Bramdehaan/iStock via Getty Images

This article appeared in the Daily Drilling Report Monday, August 15th.

Introduction

Oil and gas services company Tetra Technologies, Inc. (NYSE:TTI) turned in a solid quarter for Q-2, beating on the top line with an 8% revenue increase to $141 mm, and missing on bottom line by a penny. EBITDA of $18.7 mm was adversely impacted QoQ by suppliers exposed to Russian embargoes, but 30% higher than a year ago.

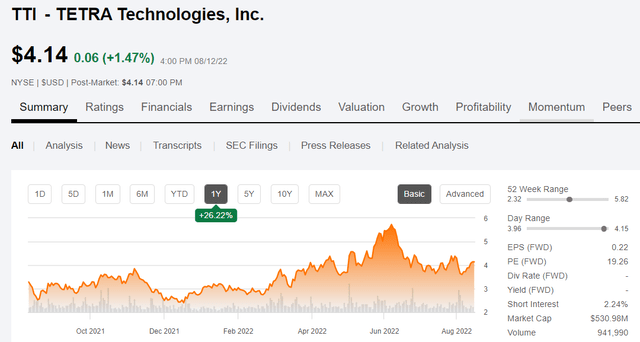

TTI price chart (Seeking Alpha)

Against the backdrop of increased rig and fracking activity, the company’s core shale fracking water treatment business generated revenue of $66 mm at 15.1% margin. This was a pace that exceeded the growth in activity, indicating TTI was taking market share from competitors. Their Clear Brines business also improved YoY generating revenues of $75 mm with EBITDA margins of 23.7%.

The company is a known industry innovator, a basic supplier of key commodities, and an established oilfield brand known for excellent field service. In the increase in offshore E&P activity that is underway, and the sustained level of drilling activity in shale plays, the company is a solid bet for growth at current prices.

Investors should also be aware of the company’s bifurcation from the oil price-related oilfield service industry, to an ESG resource play featuring production of elemental lithium and bromine. A key feature of this pivot – the fact these reserves are in the central U.S. – is not properly appreciated by the market. With increasing analyst coverage of the company this feature should lead to a rerating of the company, sending shares higher. There is also a “Clean Energy” driver here that has the support of the U.S. government in the form of the recently passed “Inflation Reduction Act.”

Recent efforts on the part of management to raise analyst coverage of the company have borne fruit. Analyst firms, Evercore, Stifel, EF Hutton, and Johnson Rice have initiated coverage of the company with Buy ratings, and price targets ranging from $6-8 per share, an approximate 50-100% boost from current prices. We think TTI is attractive at current prices for risk tolerant investors.

The Thesis for Tetra Technologies

I’ve written on Tetra Technologies a number of times, generally always with a positive outlook. (Many of these are very detailed articles where I outline the significance of their technology offerings, and I encourage anyone considering investing to give them a read.) TTI is in the segment of the business in which I “cut my teeth” over 40 years ago and I naturally gravitate their way. The result is that I’ve had some hits and misses in terms of what the stock did after the article. The stock is essentially unchanged from where it was in 2017, when I wrote the first article, so I really can’t claim a win.

The horrific macro environment that the industry in which they participate has experienced for much of the last seven years is certainly responsible for much of this underperformance. In that time, the oil industry has been gutted, rebuilt and then gutted again. It is probably substantially less than half its size than when I left in 2015. The fact TTI is still here says a lot about them, and what they bring to the industry. Many of their contemporaries are not, having fallen by the wayside, or have restructured, wiping out shareholders.

Another piece is, the company lacked the far-sighted stewardship it has now. It has taken time to repair the past missteps; taking on debt to enter the offshore well abandonment business in the mid 90’s, a 20-year debacle that only recently was put to rest with the sale of Maritech in 2018, buying Compressor Systems in 2014 for nearly a billion dollars, entering foreign markets without due diligence, and probably a host of other things made the company a train wreck financially, and for the most part kept retail and institutional investors at bay.

Over the last few years, since the arrival of Brady Murphy as CEO, they’ve fixed a lot of what was wrong, divesting Maritech, cleaning up the balance sheet, restructuring the company along its traditional, and compatible business lines- frac water management, specialized brine fluids used in oil and gas wells, and a commodity chemical business. All they needed was the supportive environment they have now.

In the last couple of years the company has been expanding its footprint on a number of Clean Energy and Resource extraction fronts. These are beginning to bear fruit and result in positive quarterly impacts to the bottom line. It is these emerging resource extraction plays that are the reason to consider investing in the company.

