Imagehit

This article was coproduced with Wolf Report.

It’s not entirely surprising that Urstadt Biddle (NYSE:UBA) doesn’t get a whole lot of love or coverage. Even we rarely mention this retail real estate investment trust with its lack of credit rating and small portfolio.

Its market cap is just somewhat north of half a billion dollars… what some REITs redevelop in a few years.

However, we shouldn’t overlook quality due to size. And there is, in fact, a lot to like about this business, including its longevity.

UBA has been around for over 50 years, having been founded back in 1969. It invests primarily in neighborhood and community shopping centers in the northeastern U.S. – mainly in the New York City/tri-state area. So, in the past, it’s been able to take advantage of that enormously populated space.

Then again, we all know NYC hasn’t been the healthiest metropolitan the last few years, to say the least. And if it’s seeing issues, it’s not far-fetched to assume that UBA faces some issues as well.

But are they big enough to back away from this REIT? That’s the question.

The Basics of Urstadt Biddle

On a high level, UBA isn’t that hard to understand compared to some of the bigger REITs we cover.

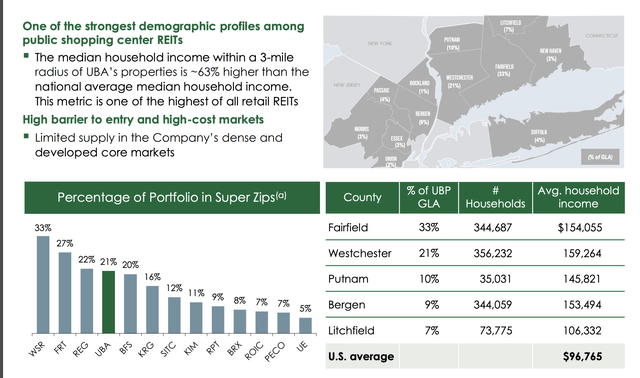

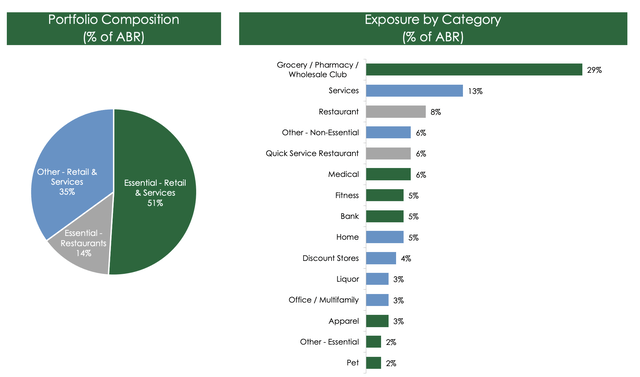

It owns and leases 77 properties, with a gross leasable area of around 5.3 million square feet. At last check, 87% of that is anchored by a pharmacy or wholesale club.

Obviously, that gives it some automatic safety since healthcare and groceries are necessities, not luxuries. And speaking of safety, let’s clarify in case there’s any confusion…

Urstadt Biddle focuses on quality suburban markets outside of NYC. Not NYC itself, but the “burbs.” The portfolio can be viewed in the following way:

(UBA Investor Presentation)

Looking at those facts and figures, it appears that UBA has a very sound strategy. Buying attractive real estate next to high-income neighborhoods and then leasing them to area-attractive clients is smart. And not that complex.

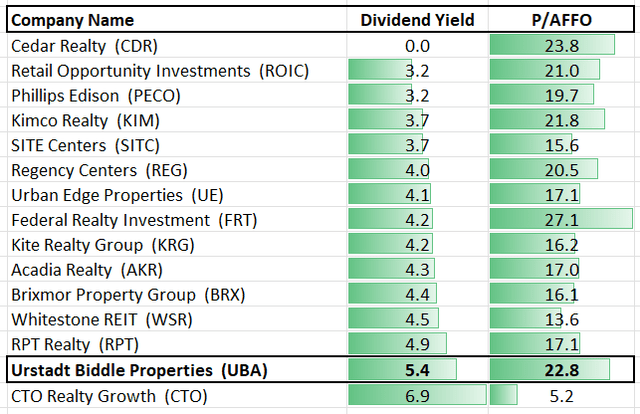

Now, despite UBA’s limited size and market cap, it does consider itself on par with some massive peers – such as Federal Realty (FRT) and Regency Centers (REG) – in some ways.

