We Are

The broad markets are currently in volatility mode as they continue to weigh whether the Fed is making the right moves or not to help battle inflation and an incoming (or already here) recession. There is nothing like these types of markets to create a substantial advantage for retail investors that have a long enough time horizon to wait out the potential carnage.

During these times there are a few options for investors. First, they can sit with their current holdings and ride out the incoming storm. Second, they can sell out and sit in cash as they wait for the market bottom. Finally, they can rebalance their portfolio to something more advantageous.

I am a devout believer in the third.

Now I don’t think it’s a bad idea to hang on to magnificent companies forever. The problem with that though is when the company is significantly overvalued, as many were and still are today, there will be long stretches where no money will be made. Thus, unless you are in a dividend grower, your portfolio returns will become stagnant.

So what’s the solution? Looking for value of course.

I want to present to you three high yielding companies, with relatively safe near term dividends, that I will continue to dump money into while I wait for high quality names to return to Earth.

#1 – Antero Midstream Corporation (AM)

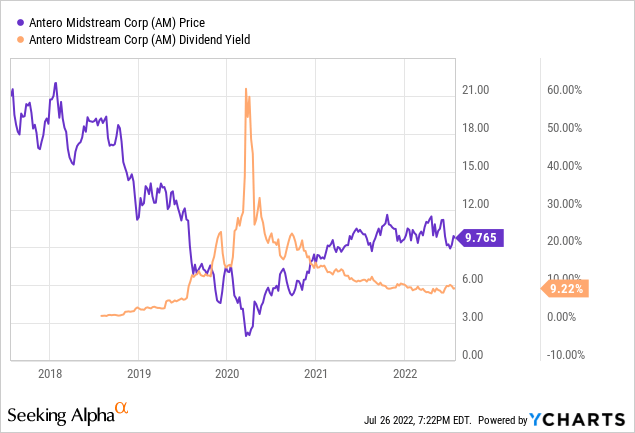

Okay, so if you have followed my articles at all then you will probably be wondering why I am recommending a stock that I wasn’t very high on previously. In February I wrote an article about Antero Midstream (find it here) and said that the risk was a bit too heavy for me. Sitting at $9.39 per share, I was looking for a continued drop to get in at a yield on cost over 10%.

That being said, the article I wrote may have been overly critical of the company and the user feedback provided me with insight on some things I may have missed. Now I am looking to purchase even if the yield isn’t at 10%.

Why?

Well for one, AM management is currently being very prudent with the distribution and will most likely do so in the future. I do not expect the $0.90 per unit to be increased anytime soon, and they in fact have already stated that it won’t until leverage decreases. Antero Midstream should produce an excess of $750 million dollars in free cash flow after dividends through 2026. This should allow for significant reduction in debt. Add to this the decreasing cap ex that is set for the incoming years and you have a recipe for success.

While the dividend may not increase over the next few years, the over 9% payout, along with volatility to increase your yield on cost, shouldn’t be overlooked. Anytime I can get in over 10% I will be adding significantly, but even at the current yield it warrants slowly adding more.

#2 – Prudential Financial, Inc. (PRU)

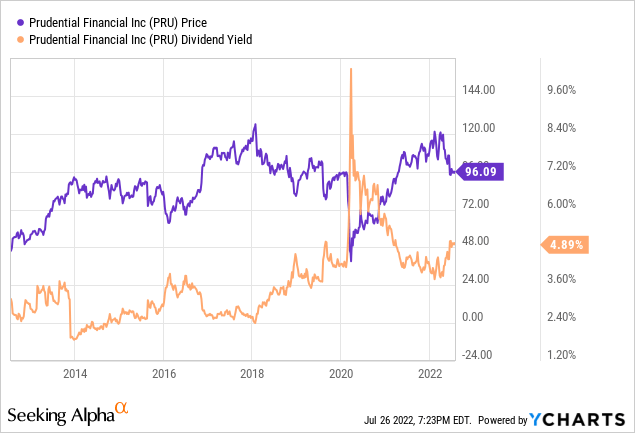

Let’s switch gears from the Energy sector for a second and take a look at one of my favorite companies in the 2k Portfolio. While there are plenty of dividend growth stocks out there, many with substantially longer records than PRU, most of them can’t be found at around a 5% yield.

