StockPhotoAstur

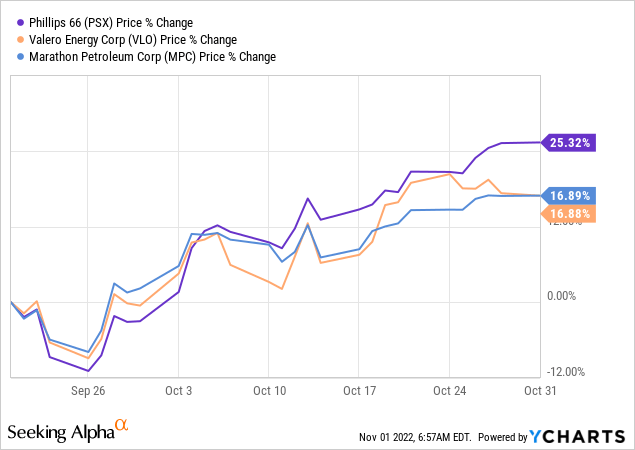

In my last Seeking Alpha article on Phillips 66 (NYSE:PSX), I described how the stock was a coiled-spring due its low stock valuation, high yield, and its advantaged position given strong diesel demand, high pricing, and the company’s advantaged Western Canadian Select (“WCS”) feedstock. It was an easy call given the clear line-of-sight investors had going into today’s (Tuesday, Nov. 1) Q3 earnings report – and the stock has gone straight-up since that piece was published on Seeking Alpha (see below) – during which PSX significantly outperformed its refining peers Valero (VLO) and Marathon Petroleum (MPC). That being the case, it is safe to say “the spring has sprung”. So, what now? Today, I’ll take a look at the Q3 earnings report and what PSX’s prospects are for Q4.

Q3 Earnings

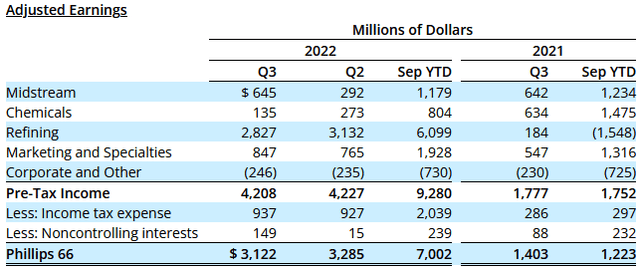

Phillips66 released its Q3 EPS report this morning and as expected it was exceptionally strong and beat consensus EPS estimates by $1.43/share. Highlights included:

- Earnings of $5.4 billion or a whopping $11.16/share.

- Backing out a $3 billion gain in Midstream Segment results related to the consolidation of DCP Midstream, Sand Hills Pipeline and Southern Hills Pipeline and the transfer of interest in the Gray Oak Pipeline to Enbridge (ENB), adjusted earnings were $3.1 billion or $6.46/share.

- During the quarter, operations at Sweeney Frac-4 started up and achieved full-production rates in early October. This brings total Sweeney Hub processing capacity to 550,000+ bpd of NGLs. This capacity is supported by long-term supply contracts.

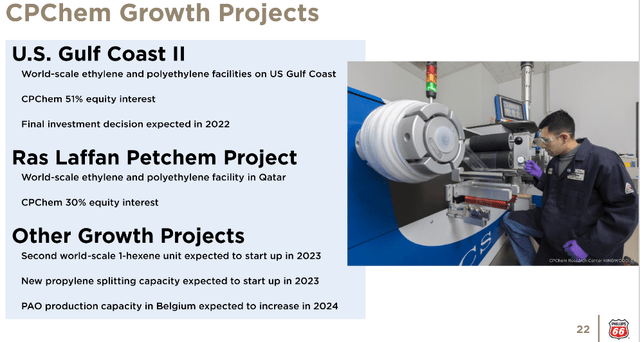

With the exception of the Chemicals Segment, primarily operated through CPChem, the 50/50 JV with Chevron (CVX) and which suffered from a sharp decline in global polyethylene margins, PSX continued the strong performance demonstrated in Q2 across all segments in Q3:

Notably, PSX’s realized refining margins declined only 6% from $28.31/bbl in the Q2 to $26.58/bbl Q3 while the composite global market crack decreased 22% from $46.72/bbl in Q2 to $36.29/bbl in Q3. PSX’s relative out-performance was due primarily to improved crude and product differentials (i.e. WCS and WTI discounts to Brent and strong diesel margin).

Midstream and M&S Segment results demonstrated strong quarter-over-quarter improvement.

PSX ended the quarter with $3.7 billion in cash & cash equivalents and a net debt-to-capital ratio of 29%.

Shareholder Returns

In May, PSX increased its quarterly dividend by 5% and currently pays a $3.88/share annual dividend. That equates to a 3.7% yield.

During Q3, PSX funded $466 million of dividends and $694 million of share repurchases, for a total of $1.2 billion returned to shareholders. That compares to $3.1 billion in operating cash flow in the quarter, which obviously leaves $1.9 billion leftover for cap-ex investment and/or additional shareholder returns going forward.

Management expects the company will deliver $6-7 billion in mid-cycle annual CFO. Sustaining cap-ex runs ~$1 billion annually. That leaves an estimated $5-6 billion in free-cash-flow for reinvestment in growth projects, shareholder returns, and debt repayment. The current dividend run-rate of $466/quarter equates to $1.864 billion. PSX already has an investment grade balance sheet. My point here is that PSX obviously has a lot of upside for both dividend growth and significant share buybacks.

