MF3d

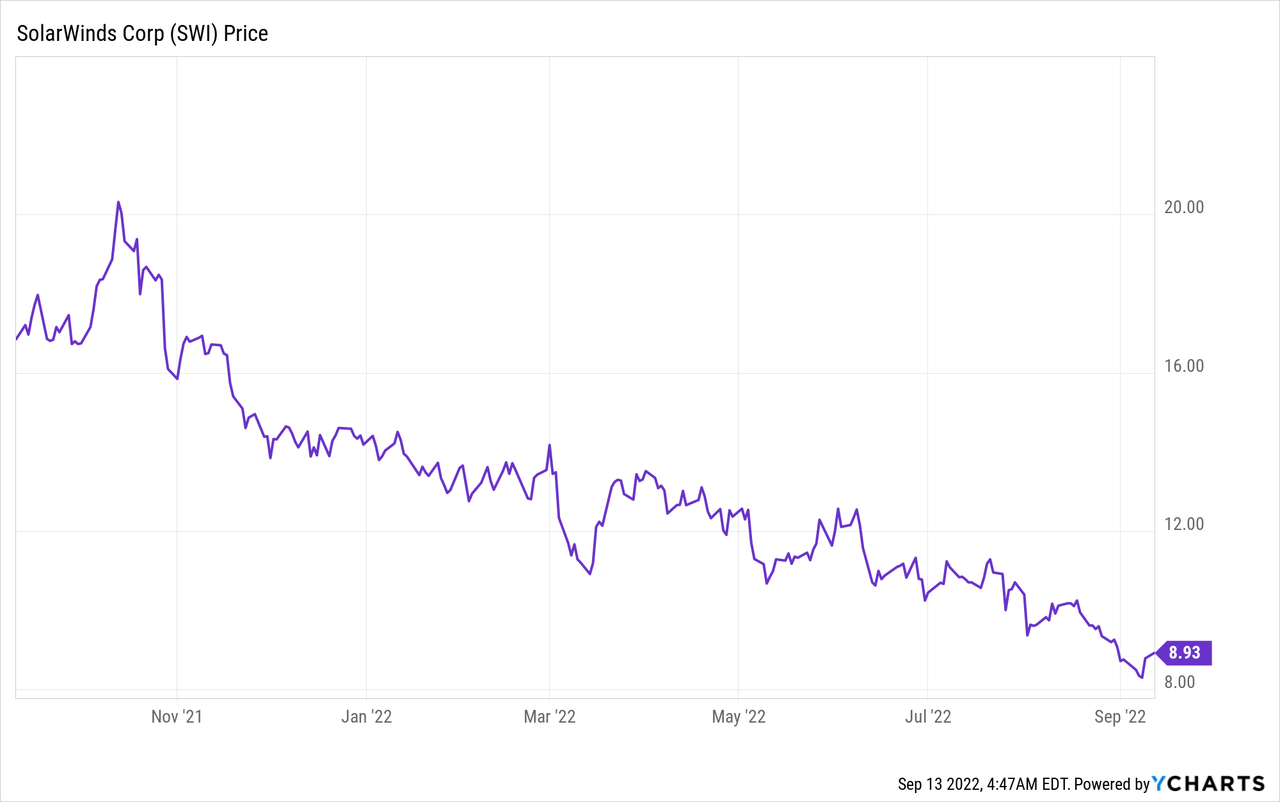

SolarWinds (NYSE:NYSE:SWI) is a Texas-based IT and cybersecurity company that was founded back in 1999. The company is poised to ride the growth across at least two major trends, cybersecurity and the hybrid cloud. The cybersecurity industry is forecasted to grow from $156 billion in 2022 to over $376 billion by 2029. While the hybrid cloud industry is forecasted to grow at a rapid 20.6% CAGR and reach $262 billion by 2027. SolarWinds share price has been butchered and is now down 64% from its all-time highs in December 2020. This major plummet came after the “SolarWinds Hack” which I will get into later. Despite the headwinds, the company has beat analyst revenue estimates for the second quarter and boasts companies such as Microsoft (MSFT) and NVIDIA (NVDA) as customers. In this post, I’m going to break down the company’s, business model, financials, and valuation. Let’s dive in.

