Chris J Ratcliffe

Credit Suisse (NYSE:CS) had a few rough months lately and is in the process of presenting another business restructuring, while the risk of a capital increase continues to penalize its stock. While its current valuation already reflects most of its fundamental issues, investors should wait for the upcoming strategy presentation to buy Credit Suisse’s shares.

Background

Credit Suisse is Swiss bank with a business profile exposed to capital market activities, operating across the globe. Credit Suisse’s operations are divided into four main segments, namely, Investment banking (‘IB’), Private banking, Corporate and institutional banking (‘CIB’) and Asset management. It has a market capitalization of about $11.4 billion and trades in the U.S. on the New York Stock Exchange through its ADR program.

In recent months, its business has been affected by several issues, including the well-known losses coming from the Archegos Capital Management and Greensill Capital collapses, which led to several top management changes and very weak financial results over the past few quarters.

Indeed, Credit Suisse reported a net loss of CHF 1.65 billion million in 2021, compared to profits of CHF 2.7 billion in the previous year. Over the past two quarters, its financial performance has not been much better, which led the bank to perform (another) strategic review of its operations, which is expected to be presented next October (together with its Q3 earnings).

This backdrop has led to a strong de-rating of its shares, which are currently trading at a depressed valuation of only 0.23x book value, a significant discount to the European banking sector average. A shown in the next graph, Credit Suisse’s shares have been in a downtrend over the past few months and have reached recently a new all-time low.

Price performance (Bloomberg)

Therefore, the main question right now for investors is if Credit Suisse offers value at its current share price, or is this a value trap and further downside may lie ahead. In this article I analyze the bank’s strategy and its valuation, to see if there is value or, despite its shares being at very low levels, if Credit Suisse should be avoided.

Business Strategy

Credit Suisse’s strategy and business profile have changed considerably following the financial crisis of 2008-09, when it was mainly an investment bank, but thereafter changed its business profile towards other activities, namely wealth management.

Like many of its peers, Credit Suisse was negatively affected after the global financial crisis by lower activity in the capital markets and overall oversupply in the investment banking (‘IB’) industry, of which fixed income, commodities and currencies (‘FICC’) operations were one of the main issues. However, Credit Suisse was quite slow to react following the GFC to the changing industry environment and only made the strategic decision to significantly scale down FICC operations back in 2015.

Nevertheless, after several years of restructuring its business and reducing its presence in investment banking activities, the bank was, to some extent, successful in changing its business profile. This means that it is now more exposed to less risky activities compared to ten years ago, even though it still has a large presence in IB activities.

This strategy reduced the bank’s exposure to volatile capital markets activities and increased its reliance on revenues and profits generated from more stable businesses over the long term, for example, wealth management, boding well for the bank’s earnings sustainability and also requiring less capital than investment banking activities.

While this strategy improved the bank’s fundamentals, its business is still greatly exposed to IB, generating some one-third of group revenues, even though wealth management has increased considerably its weight within the group over the past few years and is now the largest segment, being responsible for some 34% of total revenue.

This exposure to IB backfired during 2021 due to the losses coming from the Archegos and Greensill events, showing that despite the bank’s efforts to reduce its exposure to IB, it is still a segment representing a significant risk for the bank that has the potential to lead to high losses when things go wrong. Not surprisingly, Credit Suisse’s top management has been changed in recent months, and a new business strategy is being prepared, expected to be presented at the end of next month.

Credit Suisse has already signaled what is its desired path, mentioning objectives to strengthen Wealth Management, Asset Management and the Swiss Bank. Moreover, there have been several speculations about deep cuts in IB activities, including the exit or sale of activities in several countries including the U.S., plus the potential sale of underperforming wealth management activities, like for instance the bank’s operations in Latin America ex-Brazil.

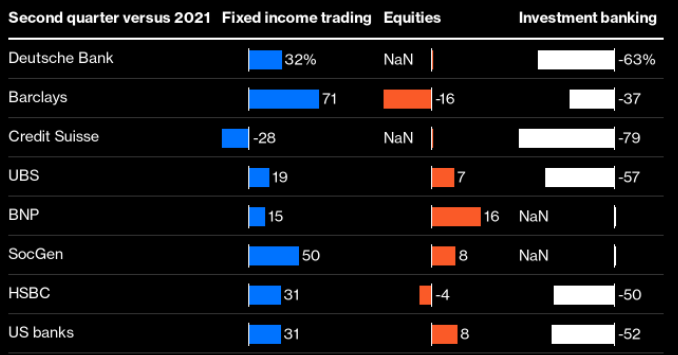

This strategic overhaul is important because I think the bank’s woes in recent months have created significant damage to its reputation and franchise value in IB, which had a clear impact on the bank’s Q2 performance compared to its peers. As shown in the next graph, Credit Suisse was a clear underperform in the most recent quarter across FICC, and to some extent, Equities activities, with total IB revenue declining by 79% YoY and being a laggard compared to peers.

