Fahroni

During volatile times, it can be considered a small victory if your investment just outperforms the market even if that means that you experienced some downside. One example of this can be seen by looking at automotive retailer Sonic Automotive (NYSE:SAH). As a company that operates franchised dealerships and that sells used cars and light trucks through its EchoPark segment, the company may not seem all that exciting considering the economic environment. But in recent months, shares have held up relatively well, driven by continued revenue growth and mixed bottom line performance. Given how cheap shares are today, I still do believe that the company warrants a ‘buy’ designation, signaling the idea that it should outperform the broader market moving forward.

Shares look attractive right now

Back in February of this year, I wrote an article that took a rather bullish stance on Sonic Automotive. I found myself impressed with the solid track record that the company had from both a revenue and cash flow perspective. The firm benefited tremendously from strong fundamental growth in demand in 2021. On an absolute basis, shares of the company looked cheap. But compared to similar players, this was not exactly the case. All things considered, I found the company to be cheap enough and high quality enough to warrant a ‘buy’ rating. Since then, shares have generated a loss for investors of 13.5%. While that’s painful to see, it is better than the 17.7% drop seen by the S&P 500 over the same window of time.

To see why Sonic Automotive has outperformed the market during this time, we need only look at the two quarters worth of data that have become available since I last wrote about it. During that six-month window, sales of the firm rose nicely, shooting up by 17.9% from $6.14 billion to $7.24 billion. This increase was driven by a variety of factors. For instance, total new vehicle revenue for the company rose by roughly 15%, driven by a 6% increase in new vehicle unit sales and an 8% increase in total revenue per new unit. Even stronger was the 18% increase in revenue associated with the retail used vehicles the company sold. This rise was driven by a 33% spike in revenue per unit, climbing from $24,368 to $32,477. Unfortunately, it was somewhat offset by a 10% drop in unit sales. Revenue associated with the company’s wholesale vehicle operations spiked by 82%. But at $290.2 million for the first half of 2022, this is a fairly small portion of the enterprise. And finally, we saw a roughly 19% increase in sales associated with the company’s ‘Fixed Operations’. This includes things like warranties, wholesale parts, and more.

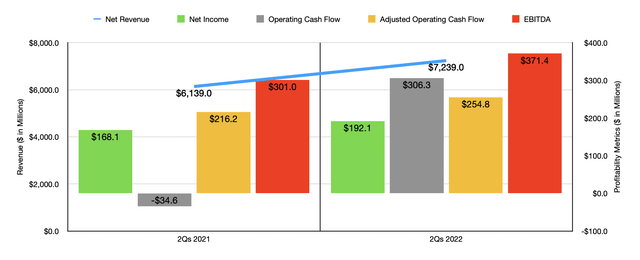

With the increase in revenue also came an increase in profitability. The company went from generating a net profit of $168.1 million in the first half of 2021 to $192.1 million in the first half of 2022. Operating cash flow went from negative $34.6 million to $306.3 million. But if we adjust for changes in working capital, it would have risen from $216.2 million to $254.8 million. Over that same window of time, EBITDA also increased, climbing from $301 million to $371.4 million.

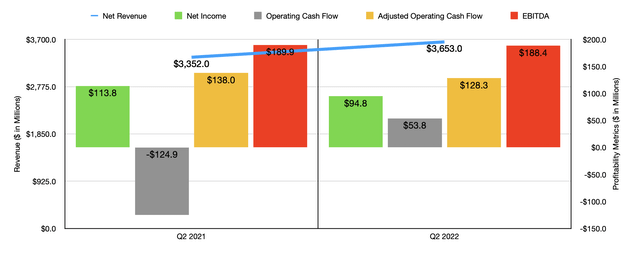

Although the general picture for the first half of the year as a whole has been positive, the second quarter alone did show signs of weakness. Yes, revenue did increase year over year, climbing by 9% from $3.35 billion to $3.65 billion. But net income fell from $113.8 million to $94.8 million. Operating cash flow did improve, going from negative $124.9 million to $53.8 million. But if we adjust for changes in working capital, it would have fallen, dipping from $138 million to $128.3 million. Even EBITDA showed some signs of weakness, declining from $189.9 million to $188.4 million. Outside of the financial side of things, management also revealed that they were putting a hold on a decision regarding their EchoPark unit. Previously, the company had been evaluating strategic options aimed at increasing shareholder value. This review process began in July of 2021. But because of the range of options out there with the current economic environment, management decided to continue to grow that enterprise internally instead. But they did also say that they’re pushing back revenue growth projections for that unit beyond the 2025 fiscal year.

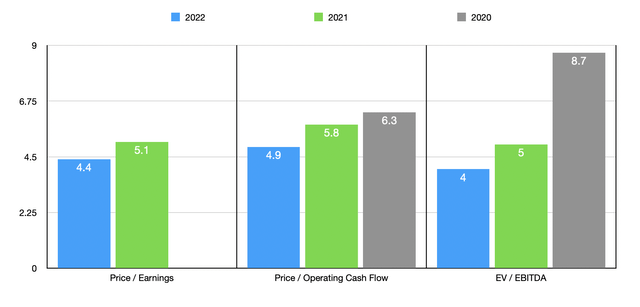

When it comes to the 2022 fiscal year as a whole, we don’t really know what to expect. But if we were to annualize results seen during the first half of the year, we would anticipate net income of $398.7 million, adjusted operating cash flow of $361 million, and EBITDA of $796.5 million. Given these figures, we would calculate that the company is trading at a forward price to earnings multiple of 4.4, at a forward price to adjusted operating cash flow multiple of 4.9, and at a forward EV to EBITDA multiple of 4. Even if financial results were to look more like what they did in 2021, these multiples would be only slightly higher at 5.1, 5.8, and 5, respectively. Unfortunately, the company did generate a net loss during the 2020 fiscal year. But if we were to instead use data from that year, we would get a price to adjusted operating cash flow multiple of 6.3 and an EV to EBITDA multiple of 8.7. As part of my analysis, I compared the company to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 6.3 to a high of 8.2. And using the EV to EBITDA approach, the range was between 5.6 and 9.6. Using the data from our 2021 fiscal year, I calculated that Sonic Automotive was the cheapest of the group. Meanwhile, using the price to operating cash flow approach, the range was between 2.7 and 6.6, with four of the five companies being cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Sonic Automotive | 5.1 | 5.8 | 5.0 |

| Group 1 Automotive (GPI) | 6.5 | 2.7 | 6.2 |

| Asbury Automotive Group (ABG) | 6.5 | 3.0 | 9.6 |

| Lithia Motors (LAD) | 8.2 | 4.8 | 7.4 |

| AutoNation (AN) | 6.3 | 5.4 | 5.6 |

| Penske Automotive Group (PAG) | 7.2 | 6.6 | 6.7 |

Takeaway

Although investors are likely feeling some pain right now, there’s no denying that Sonic Automotive has held up better than the broader market has. This is a testament to the quality of the operation and the continued top line growth and low share price of the enterprise. I fully expect uncertainty in this market to worsen moving forward. But at the end of the day, fundamentals will eventually revert back to being positive. And given how shares are priced right now, I do think that the long-term outcome for the company would be favorable for shareholders who buy in at current prices.

Be the first to comment