Secure Business Model

SolarWinds is a leading IT and cybersecurity company that specializes in securing infrastructure across the globe. This includes the monitoring, troubleshooting, and security of networks, databases, and applications. This can be implemented across on-premises, hybrid, or cloud environments.

SolarWinds (Investor Presentation)

SolarWinds serves over 300,000 customers, which includes 498 of the Fortune 500. The company is extremely “customer-centric” and offers a community called THWACK for customers to discuss their needs and desires. This “community” is a competitive advantage for the company in my eyes, as the IT community is driven strongly by word of mouth. Thus, community groups like this increase customer loyalty and help make the lives of everyday IT professionals easier.

SolarWinds is a leader in the hybrid cloud monitoring industry. This means engineers don’t just use the platform for cybersecurity, but also for troubleshooting and improving network speed. For example, SolarWinds Network Performance Monitoring [NPM] reduces the workload of network engineers by speeding up the time it takes to troubleshoot issues. This makes the platform immensely valuable to network engineers for the day-to-day operations, which again increases the “stickiness” of the platform.

Go to Market Strategy

The company continues to focus on its “high-velocity low-touch” sales strategy with targeted efforts toward building strategic relationships with enterprise customers. The company has also built out its partner strategy and offers “co-sell” opportunities across the globe.

SolarWinds Hack

The SolarWinds hack devastated the company from a reputational standpoint. The hack was believed to have been executed by a Russian hacker group called Nobelium. The group used a “supply chain attack” to insert malicious code into the Orion software. Then when SolarWinds issued an update to the Orion Software this created a “backdoor” to the IT systems of organizations. The worrying thing about this attack is the breach occurred in 2019 but wasn’t detected until 2020, thus over that time, hackers collected confidential data.

It is believed over 250 customers were infected which included major organizations like Microsoft, Cisco (CSCO), Intel (INTC), and NVIDIA (NVDA). But more worryingly, major federal agencies were breached such as the Department of Defense, Department of Homeland Security, and more.

Now, although this attack was terrible for the reputation of SolarWinds, I personally believe it could have happened to any cybersecurity company. In fact, it is obvious that SolarWinds was specifically targeted because of its elite client list. The world of hacking is always evolving, and thus, I believe many large customers will still use SolarWinds, as what is the alternative? A customer can switch to a new competitor, but the less established company is more likely to get breached in general. Anyone can be hacked, it’s just ironic when cybersecurity companies get hacked.

Stable Financials

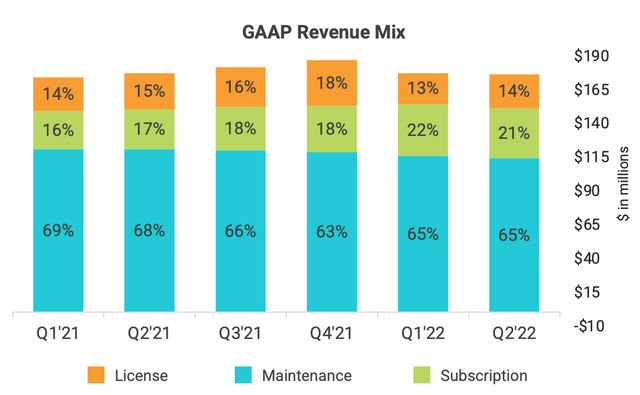

SolarWinds generated $176 million in revenue in the second quarter of 2022. This beat analyst estimates by half a million dollars, despite being down slightly year over year. On a constant currency basis, revenue actually popped by 2% year over year, which was a positive sign. The majority (65%) of its revenue comes from Maintenance and the company has a strong 91% renewal rate in this area.

