RyanKing999/iStock via Getty Images

Investment Thesis

SoFi Technologies, Inc. (NASDAQ:SOFI) delivered a Q3 earnings result that investors positively welcomed, with the stock soaring premarket by more than 15%.

I have to admit that I was surprised that SoFi was able to raise its Q4 guidance, given everything that we’ve seen from companies reporting in the last few weeks.

All considered, I now remove my sell rating from this stock. That’s not to say that it’s going to be easy sailing from this point. But there are a lot more positive than negatives to now think about.

What’s Happening Right Now?

Last week the big names in tech got hit hard, aside from Apple Inc. (AAPL). They had been carrying this market, even as many of the faster growth, small-cap players had well and truly rolled over more than 12 months ago.

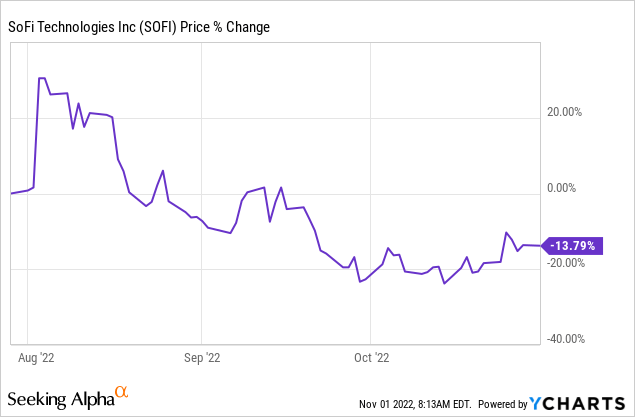

Could this be the time that fintech gets to stage its comeback? As we headed into Q3 earnings, SoFi was 12% shorted.

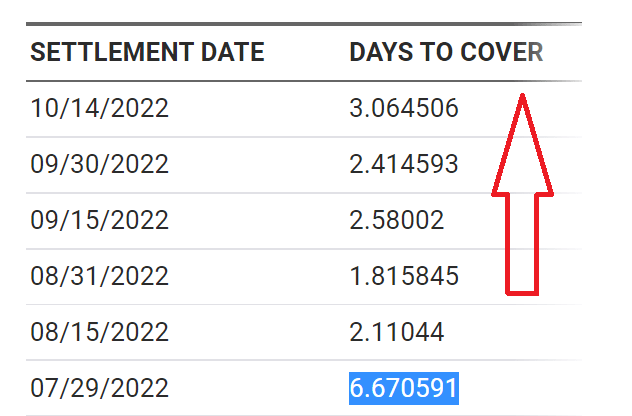

SoFi short interest

Recall, when SoFi announced its Q2 results, investors went into earnings significantly short the name, with 6.7 days to cover.

When SoFi’s Q2 results come out, the stock popped and bulls welcomed the results. Then, as time went on, shorts largely covered their positions, and we see that, on balance, days to cover are down more than 50% from its Q2 results, see above.

So, you have the combination of shorts moving on from the stock, plus the stock trending lower. This means that the reason why the stock is lower is that the bulls are selling out of the name and not enough bulls are buying into SoFi’s prospects.

That being said, let’s dig into SoFi’s Q3 results.

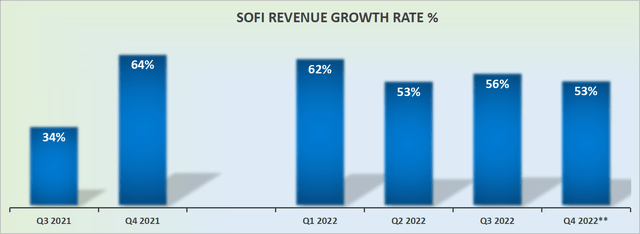

SoFi Upwards Revises Q4 Guidance

In the current market environment, when investors are desperate to cling to any reason to be bullish and get back into fintech, SoFi’s upwards revision of its Q4 was all that was needed for investors to clamber back into SoFi.

Profitability Profile Could Improve

Yet another positive seen in SoFi’s Q3 report is that the total shares outstanding were only up 15% y/y. That shows that with the stock trading very close to its all-time lows, management has attempted to slow down its stock-based compensation. Something that bears, myself included, have previously had issues with.

Altogether, this led to SoFi’s adjusted EBITDA increasing by 332% y/y. Consequently, investors are now starting to sharpen up their pencils and ponder whether it’s possible that SoFi’s adjusted EBITDA in 2023 could reach $250 million.

Given that the high end of SoFi’s full-year guidance points to $120 million of adjusted EBITDA, up from $109 million just last quarter, it now looks possible for SoFi to reach $250 million of adjusted EBITDA in 2023.

And this leads me to discuss SoFi’s valuation.

SOFI Stock Valuation — 25x Forward EBITDA

The simple fact that we as investors are now discussing companies’ bottom-line prospects, rather than zeroing on revenues, reflects how far multiples and expectations have come down in the past 12 months.

If we are willing to ignore pesky costs and measure SoFi as profits, not including management’s compensation and other expenses, then, in that case, SoFi’s bottom line prospects are likely to continue improving into 2023.

Altogether, SoFi is now priced at 25x forward EBITDA. Yes, more than 100% of SoFi’s adjusted EBITDA is stock-based compensation. Yes, if we consider depreciation and amortization to be underlying costs, then SoFi is unprofitable.

But for now, there’s little point in getting caught up in details. With the stock down so significantly, there’s the overwhelming belief that enough is enough.

The Bottom Line

Despite the beat and investor reaction, for my part, I believe SoFi stock is still overvalued.

That being said, I must give credit where credit is due, and SoFi has succeeded in expertly navigating the current environment when I didn’t believe that it would.

If SoFi can upwards revise its Q4 guidance, when many companies are either downwards revising guidance or removing guidance altogether, I believe that bodes very well for SoFi for 2023. Hence, I remove my sell rating.

Be the first to comment