The company has a number of levers to pull going forward, and these have been discussed in prior articles. So, we will elaborate here only on the shiniest object in the universe – lithium.

Lithium: The new gold and a catalyst for TTI

The advent of the electric vehicle (“EV”), government preferring its adoption for favorable ESG outcomes, and passage of the recent “Inflation Reduction Act,” all auger in favor of a successful outcome for TTI’s efforts to monetize this resource. This act doesn’t speak to lithium directly, but rather provides credits for EV purchases, and funds investment in infrastructure used develop battery storage resources with an investment tax credit of up to 60%.

The GAO has listed lithium as a critical mineral, and wishes to foster U.S. production. This is perhaps after becoming aware that China controls “60% of the world’s elemental lithium resources, 77% percent of battery cell capacity, and 60% of battery manufacturing.” The Barron’s article cited here goes on to say, “Of 200 battery mega-factories in the pipeline to 2030, 148 are in China.”

All of a sudden, this fact has the intrepid leaders of our young republic with their “knickers in a twist.” It has probably not escaped your notice that China is no longer the big fuzzy, pseudo-capitalistic Panda bear, that clever marketing and pr campaigns made it out to be for the last couple of decades. Recent events have shown that the Panda has teeth and the hardcore members of the CCP are still firmly in charge. Twisting the knickers of our fearless leader perhaps still further, as he was one of the biggest proponents of the gentler, fuzzier China fantasy. Ouch.

Tetra’s total resource of lithium is under review, but a preliminary assessment has put it at between 85K and 286K metric tons. For reference in 2021 a metric ton of lithium carbonate sold for $17,000, meaning the future expected cash flow could hit $157 mm per year, using a median estimate of 185K metric tons and a 20-year recovery. No one expects lithium prices to go anywhere but up. Citigroup is forecasting that the price could hit $60K/ton before demand destruction sets in. Further reports are due later this year to fine tune the total lithium resource estimate, as well as a Preliminary Economic Assessment-PEA, and Front Energy Engineering and Design-FEED, survey for the company to begin developments of these reserves.

As a final point on the impact of lithium, you need only to note the near sextupling of Albemarle Corporation (ALB) since early 2020 to $282 per share. CEO Brady Murphy noted the focus the company was placing on critical minerals in the Q-2 call:

Our focus on low carbon energy markets, which requires critical minerals and chemistry expertise, is creating significant growth opportunities for the company and are already contributing financial benefit with much more to come.

Risks

The risks are clearly on the oil and gas side of the business. We have a very adverse political environment these days for anything relating to petroleum. At the moment these companies are being allowed to operate, a fact that could change anytime.

In the scenario where the domestic energy business is allowed to continue operating, and the one we feel is the most likely outcome, TTI is substantially de-risked in the $3-5.00 range.

Your takeaway

It isn’t often we get to plant our feet on both sides of the energy spectrum. Tetra has a robust and growing oilfield service business that is delivering positive cash flow. It has a number of projects in the pipeline for its Neptune product, including one pending in the GoM that could ramp revenues by $10-$15 mm by itself alone. With traditional brines the Completion Fluid side of the business has been generating about $65 mm per year. Add a Neptune job into that and we can arrive at $80-85 mm per year. With the growth projected in Deepwater projects there should be more Neptune jobs. Over 10 years that’s $850 mm. Add in a couple of hundred mm for the water business and back out corporate costs of ~$150 mm, and then add in the debt at $153 mm and you get an EV of $1,053 bn/128 mm and you get a share price in the $8’s for TTI.

This is just the for legacy business with no growth calculated!

It should be noted that the company is already receiving quarterly payouts from its JV with Standard Lithium (SLI) in the form of stock. Elijio Serrano, CFO commented on the revenue impact in the call-

In late April, we received 400,000 shares in Standard Lithium when the Standard Lithium share price was $6.36 per share, with a total value of $2.5 million that we amortized over a 12-month period. And then we do mark-to-market adjustments each quarter relative to the $6.36 price. Yesterday, Standard Lithium price closed to $5.49.

Recall that last year, we accumulated 1.6 million shares of Standard Lithium and sold those at approximately $11 per share, generating about $18 million of cash proceeds.

This is revenue for which they have zero cost as SLI bears all mineral extraction costs in the JV.

Tetra today is trading below $4.00 and I think makes a compelling case for risk-tolerant investors.

Be the first to comment