shih-wei

SoFi Technologies, Inc. (NASDAQ:SOFI) is scheduled to release its Q3 results before markets open on Tuesday. Although the company has grown at a stellar trajectory over recent years, its growth is likely to succumb to recessionary and inflationary pressures. So, in addition to tracking the company’s headline financial figures, investors must also monitor its product sales, members count, segment financials, and its management’s revenue outlook for the quarter ahead. These items will better highlight the true impact of these macroeconomic pressures on SoFi’s operational and financial results, and are likely to influence where its shares head next. Let’s take a closer look at it all.

Key Operating Metrics

Let me start by saying that SoFi’s management has done a fantastic job at growing their business at a rapid rate. Their Q2 revenue was up 56% year-over-year, which is a commendable feat and an enviable position to be in. But as the Fed continues to increase interest rates and inflationary pressures weigh down on consumer spending, SoFi’s growth trajectory is likely to simmer down along the way. So, to better understand how the business is faring in these challenging times, it’s all the more important for us to monitor its key operating metrics.

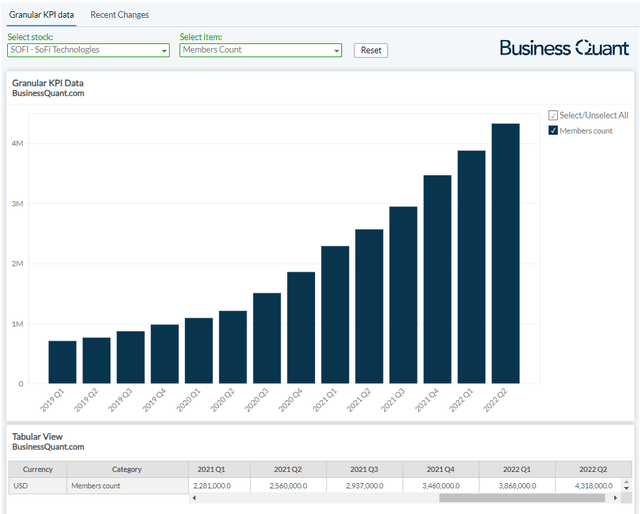

We can start by tracking SoFi’s members count. This metric is basically the total number of customers the company has had till date. The company has an extensive suite of financial products to attract, retain and cross-sell (to) customers, ranging from student loans, personal loans and home loans, in addition to services like SoFi Money, Invest, Credit Card, At Work, Lantern Credit and Relay products. Since members count is a cumulative figure, and all these products are backing the business, the metric is bound to only increase with each passing quarter.

However, pay close attention to the pace of its members growth. In the last quarter, the figure grew nearly 12% sequentially and almost 69% year-over-year. I think it’s needless to say, but any slowdown in its member growth rates would suggest loss of consumer demand, consumer disposable income, or SoFi’s competitive positioning entirely. I personally expect SoFi to be able to maintain its member growth trajectory now that it has fully integrated its banking operations and is able to offer lucrative interest rates to customers that other platforms can’t necessarily.

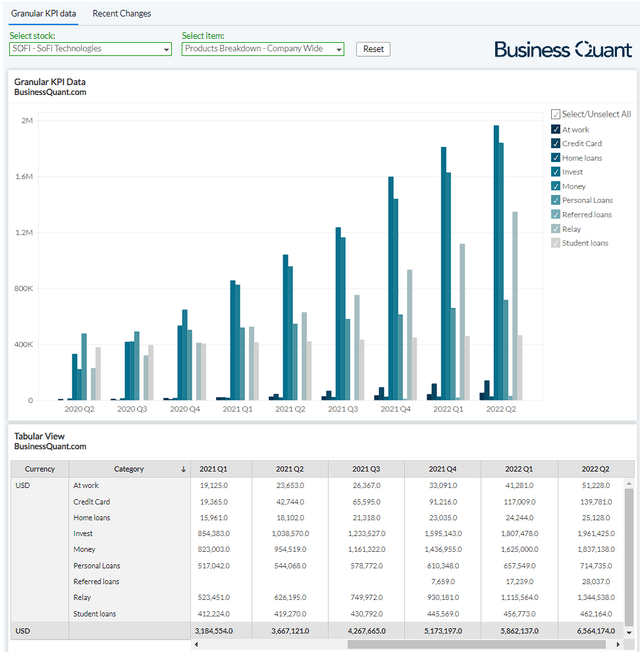

But just tracking the members count won’t indicate the true extent of transaction growth or its business traction. It’s possible that the member growth could be driven by, let’s say, its credit card offerings, and we mistake it for well-rounded business growth. So, we must also track its segregated “products count” to understand whether its growth is concentrated across specific categories, or if it is balanced across its entire suite of products. For the uninitiated, the company defines this particular metric as the number of products its customers have purchased, or subscribed to, since the company’s inception.

Note how SoFi is experiencing rapid growth across most of its product categories barring student loans. This vertical has practically stalled in recent quarters due to the student loan moratorium and the associated extensions on student loan repayments by U.S. regulators. Since there weren’t any major catalysts in Q3 to trump this ongoing trend, I expect the company to register healthy products growth in nearly all categories during Q3, except for student loans. However, the pace of growth is likely to taper down, since consumer disposable income has taken a hit and discretionary spending is significantly down.

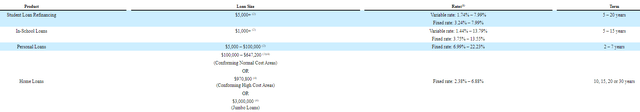

For reference, here’s a screenshot from the company’s last 10Q filing, breaking down the average rates and tenures across its various lending products as of June 30, 2022.

