Peach_iStock

Sensata Technologies (NYSE:ST) designs and produces sensors mainly for the automotive industry and more especially for EVs, but it also sells to the wider electrification market and industrial processes, aerospace and heavy vehicles, and off-road.

The company is set to do well because they have a lot of tailwinds from their markets and manage to outgrow these with new products and also on the back of acquisitions.

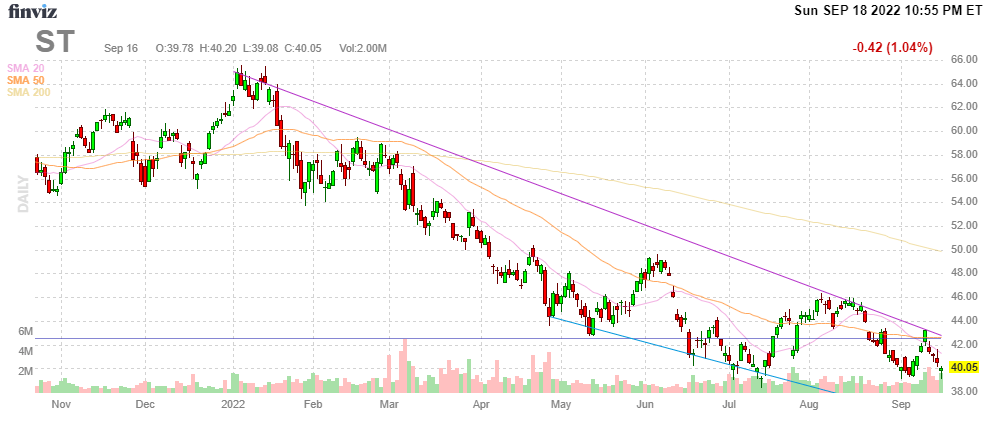

FinViz

Growth

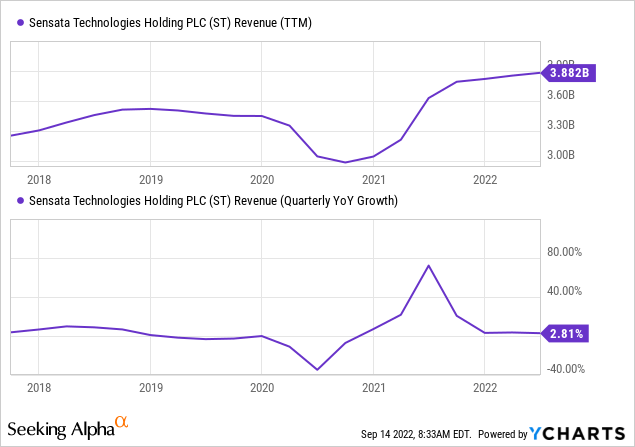

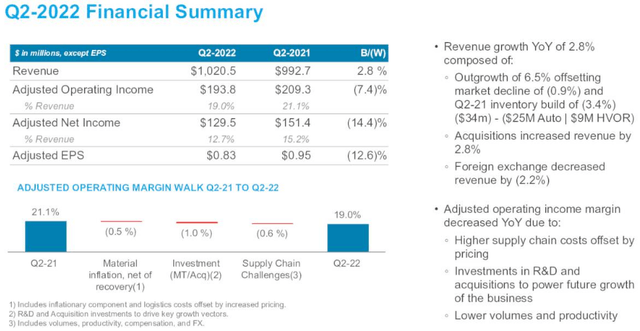

The pandemic produced a slump but there was a particularly vigorous recovery in 2021, which produces difficult comps for growth this year, hence the meager 3.5% revenue growth in Q1 and even less in Q2

However, despite the difficult comps management still expects some growth this year (albeit not in Q2) of 8%-12% (organic 6%-9%). We see two main growth vectors:

- Megatrends like electrification and insights

- New products

- M&A

The expected growth from these areas is significant, from the Q2CC:

We continue to expect over 50% growth in our electrification revenue this year and over 100% revenue growth insights.

