Viorika

Personal finance company SoFi (NASDAQ:SOFI) submitted an impressive Q3’22 earnings yesterday, but shares unfortunately dropped about 11% as the market sold off. The fintech made massive progress regarding the growth of its ecosystem and the resumption of student loan payments next year could be a big catalyst for SoFi’s EBITDA growth. Due to strong momentum regarding customer acquisition and lending and financial services product growth, the outlook for the SoFi platform and the stock is bright. Despite good earnings, shares have skidded due the Federal Reserve raising interest rates yet again. I believe shares of SoFi have an attractive risk/reward trade-off and are most likely undervalued!

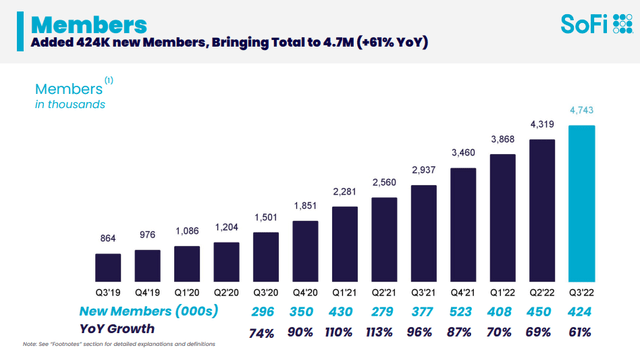

SoFi’s Q3’22: Strong member growth continues

At the end of the third-quarter of 2022, the SoFi platform included 4.7M customer accounts, showing an increase of 424 thousand quarter over quarter. Year over year, SoFi’s member count grew at an impressive 61% rate. SoFi’s growth started to moderate in FY 2021 and the digital personal finance company has now seen five consecutive quarters of deceleration in account growth.

However, SoFi’s growth remained strong nevertheless as it added the fourth-largest amount of new customers ever in Q3’22. Because of SoFi’s strong and fairly consistent growth of its SoFi-branded personal finance platform, I believe it will be a piece of cake for the company to grow past 5M accounts by the end of the year. Since SoFi doesn’t seem to have any issues at all with attracting more than 100 thousand new members to its payments platform each month, I continue to believe that SoFi will be able to grow its member base to 5.0-5.2M by the end of this year.

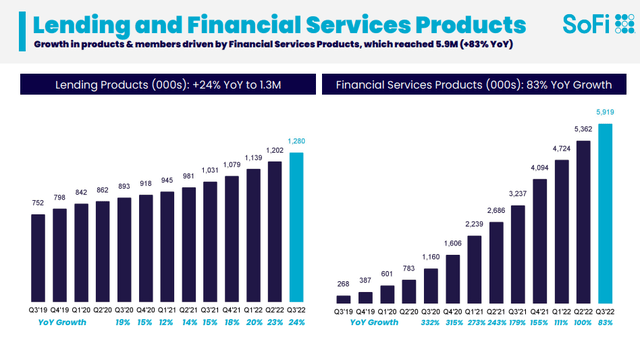

SoFi’s growth is supported by product innovation and a growing number of available products and services in the SoFi ecosystem. The number of available lending and financial services products continued to soar in the third-quarter: 5.9M financial services products (insurances, credit cards, savings tools) were available to SoFi customers in the third-quarter while lending products (personal, home, student loans) totaled 1.3M. Financial services products continue to be the most successful product category for SoFi with product growth exceeding the growth in lending products by a factor of 2.5 X. Going forward, I expect a stronger member uptake of SoFi’s lending products as inflation keeps weighing on consumer spending and customers could roll over personal loan balances, for example.

