Nikita Burdenkov/iStock via Getty Images

Over the past year, one space that I have come to enjoy is the packaging industry. Although this may seem like a boring area to invest in for many investors, the fact of the matter is that many of the companies are trading at rather low multiples at this time. On top of this, the firms have been incredibly successful, for the most part, in transferring higher costs to their customers. In fact, many of the companies in this space have even seen their profits rise during this window of time. While it is true that they could eventually see some pain should the economy start to suffer, the data available right now shows healthy and vibrant enterprises that are likely to continue to generate value for their shareholders in the long run.

Although far from the best prospect in the space, one company that I think does have some upside potential from here is Sonoco Products Company (NYSE:SON). This global packaging enterprise focuses on consumer packaging products involving rigid paper containers, fiber, and other related materials. It also provides industrial paper packaging operations and offers up other miscellaneous packaging-related goods for its customers. The most recent financial data provided by management shows that sales continue to climb nicely and that profits are rising materially as well. Add on top of this how shares are priced at the moment on an absolute basis, and I do think that some upside is on the table.

Solid performance continues

The last time I wrote an article about Sonoco Products Company was back in late July of this year. At the time, I lauded the company for its continued top line and bottom line performance. Strong pricing power exhibited with his clients, combined with an acquisition the company made in 2021, proved instrumental in achieving these results. Despite broader economic concerns, the 2022 fiscal year was looking up and shares were rather cheap on an absolute basis. All combined, this led me to keep the ‘buy’ rating I had on its stock previously, reflecting my belief at the time that shares should outperform the broader market moving forward. So far, the company has done that. But I wouldn’t exactly call the disparity significant. While the S&P 500 is down 4.3%, shares of Sonoco Products Company have seen downside of only 4%.

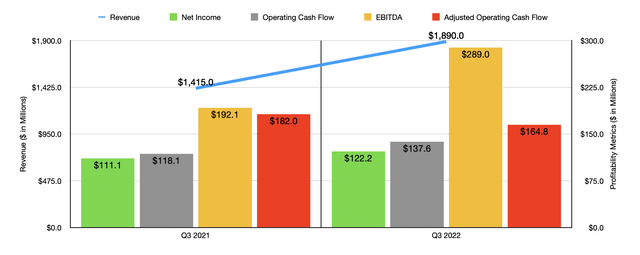

Truth be told, I find myself rather disappointed with this return disparity. After all, the company is doing quite well for itself. To see what I mean, we need only touch on results from the third quarter of the firm’s 2022 fiscal year. This is the only quarter for which new data is available that was not available when I last wrote about the business. During that quarter, sales came in at $1.89 billion. That’s 33.6% higher than the $1.42 billion generated the same time last year. Of the $475 million sales increase, an impressive $334 million was driven by the company’s acquisition of Ball Metalpack Holding that was completed in January of this year. Selling prices also increased because of inflationary pressures, leading to an additional $250 million in revenue. These numbers were, unfortunately, somewhat offset by weakness elsewhere. Because of the higher selling prices, the company suffered to the tune of $52 million from reduced volume and a change in product mix. Foreign currency translation also impacted revenue negatively to the tune of $57 million.

With this rise in revenue came improved profitability. Net income in the latest quarter, for instance, totaled $122.2 million. This compares favorably to the $111.1 million reported the same time last year. In addition to benefiting from an increase in sales, the company also saw its gross profit margin climb from 18.2% last year to 19.4% this year. Basically, strategic pricing initiatives implemented by the company allow the firm to pass on more than the inflationary costs it incurred to its customers. Other profitability metrics largely followed suit. Operating cash flow, for instance, increased from $118.1 million to $137.6 million. If we adjust for changes in working capital though it actually would have dipped from $182 million to $164.8 million. And over that same window of time, EBITDA soared from $192.1 million to $289 million.