This doesn’t come falling out of thin air but is the result of considerable investments, estimated at $65M-$70M this year to design and develop differentiated solutions.

Acquisitions

There certainly have been acquisitions:

They also divested Qinex semiconductor thermal testing control business to Boyd Corporation for $298M. Qinex has a $40M revenue run rate in H2 and 30% operating margin (compared to Dynapower’s $50M in revenue and about 20% operating margin), benefiting from the semiconductor cycle.

Electrification and Dynapower

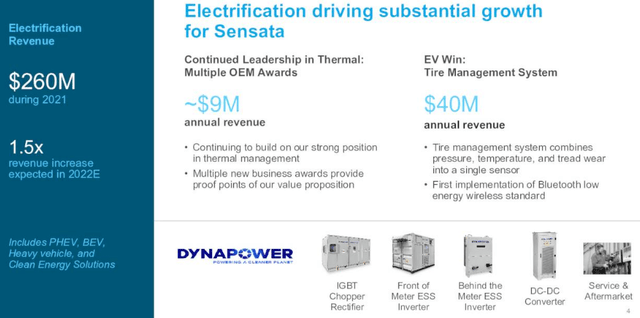

The main vector is the shift to EVs boosting sensor content but it’s not limited to this as there is a wider electrification market that the company addresses:

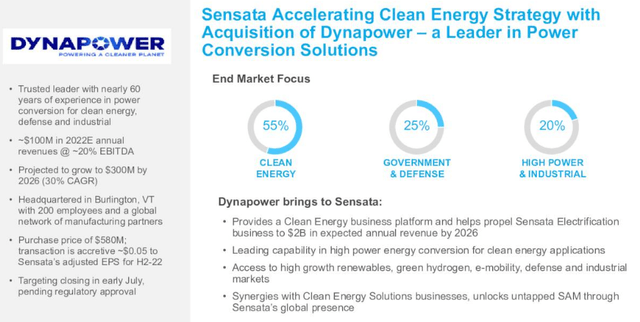

In order to address the wider electrification market, the company acquired Dynapower:

The all-cash ($580M) acquisition closed in July and it is a significant acquisition also in financial terms (Q2CC):

Dynapower is currently on a run rate to generate more than $100 million in annualized revenue and approximately 20% operating margins, while growing more than 30% per year over the next several years.

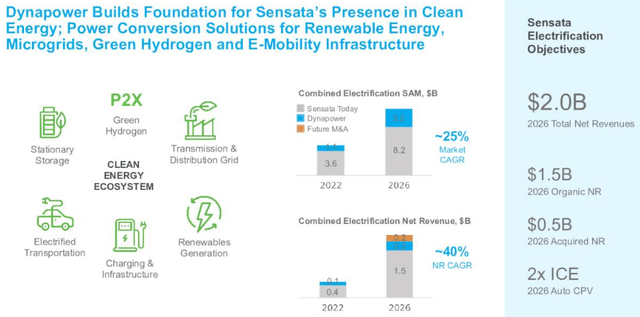

The acquisition gives Sensata a considerable boost in its exposure to electrification, especially in segments beyond EVs. Management believes that it can grow this segment to a $2B business by 2026.

It’s growing at a 40% CAGR, with $300M of that coming from Dynapower (and $200M from other acquisitions), which implies a hefty 3x revenue growth between now and then. How do we get there?

Well, apart from the 25% market growth already providing a powerful tailwind, management expects strong revenue synergies from the combination of Dynapower’s capabilities combined with Sensata’s global presence and manufacturing expertise, and its confidence stems from new business wins to date.

It is always nice to see this kind of target, but realities on the ground can be quite a bit harder and circumstances change. What is clear though is that whether it’s at 40% CAGR or 25% CAGR, their electrification business is set for a lengthy and considerable expansion.

The shift from combustion to EV-driven vehicles boosts the company’s addressable market and growth as EVs require much higher content. This year the company expects revenue from electrification to grow by 50%+.

