MMassel/iStock Unreleased via Getty Images

Sony Group Corporation (NYSE:SONY) is one of Japan’s most iconic companies. The giant made its name for making reliable consumer electronics, whether TVs, cameras, and most famously its PlayStation gaming console. But Sony is much more than a consumer electronics business; its PlayStation business is now software-driven rather than relying on hardware sales. It is also the world’s biggest music company by revenue, bigger than Universal Music Group N.V. (OTCPK:UMGNF).

Its movie business is making big hits, the latest of which was Spider-Man: No Way Home, which grossed $1.9 billion worldwide. Its computer vision system Hawk-Eye is used in many sports such as tennis, soccer, and baseball, with the goal of aiding officials and providing analytics services. It also has a very strong semiconductor business.

In addition to its technology businesses, the company has a big financial service arm in Japan. So Sony is a leading company in gaming, music, scripted content, consumer electronics, and semiconductors. Yet despite that, it has a market cap of $104 billion, much smaller than companies like Costco Wholesale Corporation (COST), The Walt Disney Company (DIS), and Salesforce Inc. (CRM). Sony generated more operating income in 2021 than all those three companies combined.

This article will argue that Sony is undervalued, and that based on the multiples awarded to its competitors, the company’s sum of the parts would be at least 50% higher than its current market cap. I will use the price/sales and price/operating income in the valuation, given those are the two metrics Sony management breaks out to investors when discussing each business unit.

Gaming

Along with Tencent Holdings Ltd. (OTCPK:TCEHY), Sony is considered the biggest gaming company in the world. Its PlayStation console dwarfs that of Microsoft’s Xbox (MSFT). Its PlayStation Plus Network monthly users stands at 106 million, much higher than Xbox users. Sony’s gaming unit generated more than $24 billion in revenue in 2021, compared to the $15 billion Microsoft generated from gaming. The comparison with Microsoft’s Xbox is apt given the two businesses are the biggest gaming consoles in the world, and because they operate the app store business connected to those consoles.

Applying Microsoft’s price/sales multiple of 9.7 on Sony’s gaming unit would result in a massive ($24.4 billion * 9.7) $236.68 billion valuation. A more appropriate approach would be to use operating income multiples. Applying the price/operating income multiple of Microsoft to Sony’s gaming unit would yield a more reasonable ($3 billion * 26) $80 billion price. One could argue that comparing the two based on the multiple would favor Sony, given Microsoft has a phenomenal cloud business and better margins that boost its multiple.

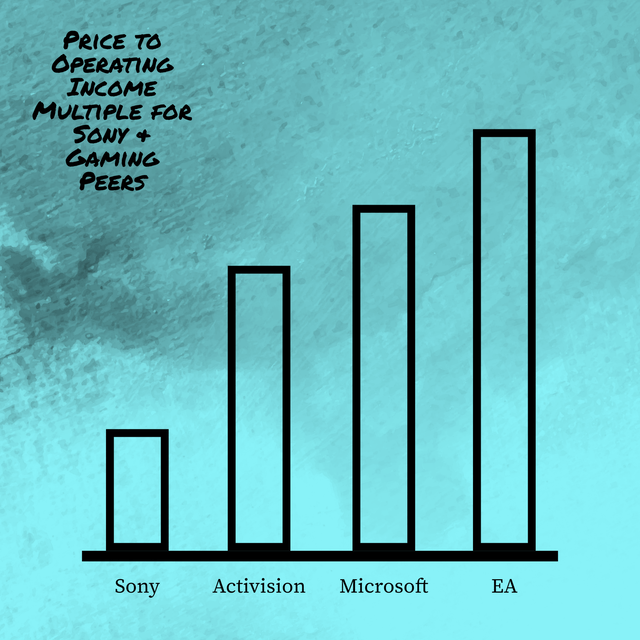

I would certainly concede that criticism for the valuation derived based on price/sales, but not the price/operating income one. This is due to two reasons: 1) the $80 billion valuation for the gaming business is only 15% higher than Microsoft’s valuation of Activision Blizzard Inc. (ATVI). Clearly Sony’s gaming business is superior to that of Activision, given it is the leading console manufacturer (primarily a duopoly) and operates the console’s app store; and 2) A 26x multiple for operating income seems reasonable, given Microsoft bought Activision for 20x operating margins. The second biggest gaming publisher, Electronic Arts Inc. (EA), sells for more than 30x price/operating income.