The little scrapper has hutzpah. We’ll give it that.

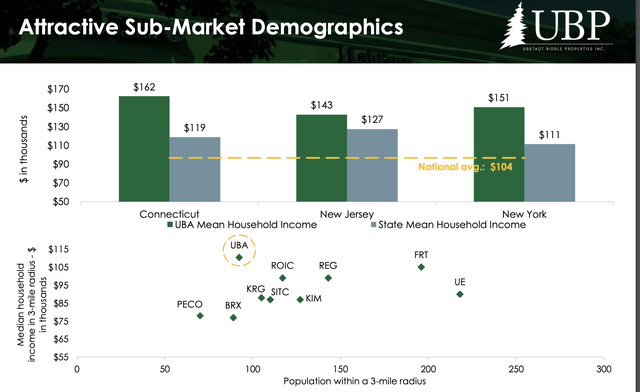

We also have to acknowledge the facts below about UBA’s demographics. They include some of the main reasons why we view UBA as a potentially attractive investment.

(UBA Investor Presentation)

Being a smaller player in the market also means that UBA is more agile. It can move in ways that larger players might have difficulty doing.

As evidenced above, the company has positioned itself in a rather unique manner. Combining affluent demographics with a relatively high population, it’s got even FRT beat in terms of targeting a median income.

The Cow Jumped Over the Moon (for Urstadt Biddle)

This brings up its portfolio again, which is definitely worth exploring further. By far, its largest tenant is Stop & Shop, with an annualized base rent of 8.3%.

Many American investors might know that grocery store chain very well. They might even shop at it. But the fact is it’s now a subsidiary of European giant Ahold Delhaize (OTCQX:ADRNY)… which Wolf Report has written about before.

For Brad’s part, as a shopping developer and investor, he was always getting rent checks from Ahold. This makes Stop & Shop a very safe tenant and a great anchor.

Other clients with a 3%+ ABR include:

- CVS (CVS)

- Acme

- The TJX Companies (TJX), which includes T.J.Maxx and HomeGoods

- Bed Bath & Beyond (BBBY)

- Staples

- Walgreens (WBA)

All in all, 87% of UBA’s space is leased to either supermarkets, pharmacies, or wholesale club anchors. Its top 10 tenants make up around 29.5% of ABR, and 76% is what the company considers to be Internet resistance.

Now, UBA’s lease expiration schedule is fairly close laddered with plenty of expirations. Fifty-three percent expires before 2026, which we’ll look at closer shortly.

However, it’s demographics and geography offer it decent protection. Plus, the company has a proven leasing ability. Occupancy has never – not in 20 years – trended below 90%.

Not even during the shutdowns. Factoring in that time, Urstadt Biddle’s average occupancy on an 18-year basis is around 94%.

(UBA Investor Presentation)

Since the pandemic first began, the REIT has made a notable recovery from what it did lose. It had a rough ride in April 2020, to be sure. But since then, the company’s trends are actually above pre-pandemic numbers.

Current foot traffic represents the number of visits up above 8 million on a monthly basis as of the end of 2021.

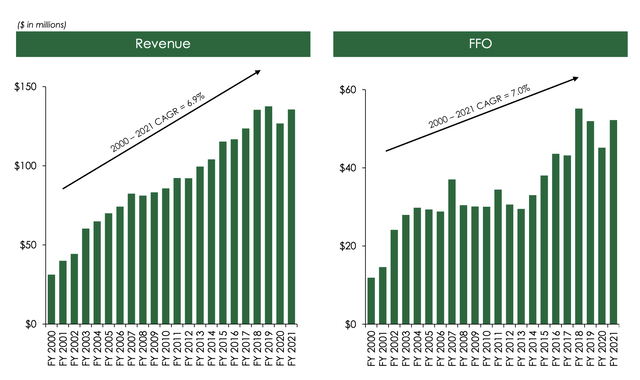

These trends drive extremely predictable revenue and funds from operations (FFO). UBA has close to a linear development in both, averaging nearly 7% annual revenue growth and 7% annual FFO growth for the past 21 years.

