Justin Sullivan/Getty Images News

SoFi’s (NASDAQ:SOFI) recent capitulation has been a lesson on how not every investment thesis works out the way you hoped it would. This very sombre affair was crystalised after the stock price ticked below its $10 Social Capital Hedosophia Holdings Corp. V reference price. That SoFi is now on a per share basis worth less than it was when it announced it was going public also implies two things.

Firstly, the company’s fundamentals have worsened when compared to its first publicly provided guidance. Secondly, the macro backdrop of a broader shift to digital financial services by American consumers has somewhat deteriorated. None of these are true. The currently materially lower valuation has been a result of an unprecedented spike in the inflation rate which has forced the FED to take on a more hawkish tone on its road map of interest rate rises. This has a negative effect on the valuation of not yet profitable stocks which in the interim are being appraised on multiples to revenue guidance.

SoFi is now down 35% since my last article on the company and 63% from its all-time high. Hence, to state that sentiment has evaporated would be an understatement as it’s entirely inverted. In such conditions, it is prudent to ask how much more the stock can go down before dreaming of returning to previous highs.

Strong Financials Against A Backdrop Of Crumbling Growth Sentiment

SoFi recently released its fiscal 2021 fourth quarter and year-end results which saw total net revenue for the quarter come in at $280 million, a 54% increase from the comparable year-ago period and a small beat on analyst consensus. This came despite an unexpected extension of the federal student loan payment moratorium in late December.

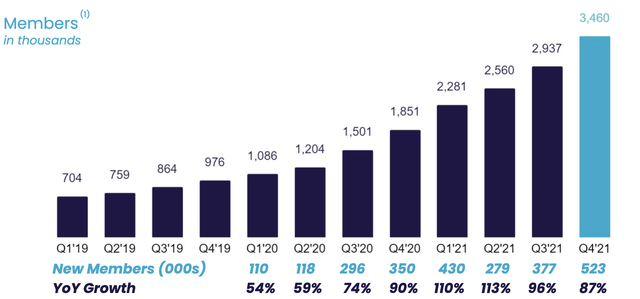

Total revenue for the year came in at $1.01 billion, a 63% increase from fiscal 2020, while adjusted EBITDA of $5 million remained positive for the 6th consecutive quarter. SoFi members also reached 3.46 million, an 87% year-over-year growth rate.

SoFi Investor Relation Website

The continued strong growth of members is a strong testament to SoFi’s core bull case. Essentially, SoFi is going against the unbundling of consumer finance through a singular platform that offers a wide range of financial services to serve all the financial needs of its members. This offers a possible future scenario where SoFi achieves critical mass in regards to revenue and profitability.

The long-term stakes could not be higher as fintech eventually matures. What’s left standing having accrued of the value will be the companies with intense scale. In this sense, SoFi’s super-platform strategy through the bundling of disparate financial products simultaneously exposes them to multi-hundred billion dollar TAMs which will snowball to create immense downstream revenue.

At its current market cap of $7.7 billion, the company trades at not more than 7.7x its fiscal 2021 revenue. SoFi is guiding for a 55% increase in fiscal 2022 revenue to $1.57 billion. This would place the forward 1-year price to revenue multiple at 4.9x. Expected revenue for 2022 is also ahead of the guidance provided when the company initially announced its go-public transaction.

SoFi Investor Relations

SoFi expects revenue to grow at a 43% CAGR from its 2020 baseline. This should see revenue accelerate to at least $3.67 billion in fiscal 2025. I expect this figure to be higher at $4 billion. This sets the tone for a long-term hold. SoFi’s valuation makes sense against the wider context of its revenue ramp.

And whilst controversy still surrounds the continued extension of the student loan moratorium, it cannot be extended forever and the current financial projections have not pencilled in this inevitable boost to underlying revenue. SoFi also continues to execute on strategic bolt-on acquisitions to bolster its financial profile. This most recently saw the company complete a buyout of Technisys, a digital banking platform, that should see SoFi embed material cost savings in its Galileo unit.

The Future Belongs To Fintech

I would be remiss not to say the last few months have been difficult for every growth investor. What was previously a shining beacon of the American stock market has in a few months become a toxic asset class despite the strength of the underlying companies. SoFi, even with its much lauded banking charter, has become a poster boy for this collapse in growth sentiment.

Panic around the pandemic has ended but has now been replaced with what looks set to be extremely sticky inflation, exacerbated by a war of aggression launched by Russia against Ukraine. These factors might plunge a somewhat fragile global economy into recession as the price for energy continues its unabated rise up. This poses further near to medium term risks to growth stocks like SoFi which could still see a valuation compression.

Hence, SoFi currently constitutes a minimum 3-year hold, ideally a longer-term 5-year period is required for its full value to be realized. Hence, I continue to add to my position as I move to reduce my cost average below $10. SoFi’s growth continues and the company will push itself into stronger profitability as its cost saving initiative is realized.

Be the first to comment