romaset/iStock via Getty Images

SolarEdge Technologies Inc (NASDAQ:SEDG) just reported its latest quarterly earnings with sales beating estimates on a record number of shipments. The company is recognized as the world’s largest photovoltaic inverter supplier which has benefited from strong demand globally amid the ongoing shift towards renewable energy solutions. Momentum in countries like Germany, and Holland along with Taiwan, South Africa, and the U.S. highlight the company’s global exposure.

Indeed, the story in Q3 was accelerating sales, particularly to Europe amid the energy crisis in the region. In the U.S., the Inflation Reduction Act (IRA) is set to represent a new growth driver by next year supporting a positive outlook. New manufacturing capacity coming online should support firm margins through 2023. We are bullish on SEDG and see more upside with room for earnings to outperform going forward while shares still appear cheap at the current level.

SEDG Earnings Recap

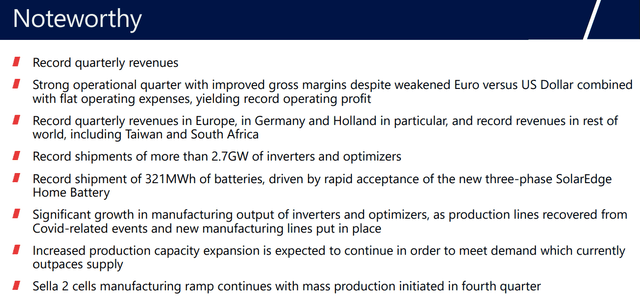

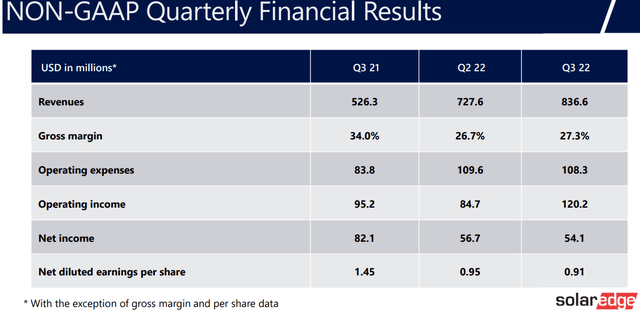

Q3 revenue of $836.6 million was up 59% from the period last year, and also $12 million ahead of the consensus estimate. The key metrics here are the 265k inverters shipped, up from 228.4k in Q2. The company also shipped 321MWh of batteries, an increase of 27% from Q2 with market acceptance of its new “three-phase SolarEdge home battery”.

Despite inflationary cost pressures and the impact of a stronger Dollar, the company was able to keep operating expenses flat while the gross margin increased by 60 basis points. This was achieved, in part, by exiting its legacy “Critical Power” division while capturing higher margins from its “e-Mobility” products targeted towards electric vehicle components.

The result here was a 26% y/y increase in the adjusted operating income reaching $120.2 million. On the other hand, the non-GAAP EPS of $0.91, was down from Q2 and missed expectations with management citing the negative impact of financial expenses related to foreign exchange depreciation of foreign currencies.

During the investor conference call, a theme from management was the strength in Europe expected to continue. Sales in Germany, for example, were up 125% year-over-year with demand outpacing capacity. Favorably, a manufacturing facility in Mexico set to ramp up production by next year will generate some logistical efficiencies by serving the U.S. market allowing sites in China, Vietnam, Israel, and Europe to focus more on their local regions. Price hikes initiated in recent quarters are expected to be more evident going forward.

In terms of guidance, the company is targeting Q4 revenue between $855 million and $885 million, representing a 4% sequential quarterly increase at the midpoint, or 57% higher than Q4 2021. Management expects margins to continue improving in a range between 27% and 30% with more upside through next year. The guidance for non-GAAP operating profit is within the range of $115 to $135 million, slightly up from Q3. Finally, it’s worth noting SolarEdge maintains a solid balance sheet, ending the quarter with $1.6 billion in cash against $0.6 billion in debt.

What’s Next For SolarEdge?

There’s a lot to like about SEDG with a good combination of value, given its recurring profitability, and significant growth opportunities. This is a case where demand is outpacing supply globally, particularly for this category of high-tech solar power management systems and specialized inverters, optimizers, and micro-inverters. By this measure, the company benefits from the high-level industry tailwinds as a critical component of solar installations.

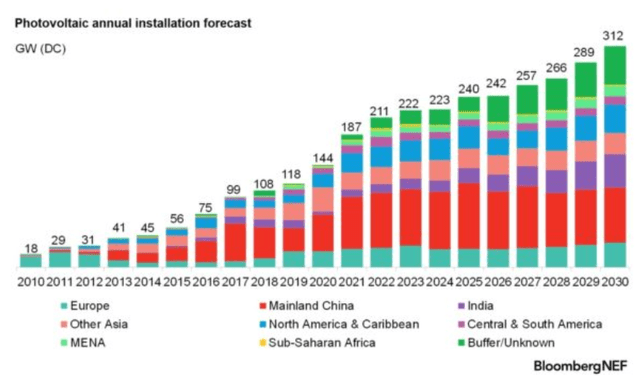

According to Bloomberg New Energy Finance, the forecast is for annual global solar power additions to reach 312GW by 2023 compared to 187GW forecast in 2021. Other sources have more aggressive estimates citing figures like 537GW in solar panel installations by 2027. The point here is that SolarEdge is well-positioned to capture this expansion.

