Tomwang112/iStock via Getty Images

Solar Integrated Roofing Corporation (OTCPK:SIRC) is growing through acquisitions at a fast pace. If management receives sufficient funds from investors, and the acquisitions don’t fail, sales growth could stay at more than 20% YOY. Assuming that Solar Integrated reaches the size of competitors, in my view, the EBITDA margin will increase as economies of scale increase. In the best case scenario, the fair price could be significantly larger than the current share price. I do see some risks coming from impairment of goodwill, intangibles, and potential equity dilution. So, the stock is not for everybody, but I am a buyer.

Solar Integrated Roofing

Solar Integrated Roofing Corporation is a single-source solar power and roofing systems installation business. The company is trying to build a diversified portfolio of assets across solar, battery backup, EV charging, roofing, and related HVAC/electrical contracts.

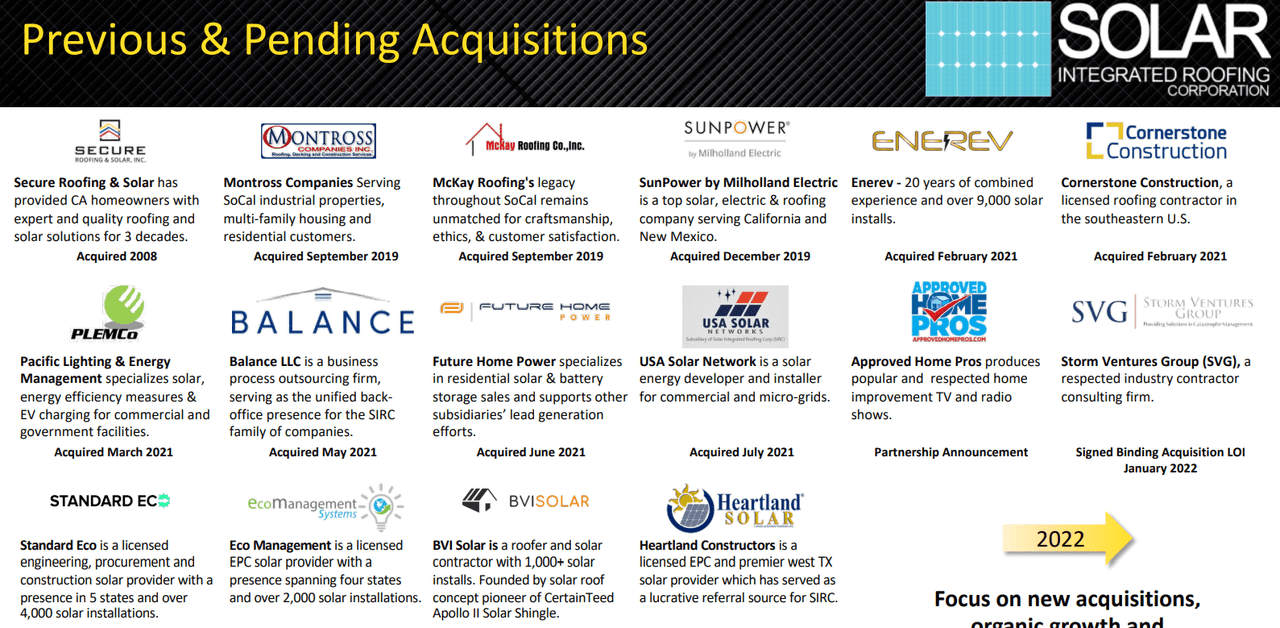

The most interesting feature about Solar Integrated is the ability of management to acquire other competitors. The number of acquisitions signed in the last two years is overwhelming, which, in my view, most financial advisors will likely appreciate. Keep in mind that the company will likely report significant revenue growth thanks to inorganic growth.

