Rich Fury/Getty Images Entertainment

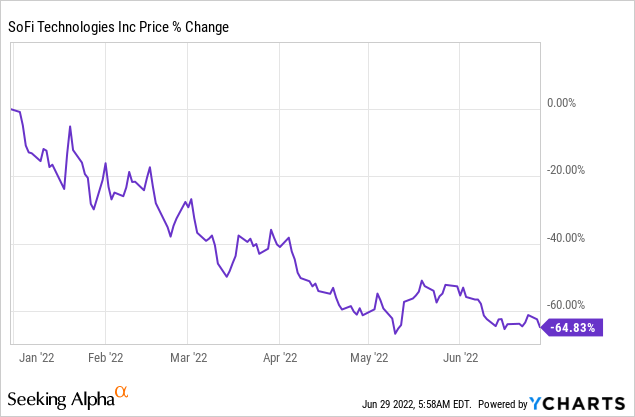

Yesterday, shares of personal finance company SoFi Technologies, Inc. (NASDAQ:SOFI) skidded more than 6% as recession fears made a comeback and stock prices dropped across the board. With SoFi now trading near its last lows, I believe the risk profile is extremely favorable. I believe the bank charter will help SoFi create a moat for itself and support profit growth. The longer-term outlook for revenues and EBITDA is very positive!

Why SoFi is a long-term buy

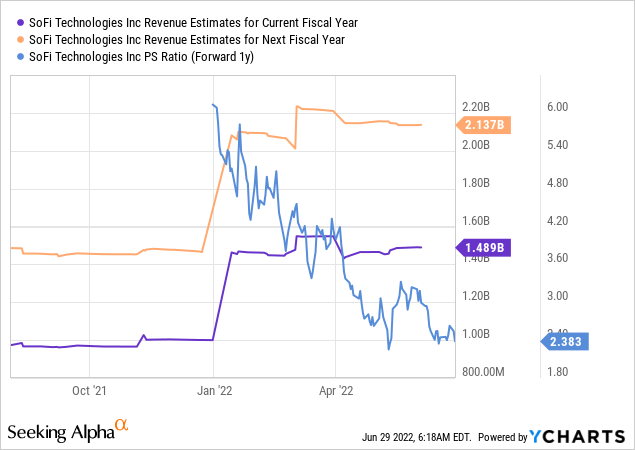

Price drops often create opportunities to engage. Although I have said this more than once regarding SoFi, I believe the market is currently not capable of rationally evaluating SoFi’s growth prospects in the market for financial services. Shares of SoFi have now declined 65% year to date despite massive growth in Q1’22, suggesting that the market has lost its ability to see SoFi’s investment value objectively.

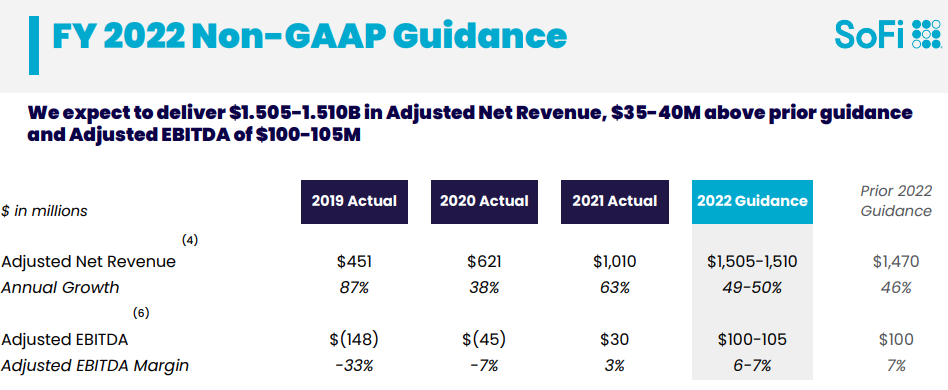

A couple of factors have weighed on SoFi’s valuation this year, including the unexpected extension of the Federal Student Loan Payment Moratorium until August, which unfortunately resulted in SoFi lowering its revenue and EBITDA guidance. Because the Federal Government delayed the repayment of student loans in April, SoFi lowered its net revenue guidance from $1.57B to $1.47B and its adjusted EBITDA guidance from $180M to $100M. Current guidance for FY 2022 is slightly higher, but the downgrade from April still affects SoFi’s stock performance in a negative way.

