Jirsak

SoFi Technologies, Inc. (NASDAQ:SOFI) saw its stock price rise by 25% following better-than-expected 2Q-22 earnings, but the factors driving the surge are weak and do not justify last week’s gains.

SoFi Technologies is still trading at an inflated sales multiple and was only profitable on an adjusted EBITDA basis in the second quarter.

Despite unjustified market exuberance following earnings, I maintain my price target of $3.50 for SoFi Technologies’ stock.

Platform Is Growing, But Growth Is Not Everything

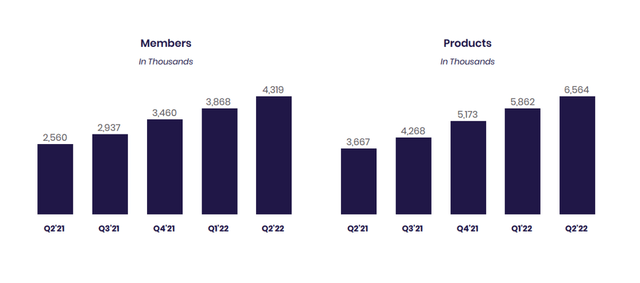

SoFi Technologies increased the number of member accounts on its platform in the second quarter. As of June 30, 2022, the company had 4.32 million members using its products and services, implying that SoFi Technologies added 450K new members in the previous quarter.

According to SoFi Technologies’ earnings release, 2Q-22 saw the company’s second-highest member growth in its history.

SoFi Technologies’ product growth was similar: 2Q-22 was the second-highest product growth quarter ever, with 6.56 million different products available to customers at the end of the quarter.

Member And Product Growth (SoFi Technologies)

Despite the fact that SoFi Technologies is expanding its membership and reach, investors must consider what price they are willing to pay for this expansion, given that SoFi Technologies is not producing any real profits.

Masking Losses = Focusing On Adjusted EBITDA

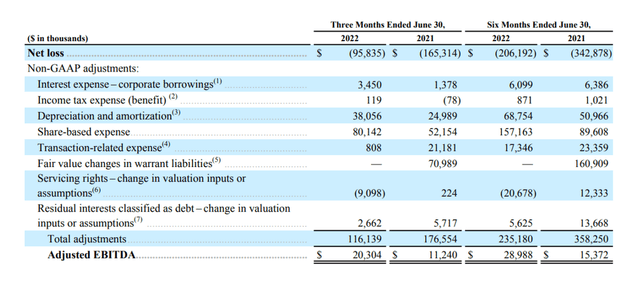

SoFi Technologies is not making any real profits in the traditional sense of the word. According to ‘adjusted EBITDA’, the company is profitable.

Adjusted EBITDA is an arguably fictitious figure that gives businesses a lot of leeway in making ‘adjustments’ to their profit measures. Adjusted EBITDA is a non-GAAP measure that allows for a wide range of net income corrections, including (but not limited to) depreciation and amortization, share-based expenses, transaction-based expenses, fair value changes in warrant liabilities, corporate borrowing-based interest costs, income taxes, and other ‘non-recurring’ items.

The issue with figures like adjusted EBITDA is that they allow management to conceal underlying losses, which are quite significant in the case of SoFi Technologies.

SoFi Technologies’ adjusted EBITDA for 2Q-22 was $20.3 million, masking a net loss nearly four times that amount: $95.8 million. Only $116.1 million in adjustments were required in the second quarter to report a $20.3 million EBITDA profit, demonstrating how unprofitable SoFi Technologies’ business truly is.

SoFi Technologies’ adjusted EBITDA line showed only $29.0 million in profits for 2022 (based on YTD figures), but net losses accumulated this year already total $206.2 million.

My point here is that adjusted EBITDA, which allows management to easily allocate share-based expenses, ignore transactions, or simply add back interest expenses, is woefully inadequate to focus on in order to see the big picture.

Adjusted EBITDA (SoFi Technologies)

SoFi Technologies had to add the $206.2 million in 2022 losses to its current year’s accumulated deficit, which had ballooned to $1.39 billion at the end of the second quarter.

So, while SoFi Technologies is expanding its reach, this expansion has come at a high cost to shareholders. And, as we will see next, growth expectations associated with SoFi Technologies’ raised 2022 guidance are also exaggerated.

0.2% Increase In 2022 Sales Guidance

SoFi Technologies increased its revenue forecast for 2022 by $3 million, to $1,508-$1,513 million. This $3 million ‘raise’ equates to a 0.2% increase in sales guidance over previous guidance. In fact, the increase is so minor that the projected annual sales growth rate is unaffected.

SoFi Technologies anticipates 49-50% sales growth this year. SoFi Technologies’ preferred profit measure, adjusted EBITDA, is expected to be in the $104-109 million range, representing a $4 million increase, or a 4% increase.

Although SoFi Technologies did technically ‘raise’ its sales and adjusted EBITDA guidance, it was not at a rate that would justify a 25% valuation increase after earnings.

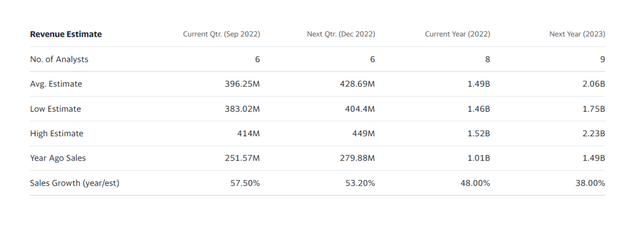

Inflated Sales Multiple

This year, the market expects a 48% increase in revenue, while SoFi Technologies anticipates a 49-50% increase. Whether raised or not, SoFi Technologies’ stock remains extremely expensive, with a sales multiple of 5.4x, owing to the company’s fundamental lack of profitability.

In my opinion, there is nothing special about the Fintech that would justify SoFi Technologies trading at such a high multiple.

Revenue Estimate (SoFi Technologies)

Why SoFi Technologies Stock Could See A Higher Valuation

SoFi Technologies’ reach and membership will expand, but growth will likely slow. The pandemic is nearly over, and people are returning to their normal lives. The resumption of student loan repayments may make a difference for SoFi Technologies and indicate higher originations/earnings in the future.

My Conclusion

SoFi Technologies benefited from a ‘not-all-is-bad’ relief rally last week, resulting in a significant 25% valuation bounce to the upside despite raising sales guidance by only 3% and remaining unprofitable.

The market is overly optimistic about SoFi Technologies, and given the company’s inflated sales multiple, I believe investors’ best bet is to sell last week’s dead cat bounce and take profits.

Be the first to comment