Presentation To Investors Presentation To Investors

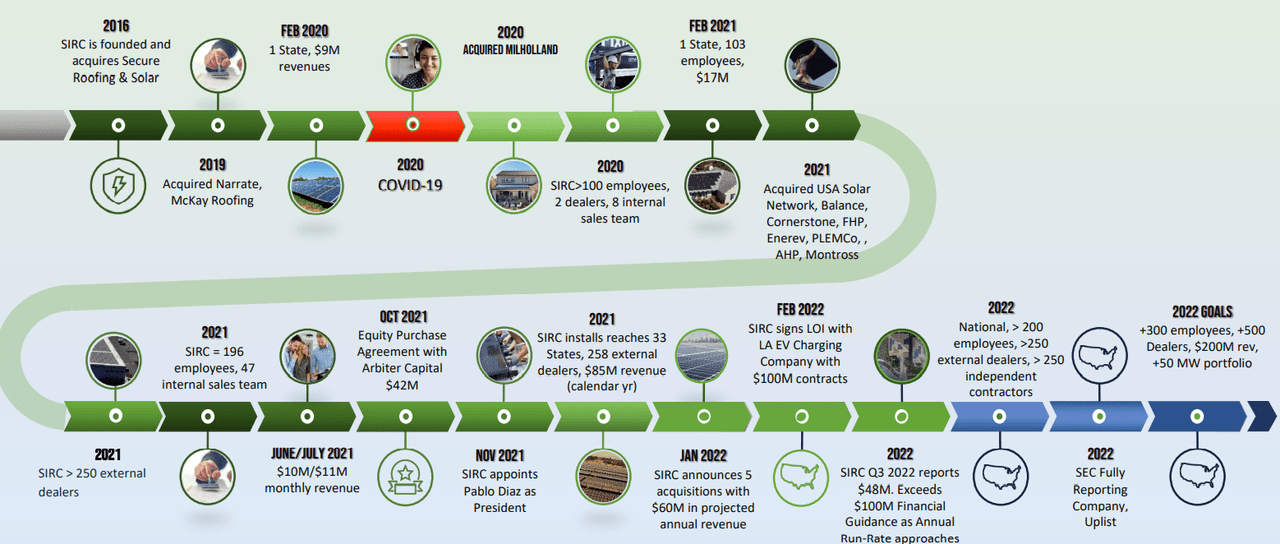

As a result of Solar’s M&A activity, its number of installations per state increased significantly in 2021 and 2020. In my opinion, the company did not really install new systems, but acquired new ones. In any case, most investors will be interested in Solar Integrated because it is reporting significant sales growth.