New products

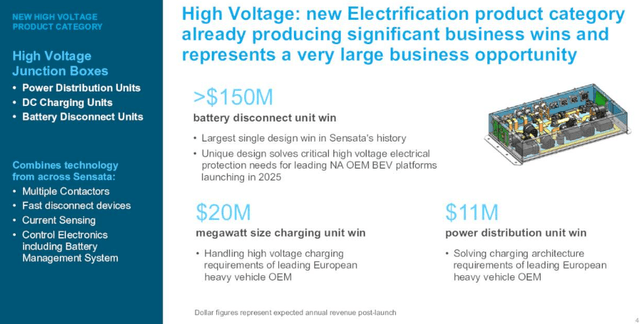

Apart from the Dynapower acquisition, the growth in electrification is getting another boost from the introduction of new products, like their high voltage junction boxes:

This is a whole new product category and complex products which are designed in cooperation with their OEM customers. They had a very large ($150M+ annual revenue) win from an American customer although the revenue will only arrive from 2025 onwards.

Insights

Insights is another high-growth area, it’s basically IoT applications with connected sensors generating data that provide insights into all kinds of stuff, for example (company website):

Sensata’s wireless sensors can collect information through a vehicle-area network and allow fleet managers to proactively monitor the health of their vehicles and conduct proactive maintenance, such as the location of assets being able to identify when a tire is at high risk of bursting.

Insights generated $19M in new business in Q1 and is expected to double(!) 2021 revenue of $75M this year to $150M. How do they get there? Well, for starters the company was awarded $40M+ of annual new tire management business from a leading electrification manufacturer.

Their solution is unique in the market as it combines pressure sensing with temperature and tread depth in a single sensor. Their insights business is also boosted by the acquisition of Elastic M2M in Q1 and we have to say that looks interesting (Q1CC):

Elastic M2M is a pioneer in delivering flexible scalable and cost-effective and intuitive IoT analytics for telematics service providers and their end customers. Their IoT cloud platform utilizes machine learning and artificial intelligence capabilities to digest and analyze an increasingly rich amount of data from connected assets to enable customers to make better operational decisions. We see sizable markets that we can pursue with these broadened technology solutions.

Gas sensors is another new category for the company with a first $10M per year contract win already under the belt. Management argues that this will be a $100M+ incremental opportunity by 2030.

Finances

In Q2 the company is still outperforming the markets by 6.5% when factoring in temporary headwinds:

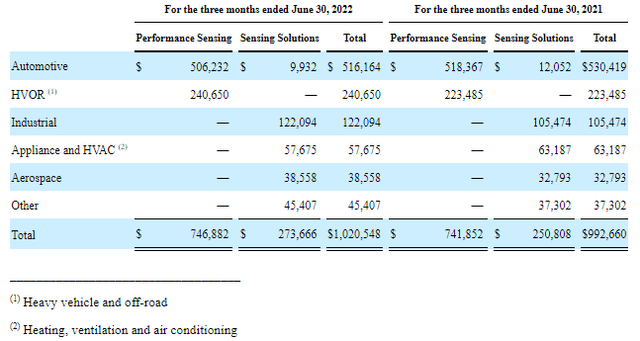

The company reports in two segments and six different end-markets:

Growth might seem low but it’s against difficult comps (a strong recovery from the pandemic) slow market growth and other headwinds like supply chain problems and forex headwinds.

Outlook

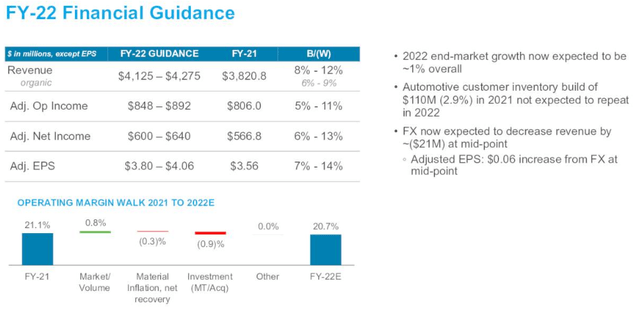

For clarity, here is the FY22 guidance at the Q1CC:

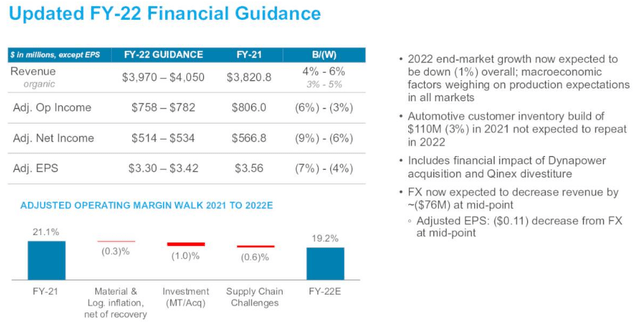

FY22 guidance has been decreased from the previous (Q1CC) $4.125B – $4.275B organic revenue to:

Adjusted net income also took a hit, with guidance declining from $600-$640M to $514M-534M. The main reasons are volume and forex headwinds, but there are also continued supply chain headwinds. But still, the company performs relatively well (Q2CC):

We started the year expecting 10% to 12% growth… expectation for the full year, market down about 1% across all our markets, foreign exchange down 2% across all our currencies, and inventory headwind 3% because the inventory that was built last year won’t repeat. So that’s starting 6% down. Despite that, we’re forecasting 5% up as a company.

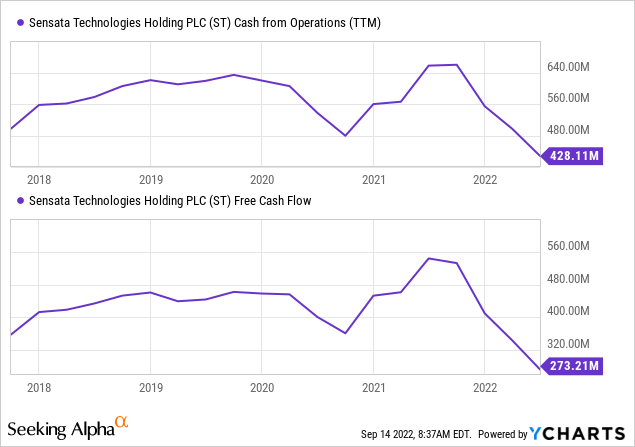

It’s quite a notch down. Added revenue from Dynapower ($50M in H2) which wasn’t included in the previous guidance is almost offset by the sale of Qinex ($40M revenue in H2). CapEx will be between $135M-$145M this year.

Margins

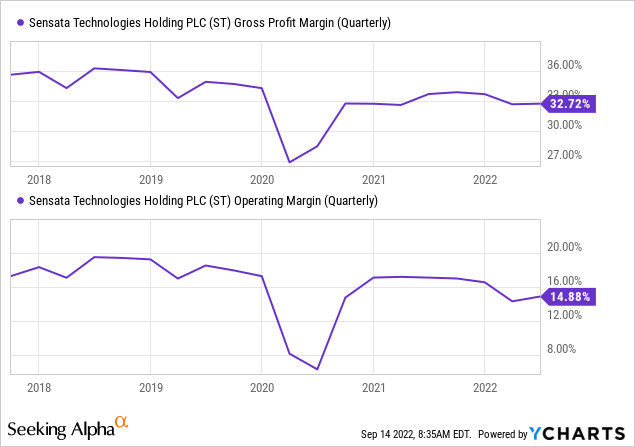

Management argues that they should run 21% adjusted OpEx margins in this environment but they’re not there with 19% in Q2 and a guided 19.3% in Q3 and 19.8% in Q4 with the improvements coming from better pricing and cost management even without volume leverage.

Cash

Cash flow is well below pandemic depths but there are some mitigating circumstances like the soft markets, continued supply chain challenges and investments. Still, free cash flow was $56.2M in Q2 which is still pretty decent.