Prudential has grown their dividend for 15 consecutive years, with a compound annual growth rate over the past 10 years of just above 12%. This is fantastic! During this time Prudential has doubled its book value, decreased their long term debt, and continued to repurchase shares.

While the current yield isn’t their highest ever (2020 was over 6%), it is significantly over their 10 year historical median of 3.22%. A move towards that mean seems likely over the long term which currently places an investor in an advantageous position.

At the moment, I will continue to add to my holdings every time the stock dips below $96 dollars and give me an opportunity to have a yield on cost of over 5%.

#3 – PetroChina Company Limited (PTR)

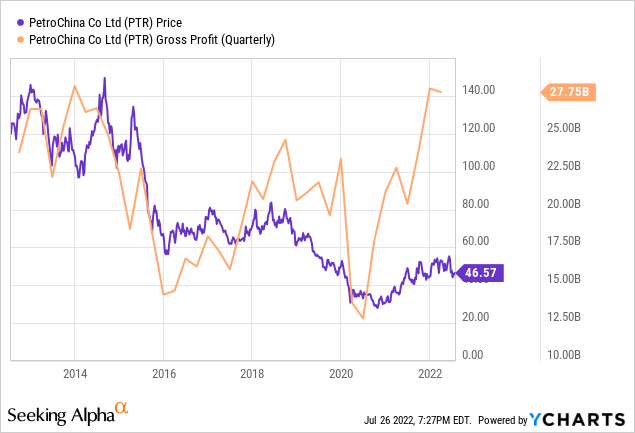

Who wants a high yield list without at least one company that is high risk? That’s where PetroChina comes in. I have recently started a position in PetroChina, and must say that it carries a pretty small weighting in my portfolio of ~3%. The weighting though will only get larger as the market continues to undervalue its potential.

Currently sitting at a yield of 6.5%, PetroChina has seen some of the most disastrous conditions for a stock this side of declaring bankruptcy. Obviously this is an over exaggeration, but the point I want to make is that this company has been getting crushed through lock downs, threats of Chinese stocks being pulled from the US markets, and the always concerning issue of Chinese government involvement.

So why am I holding/adding this to the portfolio? For one PTR, like many Chinese stocks, is sitting at a market cap priced for disaster. Without the true reopening demand, PetroChina is still lagging behind many of our domestic producers, yet it has an extreme separation from its normal relationship with its gross profit.

A big thing to note with PTR though is that they continue to have a policy of keeping a dividend payout ratio of 45%. This means that the dividend will fluctuate with the earnings of the company. Look at this how you will, but I actually like companies that perform this way because it allows me to do easy logic to see upside or downside in the future (although I’m not always right).

Yet it is always what is done with the excess money that makes a company successful or not. PTR seems to be on the right track.

Here is a snippet from the 2021 Q4 Earnings Transcript where Ren Lixin, Executive Director and Senior Vice President speaks on where that money will be spent:

As you just mentioned, in 2021, our cash flow is quite redundant, and free cash flow was RMB79.5 billion. And as decided on our Board meeting yesterday, our cash flow in addition to dividend will be used in the following three areas. The first is the cash flow will go to green and low carbon transition for high-quality development of the company. And second, it will go to the domestic on gas exploration and development, especially the development of natural gas to ensure stable supply in the market. And third, the money will be – will go to managing down our leverage and to maintain a prudent financial position of PetroChina. Thank you.

While this is definitely a risky investment, it is also one that the reward is too high for me to completely stay away from. I will most likely never get to a weighting that reaches 5% of the portfolio, but could very well reach that point if the market continues to stay with this valuation.

Conclusion

Currently there are many companies in the market priced at levels that require some sort of significant downturn to be worth the investment. With a looming risks of how the Fed will try to control inflation and potentially (or already) cause a recession, great yielding companies that have significant upside over the next few years seems like a no-brainer. As long as the dividend is relatively safe, then I am content to sit and wait and if the market takes a downturn, the dividends will be there to DRIP into continual increases of passive income for the portfolio. I will rest easy while I count my dollars coming in the door.

Thanks for reading, and as always, happy investing.

Be the first to comment