robas

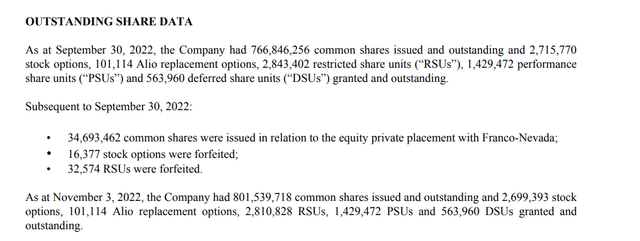

It’s been a rough year for investors in the Gold Juniors Index (GDXJ), with those holding the ETF suffering through a more than 30% drawdown even after a rough year in 2021. However, an investment in the GDXJ has done much better than an investment in Argonaut (OTCPK:ARNGF) (TSX:AR:CA), where investors have been diluted at an industry-leading rate, and we’ve seen more share dilution plus a new royalty on Magino post-quarter-end. Not surprisingly, the continued dilution at multi-year lows has put a dent in the stock, with Argonaut hovering 90% off its 2021 highs.

Typically, a 90% decline in a gold producer would represent a rare buying opportunity, and this isn’t to say that the current pullback isn’t offering one for Argonaut here at US$0.32. However, we’ve seen a violent pullback simultaneously in the sector, which has left many producers trading at their most attractive valuations in years with better stories and track records than Argonaut. Given my belief that the superior strategy is buying great producers at cheap valuations vs. mediocre producers at depressed valuations, I continue to see far better bets than Argonaut elsewhere in the sector. Let’s take a look at the recent results below:

Q3 Production & Sales

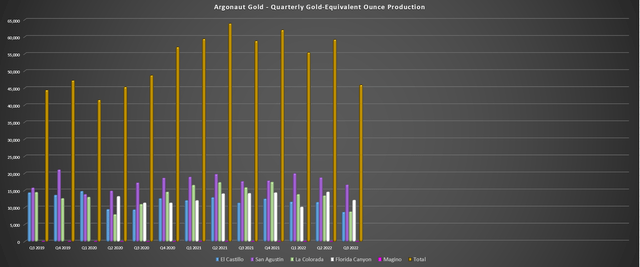

Argonaut Gold (“Argonaut”) released its Q3 results earlier this month, reporting quarterly production of ~45,900 gold-equivalent ounces, a 22% decline from the year-ago period. This significant decline was related to lower production at all four of its assets, with a significant drop in output at its lower-cost La Colorada Mine. The mine saw lower grades with less contribution from the higher-grade El Creston Pit and lower tonnes than planned from the last benches of El Creston Phase 3. Finally, heavier rainfall also impacted mining at El Creston. The result was a ~45% decline in GEO production and much higher cash costs ($1,060/oz vs. $696/oz).

Argonaut Gold – Quarterly Production By Mine (Company Filings, Author’s Chart)

The quarter wasn’t much better at the company’s newer Florida Canyon Mine, with the block model yielding lower grades than planned, offset by higher tonnes placed in the period. The result was a 14% decline in production year-over-year, which resulted in a sharp increase in cash costs to $1,692/oz when combined with inflationary pressures. Finally, San Agustin saw only a slight decline in production, but costs soared year-over-year (+23%), impacted by inflationary pressures (fuel, natural gas, cyanide) and fewer GEOs sold. The good news is that the CFE powerline was commissioned in early Q4, resulting in much lower diesel consumption.

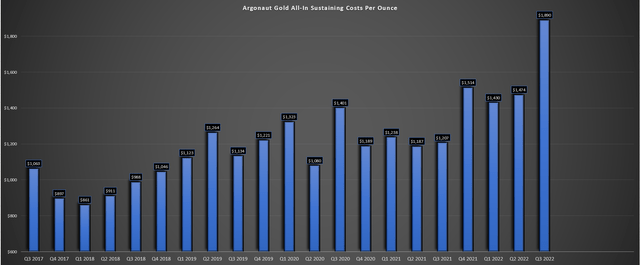

Given the weak performance, Argonaut’s production is sitting at just 160,000 GEOs year-to-date, suggesting it could struggle to meet the mid-point of FY2022 production guidance (215,000 ounces). Meanwhile, its cost guidance was revised higher for the second time this year, up from an initial range of $1,425/oz – $1,525/oz, a revised range of $1,500/oz to $1,600/oz, and now a new range of $1,650/oz to $1,725/oz. While the initial raise was not surprising given the inflationary pressures we’ve seen sector-wide, the second was disappointing, and it speaks to the lack of conservatism, making it hard to trust future guidance/promises.

