TU IS

Snowflake Inc. (NYSE:SNOW) is a leading data warehouse provider which is poised to benefit from the growth in “Big Data.” The proliferation of data sources means the Big Data industry is forecasted to grow at an 11% compounded annual growth rate and be worth $273.4 billion by 2026.

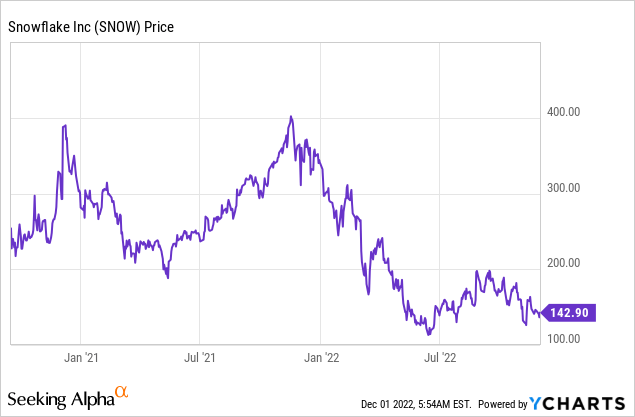

Snowflake recently announced solid Q3 financial results, beating revenue and earnings estimates. However, tepid guidance for the fourth quarter has caused an avalanche in the stock price, which fell by over 5% in pre-market trading. In this post, I’m going to break down the company’s third-quarter financials and valuation in granular detail, so let’s dive in.

Solid Third Quarter Financials

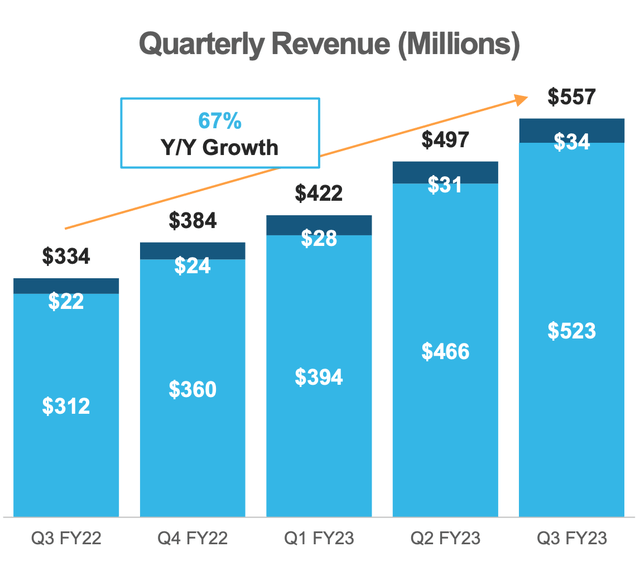

Snowflake reported solid financial results for the third quarter of the fiscal year 2023. Revenue was $557 million, which beat analyst estimates by 3.35% and increased by a blistering 67% year-over-year.

Snowflake earnings (Q3,FY23 report)

Total revenue was driven by strong product revenue growth (light blue bar in the chart above), which increased by 67% to $523 million. While the company’s revenue under contract or remaining performance obligations [RPO] increased by 66% year-over-year to $3 billion.

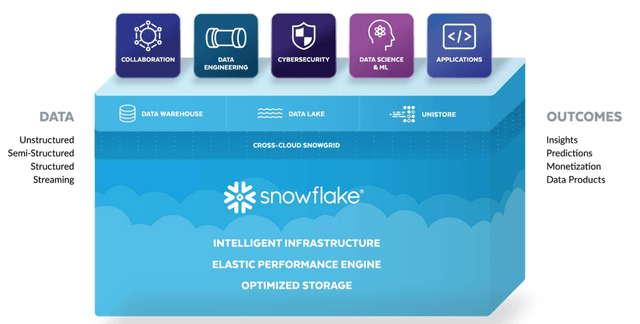

Snowflakes Data Cloud continues to resonate well with large enterprises as they aim to aggregate siloed department data in one place. As you can see from the graphic below, the Snowflake platform can take in unstructured or structured data from various sources. Machine Learning and AI can then be run on the “Big data,” which can then be further used to produce insights, predictions and develop applications.

Snowflake platform (Snowflake)

The unique thing about Snowflake is the platform can operate easily across multiple cloud infrastructure providers such as AWS, Azure, and Google Cloud.

Given a large number of enterprises are adopting a hybrid cloud model for their digital transformation, this makes the Snowflake value proposition enticing. Therefore, it is no surprise to see that G2, a popular enterprise software review website, has Snowflake rated as the number one data warehouse provider by rating. The platform is rated 4.5 stars out of 5, which beats Amazon’s Redshift, which has 4.3 stars out of 5. I have discussed Snowflake’s business model in more detail in my prior post, if you wish to learn more.