IB revenue (Bloomberg)

This means that it will not be easy for Credit Suisse to regain customer confidence and turn around its business, a profile the bank seems to be aware of, and is targeting a simpler IB segment in the future, focused on a capital-light and advisory-led business model that should have a lower risk profile. Therefore, Credit Suisse is likely to be a smaller bank in the future, less reliant on capital markets, and more focused on activities with higher levels of profitability.

Capital

Another issue that has been important for Credit Suisse’s weak share price, has been the market perception that the bank has a capital gap and will need to raise equity through a capital increase. According to some analysts, the potential capital raise could amount to about CHF 4 billion ($4.08 billion), or 37% of its current market value. This would be a significant dilution of current shareholders, and therefore quite negative for its share price, explaining why its shares have reached a new all-time low very recently.

While it is not certain that Credit Suisse will perform a capital increase at its current depressed share price, its capital ratios at the end of last June were not particularly impressive, and its business restructuring is likely to have costs, thus a capital increase cannot be ruled out.

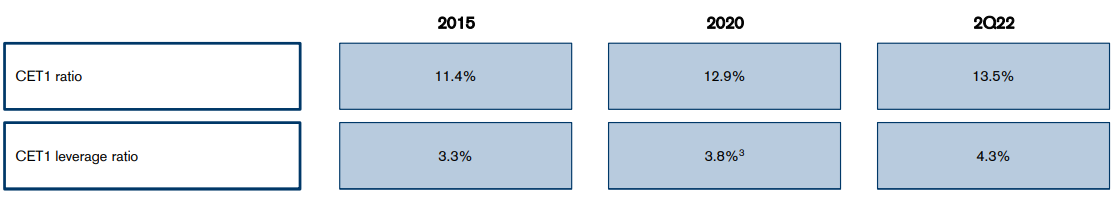

Indeed, Credit Suisse’s CET1 ratio was 13.5% at the end of Q2 2022, and its leverage ratio was 4.3%, which are acceptable ratios, but below its own medium-term targets and also lower than some of its closest peers, such as UBS Group (UBS), and significantly lower than compared to the best-capitalized banks in Europe.

Capital ratios (Credit Suisse)

This means that a capital increase seems to be sensible to strengthen its balance sheet in the short term, even though it will dilute current shareholders. On the other hand, capital ratios are well above regulatory requirements and management may want to avoid diluting current shareholders, and pursue other options to improve the bank’s capital ratios.

Indeed, it can raise capital by selling some operations at a profit, or by reducing its leverage exposure, namely in IB activities. However, restructuring costs are likely to have a negative impact on capital and are an additional burden to capital ratios, thus a potential capital increase relies mainly on management choices regarding the company’s balance sheet management and how deep it will restructure its IB operations in the coming months.

Conclusion

Credit Suisse has many issues and its fundamentals are not particularly impressive right now, justifying its depressed valuation of about 0.23x book value. While this may seem quite cheap, the bank is likely to perform a capital increase in the short term, which would decrease its book value per share. This means that investors should not be fooled by the bank’s apparently low valuation, and also consider a multiple adjusted for a potential capital increase.

At the end of Q2 2022, Credit Suisse’s book value was about CHF 45.8 billion, or CHF 17.56 per share, while it had some 2.6 billion shares outstanding. Assuming that Credit Suisse performs a CHF 4 billion capital raise at 10% discount to its current share price, it would increase the total number of shares by close to 1.1 billion to some 3.7 billion, and its adjusted price-to-book value ratio would be 0.32x.

This is still quite depressed among the European banking sector, which means that negative sentiment and, a potential capital increase, seem to be already priced-in. Despite that, I think investors should wait for the upcoming strategy presentation to have better visibility about the business prospects in the near future and avoid the shares for the time being.

Be the first to comment