(UBA Investor Presentation)

UBA’s Dividend and Debt

Things are equally positive on the dividend side of things, with 210 uninterrupted dividend payments on a quarterly basis. UBA has maintained it at an average 83% FFO payout for the past 10 years.

The company isn’t a dividend king. We fully acknowledge that and the fact that it has cut its dividend.

But we also want to point out that it’s paid uninterrupted dividends for 52 years.

Prior to the pandemic, UBA’s performance was close to that of the S&P 500. Since then, it’s significantly lagged its peers.

As such, it trades at a relative discount to where it did before.

(iREIT)

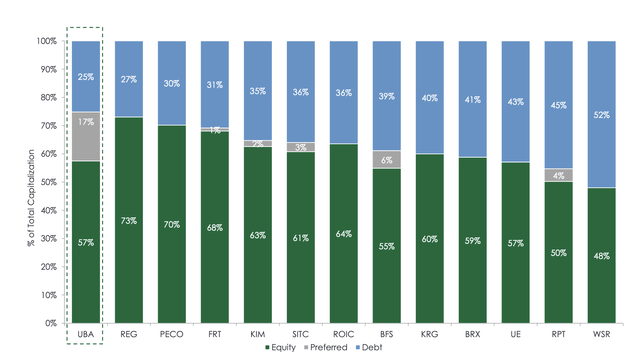

On the balance sheet side of things, UBA has a debt-to-asset ratio of 31.7%. And its fixed-charge coverage is 3.6x.

The company has negligible mortgage rollover risks, with none being relevant for this or the next years. Most of its debt is at fixed rates, and its current mortgage fixed interest rates are just north of 3%.

That’s excellent given where the market is currently going.

Now, UBA is somewhat unique in its peer group because it utilizes a decent amount of preferred debt, or preferred shares. In fact, 17% of its capitalization is actually preferred.

It has a lower debt ratio than any shopping center REIT on the market at close to 25%. But again, that comes at the cost of preferred equity.

(UBA Investor Presentation)

This might have been a negative a year ago when debt was dirt-cheap. But as things stand now, it’s actually a benefit.

Some other companies have tapped deep into debt at over 50% of their capitalization. And that could potentially be subject to significant interest rate cost increases going forward.

Growth Is the Name of Tiny UBA’s Game

UBA has also been successful with the formation of “DownREIT” joint ventures. In this, it effectively trades its stock for property interests in a tax-efficient structure.

This method of acquiring property assets is a great benefit to both UBA and its contributing property owners. And it distinguishes the company in the competition to acquire desirable properties.

Further making it unique, UBA’s capital structure is uncommon with two classes of common stock. The first trades under the symbol UBP, has super voting rights, and is held primarily by insiders.

“Class A common” then trades under the symbol UBA, is held primarily by institutional investors, and enjoys a higher dividend per share.

Now that we’ve established that, let’s next go back to its recent growth, as promised. For the latest fiscal year, FFO rose 21.7% year-over-year and same-store NOI rose 4.7%.

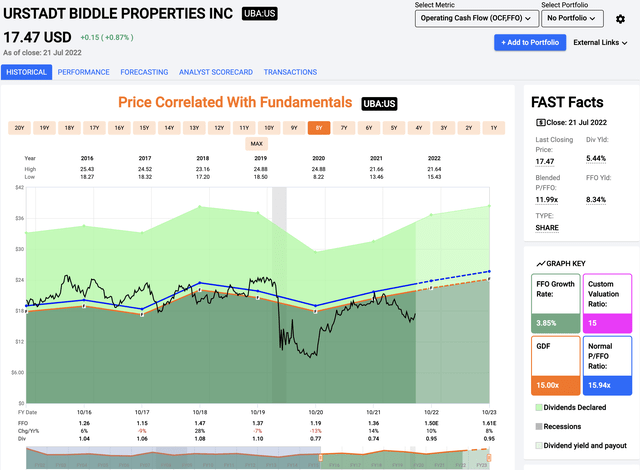

FFO did drop 7% 2019 and 13% in 2020. But it bounced back up 14% in 2021 and is expected to grow another 10% this year.

