | 59.2% | 3.7% | 3.2% | 114.0% | (2.4)% | 13.6% |

| Other Earning Assets | 1,867 | 1,723 | 2,491 | 8,994 | 13,810 | 15,022 |

| Deposits | 11,533 | 11,647 | 12,177 | 30,694 | 35,055 | 39,951 |

| Borrowings and Sub-Debt | 503 | 537 | 1,115 | 1,170 | 1,108 | 1,141 |

| Common equity | 2,309 | 2,366 | 2,373 | 4,648 | 4,803 | 5,431 |

| Book Value Per Share ($) | 77.2 | 64.3 | 68.2 | 65.2 | 67.8 | 75.3 |

| Tangible BVPS ($) | 43.8 | 37.1 | 39.4 | 41.0 | 43.6 | 46.7 |

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

Net Interest Income’s Rate-Sensitivity to Bear Fruit

The net interest income of SouthState Corporation will benefit from the sharp interest rate hikes as it is quite rate-sensitive. This rate sensitivity is mostly attributable to the loan mix. As mentioned in the latest earnings presentation, around 42% of the portfolio is based on variable rates (here the definition of variable includes adjustable loans that are to re-price within one year).

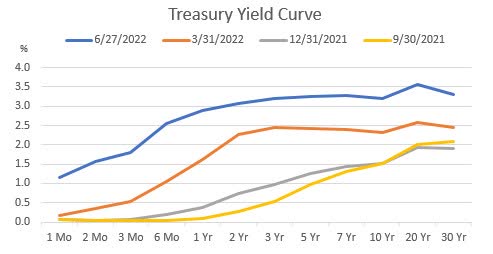

Moreover, SouthState Corporation has a large balance of cash equivalents which gives the company the flexibility to quickly shift its asset mix to take advantage of rising interest rates. Interest-earning deposits with other banks, which is the biggest cash component, made up 13% of total earning assets at the end of March 2022. Even if SouthState fails to change the asset mix, the income earned on cash equivalents will jump significantly as the yield curve has shifted upwards in recent months.

U.S. Treasury Department

Meanwhile, non-interest-bearing checking accounts, which make up a sizable 36% of total deposits, will weigh down the average cost of deposits amid a rising interest-rate environment. In anticipation of the monetary tightening, SouthState Corporation has improved its deposit mix throughout last year. The proportion of non-interest-bearing deposits increased to 36.2% by the end of March 2022 from 31.6% at the end of December 2020.

Moreover, in the past SouthState Corporation’s deposit cost has been quite sticky. In the last monetary policy tightening, which was from the fourth quarter of 2015 to the second quarter of 2019, the total deposit beta was 24%, as mentioned in the presentation. This means that a 100-basis points increase in interest rates resulted in only a 24 basis points increase in the average deposit cost.

The management’s interest-rate sensitivity analysis given in the presentation shows that a 200-basis points increase in interest rates could boost the net interest income by 9.1% over twelve months. Considering these factors, I’m expecting the margin to increase by 45 basis points in the last nine months of 2022 from 2.77% in the first quarter of the year. My estimate is at the lower end of the management’s guidance given in the conference call. The management expects the net interest margin to be in the range of 3.2% to 3.3% by the end of this year.

Expecting Earnings to Dip by 4%

The anticipated surge in provisioning expense will likely lead to a dip in earnings this year relative to last year. On the other hand, acquired and organic loan growth and margin expansion will likely support the bottom line. Moreover, the non-interest expenses will likely be lower this year relative to last year because of some cost savings from the acquisition of Atlantic Capital Bancshares. Overall, I’m expecting SouthState Corporation to report earnings of $6.41 per share in 2022, down 4% year-over-year. The following table shows my income statement estimates.

| FY17 | FY18 | FY19 | FY20 | FY21 | FY22E | ||||

| Income Statement | |||||||||

| Net interest income | 409 | 513 | 504 | 826 | 1,033 | 1,199 | |||

| Provision for loan losses | 12 | 14 | 13 | 236 | (165) | 37 | |||

| Non-interest income | 140 | 146 | 144 | 311 | 354 | 351 | |||

| Non-interest expense | 368 | 421 | 405 | 798 | 948 | 921 | |||

| Net income – Common Sh. | 88 | 179 | 186 | 121 | 476 | 463 | |||

| EPS – Diluted ($) | 2.93 | 4.86 | 5.36 | 2.19 | 6.71 | 6.41 | |||

|

Source: SEC Filings, Earnings Releases, Author’s Estimates (In USD million unless otherwise specified) |

|||||||||

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes. Further, the threat of a recession can increase the provisioning for expected loan losses beyond my expectation.

