naphtalina/iStock via Getty Images

SoFi (NASDAQ:SOFI) is a fintech stock, and one that is a leader in the space. This company has evolved significantly over the last decade. They have built their business from the ground up. We have been bullish on the stock since it dropped under $8, but today we are printing a $6 handle now as the stock has dropped to new lows. We see the company as growing from a social finance platform for simple loans, into a massive tech-focused bank that competes with its more traditional lending institutions. The problem in the stock is really two-fold. Anything bearish for banks hits the stock, and in turn, any time the Street sells down ‘innovation’ type names, SOFI gets nailed too. This is why the stock is down another 30% in 2022. Some really crazy action. Though, the action is not limited to just SOFI. There are dozens of stocks with similar charts. The question you have to ask as an investor is whether the company can and will be profitable? The company is already EBITDA positive. While recent news and guidance has led to accelerated selling, and short interest remains high, the stock in our opinion remains an investment for future growth. The stock has been a disaster for longs the last few months, but we see reasons to remain bullish. Let us discuss.

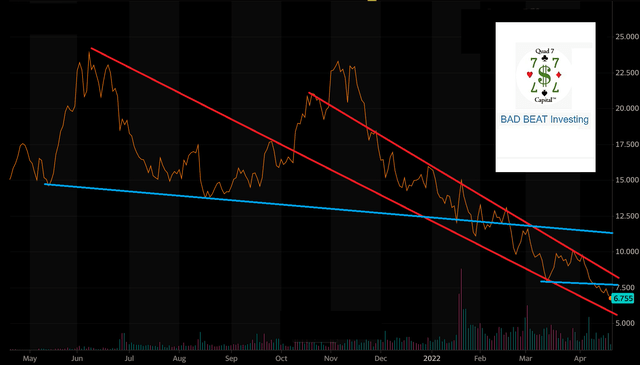

Current look at the stock

We have liked the stock since it dipped under $8, but share prices have continued to fall lower. The chart is pretty ugly, to use an industry term:

So, this chart is, well, rough. The stock is stuck in a down channel. Really needs to break back above $7.40 or so to break about above it, though as we write the stock is down 3% today and falling. Where is the bottom? Well, zero of course, but, are we to truly believe that the stock is worthless after all of the growth? Is it over? Absolutely not.

Guidance cut for the year responsible for another 20% drop

When the student loan moratorium was extended once again until August of 2022, management in turn cut their outlook. We have previously argued that the company is growing without student loans. However, student loan payments are a sizable source of revenues. Our position has been that when repayment does begin, it will be an immediate tailwind. At $6.70 per share, we see the negative impacts of the lack of student loan repayment more than baked into the stock here.

As we know, student loan payments have been on hold for two years. We have believed that when repayments resumed, it would help SoFi. That is a fact. When repayment begins, it will help. That said, repayment has been delayed time and again, most recently now until August. After the moratorium, which is in our opinion not rooted in an economic need, but more a political one (hey elections in the U.S. are just around the corner), the company ‘kitchen sinked’ its guidance and projected numbers that would look at student loans as not being paid all year. Management expects that there will be a seventh extension beyond August 2022 by the Administration.

SoFi updated its guidance two weeks ago, and the stock has been beat up since then. Here is the thing. Even with the cut, the company is still growing, and growing strongly. Adjusted net revenue and adjusted EBITDA guidance for the full-year 2022 is now seen at $1.47 billion and $100 million, respectively. Make no mistake, this is a drastic reduction from previous guidance. The past guidance called for revenue of $1.57 billion and EBITDA of $180 million. But, it is worth pointing out that the company expects profitability to improve later this year. For Q1 2022, management still sees $280-285 million of revenue and $0-5 million adjusted EBITDA for the first quarter of 2022.

In the 8-K (linked above) Anthony Noto, CEO of SoFi stated:

“SoFi remains incredibly well positioned to drive continued strong growth in revenue, members and products, along with continued and improving profitability, despite the fact that our student loan refinancing business has operated at less than 50% of pre-COVID levels for the last two years. Even with the assumption of no end to the moratorium in 2022, our new full year 2022 financial guidance represents approximately 45% year-over-year Adjusted Net Revenue growth to $1.47 billion, a tripling of Adjusted EBITDA to $100 million, and a doubling of margins. SoFi has done an outstanding job achieving record financial results, member and product growth and consistent profitability, despite the negative impact of the extended student loan payment moratorium. We will work diligently to continue that trend in 2022.”