In the U.S., the recently passed IRA or “climate spending bill” is seen as a game changer for the industry with billion in incentives supporting solar adoption as well as production tax credits for local manufacturers. On this point, SolarEdge plans to move forward with the U.S. site pending the final regulatory details justifying domestic production.

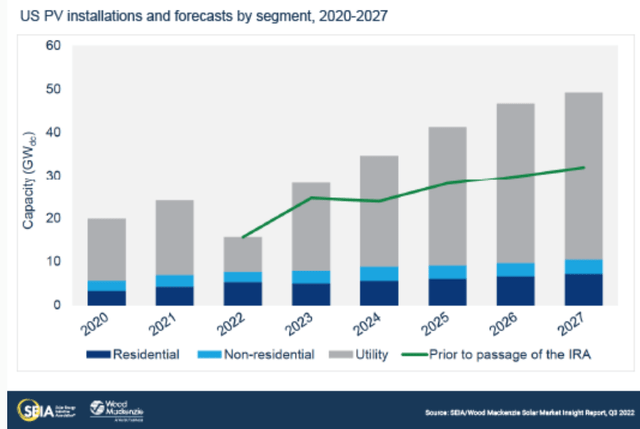

The Solar Energy Industries Association (SEIA) sees PV installations 40% higher through the next five years as a direct result of the legislation compared to prior estimates. Notably, the greatest impact would ramp up starting in 2024.

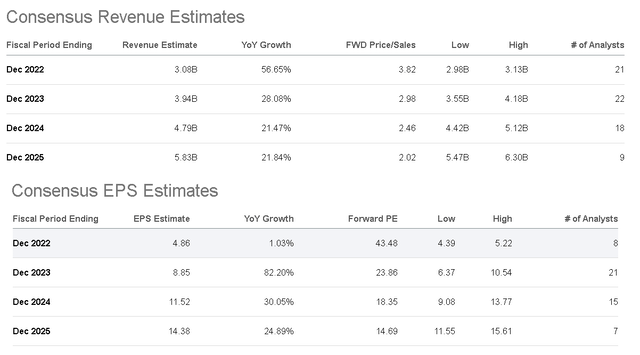

The market forecasts translate into a strong consensus revenue and earnings outlook for the company. The market sees annual top-line growth averaging 32% over the next five years while EPS has room to climb nearly three-fold from $4.85 expected this year towards $14.38 by 2025.

Importantly, we see room for SEDG to outperform these estimates based on the following factors.

- Record demand from Europe, which is the company’s primary market.

- Pricing hikes implemented in recent quarters have not yet translated into revenue upside given the time lag.

- Ramp-up at the Mexico manufacturing facility will support higher margin U.S. market demand.

- The company is generating scale advantages on the corporate side.

- The tailwind of IRA legislation kicking in by next year.

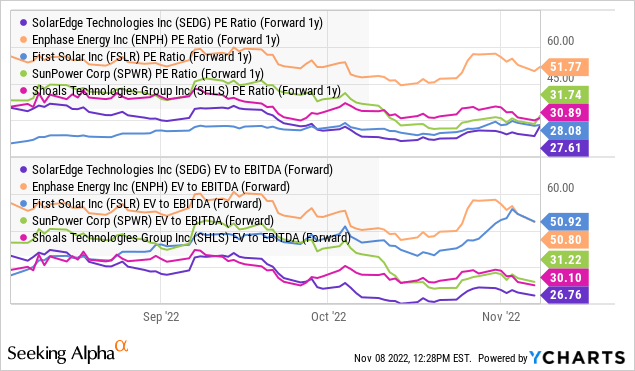

Focusing on the current 2023 EPS estimate of $8.85, we believe the stock trading at a forward P/E under 30x is attractive relative to industry peers. With a group that we include names like Enphase Energy Inc (ENPH), First Solar Inc (FSLR), SunPower Corp (SPWR), and Shoals Technologies Group Inc (SHLS); SEDG trades at a discount on its earnings and forward EV to EBITDA multiple.

While these companies have their differences and focus on different segments ranging from solar panel manufacturers and power management systems suppliers, we sense that SEDG’s valuation has room to converge higher towards the multiple from ENPH as part of the bullish thesis for the stock.

SEDG Stock Price Forecast

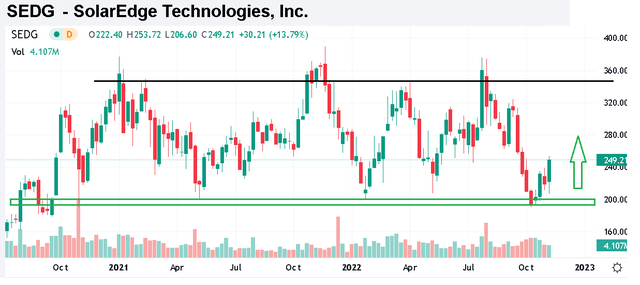

We rate SEDG as a buy with a price target for the year ahead at $350 representing a 40x multiple on the consensus 2023 EPS. Our thinking here is that the valuation spread compared to large-cap leader Enphase Energy will narrow with the market focusing on SolarEdge’s growth momentum. The stock traded as high as $370 as recently as Q2, and there’s a case to be made that its outlook is as strong as ever now following the Q3 results.

To the downside, the $200 share price level now works as a critical area of support which we believe will hold. The main headwind continues to be broader macro uncertainty and broader financial market volatility. The results from the U.S. midterm elections have implications for the solar industry considering the possibility that a GOP-led congress would attempt to slow down any further clean energy legislation. Even though the IRA has already been passed, clarity on the details and specific regulations will be important for sentiment toward the sector.

Be the first to comment