Subscription revenue growth is a key area of focus and this popped by 25% year over year to $37 million. It should be noted that the business is playing a delicate balancing act as when they switch customers over to a subscription, this will cause a short-term hit in revenue from other areas. For example, license revenue declined 6% YoY, but longer-term subscription revenue tends to be consistent.

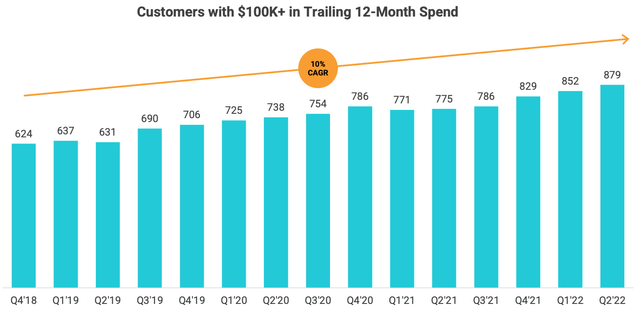

The company has 879 high ticket customers which have spent over $100,000 on the platform over the last 12 months, up 13% year over year. Strong growth in its larger customers is a positive sign, as these tend to be more “sticky”, and of course, spend more overall.

Large Customers (Q2 Earnings Presentation)

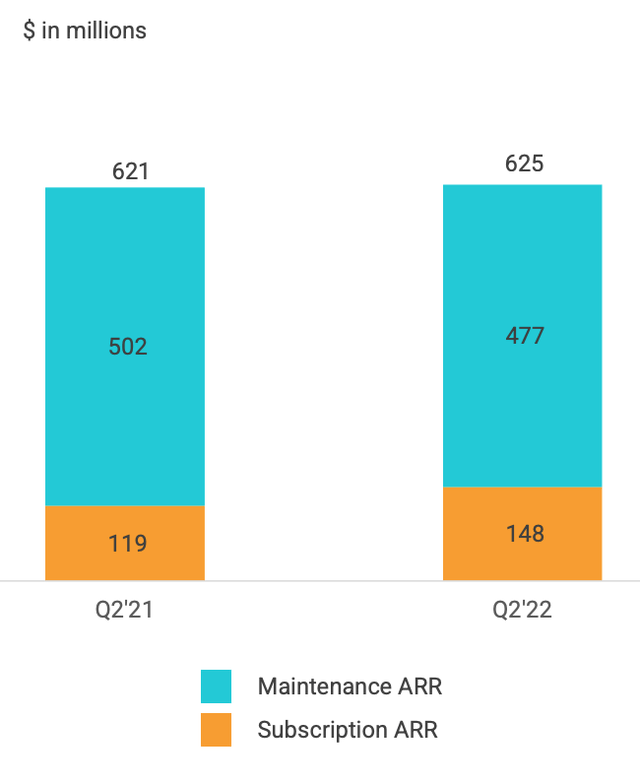

SolarWinds generated $625 million in Total Annual Recurring Revenue, which increased by 1% year over year. This was driven by 24% growth in subscription revenue, while maintenance ARR decreased by 5%.

SolarWinds (ARR)

Adjusted EBITDA was $67 million, representing with adjusted EBITDA margin of 38%, which was in the outlook range.

Earnings Per Share [Normalized] was $0.21, which beat analyst estimates by $0.01.

SolarWinds has $778 million in cash, cash equivalents and short-term investments on its balance sheet. In addition, to net debt of ~$1.1 billion, which is fairly high but management plans to reduce this over the next 2 years.

In the third quarter, management is expecting revenue of $180 million to $185 million, down 2% year over year. However, on a constant currency basis, this is expected to pop by between 2% and 5%. The primary growth driver of this is expected to be an increase in sales to federal customers, as well as renewals that are expected from existing customers.