Sony’s multiple is much lower than its gaming peers (Created by author using regulatory filings)

Music

Sony’s music business is the biggest in the world by revenue, or second-biggest if you count Spotify. It generated almost $10 billion in revenue in its fiscal year that ended March 2021. In the calendar year 2021, the company generated $9.5 billion in revenue, significantly higher than what Universal Music Group and Warner Music Group Corporation (WMG) generated. The business is growing rapidly; Revenues grew almost 19% year-over-year in constant currency in 2021. Revenue from streaming music grew 37% during the same period in constant currency and currently makes up 42% of sales.

Pricing Sony’s music business is a lot more straight forward compared to gaming, giving both its competitors are public companies. Universal Music Group and Warner Music Group trade at a price/operating income of 27.2 and 21.2 respectively. Sony’s music business made more revenue, operating income, and had higher operating margins than both companies in 2021. But for the sake of conservatism, I’ll assign the business the average price/operating income of its competitors of 24.2. This would give the music business unit a price of (24.2 * 1.9) of almost $46 billion.

Pictures

Sony has maintained a decent TV and movie business after it acquired Columbia Pictures a decade ago. The unit generated more than $11 billion in revenue and close to $2 billion in operating income in 2021.

The company has two phenomenal movie franchises in Spider-Man and Venom. It also distributed and produced some of TVs most iconic shows like Seinfeld, Breaking Bad, Better Call Saul, and The Crown. A smaller yet sizeable portion of the unit’s revenues come from a group of pay tv channels it offers in the U.S. and abroad.

The business is a lot similar to Warner Bros. Discovery Inc. (WBD), given the exposure to cable and the strong movie and TV franchises.

It is hard to argue that Warner Bros. Discovery is trading on fundamentals, but applying its current price/2021 operating profit to the Sony pictures business would give the unit (3.7 * $1.9 billion) a $7 billion price tag.

Consumer electronics, semis, computer vision system

I lumped the consumer electronics, semis, and hawk-eye businesses together because Samsung (OTC:SSNLF) can serve as a comparable company in pricing those units. Those businesses generated more than $30 billion in revenue in the company’s 2021 fiscal year. Operating profit was $3.3 billion. Those 3 units have some of Sony’s most famous products, whether its TVs, smartphones, cameras, or the Hawk-eye computer vision system used in tennis and other major sports.

Samsung is a good comp. to those units given the South Korean company’s similar business lines in consumer electronics and semiconductors. Samsung currently sells at 7.45x trailing 12-month operating income. This would give the Sony business units a price of (7.45 * $3.3 billion) $24.5 billion.

Bringing it all together

Adding the price of all business units together would give Sony a price of (80+46+7+24.5) of $157.5 billion ($125 a share), or a 48% upside. You also get the financial services business for free. That unit made $1.3 billion in operating income on $13.7 billion of revenue in 2021.

Sony’s return on equity is in-line with the average S&P 500 company. Its businesses have different types of barriers to entry that could see the company at the very least maintain its ROE going forward. Assigning a price to book multiple of 3.9 that the average S&P 500 company gets to Sony’s current book value (3.9 * $39) would fetch a valuation north of $150 per share. Sony could also grow its book value by roughly $6 a share per year, meaning book value could double at least every 6.5 years.

Risks

Further declines in the general prices of stocks would likely bring down the multiples of Sony’s comparable stocks. The valuation provided in the article did lean towards conservatism whenever the option existed, providing some margin of safety against any potential declines. Inflation could see Sony increase its capex, potentially lowering the quality of the company’s operating income. A deterioration in economic conditions could see the company struggle to replicate its 2021 performance for some time, which would require lowering the stock’s valuation.

Be the first to comment