Presentation To Investors

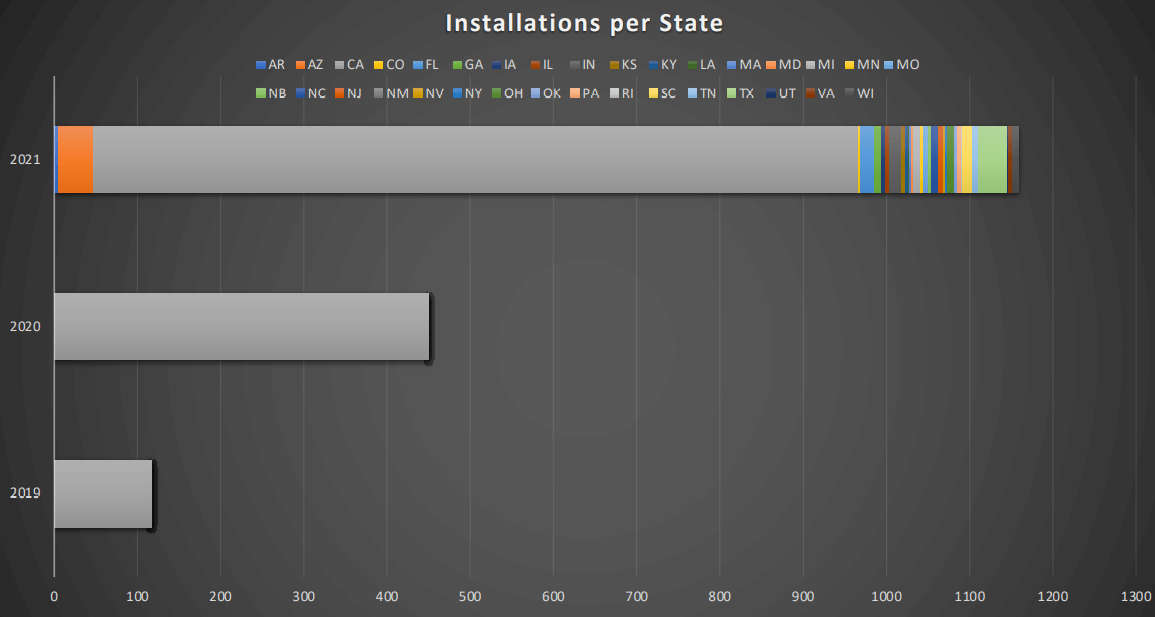

In the nine months ended November 30, 2021, Solar reported revenue of $66.1 million, close to 400% more than that in the same period in 2020. The gross profit also increased quite a bit, and the amount of salaries and wages more than doubled. Already with positive net income, I believe that the demand for the stock could increase from 2022.

10-Q

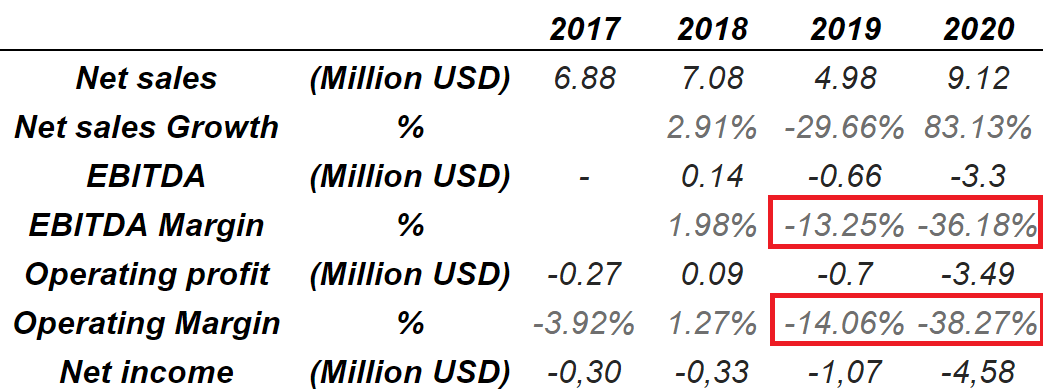

The figures reported from 2017 to 2020 were quite detrimental. The company did not only report negative EBITDA margin and negative net income, the total amount of sales was also quite small. That’s why I believe that the stock is currently trading a bit undervalued. Many investors may not be looking at the new numbers because the old figures were not that encouraging.

marketscreener.com

marketscreener.com

If Solar Integrated Grows Like The Solar Rooftop Market, The Implied Fair Price Could Reach $1.1

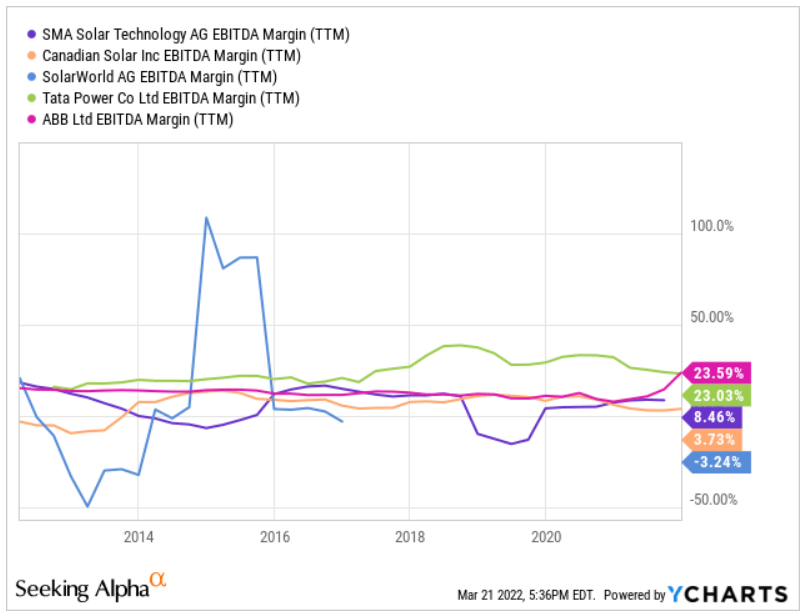

Under the best case scenario, I have assumed that Solar would continue to grow its core business through M&A transactions. I believe that management will obtain economies of scale, and the EBITDA margin will likely increase. Keep in mind that I am assuming that Solar will acquire businesses at decent EV/EBITDA multiples. If Solar Integrated buys private businesses at 5x-9x EBITDA, and trades at 11x like other large competitors, management will likely report a decent ROE.

