imaginima

Thesis

When it comes to navigating a looming recession, no company will be immune, including defensive utility stocks such as The Southern Company (NYSE:SO). The company’s confident posture (of not seeing recession in its data) in its previous Q2 earnings call would be tested in its upcoming Q3 release.

However, the market has already reacted to SO’s overvaluation in the increasing likelihood of a global macroeconomic recession. Notably, SO has collapsed more than 20% from its August highs, as Southern Company’s growth cadence in FY23 could moderate markedly. As a result, the market needs to de-risk its valuation through 2023 to reflect increased execution risks over its growth profile.

Therefore, the critical question investors have in mind is whether the battering is near completion. Our assessment suggests that SO is likely at a near-term bottom after the recent capitulation move. However, its valuation is still too expensive going through the cycle. As such, we expect further value compression could be in store to force the digestion of its valuation premium down further.

Hence, we don’t encourage investors to add SO at the current levels until its valuation has been de-risked meaningfully to reflect its recessionary challenges. Also, we encourage investors to assess management’s commentary on potential changes to its forward guidance and changes to its commentary about a recession.

As such, we rate SO as a Hold for now.

SO Is Still Too Expensive Going Into A Recession

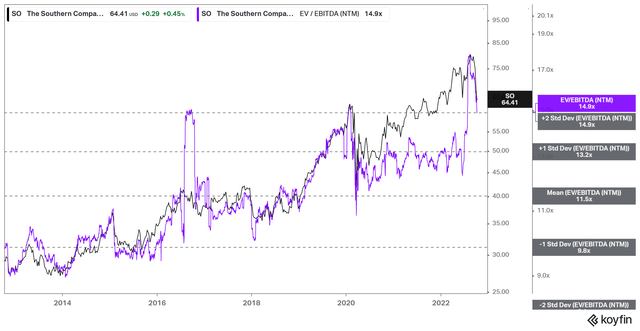

SO NTM EBITDA multiples valuation trend (koyfin)

As seen above, SO’s NTM EBITDA multiples traded well above the two standard deviation zone over its 10Y mean, suggesting a relatively overvalued stock. Also, the optimism over SO has kept it in overvaluation zones for much of 2021.

Therefore, we expect well-deserved digestion to de-risk its near-term challenges through the recession, even though its long-term secular growth drivers remain intact. Investors should not expect SO to continue trading at such elevated valuation levels through the worsening macroeconomic climate, which could impact its performance significantly.

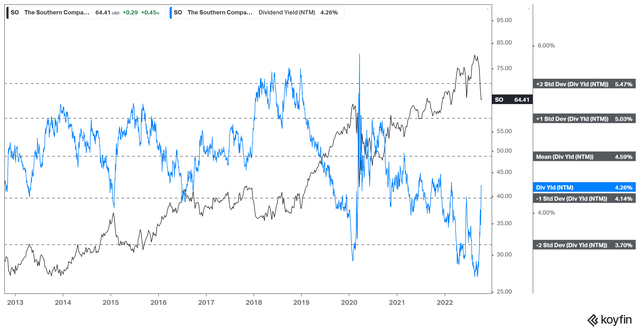

SO NTM Dividend yields % valuation trend (koyfin)

A further glance over its NTM dividend yields corroborated our previous observation. Buyers have continued supporting SO through its August highs even though its yields recently fell to their 10Y lows.

Despite the recent surge, as the market sent SO tumbling from its August highs, it’s still nowhere close to being relatively undervalued. Hence, we encourage investors to remain patient, allowing the market to indicate where the likely consolidation zone could be following its pummeling.

Southern Company’s Growth Likely To Be Impacted in 2023

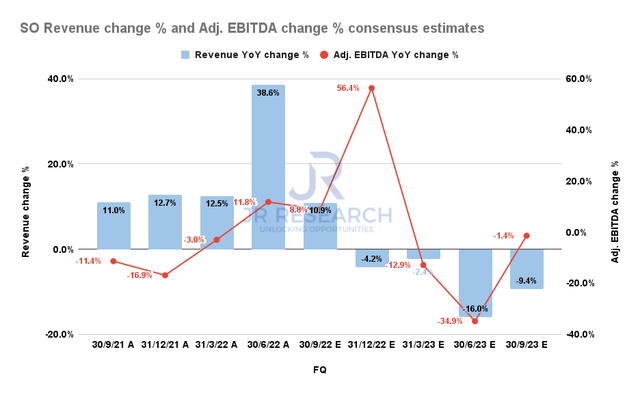

Southern Company Revenue change % and Adjusted EBITDA change % consensus estimates (S&P Cap IQ)

The consensus estimates (neutral) indicate that investors need to expect significant moderation in the company’s revenue and profitability growth cadence through FY23. Notably, its adjusted EBIT growth could decline by 34.9% in FQ2’23, with revenue down by 16%.

Therefore, we urge investors to carefully parse management’s Q3 commentary on their expectations about the coming recession. At its Q2 call, management highlighted that it did not expect a recession. However, the market’s reaction suggests that it has likely de-rated SO in anticipation of a growth normalization. Therefore, a worse-than-expected downturn could cause SO to suffer further value compression, given its growth premium.

Is SO Stock A Buy, Sell, Or Hold?

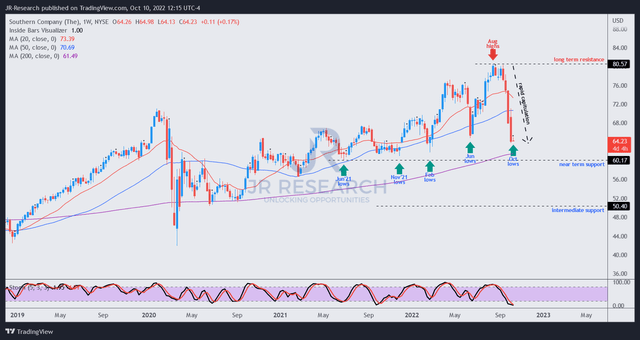

SO price chart (weekly) (TradingView)

The capitulation move seen from its August highs could lead to a near-term consolidation zone as the market attracts dip buyers.

However, we urge investors to refrain from pulling the buy trigger now, as its valuation is not attractive. Furthermore, we expect a re-test against its near-term support, which has supported SO’s medium-term uptrend since June 2021. Therefore, it’s critical to assess whether buyers would be keen to defend that zone robustly before pulling the buy trigger.

A failure of that zone could see SO plunging toward the $42 intermediate support zone, which is not unthinkable. If you observe its valuation metrics, a decline toward its $42 zone will rein in its overvaluation to its 10Y EBITDA multiple mean.

We also expect that level to attract buyers to vigorously defend, which could unveil clues into whether adding at that level is appropriate. Therefore, we postulate that it’s still too early for buyers to consider adding SO.

We rate SO as a Hold and urge investors to be patient.

Be the first to comment