Let that sink in for a minute. The stock has been cut in half in 6 months, and is down over 70% from highs. Yet for the year, with the lack of student loan repayments, margins will double, revenues will be up 45% from last year, and EBITDA will triple.

We have been investing a long time. Right now, the market hates the stock, though, we are seeing a lot of capitulation. Take a look at some of the social media posts on the stock. A cursory glance will note a change in sentiment from former bulls, to throwing in the towel. Capitulation of the biggest bulls generally is a bottom or near-bottom signal. We are still seeing growth, and big growth. New products are coming to market. We see this as overdone now.

High short interest

We think it is worth noting that on top of what seems like some capitulation, the stock has been very happily walked down by shorts. The short interest is quite high, around 20%. Any positive news could trigger a ‘rip your face off rally’ as they say. This is especially true after the large degree of profits that are now on the table for shorts. Of course, if the stock goes lower, that is more potential profit for shorts. However, much like being long a stock, being short, you have to know when to get out. Each day SOFI becomes less expensive. That was always the complaint, the stock was grossly overvalued. It is hard to make that argument now. While it may be expensive relative to a legacy bank, compared to innovation names, it is much more reasonable down at $6.70.

A few positives

There are a few positives. First the company got the bank charter which means the company is going to simply pay much less to lend to customers. This move lowers borrowing costs for the company. Lowering the borrowing costs will then combine with the already low cost to acquire customers. You probably recall that SoFi was doing very well margin-wise with its loans, and lending rates going higher is a big positive at least on earnings per loan. Rates going up improves margins. Lenders right now are seeing some “rate shock” as consumer demand for new loans slows as the rates skyrocket. Of course, this lower demand slows bank loan originations in the short-term, but long-term higher rates will be a benefit. The cost of funding is about to go way down because they can keep the money in house. Further SOFI has been acquiring companies. Lending is SoFi’s biggest source of revenue and profits and, in order to lend money to people, SoFi was borrowing money to lend it out.

About 6 weeks or so ago, SOFI closed the acquisition of Technisys. We touched on this briefly in the past but this is a cloud-based multi-product banking platform. By scooping up this company, SOFI will create new fintech products that meet consumer needs. This move should help margins longer-term as it helps keep business ‘in house’ and not have to farm out added work to outside companies. When combined with Galileo, an acquisition that has directly contributed to the company’s growth in revenue since 2020, SOFI is becoming a single shop for borrowing and banking.

The big risk is that SOFI is not yet profitable and dilution is ongoing

While the company is growing nicely and there is a ton of improvement in internal metrics, at the end of the day, while being EBITDA positive is a big plus, the company still loses money. Money losing stocks have been crushed in the last year. In this regard, SOFI has been lumped with so many other stocks. Folks, this is a real risk. Like some other popular innovation names, there has been some dilution with stock-based compensation as well. Every time stock is given as compensation, it increases the float. Stock-based compensation expenses more than doubled from 2020 to 2021. Such compensation jumped from about $100 million in 2020 to nearly $240 million in 2021. This is an investment risk that needs to be stated, and if you look closely at the guidance, another $350 million in stock-based compensation is on tap this year. In short, shareholders are being watered down. That hurts.

Now combine the fact that not only is there huge stock-based compensation, SOFI’s net losses are increasing significantly. All of the positives in the metrics means little when the Market decides earnings are a must and stock in companies without earnings get rotated out of. We have been seeing it for months and months now. SOFI has to work toward true profitability. Net losses doubled from $225 million in 2020 to about $485 million last year.

Take home

So here is where we are at. The stock chart is ugly. Short interest is high. Guidance was cut and factors in student loans not being repaid at all this year. Stock-based compensation is dilutive. Further, net losses are widening. On the positive side, valuation is improving daily as the stock implodes. Revenue is growing strongly. EBITDA is widening, and margins are improving. The bank charter is a long-term win, and the ongoing expansion through acquisitions will help the company long-term. The question to ask yourself is whether you will capitulate here or ride the choppy tides. If you believe the company will go broke, get out. If you see long-term potential, these are levels that you should be buying heavily. Short-term a relief rally is likely, but long-term, we think the stock offers a compelling opportunity despite the near-term negatives.

Be the first to comment