Besides, I would also expect management to continue its expansion in the EV industry. Note that Solar promised to close the acquisition of LA EV Charging company, which includes close to $100 million contracts. If management also reports the construction of 20 MW of micro-grid opportunities and new investments in the C&I market, FCF expectations will likely increase.

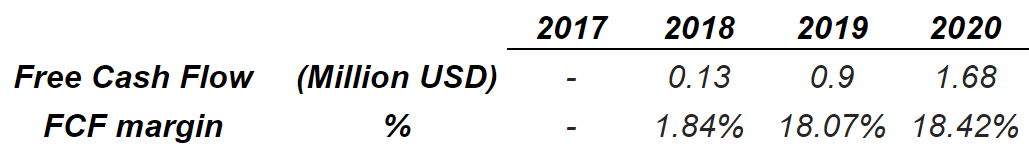

In this case scenario, I have assessed the growth of the market and the profitability ratio of other competitors. In my view, if Solar becomes a large player, the EBITDA margin and the FCF/Sales ratio will likely look like that of other competitors.

The growth of the solar rooftop market is expected to be close to 20%, so I would say that Solar could grow at 20% YOY:

According to a comprehensive research report by Market Research Future (MRFR), Solar Rooftop Market Information Report by Capacity (>10 kW, 11 kW- 100kW and <100 kW), By Connectivity, (On-Grid and Off-Grid) By End User (Residential, Commercial and Industrial) and By Regions – Global Forecast to 2028” the market grow at a rate of 20.57% during the forecast period 2021-2028. Source: globenewswire

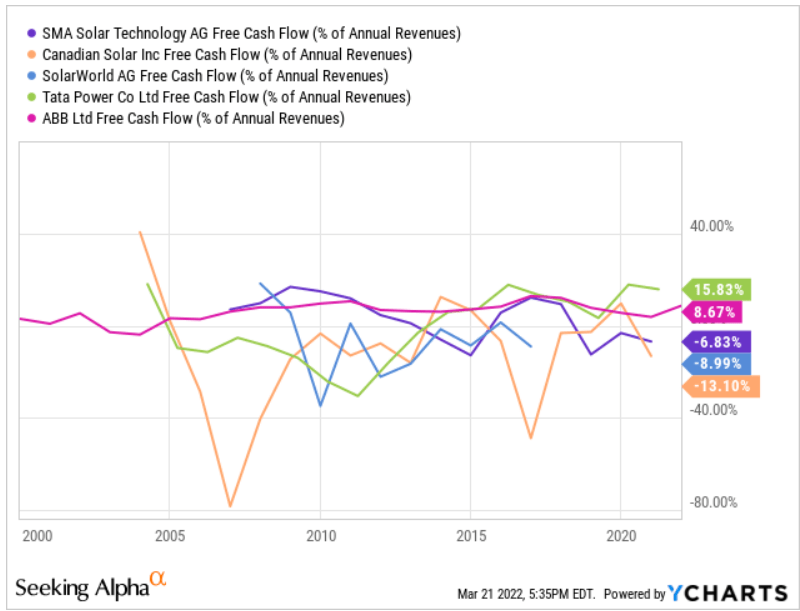

Competitors also report an EBITDA margin of 3%-24%, so I would say that in the future, Solar’s EBITDA margin could be close to that figures.