Waiting for Dips

SouthState Bancshares is offering a dividend yield of 2.5% at the current quarterly dividend rate of $0.49 per share. The earnings and dividend estimates suggest a payout ratio of 31% for 2022, which is close to the average of 35% for 2017 to 2019. Based on the payout ratio, I’m not expecting any change in the dividend level.

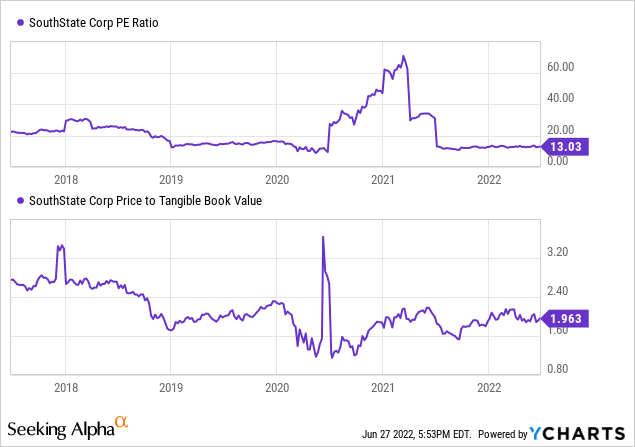

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value SouthState Corporation. The historical trends of these multiples have some outliers, as shown below. Therefore, I’m using trimmed averages.

The stock has traded at a trimmed average P/TB ratio of 1.72 in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | T. Average | ||

| T. Book Value per Share ($) | 37.1 | 39.4 | 41.0 | 43.6 | ||

| Average Market Price ($) | 82.8 | 73.9 | 60.8 | 79.0 | ||

| Historical P/TB | 2.23x | 1.88x | 1.48x | 1.81x | 1.72x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $46.7 gives a target price of $80.5 for the end of 2022. This price target implies a 2.2% upside from the June 27 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.52x | 1.62x | 1.72x | 1.82x | 1.92x |

| TBVPS – Dec 2022 ($) | 46.7 | 46.7 | 46.7 | 46.7 | 46.7 |

| Target Price ($) | 71.1 | 75.8 | 80.5 | 85.1 | 89.8 |

| Market Price ($) | 78.7 | 78.7 | 78.7 | 78.7 | 78.7 |

| Upside/(Downside) | (9.7)% | (3.7)% | 2.2% | 8.1% | 14.1% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 14.2x in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | T. Average | ||

| Earnings per Share ($) | 4.86 | 5.36 | 2.19 | 6.71 | ||

| Average Market Price ($) | 82.8 | 73.9 | 60.8 | 79.0 | ||

| Historical P/E | 17.0x | 13.8x | 27.7x | 11.8x | 14.2x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $6.41 gives a target price of $91.1 for the end of 2022. This price target implies a 15.7% upside from the June 27 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 12.2x | 13.2x | 14.2x | 15.2x | 16.2x |

| EPS 2022 ($) | 6.41 | 6.41 | 6.41 | 6.41 | 6.41 |

| Target Price ($) | 78.2 | 84.7 | 91.1 | 97.5 | 103.9 |

| Market Price ($) | 78.7 | 78.7 | 78.7 | 78.7 | 78.7 |

| Upside/(Downside) | (0.6)% | 7.5% | 15.7% | 23.8% | 32.0% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $85.8, which implies a 9.0% upside from the current market price. Adding the forward dividend yield gives a total expected return of 11.4%. As the total expected return is not high enough for me, I’m adopting a hold rating on SouthState Corporation. I would prefer to wait for price dips of around 5% before considering investing in the stock.

Be the first to comment