lorozco3D/iStock via Getty Images

Intro

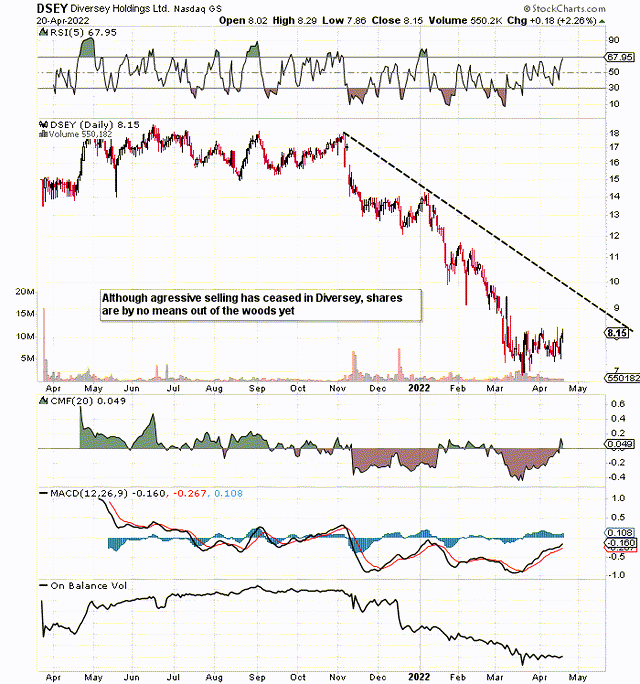

If we look at a technical chart of Diversey Holdings, Ltd. (NASDAQ:DSEY) (Hygiene, Infection Prevention & Cleaning Products), we can see that selling really accelerated to the downside in the latter stages of last year. We finally got a reprieve to the selling in late March of 2022 so it will be interesting to see if indeed shares can push on from present levels. Although money-flow trends have finally turned positive, we would caution that the downcycle trendline (currently above $9 a share) needs to be taken out to the upside on strong volume to confirm a fresh bullish trend is underway in Diversey.

Technical Chart of Diversey (StockCharts)

Beaten down companies (If fundamentals have remained strong) always attract interest from value investors if a line of sight is visible towards growth. However, as alluded to earlier, buying companies caught in a bearish trend brings risk to the table (Because the downward trend could easily continue). The issue for Diversey from a profitability standpoint is that the company did not make a net profit nor generate free cash flow in fiscal 2021. Suffice it to say, although shares presently trade with a book multiple of 3.4 and a very low sales multiple of 0.9, we would exercise caution at present from the long side for the following reasons.

Inflation

The company initiated a series of price increases on its products in fiscal 2021 and is just after announcing a global energy surcharge (8 to 15%) which will be added further to products from mid-April onward. This means the company is being hit hard on the supply side and attempting to pass on these additional costs to customers as soon as possible. The problem here is that there is always a time lag with respect to the recouping of these additional costs and demand may very well fall off if inflation (and subsequent price increases) continue aggressively. In fact, given the IMF’s recent comments surrounding prolonged inflation, there is every likelihood that Diversey’s margins will continue to suffer even in the face of rising sales. Therefore, the cost-side of Diversey’s business is paramount now and the new facilities in Kentucky cannot come quickly enough.

Supply Chain

The above comments on higher costs tie in with what we mentioned previously on cash flow. Why? Because the absence of cash flow always brings a time element into play especially considering Diversey’s present $1.86 billion net debt load. In this respect, management has been buying time in recent quarters through the ongoing securing of additional capital for growth and infrastructure purposes. Furthermore, if supply chain issues escalate in upcoming quarters, management will be forced to hold more inventory than normal in order to keep servicing its customers. Tying up badly needed cash flow in inventory would be an opportunity cost for the company as that cash would be better used for organic growth as well as more accretive acquisitions.

Earnings Revisions

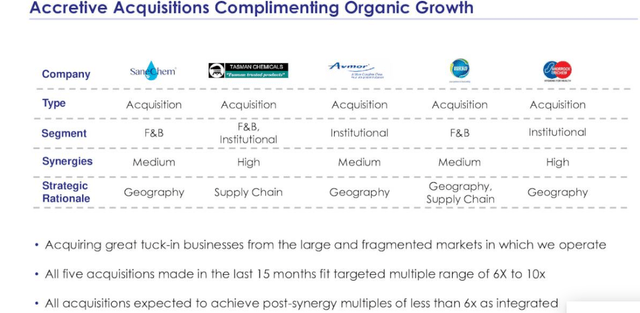

All of this ties into future earnings in that management seems to be banking on an ease-up in inflation and a return to normal trading conditions. Analysts though who follow Diversey continue to revise earnings and sales estimates down in an aggressive manner which is unfortunate given the investment the company has undergone in recent quarters. As we can see below with respect to the company’s recent acquisitions, the potential is certainly there to boost profitability once synergies come off these deals. Declining estimates however mean analysts believe profitability will remain restrained despite the larger arsenal of products Diversey now has at its disposal.

Q4 Earnings Presentation – Recent Acquisitions (Q4 Earnings Presentation)

Conclusion

Inflation & supply chain headwinds have hit Diversey hard in recent months. The company has attempted to pivot by increasing its prices aggressively and by taking on more inventory than normal. Given the outlook on inflation, however, quarterly earnings estimates continue to contract which is worrying. Management has pledged to work aggressively on the cost side and its new facilities in Kentucky will help in this regard. However, from our perspective, shares are still not cheap enough in our opinion to consider taking on risk here on the long side. Shares indeed may have further to fall. We look forward to continued coverage.

Be the first to comment