Ycharts

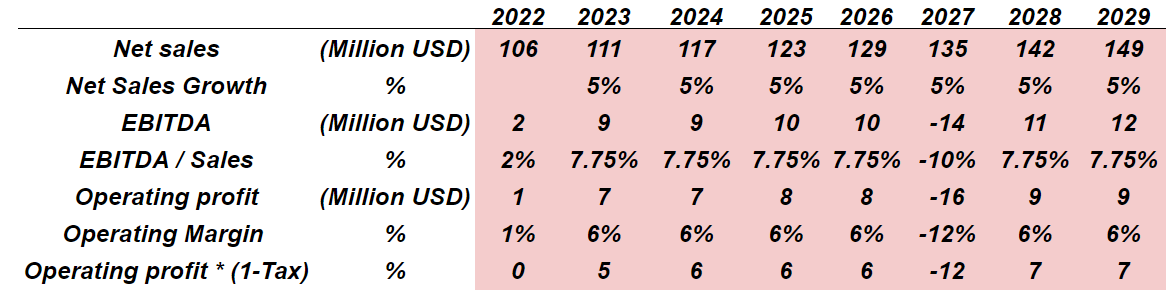

With sales growth close to 20%-17% from 2022 to 2029 and EBITDA margin of 2%-15%, 2029 NOPAT could stand at $34 million, and 2029 revenue could be around $335 million.

Ycharts

Right now, competitors report a FCF/Sales ratio close to 15% and -13%. However, in the past, some competitors even reported FCF/Sales ratio close to 40%. I am trying to be very conservative, but let’s say that we could see impressive FCF margin in the coming years.

Ycharts

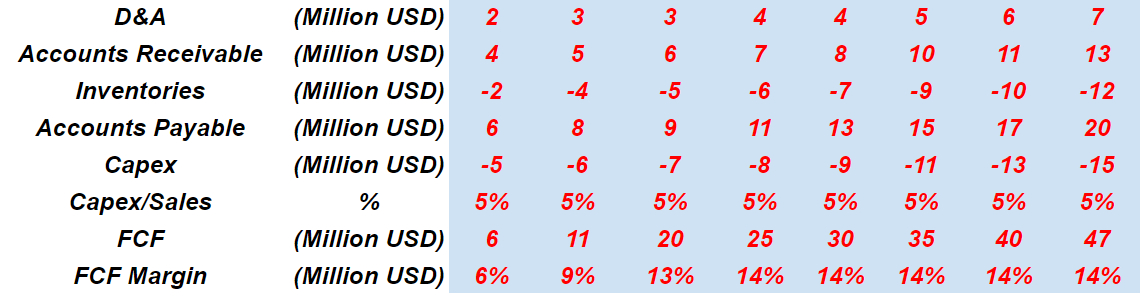

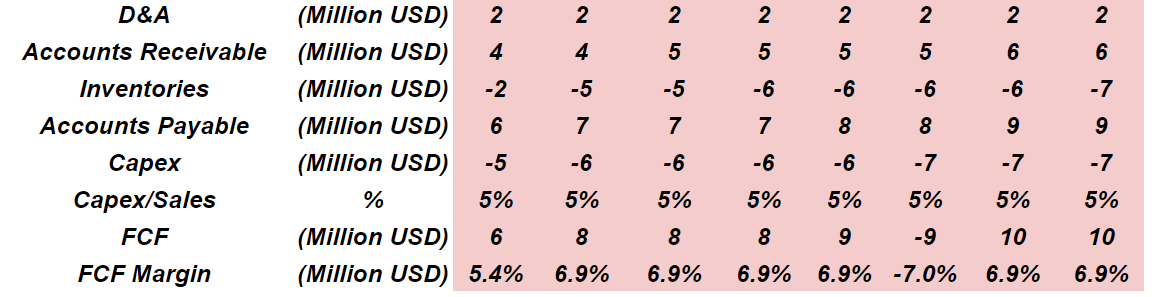

With conservative D&A, changes in working capital, and capex/sales close to 4%-5%, the FCF would grow from $6 million to $47 million. Under my assumptions, I obtained FCF/Sales of 14%.