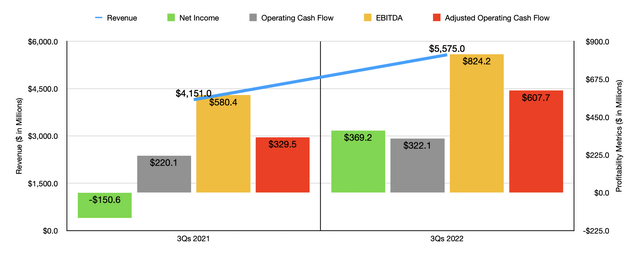

The third quarter of 2022 was not the only positive time for the company this year. All of 2022 so far has been looking up. Revenue of $5.58 billion dwarfed the $4.15 billion generated the same time last year. Just as was the case with the third quarter, much of this increase, about $765 million in all, was driven by acquisition activities. But surprisingly, pricing played an even larger role, adding $823 million to the company’s top line. This rise in sales brought with it improved profits as well. The firm went from generating a net loss of $150.6 million in the first nine months of 2021 to generating a profit of $369.2 million the same time this year. Operating cash flow jumped from $220.1 million to $322.1 million, while the adjusted figure for it expanded from $329.5 million to $607.7 million. Likewise, EBITDA for the company expanded from $580.4 million to $824.2 million.

When it comes to 2022 as a whole, the picture should be rather interesting. Management is forecasting earnings per share of between $6.40 and $6.50. That would translate to net income of $637 million. The firm is also forecasting operating cash flow of between $565 million and $615 million. At the midpoint, that would be $590 million in total. Unfortunately, no guidance was given when it came to EBITDA. But if we assume that the change in operating cash flow should be reflective of what the change in EBITDA will end up being, we can anticipate a reading there of $958.3 million. Of course, we also need to pay attention to the fact that management recently acquired the rest of what was previously a minority joint venture that it was engaged in. In exchange for $330 million in cash, the company received an entity that should generate $270 million in revenue and $50 million in EBITDA per year. The firm is also forecasting $16 million in operating synergies over the next two years. For the purpose of my analysis, ignored the potential synergies, assumed that the company is paying for the acquisition with cash flow, and applied a 21% tax rate on the EBITDA the company is generating, and apply those numbers to my valuation.

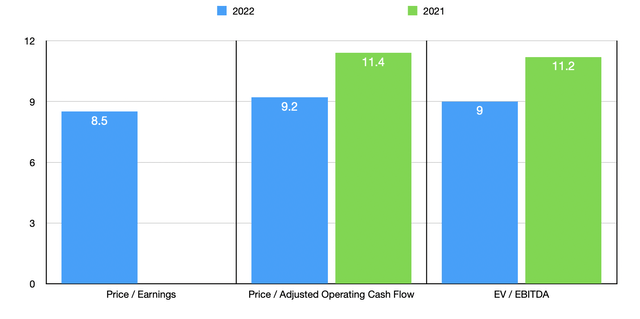

Based on these figures, Sonoco Products Company is trading at a forward price-to-earnings multiple of 8.5. Last year, the company generated a net loss, so there is no multiple there to compare it to. The forward price to adjusted operating cash flow multiple should be 9.2, which is down from the 11.4 reading that we get using data from 2021. And the EV to EBITDA multiple should fall from 11.2 using data from last year to 9 using data from this year. Also as part of my analysis, I compared the firm to five similar businesses. On a price-to-earnings basis, these companies ranged from a low of 9.6 to a high of 21.8. In this case, Sonoco Products Company was the cheapest of the group. Using the price to operating cash flow approach, the range was from 4.5 to 13.2, with three of the five companies being cheaper than our target. And when it comes to the EV to EBITDA approach, the range should be from 5.4 to 12.9. In this case, two of the five companies are cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Sonoco Products Company | 8.5 | 9.2 | 9.0 |

| Graphic Packaging Holding Co. (GPK) | 16.3 | 8.6 | 9.4 |

| Packaging Corp of America (PKG) | 11.9 | 8.3 | 7.2 |

| WestRock Co. (WRK) | 9.6 | 4.5 | 5.4 |

| Sealed Air Corp. (SEE) | 13.0 | 11.5 | 9.5 |

| Amcor (AMCR) | 21.8 | 13.2 | 12.9 |

Takeaway

Based on all the data that I see right now, I continue to be impressed by the trajectory that Sonoco Products Company has experienced. Admittedly, the aforementioned acquisition was instrumental in this regard. But there is no denying that operationally speaking the company is doing quite well. It is true that shares are not as cheap as what other firms in this space might be trading for. But all things considered, the stock does look quite affordable and suggests to me that further upside could very well be on the table so long as the business does not experience any meaningful deterioration moving forward.

Be the first to comment