aerogondo/iStock via Getty Images

A Quick Take On SONDORS

SONDORS (SODR) has filed to raise $31.2 million in an IPO of its common stock, according to an S-1 registration statement.

The firm designs and manufactures premium electric bicycles and motorcycles.

SODR operates in a high-growth market but its recent growth rate has dropped.

I’ll provide a final opinion when we learn more IPO details from management.

SONDORS Overview

Malibu, California-based SONDORS was founded to develop and sell high quality electric bikes and motorcycles for sale worldwide.

Management is headed by founder and CEO Storm Sonders, who has been with the firm since its inception in 2015 and was previously an entrepreneur in the toy business, designing models for Mattel, McDonald’s, and Fisher-Price.

The company’s primary offerings include:

-

Electric bicycles

-

Electric motorcycle

-

SONDORS mobile app

-

Community

As of June 30, 2022, SONDORS has booked fair market value investment of $4.9 million as of June 30, 2022, from investors.

SONDORS – Customer Acquisition

The firm sells its products through retail outlets such as Costco Wholesale and direct-to-consumer [DTC] via the company’s website.

To-date, the company has delivered more than 51,000 e-cycles to 72 countries.

Selling and Marketing expenses as a percentage of total revenue have been uneven as revenues have increased, as the figures below indicate:

|

Selling and Marketing |

Expenses vs. Revenue |

|

Period |

Percentage |

|

Six Mos. Ended June 30, 2022 |

10.3% |

|

2021 |

19.2% |

|

2020 |

17.8% |

(Source – SEC)

The Selling and Marketing efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of Selling and Marketing spend, rose to 1.6x in the most recent reporting period, as shown in the table below:

|

Selling and Marketing |

Efficiency Rate |

|

Period |

Multiple |

|

Six Mos. Ended June 30, 2022 |

1.6 |

|

2021 |

1.4 |

(Source – SEC)

SONDORS’ Market & Competition

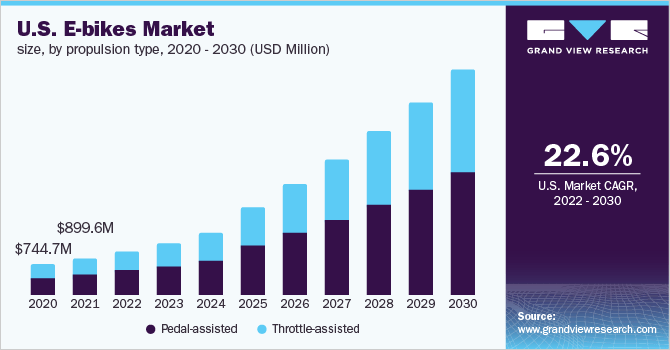

According to a 2022 market research report by Grand View Research, the global e-bicycle market was an estimated $17.8 billion in 2021 and is forecast to reach $55.7 billion by 2030.

This represents a forecast CAGR of 13.5% from 2022 to 2030.

The main drivers for this expected growth are an increasing awareness by consumers about cleaner alternatives to existing modes of transportation and a growing number of regions that are installing or modifying streets that are bicycle friendly.

Also, the chart below shows the historical and projected future growth trajectory of the U.S. e-bicycle market:

U.S. E-Bikes Market (Grand View Research)

Major competitive or other industry participants include:

-

Specialized Bicycle Components

-

Trek Bicycle

-

Canyon Bicycles GmbH

-

Rad Power Bikes

-

Zero Motorcycles

-

Energica

-

LiveWire

-

Super 73

-

Pedego Electric Bikes

-

Yamaha Motor Company

-

Aima Technology Group Co. Ltd.

