Sundry Photography

General Motors (NYSE:GM) has laid out expectations for its autonomous ride-hail unit Cruise to reach $1 billion in revenues by 2025, with the service live in San Francisco with upcoming roll-outs planned in Austin, Phoenix, and Dubai. The robotaxi operator recently announced plans to expand to more locations in 2023, although specific cities and dates have not been released; Cruise also aims to scale to thousands of robotaxis during the year, per COO Gil West. With initial pricing data available, estimating Cruise’s potential revenue as it scales is possible, and it offers insights into the amount of revenue thousands of robotaxis can generate.

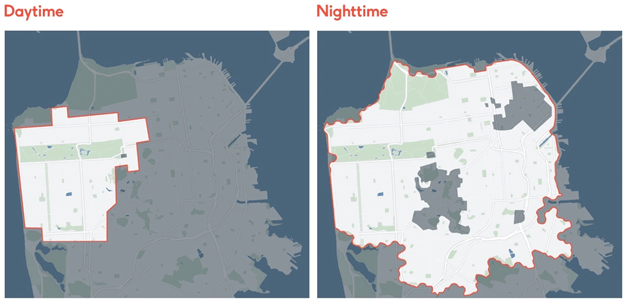

Service Area Expansion In San Francisco

Last month, Cruise greatly expanded its robotaxi service area in San Francisco, with service not available in the north-east corner (District 3/6) and central region (District 8). The service expansion will allow Cruise the ability to transport more passengers to more areas of the city; however, the service is not fully available to the general public, who are still limited to nighttime hours.

Cruise

Cruise’s daytime service area, available only to employees ahead of a release to the general public, is currently restricted to the western side of the city (primarily District 1/4), potentially limiting the amount of passengers with access to the service. An expansion to match nighttime service are will greatly expand reach, although Cruise still will not have access to the high volume, taxi-dominated northeast corner in District 3 and 6.

Annual Revenue Possibilities

Cruise’s current fares “include a base fee of $5 and a $0.90 per mile and $0.40 per-minute rate.” Fares also include a 1.5% city tax, and are calculated “using the estimated time and distance of the fastest, most optimal route.”

Data from the SFCTA place the average ride-hail trip distance at 2.6 miles for intra-SF rides, with an average time of ~11 minutes. Given Cruise’s pricing structure, an average paid trip in a Cruise autonomous vehicle would be approximately $11.92. A longer trip, such as a 5.2 mile, 18 minute trip, could cost about $17.13.

Data points to ridehail vehicles averaging around 26 to 29 trips per day in the city, but the number of trips for Cruise is likely to be much lower, potentially between 12 to 16 trips to start given the semi-limited service area (not available in high-volume districts) and current limited operating hours (subject to change), and a lack of public trust. Given that level of projected trips, each Cruise vehicle could generate about $143 to $167 per day.

With about 70 AVs operating in the paid service area in San Francisco, the fleet could generate $10,010 to $11,690 daily, or about $3.85 million annually at midpoint.

A 300 Vehicle Fleet

Cruise has approximately 300 autonomous vehicles in its fleet at the moment, testing and operating in San Francisco, Austin, and Phoenix. Assuming that Cruise commercializes operations in the latter two cities early in 2023, and can generate revenue across all three, revenue potential expands, though not significantly.

Assuming that by mid-2023, Cruise has a 300-vehicle revenue-generating fleet and keeps the same pricing structure across the fleet, revenues could rise to about $16.9 million at midpoint.

The main takeaway here is that Cruise will have to significantly span operations over the next 24 months if it wants to solidly achieve that $1 billion revenue target in 2025. Cruise is aiming to deploy thousands of vehicles in 2023, yet dozens of more cities will be needed to facilitate such an expansion. Cruise is looking to use a cookie-cutter model in which it can successfully replicate deployments across other cities in less than 90 days.

