asbe/iStock via Getty Images

Investment Thesis

SoFi Technologies, Inc. (NASDAQ:SOFI) continues to perform well, given the narrowing net losses and stellar adoption/ membership growth in FQ’22. Its newly established bank charter also performed much better than expected, with an excellent 36.8% growth QoQ to $2.7B of deposits and GAAP net income of $25M in FQ2’22. The robust growth is mainly attributed to the company’s raised Annual Percentage Yield from 1.5% in June to 1.8% in July 2022, accelerating the weekly deposit growth to $120M in FQ2’22.

Assuming similar outperformance for its bank segment ahead, there is a good chance that SOFI could report profitability earlier by FY2024, interestingly aided by the worsening macroeconomics. Thereby, it could potentially trigger a long-term stock rally then.

Given its current undervaluation and robust potential, SOFI remains our top pick in the fintech market for long-term investing. However, investors should always size their portfolios accordingly, since the company is not expected to report profitability for the next two years.

SOFI Continues To Outperform Estimates – Highlighting Its Prowess Ahead

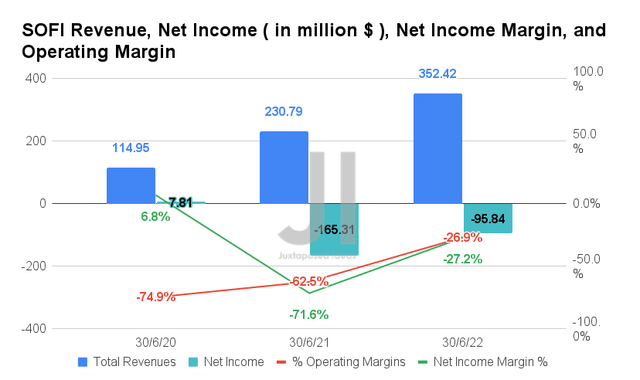

In FQ2’22, SOFI reported revenues of $352.42M and operating margins of -26.9%, representing massive increases of 52.7% and 35.6 percentage points YoY, respectively. In addition, the company also reported improving profitability, with net incomes of -$95.84M and net income margins of -27.2%, representing an increase of 42% and 44.4 percentage points YoY, respectively. The improved financial performance is mostly attributed to the growth in contribution profit from the lending segment by 59% YoY and the technology platform by 58% YoY.

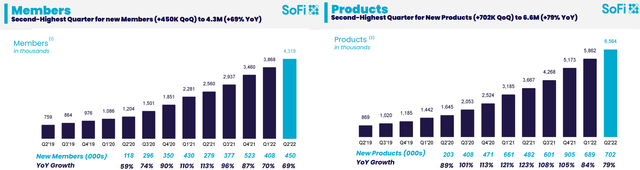

Growth in SOFI Members and Product Adoption In FQ2’22

For Q2’22, it is also apparent that adoption of SOFI’s products continued to strengthen, despite the market’s fears about elevated interest rates. The company reported that it added 450K new members, representing 61.2% YoY growth to a total of 4.31M. In addition, SOFI also had an excellent new product adoption of 702K in 6.56M, thereby, dispelling any fears about slowing growth in the pessimistic macroeconomics environment.

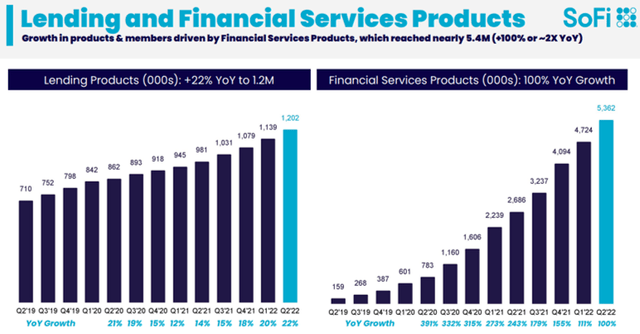

Growth in SOFI Lending and Financial Services Product Adoption In FQ2’22

Furthermore, SOFI’s financial services products continue to report exponential growth at 100% YoY to a total of 5.36M in FQ2’22, albeit with a slight deceleration in comparison to the hyper-growth in 2020 and 2021. With the assumption of an extension in the student loan moratorium until the end of 2022, it is evident that the company continues to perform excellently, due to its raised revenue and adj. EBITDA guidance for the year.