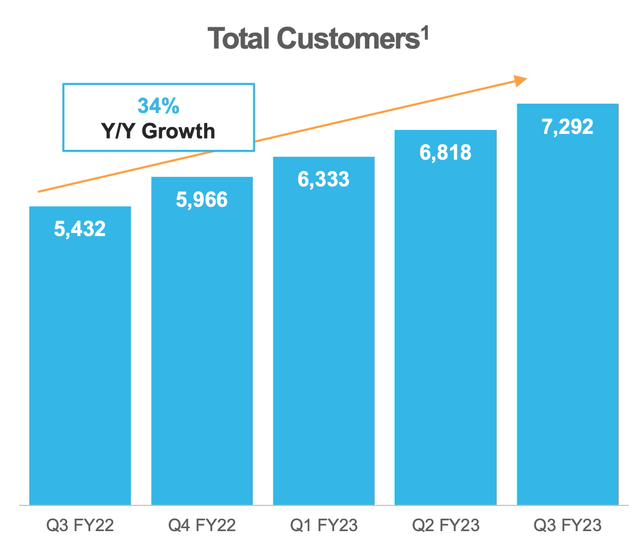

Snowflake has continued to grow its customer base of enterprises and added 28 Global 2000 customers in the third quarter. Total Customers increased by 34% year-over-year, to 7,292.

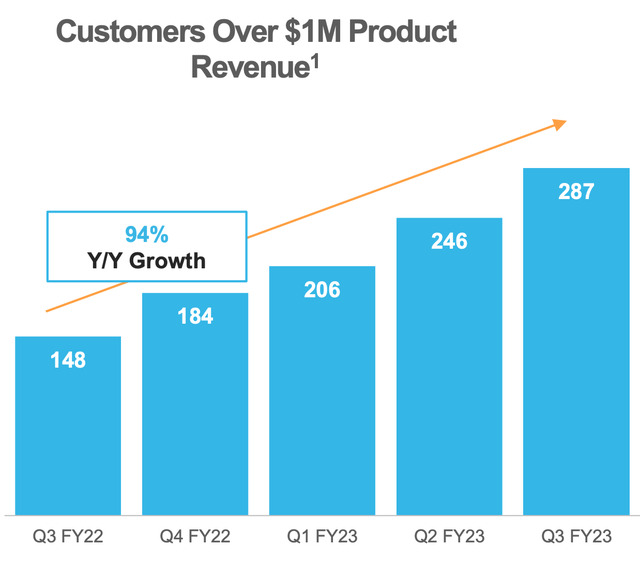

Snowflake now has ~40% of its customers from global 2000 companies and has grown its Customers with over $1 million in product revenue by a rapid 94% year-over-year to 287. Growing “upmarket” is a brilliant strategy, as enterprise customers tend to be more “sticky” by nature and offer greater opportunities for cross-selling products.

Customers $1 million (Q3,FY23)

The beautiful thing about Snowflake is it has built an ecosystem of data providers via its marketplace which acts as a global data-sharing network. This means companies can buy and sell data in order to improve the accuracy of their own machine-learning models and generate extra revenue. Marketplace listings increased by 11% YOY to 1,700 as the service continues to increase in popularity. The goal for Snowflake is to bring the “work to the data” rather than bringing the data to the work, which was the legacy method.

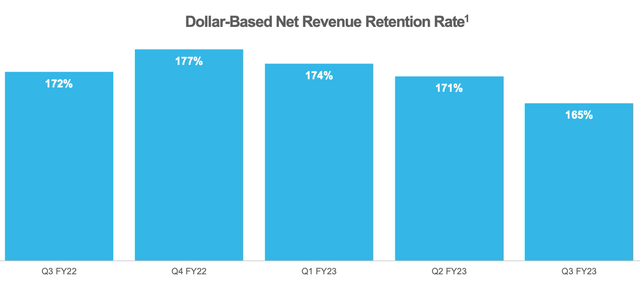

Snowflake further expanded its platform model with the $800 million acquisition of Streamlit, which will enable developers to build data-based applications on top of Snowflake. Since the acquisition in early 2022, the platform has grown its community by over 60% to include 70,000 developers. I believe this is a fantastic acquisition, as the customers of Snowflake have already been using the Streamlit platform to build data apps, and thus it is a natural fit. The Streamlit platform enables apps to creates with simple Python, which is a fairly easy-to-use programming language. The development of Apps on top of the Snowflake platform will likely increase switching costs and thus result in improved customer retention. Snowflake already has a super-high dollar-based net revenue retention rate of 165%, which means customers are staying with the platform and spending more.

