VIDOK/iStock Unreleased via Getty Images

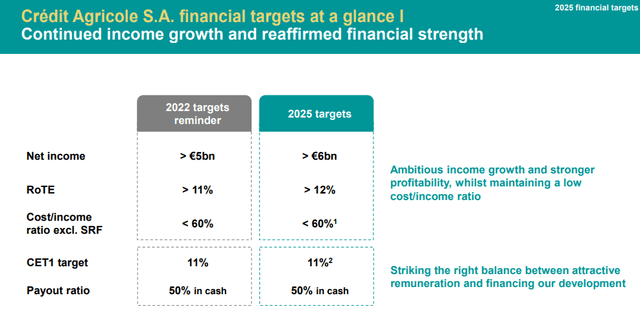

Today, Crédit Agricole (OTCPK:CRARF) just released its plan for the 2025 target, which aims, in particular, to reach €6 billion in net profit in a three-year horizon. This plan is based on strong organic growth potential with a target of more than one million additional customers. To succeed, the French bank aims to “expand and adapt its offers” so that they are “more accessible, more responsible and more digital“.

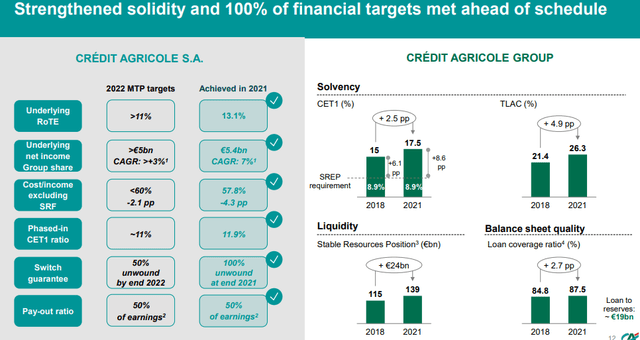

We should note that in 2021, a year in advance, Crédit Agricole already achieved its previous financial target.

Crédit Agricole S.A.‘s past target

Source: Crédit Agricole S.A.‘s ambitions for 2025

It is now the time to raise the bar. This plan also aims to further strengthen profitability with a ROTE of more than 12%.

Looking more in detail, here below how the bank will proceed:

- It plans to raise the integrated bank-insurance-asset management business model. In a previous publication, we already mentioned why “cross-selling opportunities and these hedged business models are very important for these businesses to add value and generate a margin of safety beyond the net interest margin“. Crédit Agricole Assurances aims to accelerate the development of non-life insurance equipment with a target of 2.5 million additional non-life insurance policies.

- It plans to develop new partnerships ” with financial players and industrial leaders”

- It plans new acquisitions. Once again we have already commented on the bank’s latest Italian acquisition and we are closely monitoring competition activities. Crédit Agricole is also looking for targets with strong credit ratings and in line with their “profitability criteria“. Regarding the geographical area, the French bank is targeting its home market but also increasing its international presence.

- In the longer term, “2030 and beyond“, the Group indicates that it will launch two new businesses “useful to society and providing development opportunities“. Indeed, the bank is launching Crédit Agricole Transitions and Energies “to make energy transitions accessible to all and accelerate the advent of renewable energies“. They will also launch Crédit Agricole Santé and Territoires “to facilitate access to healthcare and age well“. We should note that there are no target revenues for the new business line as well as no-cost guidance.

In the press release, the group also indicates a €20 billion budget over the period for new technologies. This includes €1 billion in digital “for the technological transformation investment programs” explained Jérôme Grivet, deputy general manager of Crédit Agricole.

From numbers to our future estimate

Looking at the Wall Street analyst’s consensus, our internal team noticed that Crédit Agricole’s plan is just humbly above future estimates. Crédit Agricole S.A.‘s ambitions for 2025 are set to a prudent growth rate hypothesis (3m EURIBOR +1.25% in 2025) and on a conservative cost of risk (40 basis points vs. 28 basis points in 2021).

Our internal team estimates a top-line sales increase by an average 2021-25 CAGR of 3.5% versus a consensus estimate of 2.6%. The company plans a cost/income ratio capped at 60%, and this will translate into a profit CAGR of +3% over the same horizon. Even if costs are not disclosed, IFRS17 expenditure is forecasted to be neutral on capital by 2025. Again, we should note that Crédit Agricole increased cumulative IT spending from €15 billion to €20 billion.

The group’s efficient and flexible structure makes it possible to set an optimized CET1 ratio target for Crédit Agricole over the entire duration of the medium-term plan at 11% and a floor of 250 basis points above SREP requirements (currently 7.9%). The 50% cash dividend payout will be maintained.

Crédit Agricole S.A.‘s new target

Source: Crédit Agricole S.A.‘s ambitions for 2025

The bank’s new strategy for 2025 is an evolution of the current plan with a focus on well-diversified revenues with low-risk banking operations supported by strong group solvency. Then, we reaffirm our Crédit Agricole valuation that is based on a ROTE at 11% arriving at a €13 per share valuation versus the current €9.25 per share. Crédit Agricole is also pretty discounted compared to its TBV. As we predicted, the CASA dividend was a strong margin of safety to navigate short-term turbulences in this stock market environment.

Source: Mare Evidence Lab’s previous publication

Be the first to comment