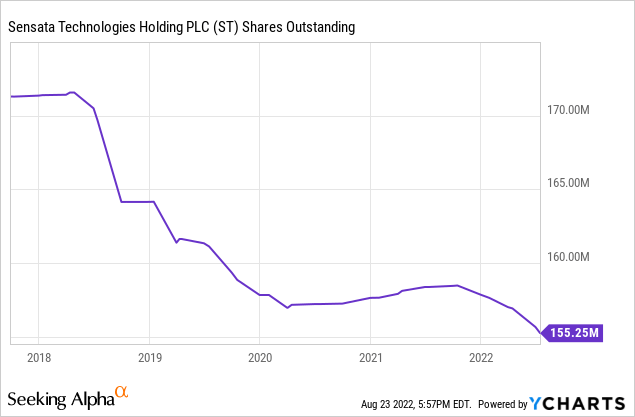

The share count has fallen pretty comprehensively despite several acquisitions due to buybacks ($77M in Q2 on top of a quarterly dividend of $0.11):

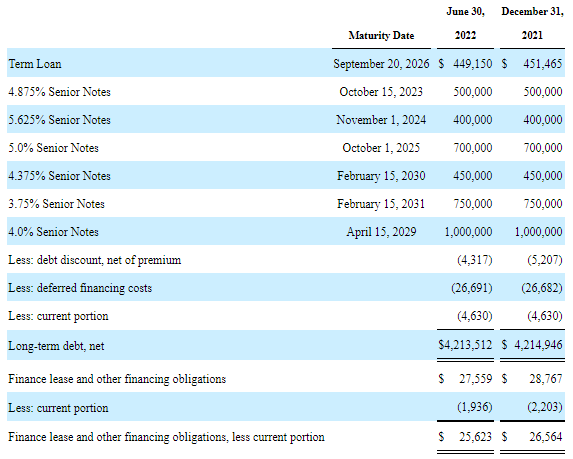

However, the company has a substantial amount of debt outstanding:

ST Q2/22 10Q

But they also sit on $1.5B of cash. After the quarter closed they issued $500M of senior notes at 5.875% to redeem the 4.875 notes due next year.

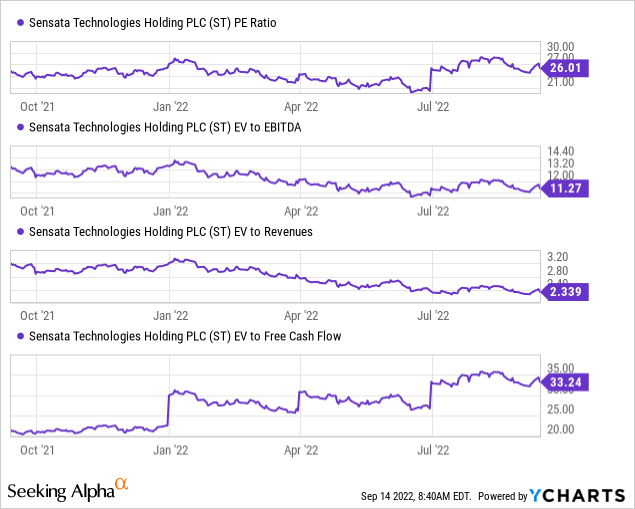

Valuation

Some metrics:

- 157M shares outstanding

- 3.4M options outstanding from performance pay

- Market cap of $6.4B

- Net debt of $2.7B

- EV of $9.1B

- FY22 Revenue $4.0B

- FY22 EV/S at 2.3x

Analysts expect an EPS this year of $43.40 (down from $3.86), rising to $4.0 (down from $4.49) next year, which still gives the stock a cheap earnings multiple.

Conclusion

- There are strong secular tailwinds from electrification, the IoT, and to lesser extent telematics but as of yet, they are not yet moving the needle all that much.

- Many of the markets the company serves are going through a soft patch which is likely to continue due to supply chain issues and an economic slowdown, but growth will come back at some point.

- The company manages to outgrow the market on the basis of increasing content wins and M&A.

- Margins and cash flow are set to recover a little in H2 on improved pricing.

- The shares are fairly cheap.

Against that one could argue:

- The company formulates lofty goals but got off to a slow start this year (albeit faster than the market) and H2 might suffer from an economic slowdown as management had to take guidance down quite a bit.

- The company has substantial debt.

Be the first to comment