Financial Expectations

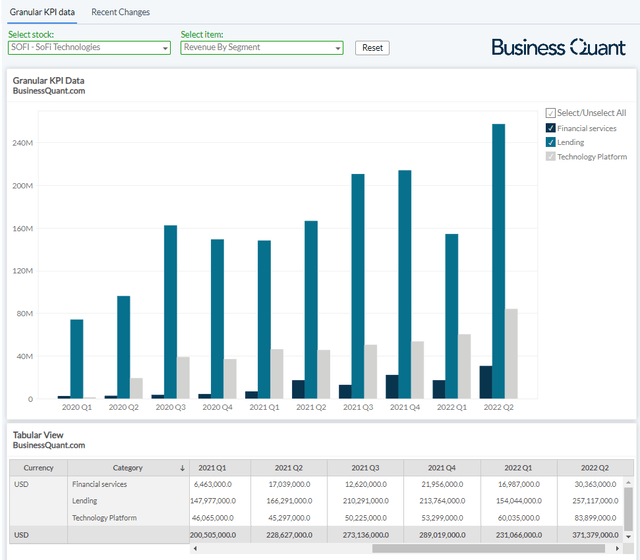

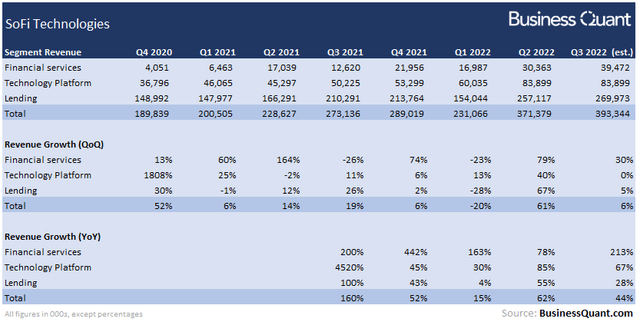

It’s important to note that SoFi classifies its revenue into 3 reporting segments, namely Lending, Financial Products, and Technology Platform. Its Financial Services segment includes the sales contribution of its consumer-facing services such as SoFi Money, Invest, Credit Card, At Work and other such products. It’s by far the smallest segment in terms of revenue generation and accounted for just over 8% of the company’s total revenue last quarter. Many of these products cater to discretionary spending behavior, which in my opinion, will take a backseat for consumers for as long as we’re in an interest rate hike cycle. So, I expect Q3 revenue from this segment to more or less remain flat sequentially, around $84 million.

The Technology segment is the second largest revenue driver for the company, accounting for a little over 22% of its total revenue last quarter, and including sales contribution from the Galileo platform that it acquired back in 2020. This is a business-to-business product offering wherein SoFi provides the technology infrastructure to institutions to setup their own financial products. With enterprises cutting down spending across the globe, I contend that new enterprises will refrain from signing up for Galileo for a quarter or two and the segment’s revenue will be driven largely from its existing clients. So, I’m expecting the segment’s revenue growth to slow down sequentially to 30%, with its revenue amounting to $39.5 million for the quarter.

Lastly, its lending segment includes the sales contribution from student, personal and home loans. I expect student loans originations to remain subdued in Q3, but they’re likely to start picking up in Q4 as repayments are set to begin in January 2023. Also, the Federal student loan forgiveness plan has been blocked by the U.S. Court of Appeals very recently. So, it’s likely that students with federal debt, will actively seek to refinance their loans at competitive rates using SoFi’s platform during Q4.

Also, with interest rates on a meteoric rise, there may not be many new loan originations for new home purchases industry-wide. Instead, borrowers with existing home and personal loans are likely to explore SoFi in order to refinance their existing loans. So, in light of these factors, I’m expecting SoFi’s Lending segment revenue to grow 5% sequentially and amount to roughly $270 million for Q3.

This brings us to a company-wide revenue estimate of $393 million for Q3. Note that my figure is right in the middle of the Street’s revenue estimates for the said quarter, spanning from $381 million to $414 million. But having said that, pay close attention to SoFi management’s outlook for Q4. Specifically, look for their comments around the pickup of student loan refinancing and which product categories are likely to underperform or outperform.

Final Thoughts

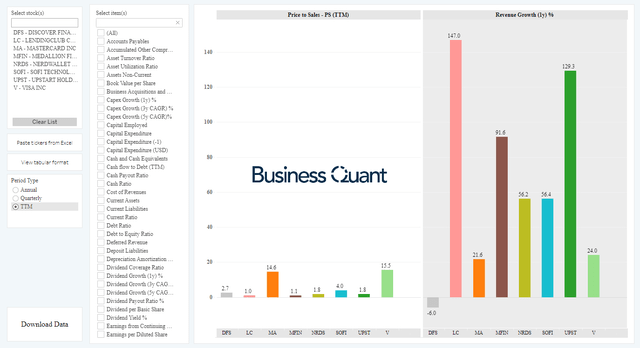

SoFi’s shares are down 70% over the last year, but this metric alone isn’t enough to determine whether the stock has bottomed out yet. For all we know, the stock is trading at 4-times its trailing twelve-month sales, which is considerably higher than many of the other rapidly growing names in the credit services industry. So, risk-averse investors may want to wait for further price declines in order to accumulate SoFi’s shares.

But as far as Q3 results are concerned, investors should keep a close eye on SoFi’s products count, members count, bifurcated financials and its management’s outlook for Q4. These items will have a bearing on where the company and its shares will head next. Good Luck!

Be the first to comment