YC

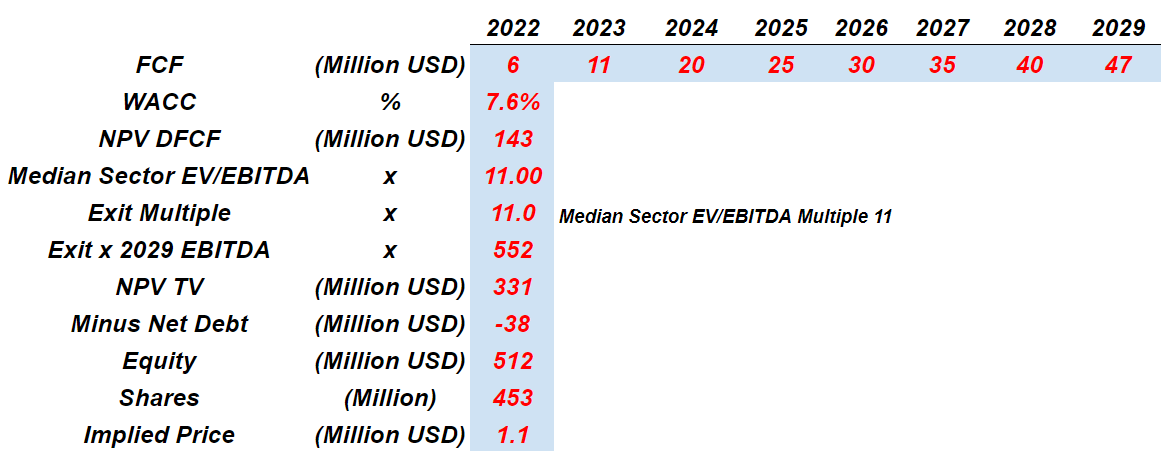

If we assume a WACC of 7.6%, the discounted sum of future FCF should be close to $143 million. With an exit multiple of 11x, the terminal value discounted would stand at $331 million, and the implied share price should be $1.1.

YC

Risks: Failed Acquisitions And Impairment Of Goodwill Could Lead To A Decline In The Share Price

With management launching many transactions, in my view, it is likely that one or more acquisitions don’t work. In the worst case scenario, accountants may have to impair certain intangible assets or goodwill, which would lead to a decrease in the book value per share. If financial analysts lower their free cash flow expectations, the company’s fair value could lower significantly. As a result, I believe that the stock price would decline:

Tangible and intangible assets are assessed at each reporting date for indications that an asset may be impaired. If any such indication exists, or when annual impairment testing for an asset is required, the Company makes an estimate of the asset’s recoverable amount. The asset’s recoverable amount is the higher of an asset’s or cash-generating unit’s fair value less costs of disposal and its value in use and is determined for an individual asset, unless the asset does not generate cash inflows that are largely independent of those from other assets or groups of assets. Source: 10-Q

In the last annual report, I could read very detrimental terms about the company’s financial status. The current environment is a bit better than that when the annual report was produced. With that, some risks are still present. If management cannot obtain sufficient financing to acquire more competitors as well as to install more solar panels, sales growth may diminish. As a result, management may suffer lack of demand, which may lead to a decrease in the company’s total valuation:

If the Company is unable to obtain additional funds when they are required or if the funds cannot be obtained on favorable terms, management may be required to restructure the Company or cease operations. The financial statements do not include any adjustments that might result from the outcome of these uncertainties. Source: 10-k

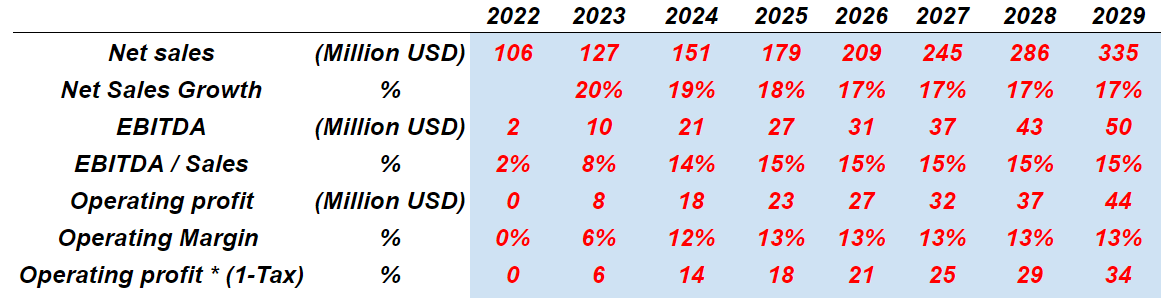

With the solar rooftop market growing at more than 20% YOY, I believe that assuming sales growth of 5% is quite pessimistic. Under these conditions, 2029 sales would stay close to $150 million. I also assumed an EBITDA margin of 7.75% and an effective tax of 22%.