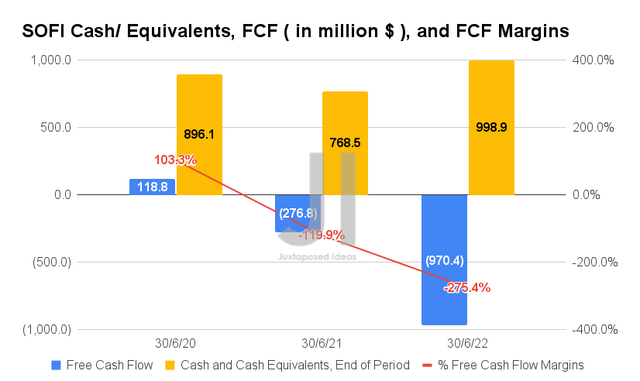

Nonetheless, it is also evident that SOFI continues to report negative Free Cash Flow (FCF) generation thus far, with an FCF of -$970.4M and an FCF margin of -275.4% in FQ2’22. It represents a massive decline of 350.5% and 155.5 percentage points YoY, respectively. Also, a far cry from its previous FCF profitability of $332.61M in FQ1’21. Nonetheless, investors have nothing to fear, given its more than sufficient cash and equivalents of $998.9M on its balance sheet at the same time.

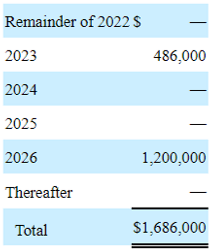

SOFI Borrowings Maturity

S&P Capital IQ

Though SOFI reported $3.77B of long-term debts in FQ2’22, it is essential to note that most of it is attributed to its Credit Facilities. If we were to narrow them down to the company’s actual borrowings, these would be reduced meaningfully to $1.68B for its latest quarter. Furthermore, with only $486M maturing by 2023 and the rest by 2026, SOFI appeared well poised to handle the worsening macroeconomics in the short term.

SOFI’s SBC Remains A Notable Concern For Long-Term Investors

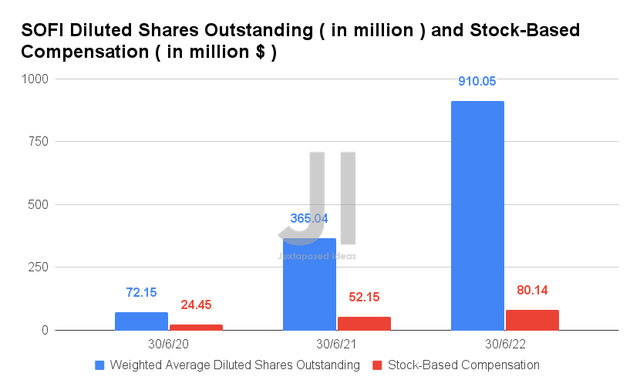

Nonetheless, it is also evident that SOFI has continued to dilute its existing shareholder by multiple times since its IPO. By FQ2’22, the company reported diluted shares outstanding of 910.05M, representing an increase of 13.6% from its secondary offering in November 2021 and an eye-watering increase of 249.3% since its IPO in June 2021. In addition, with another $1B of mixed shelf offering announced in July 2022, we may expect to see a further share dilution of 157.97M moving forward, based on its current share prices. Thereby, potentially further diluting its IPO shareholders by 292.5% or 33.4% since SOFI’s secondary offering.

Somewhat alarming indeed, given the continued rise in SOFI’s Stock-Based Compensation (SBC) by 53.6% YoY in FQ2’22. Assuming a similar rate moving forward, we may see the company report up to $336.32M in SBC expenses for FY2022, representing a massive increase of 40.5% YoY. Thereby, gradually but surely diluting existing shareholders’ value moving forward.