Margins & Recent Developments

Given the sharp rise in costs, it’s no surprise that Argonaut saw margin pressure in Q3, with its all-in-sustaining [AISC] cost margins dipping to just $5/oz from $561/oz in the previous year. The only reason that margins were positive is that the company benefited from a higher gold price due to selling into forward gold sales contracts at $1,910/oz, which allowed the company to report a much higher sales price than its peer group (~$1,730/oz). The good news is that Argonaut has a considerable amount of production hedged above $1,800/oz, so it will likely continue to beat its peer group from an average sales price standpoint over the short run.

Argonaut Gold – All-in Sustaining Costs (Company Filings, Author’s Chart)

As the chart above shows, Argonaut’s costs skyrocketed in Q3 2022 due to lower production/sales but could improve slightly in Q4 based on lower diesel consumption and lower fuel prices and what appears to be a slight moderation in inflationary pressures. That said, I wouldn’t expect a significant improvement, and even if costs do dip, all-in costs are still well above the current average realized gold price. This is not surprising given that Argonaut operates very low-grade assets in a period of extreme inflationary pressures, with this leading to a more significant impact from a fuel/cyanide standpoint than low-volume, high-grade names like Alamos Gold (AGI) and Yamana (AUY) operate – two companies that have controlled costs very well.

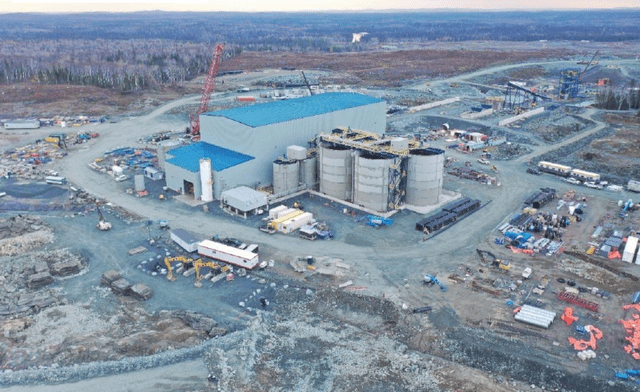

Magino Construction Progress (Company Presentation)

Finally, when it comes to recent developments, investors can sleep easy at night knowing that Magino is fully financed and over $580 million is committed vs. an estimated $740 million in total to build the project. However, the last batch of funds came with additional share dilution (~35 million shares at US$0.30) on top of the ~434 million shares at US$0.36 sold earlier this year. In addition, Magino will now be saddled with a 2.0% NSR, up from the previous 0.85% over the mine life. So, is the stock an attractive investment relative to its peers after this violent drop, even after accounting for the mountain of share dilution? Let’s take a look:

Valuation & Peer Comparisons

Following multiple financings at multi-year lows, Argonaut now has ~809 million fully-diluted shares and a share price of US$0.32, translating to a market cap of ~$260 million. This is an attractive valuation for a company with four mines (and soon to be five with Magino). That said, I don’t see much value in the company’s Nevada asset, Florida Canyon, which has razor-thin margins on a cash cost basis (YTD 2022: $1,640/oz), nor do I see much value for El Castillo, where cash costs have also remained elevated, and which has a sub-1-year mine life remaining.

Argonaut Share Count (Company Filings)

This leaves only two robust operations (La Colorada and the future Magino Mine) and two mediocre operations (Florida Canyon, San Agustin). The good news is that Magino covers the current market cap based on an estimated NPV (5%) of ~$430 million at a $1,700/oz gold price. However, I see a combined NPV (5%) of just ~$370 million for the remainder of its portfolio (Mexican assets + Florida Canyon), translating to a total NPV (5%) of ~$800 million. After subtracting ~$130 million in corporate G&A, this translates to an estimated net asset value of $670 million. If we compare this figure to a current market cap of $260 million, Argonaut trades at just 0.39x P/NAV.