Advanced Valuation

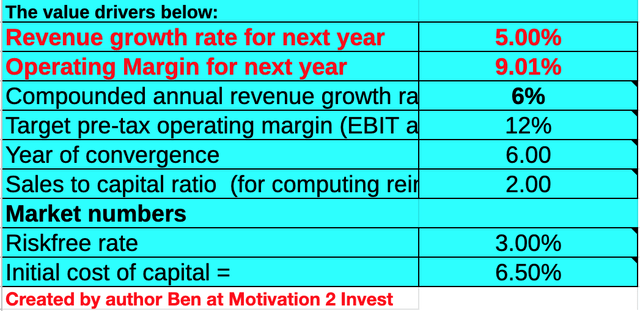

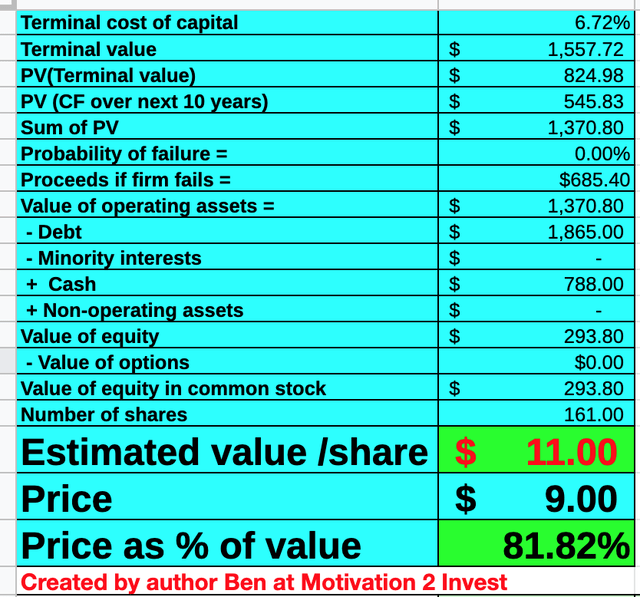

In order to value SolarWinds, I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of valuation. I have forecasted a conservative 5% revenue growth next year and 6% over the next 2 to 5 years, as I believe FX headwinds will subdue.

SolarWinds stock valuation (created by author Ben at Motivation 2 Invest)

In addition, I have forecasted the operating margin to expand to 12% over the next 6 years, as the platform benefits from higher operating leverage. Note the base operating margin will look higher than company numbers as this includes an adjustment for R&D expenses which I have capitalized.

Valuation Model (created by author Ben at Motivation 2 Invest)

Given these factors, I get a fair value of $11 per share, the stock is trading at ~$9 per share at the time of writing and thus is ~18% undervalued.

