Drew Angerer

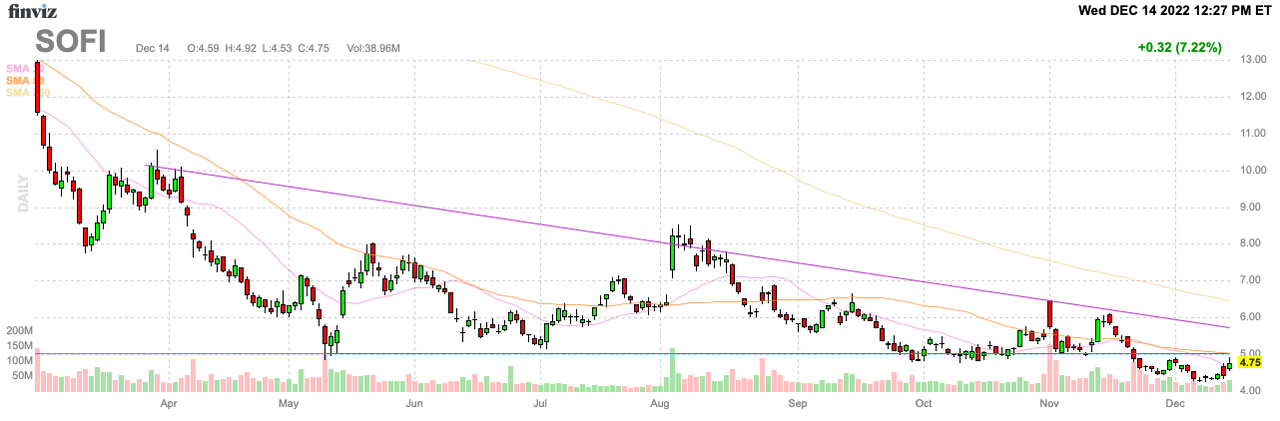

Over the last couple of months, SoFi Technologies (NASDAQ:SOFI) appeared under siege. The fintech faced claims of accounting issues, a Congress crypto attack and the Biden Admin. again pushed back the student loan moratorium causing the stock to plunge below $5. My investment thesis remains ultra-Bullish on the stock, especially after the CEO made a large insider buy.

Source: FinViz

5 Million Reasons

Insiders have a lot of reasons to sell a stock without signaling something is wrong with the company. An insider only has one reason to buy a sock.

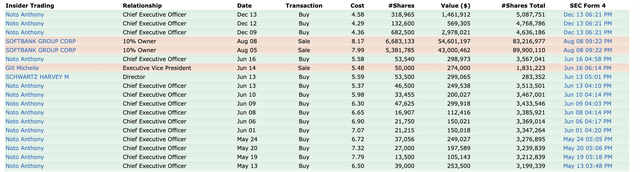

SoFi CEO Anthony Noto purchased $5 million worth of the stock over the last few days at prices ranging from $4.29 to $4.58. In total, the CEO bought 1.134 million shares for an average cost of $4.42.

In fairness, Mr. Noto bought shares back in May and June at higher prices, but he never bought anywhere close to these values when the price was up in the $6s and $7s. The largest previous purchase was only $300K worth of shares on June 9 at $6.30.

The insider purchases definitely flip the switch from the summer when SoftBank Group (OTCPK:SFTBY) unloaded all of their shares. The investment bank sold nearly 100 million shares in August before the position fell below the 10% threshold at 83 million shares.

Still On Track

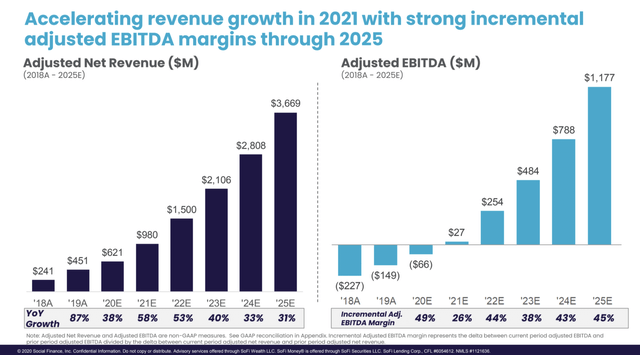

The crazy part of the SoFi story is that the company remains on track to generally hit the financial targets from the original SPAC presentation back in January 2021. The company guided to 2022 revenue of $1.5 billion and despite the student loan moratorium, SoFi guided to top that target.

Source: SoFi SPAC presentation

The EBITDA targets are a slightly different story as the fintech has invested in other areas in order to reach the revenue goal. SoFi still targets adjusted EBITDA for the year at over $100 million with an original goal of $254 million.

The company originally guided to maintaining 30% revenue growth rates through 2025 with the EBITDA margin reaching 30%. The market is currently sweating whether SoFi is profitable, yet the growth story remains massive warranting the investment in product expansion at this point.

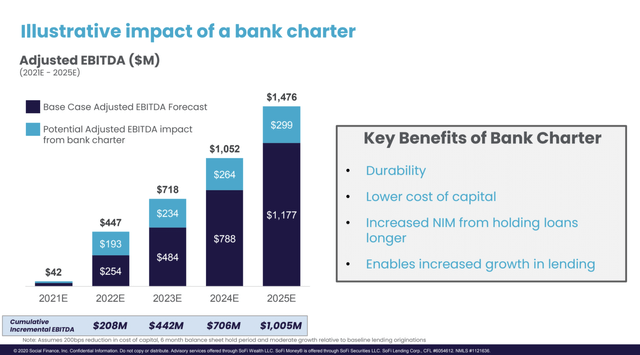

The profit picture gets even better with this base EBITDA forecast prior to SoFi obtaining the digital charter. The company guided to a 2025 adjusted EBITDA boost of $299 million after obtaining the digital charter to start 2022 to hit $1,476 million for an impressive 40% margin.

Source: SoFi SPAC presentation

SoFi now benefits from a lower cost capital and the ability to hold loans longer to generate more net interest margin. Part of what the bears don’t like about the fintech right now is this ability to hold loans longer and collect interest income on fears of higher loan losses.

The company definitely needs to provide an updated picture of the profit path with a more a weaker economy in 2023 where the fintech no longer has to invest aggressively. The stock only has a market cap of $4.5 billion providing a lot of mouthwatering appeal with those adjusted EBITDA targets in 2024 and 2025.

While a lot of investors dislike all SPACs now, SoFi traded at $15 to $20 due to these financial projections. If the company stays on track to hit these numbers once the student debt moratorium expires, one should consider whether the $5 stock returns to those previous valuations.

The company won’t still have a market cap below $5 billion when a legitimate updated EBITDA target for the next year tops $1 billion and this could occur in 2023.

Takeaway

The key investor takeaway is that SoFi is too cheap and CEO Anthony Noto loaded up on the stock. The CEO sent a clear message that business remains strong and the company isn’t facing any loan loss issues in the personal loan sector.

Investors should continue loading up on SoFi below $5 alongside Mr. Noto.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market during the 2022 sell off, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.

Be the first to comment