SoFi

Another factor that has weighed on SoFi in recent weeks and months is a general feeling that a recession is about to grip the U.S. economy. During recessions, prospects for earnings growth are greatly diminished, but fintechs that already achieve a baseline of profitability and benefit from continual customer acquisition momentum could outperform their rivals.

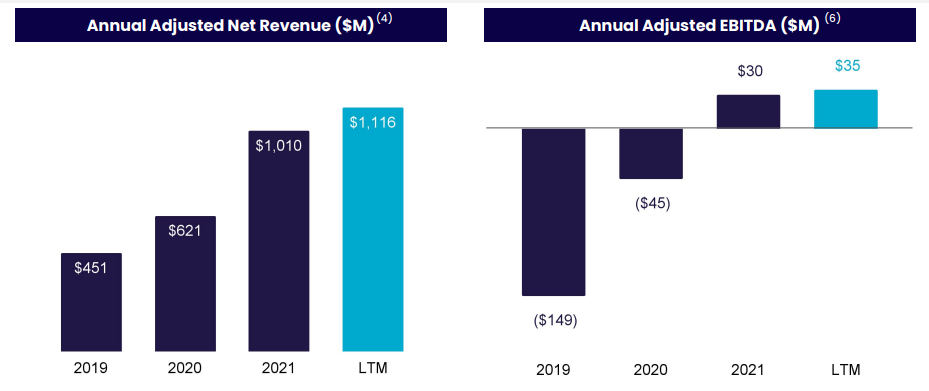

On a last-twelve-months basis, SoFi has already been profitable which distinguishes SoFi from many unprofitable fintechs: the firm generated $35M in adjusted EBITDA on $1.1B in net revenues… which calculates to an adjusted EBITDA margin of 3%.

SoFi

SoFi expects to generate $5-15M in adjusted EBITDA on net revenues of $330-340M in Q2’22 and $100-105M in EBITDA on net revenues of $1,505-1,510M in FY 2022, implying margins of 2-4% (Q2’22) and 6-7% (FY 2022). Margins are expected to increase in part due to the bank charter the company obtained in February.

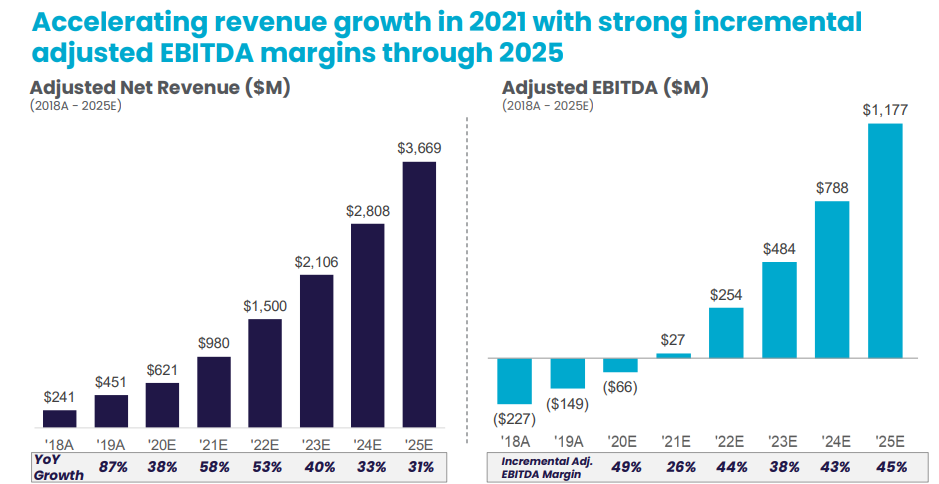

The longer-term revenue and EBITDA outlook looks very compelling and calls for significantly ramped profitability in the next three years.