Relative Valuation

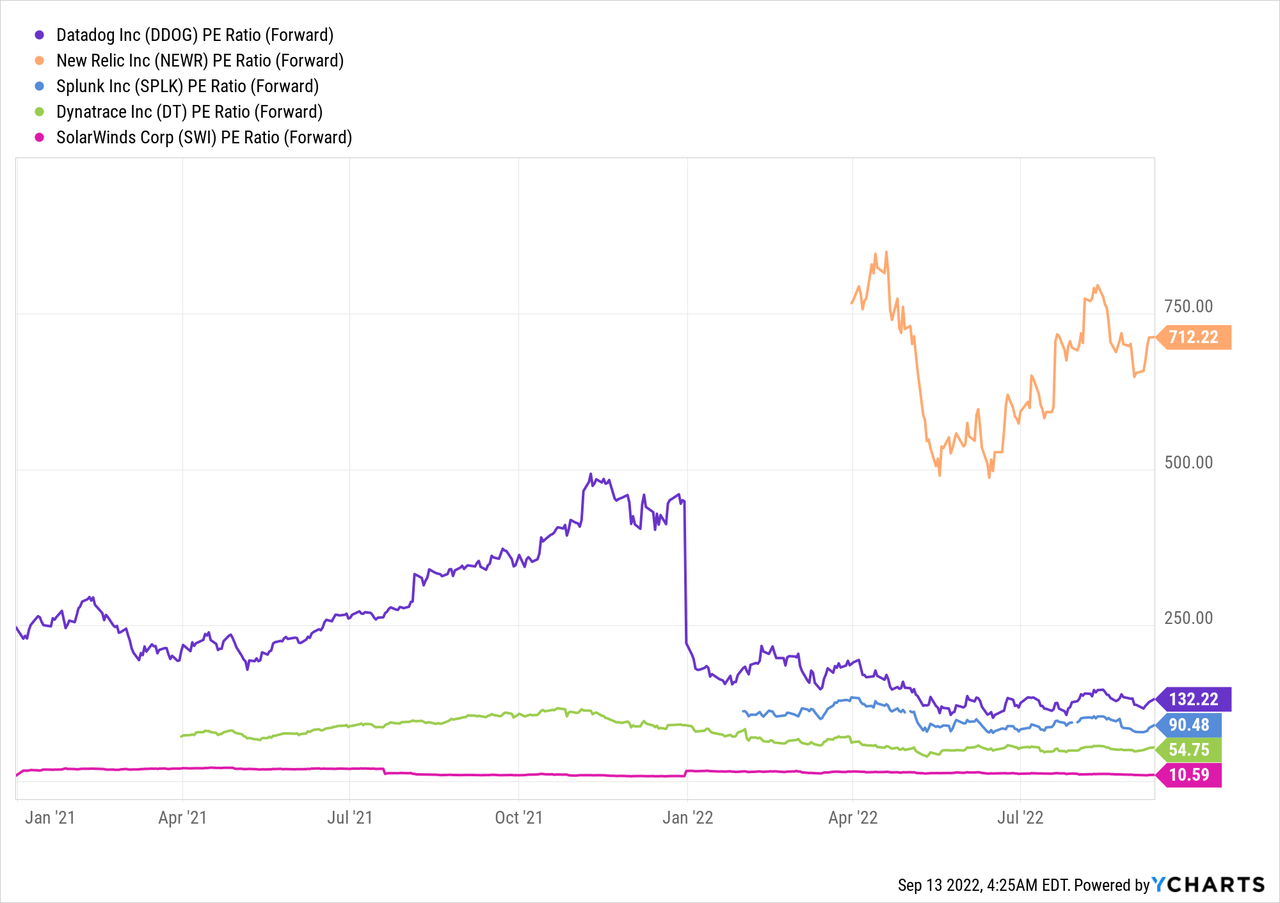

SolarWinds trades at a forward Price to Earnings Ratio = 10.43, which is 43% cheaper than its 5-year average of 18. In addition, this is 42% cheaper than the IT sector average. Relative to competitors in the IT observability market, SolarWinds is also the cheapest. For example, Datadog (DDOG) trades at a PE Ratio = 132, as the company is investing aggressively for growth.

SolarWinds also trades at a Price to Cash Flow = 9.35, which is 38% cheaper than its 5-year average.

Risks

Competition

SolarWinds faces a vast amount of competition from rapidly growing companies such as Datadog, which is growing revenue at over a 50% clip. Other players in the IT observability market include NewRelic, Dynatrace (DT), and even AWS Cloudwatch by Amazon. The majority of these companies are growing much faster, but they are also trading at a higher valuation, so it is really about identifying which strategy you prefer.

Recession/IT Spending Slowdown

Many analysts are forecasting a recession and thus this may cause a temporary slowdown in IT spending towards the latter half of the year.

Final Thoughts

SolarWinds is a leading cybersecurity company that serves an elite list of enterprises and government agencies. I believe its established client base offers consistency to the revenue and its profitability will appeal to a certain type of investor. However, I wouldn’t expect rapid growth like other companies in this industry, but the valuation is too cheap enough to ignore.

Be the first to comment