“Thousands Of Vehicles” By 2023

Cruise COO Gil West told Reuters the AV developer is aiming to enter a “large number of markets” and deploy up to “thousands of vehicles” in 2023. This would mark a pretty rapid expansion of commercial services and fleet size, not just for Cruise but for the broader AV industry. Cruise believes this expansion can be done with the launch of the Origin, a purpose-built AV with no steering wheel or pedals, tailored for autonomous ride-hailing. The California DMV has approved Cruise to test the Origin in San Francisco, so commercial deployment and charging for rides to the public still is multiple months away.

Cruise is also working with the Dubai Roads and Transport Authority to deploy a fleet in Dubai by the end of 2023. Two Cruise vehicles begin mapping in the city earlier this summer, paving the way for commercial deployment. Although specifics about an initial fleet size have not been released, RTA Director General Mattar Al Tayer is hoping to reach 4,000 Origins in operation by 2030.

Aside from geographic expansion, Cruise is also exploring an expansion of driverless delivery services, like what it is testing with Walmart in Phoenix. Driverless services are an entirely different use case and may also be easier to scale due to the lack of passenger liability.

As Cruise plans to scale, it faces increasing competition from other AV developers, namely Alphabet’s Waymo (GOOG), which is now testing in LA and Bellevue, Wa., with commercial operations in Phoenix and services in SF. Uber (UBER) and Motional just deployed robotaxis in Las Vegas, a market Motional is already familiar with via Lyft (LYFT).

What’s Needed To Reach $1B By 2025?

So while Cruise is planning a packed year next year in terms of expansion efforts, what would actually be needed to reach $1 billion in revenues in 36 months?

To reach $1 billion in revenues, Cruise’s fleet would need to generate at least $2.74 million per day, on average; obviously ride-hail revenues fluctuate depending on the day/season, but the figure can provide an estimation on fleet size and trips taken.

Under the original assumption for SF, with each vehicle averaging about $155 per day on about 14 trips, Cruise would need a fleet of more than 17,650 autonomous vehicles; reaching such a fleet size would seem like a challenging objective, especially if each city tops out at 500 vehicles — that would require Cruise to expand to 35 cities by 2025.

If Cruise increases its trip volumes, mirroring ride-hail drivers at about 28 trips per day, to earn about $335 daily per vehicle, Cruise would need 8,100 vehicles in its fleet.

Assuming trips are longer, averaging about 20 minutes with a total cost of $18, a vehicle taking 15 trips per day would generate about $270. At that level, Cruise’s fleet size would need to be near 10,000 AVs.

An analysis from Forbes estimated Cruise would need about 5,500 AVs in order to reach $1 billion in revenues, working off the assumption that each vehicle would run about 73,000 revenue miles annually. Such an assumption would mean each vehicle runs ~200 revenue miles daily; or about 40 trips at SF’s average trip distance or 24 trips at Phoenix’s average ride-hail trip distance of 8.2 miles.

Another way to see Forbes’ projection would be if Cruise averages about 10 miles per trip across its entire fleet at an average of $25 per trip, to account for differences for different geographies, and about 20 trips per day. This scenario would require a fleet of about 5,500 vehicles.

The Takeaway

The takeaway: Cruise would need to scale its fleet significantly, likely to at least 8,000 AVs, and match or exceed ride-hail trip volumes, with at least 28 to 30 trips daily. Operating around the clock can aid trip volumes, but a bit of public wariness could offset that.

Reaching $1 billion in revenues by 2025 is definitely possible for the GM-backed AV unit, but it will require fleets to scale significantly to at least 5,000 vehicles, maybe higher, depending on the average trip distance and rate (fares could be different in Dubai, for example). Such a target will still be a challenge as a lack of progressive national policy paving the way for commercial AV deployment may hinder progress; the next markets for expansion may be Las Vegas or Los Angeles.

Even with $1 billion in revenue still on the plate, profits likely are not. GM has noted that it will continue investing in Cruise to the tune of ~$500 million per quarter ($2 billion per year), meaning that cash flows and profits are likely to be deeply negative until closer to 2028 to 2030, where GM is targeting revenues of $50 billion from Cruise. All in all, the potential for Cruise is quite massive, but it requires a near-perfect execution as the decade progresses to reach such potential.

Be the first to comment