YC

In this case scenario, I also assumed D&A of $2 million, changes in accounts receivables of $4-$6, and changes in accounts payables of $5-$10 million. Finally, with a capex/sales ratio of 5%, the free cash flow should grow from $5 million to close to $10 million:

YC

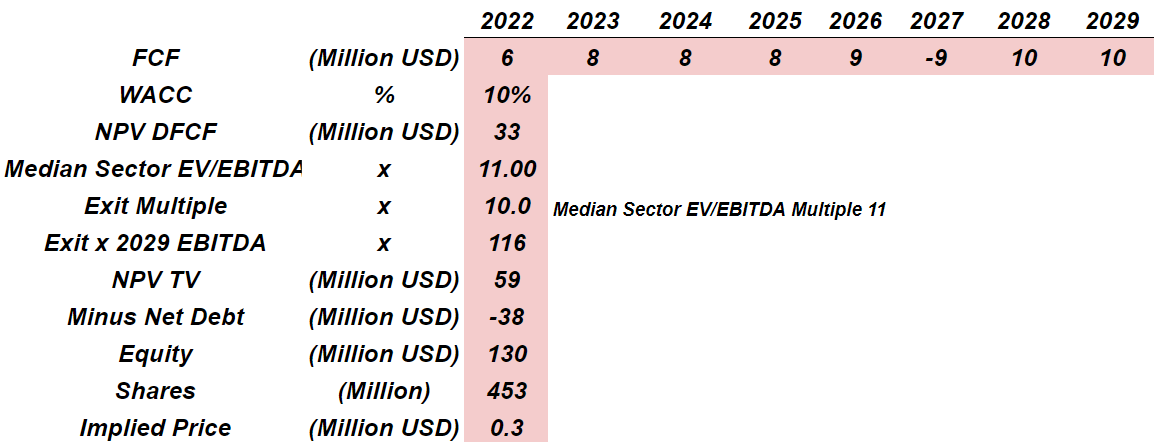

If we sum the future free cash flow with a WACC of 10%, the net present value stands at $33 million. I also used an exit multiple of 10x, which implied a terminal value of almost $115 million. Discounting both the terminal value and future FCF, and dividing by the share count, Solar’s share price is equal to $0.3.