Going Forward

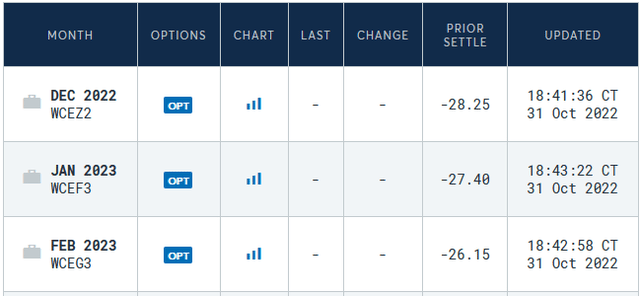

Not to belabor the point, but PSX’s heavily discounted Canadian crude feedstock continues to be a very positive catalyst. I say that because the WCS DEC 2022 futures still show WCS trading at a deep-discount to WTI – and that discount stays over $25/bbl for the next three months:

This is a strong catalyst for Phillips 66 considering its 50/50 WRB joint-venture with Canadian oil sands producer Cenovus (CVE) – and operated by PSX – that imports Canadian crude directly into two of PSX’s refineries: Wood River and Borger, which have, in aggregate, a throughput of 272,000 bpd and 105,000 bpd of distillate production.

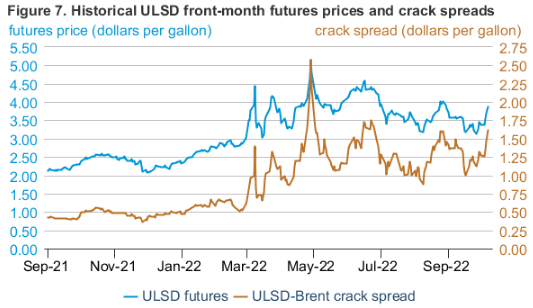

Meantime, the EIA’s Short-Term Energy Outlook published last month continues to report high ULSD (ultra-low sulfur diesel) crack spread and futures:

EIA

The EIA said:

We expect downward pressure on distillate prices and crack spreads, related to economic conditions, to continue through the end of 2022 and the first half of 2023, but we still forecast distillate crack spreads to remain well above historical levels through the end of the year.

In the EIA’s weekly status report published last Wednesday, we learned that distillate production declined by an average 5 million bpd last week (likely due to refinery maintenance and outages) while distillate fuel inventory was 20% below the 5-year average as we enter the winter heating season.

Add it all together, and I expect PSX to report relatively strong refining results again in Q4.

Also, Frac-4 going in-service (150,000 bpd) should add to Q4 Midstream Segment profits while the total $525 million cap-ex spend on the project is largely in the rear view mirror.

A bit farther out in the Midstream Segment, and as I reported in my previous article, investors should expect that the DCP JV between PSX and Enbridge is likely to be completely dissolved in a subsequent transaction if and when PSX is successful in buying all of DCP’s outstanding units (which I expect the company will do). This will enable PSX to improve its logistics and fully integrate DCP’s NGLs value-chain from wellhead to midstream (i.e. Sweeny Hub) and to CPChem and PSX’s 260,000 bpd Freeport LPG export terminal on the Gulf Coast.

In Chemicals, PSX has several large-scale projects on the US Gulf Coast and globally going forward, some of which will start-up next year:

Meantime, note that PSX is cutting staff and restructuring its refining operations: CEO Mark Lashier was quoted as saying earlier this year that the company was looking to cut costs by at least $700 million to “remain competitive in any market environment.”

Risks

Risks include the potential for windfall profits taxes on the refining segment (although I doubt such a measure would pass Congress), and potential demand destruction due to inflation, higher interest rates, and/or a possible recession. Also, keep an eye on WCS futures – if they narrow considerably, that would have a significant impact on PSX’s refining profits.

Summary & Conclusion

PSX is currently in a very strong position. The balance sheet is investment grade, the company ended the quarter with $3.7 billion in cash, Frac-6 has gone in-service, and the Refining Segment continues to just kill it on high diesel margin and its advantaged due to its heavily discounted WCS feedstock. The outlook for dividend growth and additional share repurchases is excellent in my opinion. I reiterate my BUY on PSX and note that the stock currently trades at only 6.2x forward earnings and yields 3.7%.

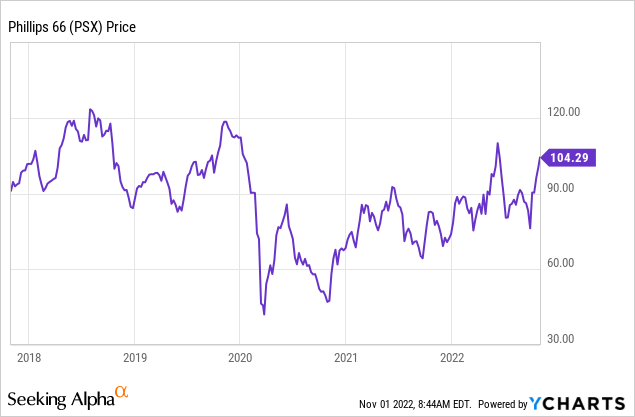

I’ll end with a 5-year price chart of PSX and note that while the company’s balance sheet and financials have totally recovered from the impact of COVID-19, the stock price is still close to its pre-COVID highs.

Be the first to comment