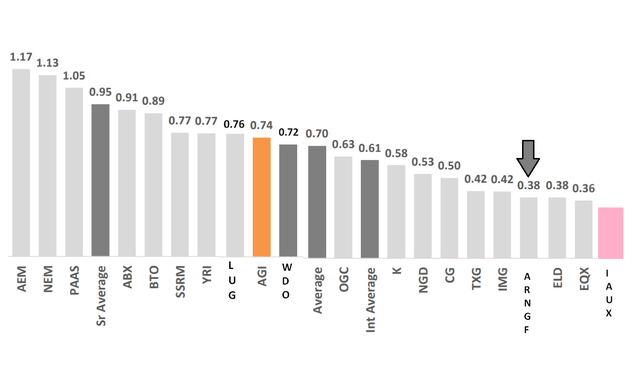

This is a very reasonable valuation for a mid-tier gold producer, especially one that owns a medium-scale Tier-1 jurisdiction project that’s set to enter into commercial production by Q4 2023. However, if we apply more conservative multiples to Argonaut compared to where sector peers sit today, it’s hard to argue for the stock commanding a valuation of more than 0.75x P/NAV. Using this multiple, I see a fair value for Argonaut of $502 million, translating to a fair value of US$0.62, assuming no further share dilution. While this is certainly an attractive upside case (90% upside to fair value), I continue to see Argonaut as an inferior bet.

For starters, with the sector in the doldrums, several producers can be bought for less than 0.50x P/NAV, and many of these producers are not reliant on a single mine for a re-rating. So, if there are any issues at Magino during the start-up, Argonaut could remain under pressure and continue to underperform the sector. Given that teething issues aren’t unusual, I wouldn’t rule this out completely. Secondly, Argonaut has sold a significant portion of future gold production at sub $1,860/oz, meaning that it will benefit less from an outsized move in the gold price than non-hedged peers. Finally, it’s hard to be overly optimistic about its current production profile, where AISC is well above the peer average, and most production comes from a Tier-2 jurisdiction (Mexico).

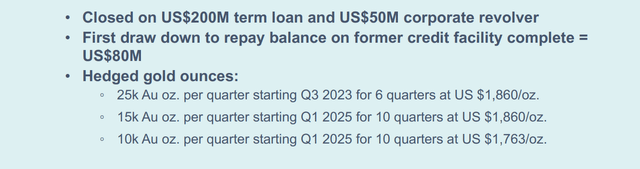

Gold Forward Contracts (Company Presentation)

Some investors will argue that Magino is a game-changer; the stock is attractively valued at sub-0.40x P/NAV, which is why one should own the stock. While I don’t disagree with these points, there is an abundance of great stories out there at attractive valuations, and one name that I see as more attractive is i-80 Gold (IAUX). Like Argonaut, the company has a path to growing to be a 300,000-ounce per annum producer, but i-80 will operate in better jurisdictions, has no marginal mines (three ultra high-grades instead), and has a robust development pipeline. However, it trades at a deeper discount to net asset value, and its management team has aggressively bought back stock, showing clear alignment with shareholders.

Plus, unlike Argonaut, which saw its share count destroyed by the capex blowout/weaker gold price, i-80 Gold has continued to make strategic moves in this cyclical bear market. Not only has it added considerable value through the drill bit at properties acquired for attractive valuations, but it also made a deal with Nevada Gold Mines LLC for an autoclave/processing agreement, it acquired key water rights at Cove and a rail siding with access to the Northern Nevada Railway, and it added key land at Granite Creek. When it comes to small-cap companies, I want those companies with aligned management that are surprising to the upside as they tend to be improved by crises, not worsened, as the saying goes by former Intel (INTC) CEO Andy Grove:

Intel CEO Andy Grove Quote (Company Presentation)

Summary

Argonaut Gold had another rough quarter in Q3, and as I noted in previous updates, it was difficult to be bullish on the stock when it had relatively marginal mines (high-volume, low-grade) that were set to become more marginal with sticky inflationary pressures. That said, with production at Magino less than seven months away and the finish line nearing, it makes sense to focus on the future. However, even if we focus on a much different company with Magino online, this doesn’t change the fact that nearly half of its future production comes from high-cost assets in less favorable jurisdictions (Mexico).

Producer Valuations (Alamos Gold Presentation, Author’s Notes/Drawings For Peers Not Included (IAUX, WDO, LUG, ARNGF, IAUX))

When it comes to companies with mixed jurisdictional profiles with sub-par track records, we often see discounted valuations remain in place, similar to what we’ve seen with IAMGOLD (IAG), Eldorado Gold (EGO), and Equinox (EQX). This doesn’t mean Argonaut will not see a material re-rating. Still, if I’m going to invest in small-cap names, I want to buy those where I can trust the management team, which is helped by alignment with shareholders and a strong track record of meeting/exceeding promises. Argonaut Gold has not excelled in this category, so while I see a clear upside from current levels, I think there are far more attractive bets elsewhere in the sector. My preference in the small-cap space would be i-80 Gold and Agnico Eagle (AEM) among large caps.

Be the first to comment