By geography, Snowflake reported its fastest growth in North America and the EMEA region, which are its largest segments. By industry, Snowflake is fairly diversified, although its largest segment Financial services increased at the fastest rate overall. Advertising and entertainment sectors lagged, as these industries are currently going through a cyclical downturn.

Profitability, Expenses and Cash Flow

Snowflake has a high gross margin of 75% (non-GAAP), which has improved by 6% year-over-year due to product improvements and increased scale.

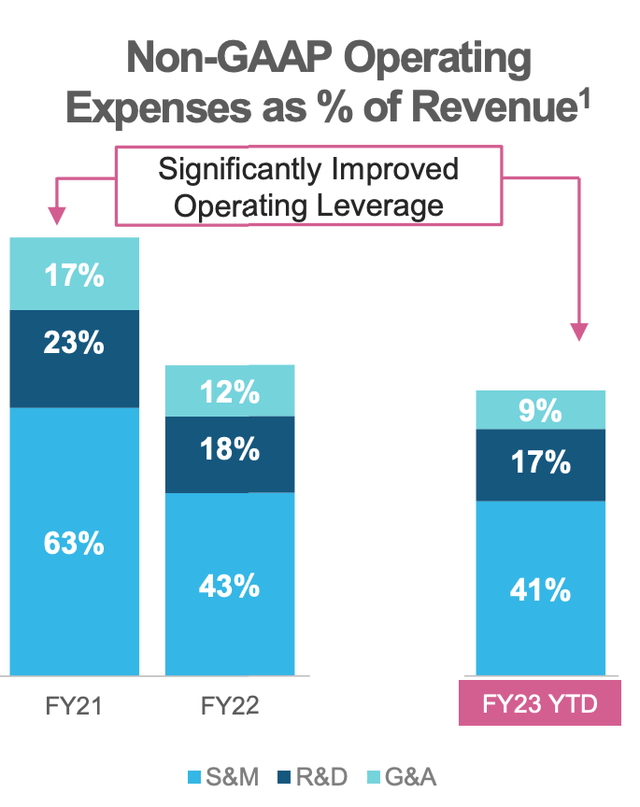

Snowflake reported EPS of $0.11 which beat analyst estimates by 139.34% according to Google Finance data. This was driven by top-line growth as well as a reduction in operating expenses as a portion of revenue. For instance, Snowflake has reduced its G&A expenses from 17% of revenue in FY21 to just 9% by FY23, as the company benefits from economies of scale. The business has also improved its Sales and Marketing efficiency substantially and R&D as a portion of revenue.

Operating Expenses (Q3,FY 23 report)

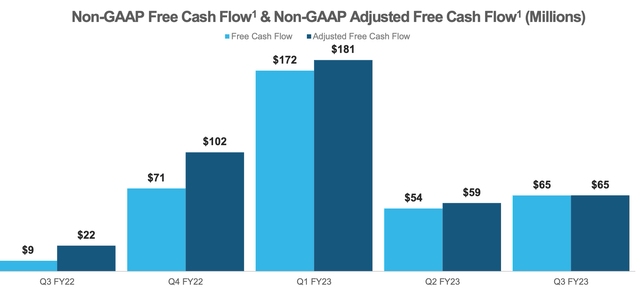

Snowflake reported $65 million in FCF (Free Cash Flow, non-GAPP) at an adjusted free cash flow margin at 12%. This was an improvement over last quarter due to collections and last year as a whole. Like many contract-based SaaS companies, Snowflake will likely see a boom in cash flow in Q1 FY24, as that matches with the timing of contract renewals and collections. You can see a similar pattern play out in Q1,FY23 with a spike in cash flow on the chart below.

Snowflake has a solid balance sheet with $4.9 billion in cash, cash equivalents, and marketable securities. In addition, the company has minimal debt of approximately $241 million as per the Seeking Alpha Balance sheet report (which may not be fully updated yet) or virtually zero debt as per the company’s released documentation.

Tepid Guidance

Snowflake’s management has reported tepid guidance despite confidence in recent consumption patterns by customers. The company is guiding for between $535 million and $540 million of revenue in the fourth quarter, which would represent an increase of between 49% and 50%. This is substantially slower than this quarters year-over-year product revenue growth of 67%. However, management does state they are taking a “conservative approach,” which makes sense given the macroeconomic environment.

