Adam Smigielski/E+ via Getty Images

I’d put my money on the sun and solar energy.

–Thomas Edison, March 1931.

Solar is nature’s preferred way to generate and store energy – I wouldn’t be surprised in the least if solar technology ends up supplying a plurality of the energy used by the world at some point. To this point, solar technology continues to improve while the cost drops. This means that there are opportunities for both consumers who are interested in cutting their electricity bills and for investors in solar stocks like the Invesco Solar ETF (NYSEARCA:TAN).

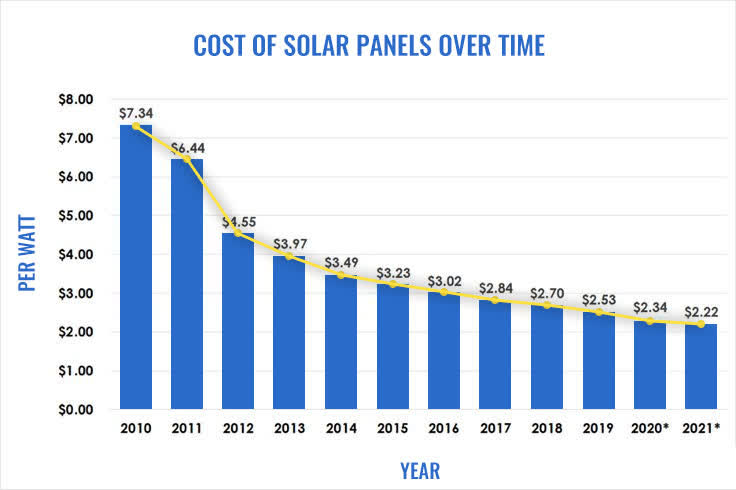

Solar Energy Cost (GTF Power)

It’s no secret that I believe the stock market is overvalued and will continue to fall. But if you’re looking for something else you can buy on dips, TAN looks as solid as anything. And if you’re willing to think outside the box and execute correctly, solar panels can now offer returns of 20% or higher by cutting your electric bill to around zero. Years ago, people got excited about the cost savings for solar but the technology wasn’t quite there, so the ROI was sometimes disappointing. Now, with the technology steadily improving the yields (and thus decreasing the price) of solar panels as conventional electricity prices skyrocket, the math keeps getting better for consumers.