Such growth would put UBA back to levels above pre-pandemic.

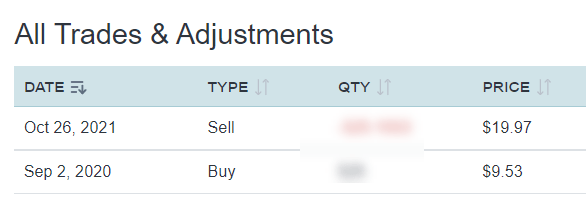

Now, admittedly, the time to have best bought it would have been during the pandemic when it was trading at 4x-5x P/FFO valuations. And we did in fact do that in the Small-Cap REIT portfolio.

(iREIT on Alpha)

But today, we’re once again looking at multiples that are significantly below what we believe UBA should be trading at.

Its merger and acquisition (M&A) program is back on track. As such, it recently acquired the Shelton Square Shopping Center, in Shelton, Connecticut, for just below $34 million.

That asset’s tenants include a Shop & Stop, Burger King, a bank, and more.

Evaluating Urstadt Biddle’s Valuation

There really just are a lot of things to like about UBA.

It might not be your premier choice for investment given its limited size. But that 5.44%+ yield might of interest. From an estimated 2022 FFO basis, it covers the company’s payout with a 63% ratio.

Furthermore, at current multiples, UBA still trades at below 12x P/FFO – despite being a very streamlined, grocery/pharmacy-anchored shopping center REIT.

(FAST Graphs)

Based on FFO or adjusted FFO (AFFO), we’re forecasting an upside of no less than 6.4% annually. And that’s 6.4% if it drops in valuation to an 11x P/FFO.

If we see any sort of fundamental reversal to more accurate historical multiples here, the story becomes entirely different.

At 12.5x P/FFO, for instance, you get 17.5% annually, or 22.5% to estimated fiscal-year 2023. Recovering to a more standard 15x-15.5x, that upside balloons to 38.5% annually, or 51.6% in less than two years.

So basically, don’t underestimate UBA just because it’s small. It’s very well capitalized and well prepared for the environment we’re moving into.

And, believe it or not, we view any NYC risk as small. Remember: UBA isn’t “in” NYC. It’s in its affluent suburbs.

While the area will no doubt be affected by a general downturn in NYC, it remains much more insulated than an office REIT with specific NYC properties. And its operations are just too fundamental to the area.

UBA has superb tenant quality, and excellent diversification. The 8% ABR from Ahold Delhaize isn’t exactly an issue.

Despite what could be described as headwinds, Urstadt Biddle is trading at multiples that, in our view, aren’t justifiable.

Even if you consider it more in terms of AFFO instead of FFO, its payout coverage remains above 80% and it trades over 15% to its five-year average multiple.

In Conclusion…

UBA is a Buy in our book – though a speculative one – under $22.50. We give the company a 25% margin of safety.

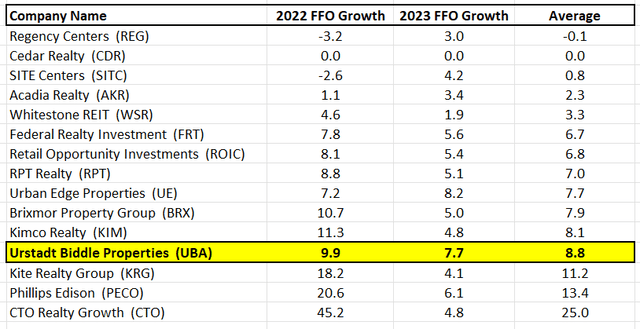

It did record some slightly slower growth than its peers, we know, but it’s also cheaper than them.

It’s a fundamentally sound, well-managed shopping-center REIT with a solid portfolio and 5.4%+ yield. This makes it a relatively high yielder with what we view as high quality.

There are some growth lag concerns. And rent collection might not be fully normalized yet. But the way we see it?

Those issues pale to the upside on offer here.

(Analyst Consensus Estimates – iREIT)

Thank you for reading. Let us know your thoughts…

Be the first to comment