Advanced Valuation

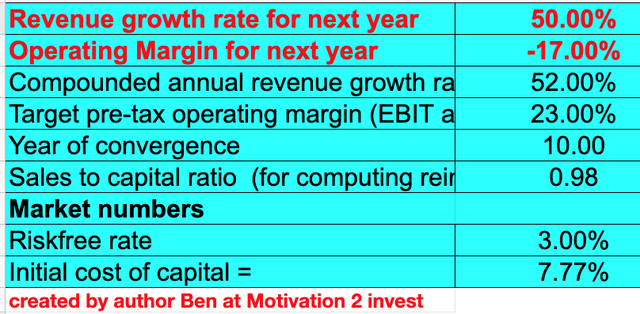

In order to value Snowflake, I have plugged its latest financials into my advanced valuation model which uses the discounted cash flow (“DCF”) method of valuation. I have forecasted a conservative 50% revenue growth for next year (including Q4) which is aligned with management estimates. Then, in years 2 to 5, I have forecasted the revenue growth rate to increase slightly to 52% per year, as economic conditions improve.

Snowflake stock valuation 1 (Created by author Ben at Motivation 2 Invest)

To increase the valuation accuracy, I have capitalized R&D expenses. In addition, I have forecasted a target pre-tax operating margin of 23% over the next 10 years, which is the average for the software industry. I expect this to be driven by continual improvements in operating leverage, and efficiency in marketing.

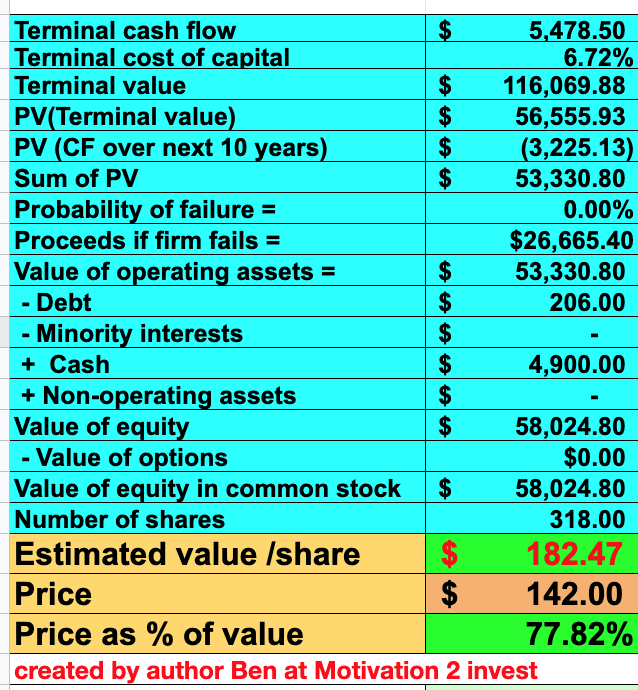

Snowflake stock valuation 1 (created by author Ben at Motivation 2 Invest)

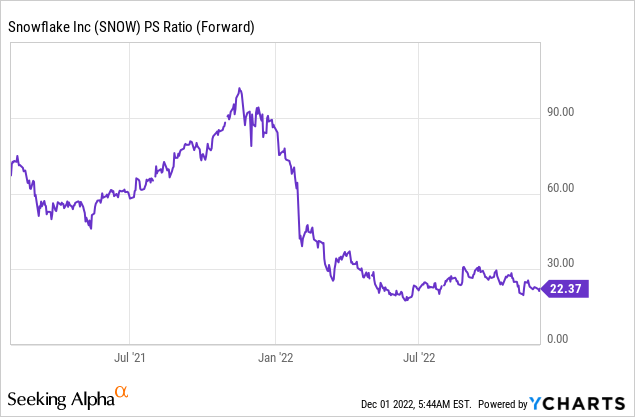

Given these factors, I get a fair value of $182 per share. The stock is trading at $142 per share at the time of writing and is thus is 22.2% undervalued. As an extra data point, Snowflake trades at a Price to Sales ratio = 22, which is still fairly high but cheaper than historic multiples of over 90.

Risks

Recession/Longer Sales Cycles

The high inflation and rising interest rate environment has caused many analysts to forecast a recession. This environment has stricken fear into the hearts of decision-makers at corporate companies. Human beings have a tendency to freeze in times of fear like a rabbit caught in the headlights of an oncoming vehicle. Therefore, I expect longer sales cycles and larger buying committees, which could mean a further slowdown in growth.

Final Thoughts

Snowflake Inc. is a tremendous technology company that is continually innovating its product for consumers. The company has continued to produce strong financial results, and the recent guidance is prudent based on the economic conditions. Snowflake is a stock that is rarely undervalued, but after the recent decline, the stock now looks to be a great long-term investment.

Be the first to comment