Of course, bullish investors with a higher tolerance for risk should not be overly worried, since these strategies are common to most high-growth tech companies, which have yet to report sustained profitability. Block (SQ) had diluted its long-term investors by 340.9% since its IPO in 2015. Even Upstart (UPST) had done similarly by 322.4% since its IPO in 2020, otherwise, by 351.7% post-secondary offering in FQ1’21. Though it is also important to note that the latter had also embarked on a meaningful stock repurchase program in February 2022. Once SOFI achieves sustained profitability, we may also speculatively see the company announce similar programs from 2025 onwards.

SOFI May Achieve Profitability Earlier, Assuming Sustained Growth In Bank Segment

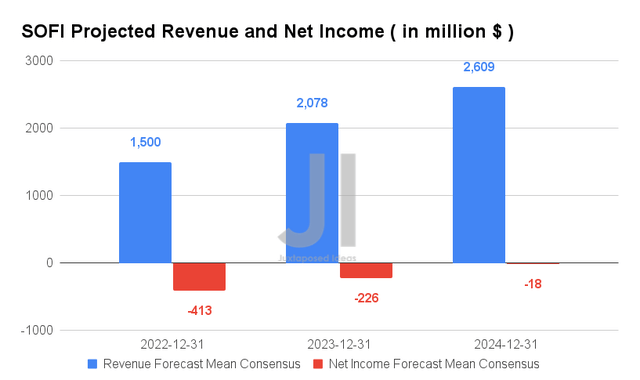

Over the next three years, SOFI is expected to report revenue growth at a CAGR of 38.91%, while potentially nearing net income break-even from FY2025 onwards. These numbers represent an apparent moderation of -8.1% since previous estimates in April 2022. Thereby, indicating Mr. Market’s continuous worries about the potential recession in FY2023 and FY2024.

Nonetheless, consensus estimates that SOFI will report exemplary revenues of $1.5B and net incomes of -$0.41B in FY2022, representing an impressive improvement of 54.6% and 15.2% YoY, respectively. These are mostly attributed to the company’s raised guidance for the year, with up to adj. EBITDA of $104M to $109M.

We are confident in SOFI’s forward execution and continued growth in membership and adoption, once the student loan repayments are restarted next year, post-mid-term elections in the US. Combined with its stellar bank segment, there are many reasons to believe why consensus estimates may likely upgrade SOFI’s revenue growth and profitability from FY2023 onwards. We shall see.

In the meantime, we encourage you to read our previous article on SOFI, which would help you better understand its position and market opportunities.

So, Is SOFI Stock A Buy, Sell, or Hold?

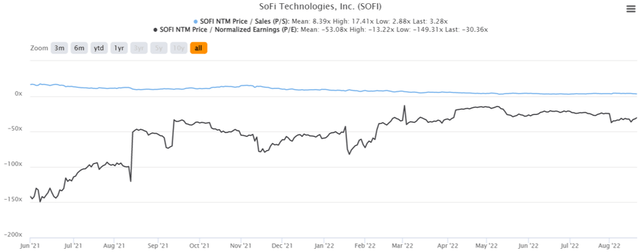

SOFI 2Y EV/Revenue and P/E Valuations

SOFI is currently trading at an EV/NTM Revenue of 3.28x and NTM P/E of -30.36x, lower than its 2Y EV/Revenue mean of 8.39x though improved from its 2Y P/E mean of -53.08x. The stock is also trading at $6.10, down 75.2% from its 52 weeks high of $24.65 and nearing its 52 weeks low of $4.82. It is evident that the rally post stellar FQ2’22 earnings has already been digested, providing a highly attractive entry point for patient investors.

SOFI 2Y Stock Price

It is evident that consensus estimates remain bullish about SOFI, given the price target of $11.13 and 75.83% upside from current prices. The Fed’s next hike in interest rates is also expected to be slower than previous ones, potentially signaling greener days ahead. Thereby, putting the rumors of a potential recession to rest, for now.

Though SOFI is also trading at a slight premium from the previous bottom of $4.82, we reckon that the current risk-reward ratio still appears relatively attractive for long-term investing. Bottom fishing investors may continue to wait for another retracement before the Fed’s next hike in September 2022. However, given the recent recovery in the S&P 500 Index by 15.3% in the past two months, the extreme market pessimism could already be baked in by now.

Therefore, we reiterate our Buy rating on the SOFI stock.

Be the first to comment