YC

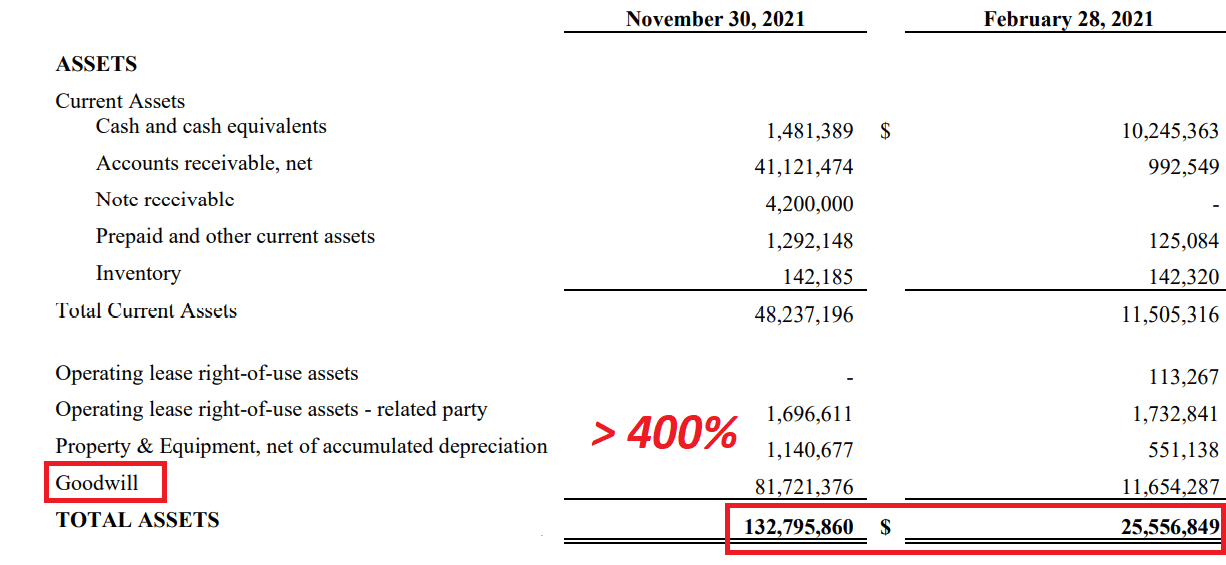

Total Amount Of Assets Increased Quite A Bit

As of November 30, 2021, Solar reported $1.4 million in cash, which is significantly lower than that in February 2021. The company invested a lot of cash in the acquisition of other companies, which resulted in a dramatic increase in the total amount of assets and goodwill. If the book value per share and the balance sheet keep growing at that pace, in my view, many investors will likely study the company’s business model.

10-Q

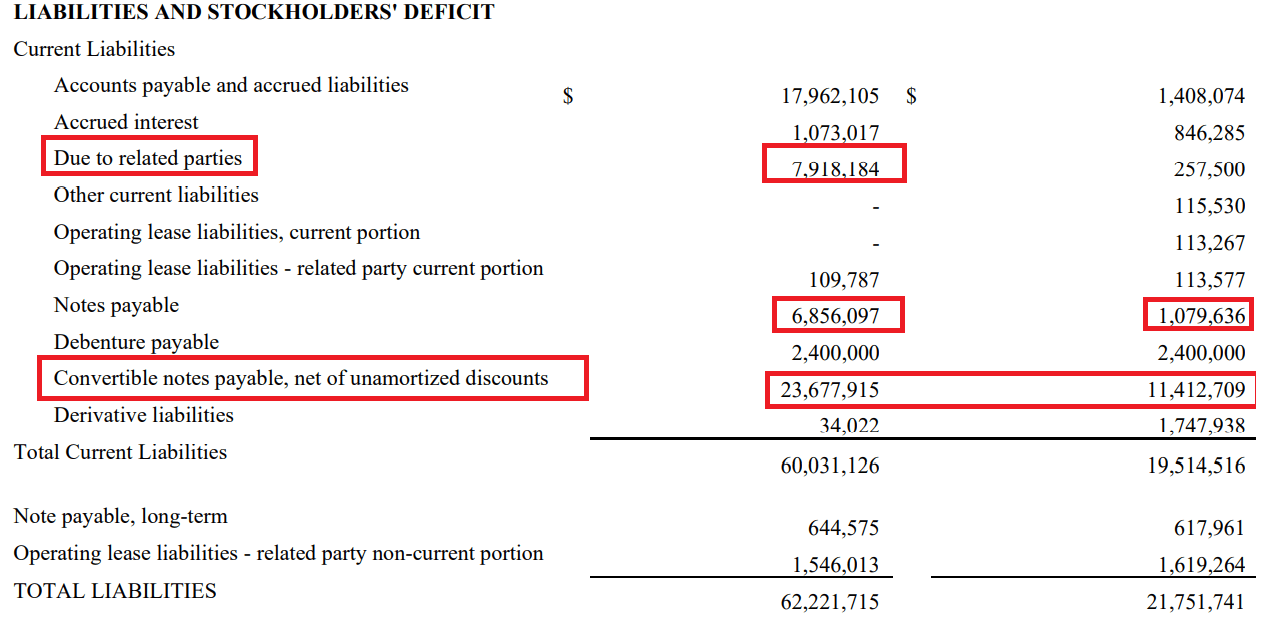

Solar Integrated appears to be financing some of the acquisitions with a combination of convertible notes, debts with related parties, and notes payable. I am a bit concerned about the equity dilution risk from the convertible debt. With that, if future free cash flow is enough to pay the effect of dilution and the debt obligations, I wouldn’t expect significant downside pressure on the stock price.

10-Q

Conclusion

If Solar Integrated Roofing continues to acquire small competitors, and grows with the Solar rooftop market, the stock price could trend north. In my view, the current market price fails to represent the potential profitability that shareholders may enjoy soon.

With that, there are also some risks. If management is unable to convince new investors, and does not obtain financing, sales growth may decline significantly. Taking into account that you need tons of cash to buy other companies, if some of the acquisitions fail, the book value per share could decline too. I remain a buyer of shares, but investors should perform significant due diligence. The stock is not for everybody.

Be the first to comment