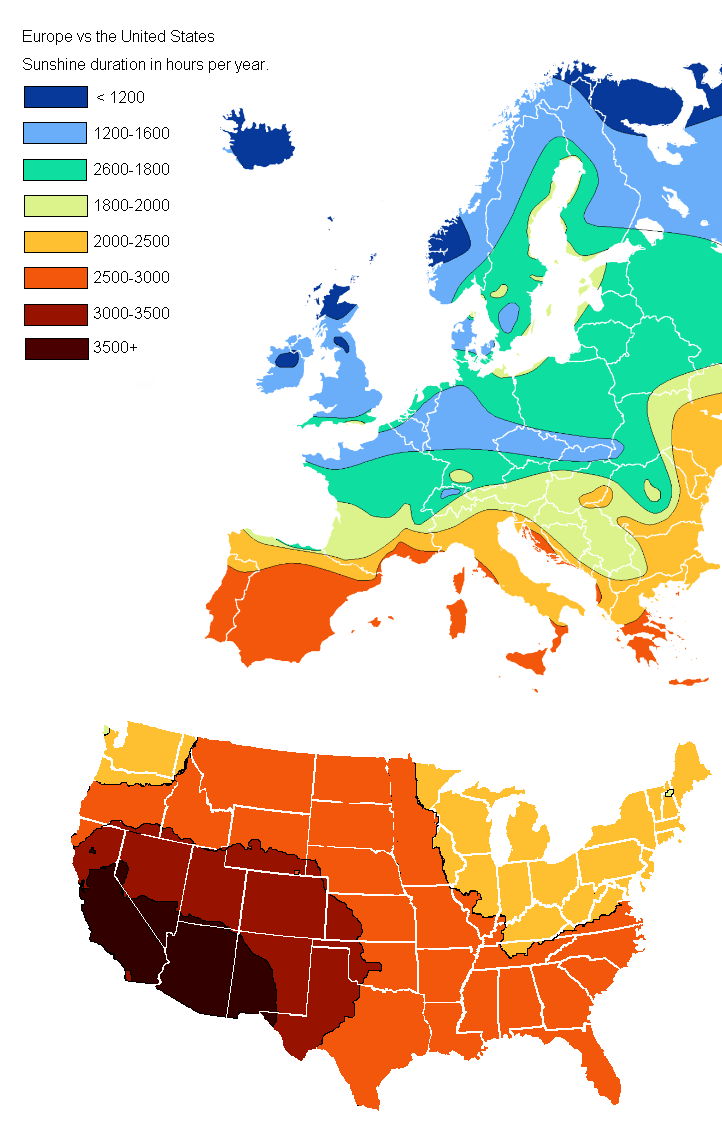

My friend Pietros Maneos is the king of these sorts of unconventional investments. He recently pumped some money into a new solar system –we’ll be able to track the returns going forward to see how reality matches with the initial projections. There are a number of factors that affect your return on solar ranging from latitude (Southern California, Florida and Texas are good, England is bad), tax credits in your local jurisdiction, to whether you overpay a solar company to install, to whether you buy the best equipment for ROI. And this goes without saying, but leasing solar panels is a hustle.

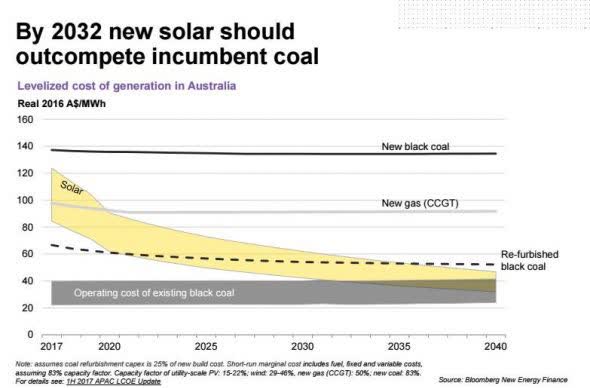

There are other ideas as well, such as how investing in battery storage can help or hinder your ROI, and clever tricks like mining some Bitcoin (BTC-USD) in your garage with excess electricity that you can’t store. This is a micro picture, but millions of micro decisions make up the macro. Solar has now become so cheap that it’s muscling out existing inefficient coal plants in some cases, with more to come.

Solar Keeps Getting Cheaper (Bloomberg)

What this says is that:

- There’s a good return on investment to be had by investing in solar.

- There are solid tax credits to incentivize consumers to invest in solar, and these tax credits were improved by the recent US climate bill.

- The technology keeps getting better – if solar has indeed hit an inflection point, then costs can continue to go down while efficiency can go up. This is known as Swanson’s Law and will drive the solar industry in a similar way to how Moore’s Law drove the information tech industry. Nobody has enjoyed paying high prices for gasoline this year, but we may look back at the current energy crisis as a key driver for change – to make supply chains better and stronger, to take care to secure energy supplies, and to force improvements in efficiency.

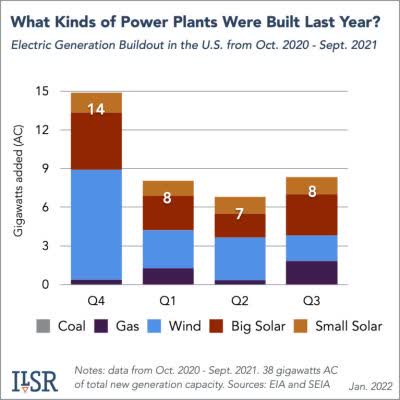

- The ROI for households is solid for those who use common sense and don’t overpay providers, but the ROI is even better for utility-scale solar. This will drive tons of revenue for solar manufacturers. The sun doesn’t always shine and the wind doesn’t always blow, so natural gas will always have a place in the power generation mix. However, it’s likely to me that solar will be the cheapest source of electricity going forward. This doesn’t mean you shouldn’t invest in companies like Exxon Mobil (XOM) or Occidental Petroleum (OXY) that will make big profits over the next 5-10 years, but it does mean that the future of energy is likely to look different than the past.