SoFi

Bank charter could help drive profitability and EBITDA margins

By obtaining a bank charter, SoFi has an opportunity to lower its interest expenses due to cheaper debt financing while increasing the amount of interest income it generates from loans. Typically, fintechs without banking charters originate loans and immediately sell them on to other investors for a small profit. Now that SoFi has a banking charter, the company can hold on to these loans and capture interest income over the life of the loan, boosting the firm’s interest income and margins. Additionally, SoFi’s bank charter helps the company differentiate itself from rivals which in turn could result in SoFi expanding its deposit base even faster.

SoFi’s growth is underestimated

Shares of SoFi took a serious hit in 2022 which I blame mostly on market factors. True, SoFi’s member growth decelerated in Q1’22 and shares were trampled upon after the company adjusted its revenue and EBITDA outlook, but SoFi has tremendous long-term value as a stand-alone digital finance brand that could grow from a 3.9M-strong customer base today to a 9M-strong customer base in by FY 2026.

Since SoFi is set to benefit from its bank charter, is already profitable (based on EBITDA), and generated impressive member growth (despite deceleration) in Q1’22 (70% growth year over year), SoFi has much more to offer than the market is currently willing to acknowledge.

Based off of FY 2023 revenues, SoFi has a market-price-to-revenue ratio of 2.4 X. An end to the Federal Student Loan Payment Moratorium, which implies the resumption of student loan payments, as well as the positive effects resulting from the bank charter, make SoFi very reasonably valued.

Risks with SoFi

SoFi has traveled very far in a very short period of time: revenues are ramping up quickly and the pace of customer sign-ups in Q1’22 tells investors that SoFi is doing something right. What I see as a risk for SoFi is slowing topline momentum – driven by a potential slowdown in customer acquisition post-pandemic – and delayed profitability if the current administration extends the Federal Student Loan Payment Moratorium once more in August.

Longer term, I see growing competition in the fintech space as a threat to SoFi’s operating margins. What would change my mind about SoFi is if customer sign-ups slowed down sharply and the company started to have problems retaining existing customers.

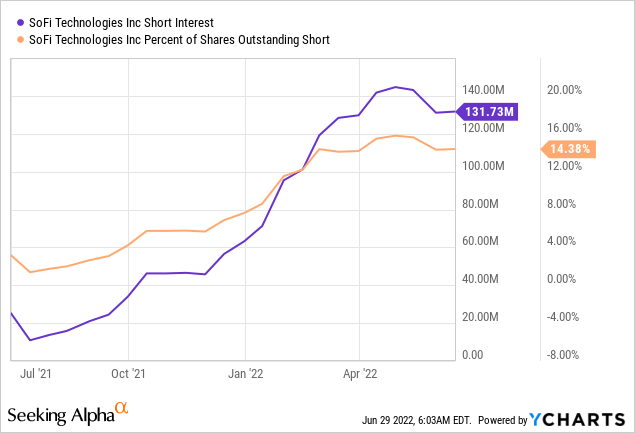

Additional risk: High short interest

SoFi is unfortunately heavily shorted. The short interest ratio is about 14.4%, meaning a lot of investors are betting on a continual decrease in SoFi’s share price.

Final thoughts

SoFi has possibly less risk – at the current valuation – than at any time in the last year. The biggest asset for SoFi is that the personal finance company is already profitable on an adjusted EBITDA basis and has a large customer base. Fintechs that already achieve some baseline level of profitability and maintain customer acquisition momentum are not at risk of drowning in a recession. Additionally, SoFi has received a bank charter earlier this year which will help the company differentiate itself from the competition and make it easier to draw in deposits from customers. The valuation, based off of revenues, is attractive!

Be the first to comment