SoFi: Lending And Financial Services Product Growth

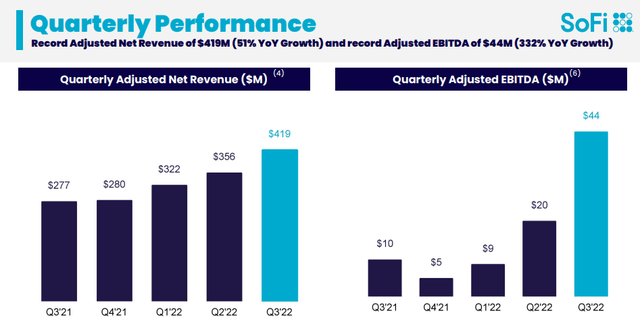

Revenue record and strong growth in EBITDA

SoFi generated $44M in adjusted EBITDA on $419M in adjusted net revenues in the third-quarter, showing year over year growth of 340% and 51%. Because the student loan moratorium is expected to end at the end of FY 2022 and payments are set to resume in FY 2023, I believe that SoFi could see $200M in adjusted EBITDA next year.

SoFi: Q3’22 Revenue And EBITDA Growth

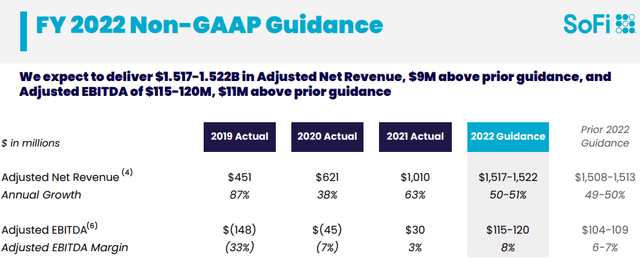

Raised guidance and valuation

SoFi again raised its guidance for FY 2022. The fintech now expects to generate $1,517-1,522M in revenues for the current fiscal year, which represents a $9M increase from an earlier guidance range of $1,508-1,513M. SoFi also raised its expectations for adjusted EBITDA which is now expected to be between $115-120M instead of $104-109M based off of the last quarter’s guidance.

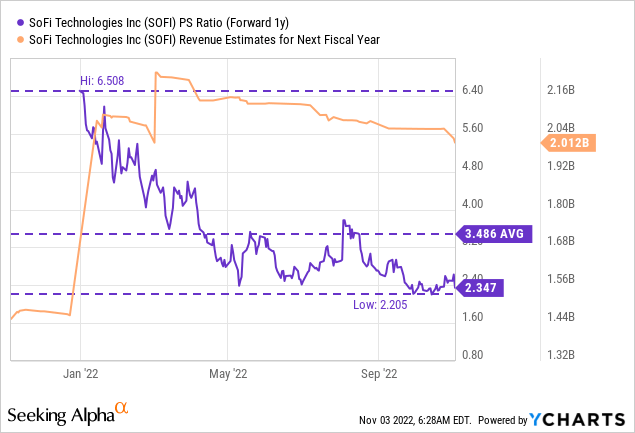

Estimates call for about $2.0B in revenues next year, implying year over year growth of 34%. Shares of SoFi, given the opportunity for long term growth in the fintech niche, are very reasonably valued now with a P-S ratio of 2.3 X. They are also trading well below their 1-year average P-S ratio of 3.5 X.

Risks with SoFi

There are a couple of risk factors that affect an investment in SoFi. Obviously, growth is slowing down in a post-pandemic world and SoFi has seen its fifth straight quarter of slowing customer acquisition, although the digital personal finance company still added an impressive number of new accounts to its platform in the last quarter. The student loan payment freeze was a big problem for SoFi between FY 2020 and FY 2022, but repayments appear set to resume next year which could lead to significant earnings growth for SoFi.

Final thoughts

SoFi remains a fintech diamond for me and the market’s reaction yesterday was overblown. The personal finance company is executing well and expanding its ecosystem rapidly. By growing its lending and financial services product portfolio quickly, SoFi has been successful in drawing more customers to its platform. SoFi also faces a catalyst: the resumption of student loan payments which is set to drive the firm’s earnings growth in FY 2023. I believe the valuation, given the growth opportunity in the fintech space, is very attractive and management has proven that it can grow its ecosystem despite headwinds. SoFi’s shares have considerable upside in the long term and the risk profile remains skewed to the upside!

Be the first to comment