What Kind of Power Plants Are Being Built? (CleanTechnica)

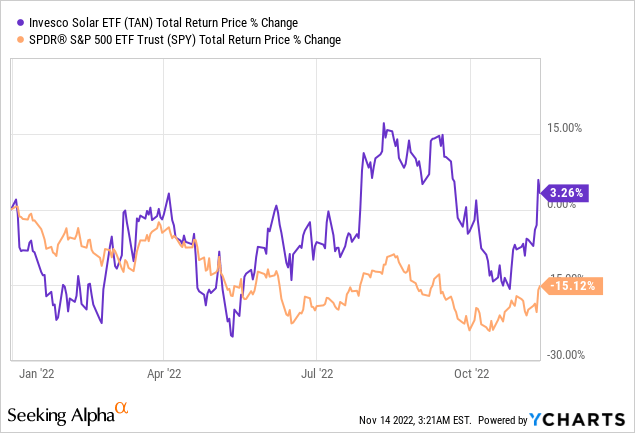

TAN Is Crushing The Market This Year

TAN is outperforming the broader market by nearly 20 percentage points this year, in no small part thanks to the climate bill passed by Congress. Securing sufficient supplies of energy has been a continual problem in the US over the last century, with particular strain during the rationing eras of WW2 and the 1970s. However, after decades of maintaining the status quo, the wheels are now turning in a big way after skyrocketing oil prices in 2021 and 2022 spurred Congress to action. Managing industrial policy like this is risky but rewarding when done right. South Korea managed its economy in this way from abject poverty after the Korean War and is now of the wealthiest countries in the world. Meanwhile, in certain countries in Latin America, companies paid workers to take apart imported TVs and put them back together to qualify for government subsidies for “manufacturing.” The results were predictably bad.

TAN’s largest holdings include Enphase Energy (ENPH), First Solar (FSLR), SolarEdge (SEDG), GCL Technology (OTCPK:GCPEF), Xinyi Solar (OTCPK:XISHY), and Sunrun (RUN). The ETF has broad exposure to different aspects of the solar industry. TAN is invested both in China where much of the manufacturing is currently taking place and in Western companies that will be beneficiaries of new subsidies. TAN has an expense ratio of 0.75% annually which is a bit high, but you can always make an ETF substitute by buying the top 20 holdings and skipping the ETF.

A fair question to ask is whether the valuations are excessively pumped up for solar stocks. Just looking at the top two companies in the ETF, Enphase trades for a forward PE of 54x estimated 2023 earnings, while First Solar trades for 28x estimated 2023 earnings. These are big numbers, but I think the growth can back it up. If current technological trends hold, I honestly believe solar revenue will grow at 20% or more for the next 20 years. If this holds, investing in solar today could be like investing in information tech in the 1990s. The early trends are quite encouraging. SolarEdge had a huge pop this week, citing strong momentum in Europe (I mean, if you were an energy consumer in Southern Europe and you had the money to extract yourself from the energy situation, why wouldn’t you?). First Solar has been on a roll as well lately, up over 20% in the last month. And despite fears that money-hungry California would impose a tax on the sun-compromise won out, laying the groundwork for the rapid pace of solar adoption to continue.

Thus, these price-to-earnings multiples are likely much more reasonable than they first appear. Thomas Edison was thinking about solar energy in 1931, so the ideas are not new. What is new is the breakneck advances in technology. If technological advances continue at anywhere near their current speed, solar adoption will increase exponentially. This isn’t because people want to feel warm and fuzzy about solar, but because the returns that consumers can get in cold hard cash will eventually make it silly to do anything else.

Thomas Edison also liked the idea of using the wind and tides to generate electricity, noting that windmills had been in use for 1,000 years but that the technology had barely changed. If you are interested in investing in wind energy, the easiest way is the First Trust Global Wind ETF (NYSEARCA:FAN). Also, just for kicks, here’s a map that shows just how sunny the US is, displaying the full potential of solar in the US.

Sunshine Hours Per Year (Reddit)

Bottom Line

Solar technology continues to improve, and adoption is going to occur at a surprisingly high pace. Owning a broad selection of solar stocks is a neat way to play this trend. Given the high ROIs on investing in solar, business-savvy investors also may want to consider exploring solar for their homes to pick up tax-free cost savings. Solar energy is good for the environment, it’s good for your pocketbook, and it’s good for America which is blessed with a surprising amount of sunshine. If solar energy continues to smash expectations, this allows the US to export much of the oil and gas produced domestically, finally achieving energy independence and turning the tables on a world that for decades has squeezed us on our high demand for energy.

Do you agree? Share your thoughts in the comment section!

Be the first to comment