-

Merida Industry Co. Ltd

-

Pon Bike

-

Harley Davidson

SONDORS Financial Performance

The company’s recent financial results can be summarized as follows:

-

Growing topline revenue, though at a decelerating rate of growth

-

Increasing gross profit

-

Uneven gross margin

-

Fluctuating operating losses

-

A swing to cash used in operations

Below are relevant financial results derived from the firm’s registration statement:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

Six Mos. Ended June 30, 2022 |

$ 9,767,000 |

19.2% |

|

2021 |

$ 16,463,000 |

37.2% |

|

2020 |

$ 11,999,000 |

|

|

Gross Profit (Loss) |

||

|

Period |

Gross Profit (Loss) |

% Variance vs. Prior |

|

Six Mos. Ended June 30, 2022 |

$ 2,652,000 |

4.4% |

|

2021 |

$ 3,510,000 |

-20.8% |

|

2020 |

$ 4,434,000 |

|

|

Gross Margin |

||

|

Period |

Gross Margin |

|

|

Six Mos. Ended June 30, 2022 |

27.15% |

|

|

2021 |

21.32% |

|

|

2020 |

36.95% |

|

|

Operating Profit (Loss) |

||

|

Period |

Operating Profit (Loss) |

Operating Margin |

|

Six Mos. Ended June 30, 2022 |

$ (2,005,000) |

-20.5% |

|

2021 |

$ (4,883,000) |

-29.7% |

|

2020 |

$ (753,000) |

-6.3% |

|

Net Income (Loss) |

||

|

Period |

Net Income (Loss) |

Net Margin |

|

Six Mos. Ended June 30, 2022 |

$ (2,008,000) |

-20.6% |

|

2021 |

$ (4,892,000) |

-50.1% |

|

2020 |

$ (745,000) |

-7.6% |

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

Six Mos. Ended June 30, 2022 |

$ (2,721,000) |

|

|

2021 |

$ 5,195,000 |

|

|

2020 |

$ 1,706,000 |

|

(Source – SEC)

As of June 30, 2022, SONDORS had $5.2 million in cash and $22.9 million in total liabilities.

Free cash flow during the twelve months ended June 30, 2022, was negative ($3.3 million).

SONDORS IPO Details

SONDORS intends to raise $31.2 million in gross proceeds from an IPO of its common stock, although the final figure may differ.

No existing shareholders have indicated an interest to purchase shares at the IPO price.

Management says it will use the net proceeds from the IPO as follows:

for the repayment of the portion of our Senior Secured Notes (including interest thereon) that are not converted into shares of common stock at the closing of this offering and the remaining [as-yet undisclosed amount] of the net proceeds from this offering for new product research and development, existing product development and commercialization, the development of international markets and to fund our growth and to fund other general corporate purposes.

(Source – SEC)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management said the firm is not presently involved in any legal proceedings that would have a material adverse effect on its financial condition or operations.

The sole listed bookrunner of the IPO is Lake Street.

Commentary About SONDORS’s IPO

SODR is seeking U.S. public capital market investment to pay down debt and fund product development and sales efforts.

The firm’s financials have produced increasing topline revenue, though at a decelerating rate of growth, growing gross profit, variable gross margin and operating losses and a swing to cash used in operations.

Free cash flow for the twelve months ended June 30, 2022, was negative ($3.3 million).

Selling and Marketing expenses as a percentage of total revenue have been uneven as revenue has increased; its Selling and Marketing efficiency multiple rose to 1.6x in the most recent reporting period.

The firm currently plans to pay no dividends on its capital stock and intends to retain any future earnings to reinvest back into the company’s growth initiatives.

SODR’s trailing twelve-month CapEx Ratio was negative 2.37, which indicates it has spent significantly on capital expenditures while generating negative operating flow.

The market opportunity for two-wheeled e-transportation is large and expected to grow at a high rate of growth in the coming years, so the firm enjoys a very strong industry growth dynamic in its favor, although it also faces significant competition.

Lake Street is the sole underwriter and there is no data on IPOs led by the firm over the last 12-month period.

The primary risks to the company’s outlook include a rising cost of sourced materials due to continued inflationary pressures as well as its relatively small size and uneven growth history.

When we learn more about the IPO’s proposed pricing and valuation assumptions, I’ll provide a final opinion.

Expected IPO Pricing Date: To be announced.

Be the first to comment