Sundry Photography

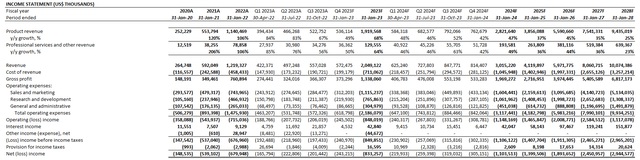

In our most recent coverage on the Snowflake (NYSE:SNOW) stock, we had provided a deep dive into the company’s consumption-based business model, and discussed the implications of which on its near-term fundamental prospects ahead of looming recession risks. During the company’s announcement of its fiscal third quarter results and forward outlook, revenue had continued a trend of deceleration, while other key performance metrics including net retention rate (“NRR”) had moderated as well, which was reflective of an anticipated slowdown in IT spend. The following analysis will dive further into Snowflake’s fundamental prospects, as well as two key weaknesses under today’s volatile market climate – namely, its recurring GAAP-based losses and substantial stock-based compensation spend – and gauge their implications on the stock’s near-term outlook.

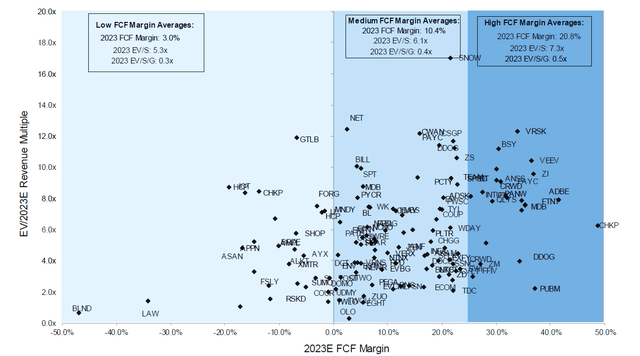

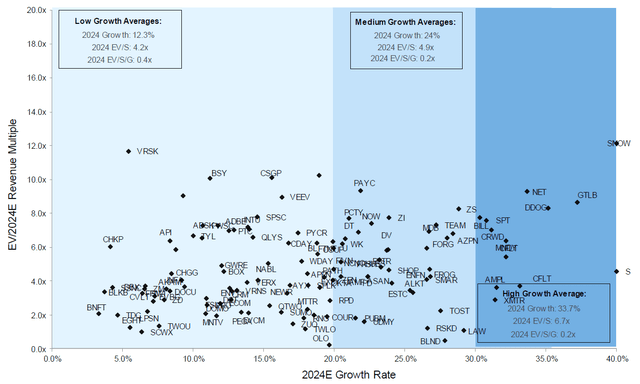

Snowflake has lost close to 60% of its value this year as the broader market rout continues, with software being one of the hardest hit corners as investors’ confidence buckle on rising recession fears. Despite the substantial correction endured by its valuation, Snowflake continues to trade at a lofty premium relative to peers with similar growth and profitability profiles:

Software Peer Comp (FactSet) Software Peer Comp (FactSet)

This continues to dial up the stock’s vulnerability to further downside potential in the near-term. The looming macro downturn is creating an increasingly adverse backdrop for tech stocks with lofty premiums, especially considering expectations for a more prevalent slowdown in tech spending over coming months.

While we expect revenue growth to reaccelerate for Snowflake once current macroeconomic challenges subside, given sustained expansion of its customer base and contracted revenues (or remaining performance obligations, “RPO”) buoyed by spending preference changes in the current market climate as previously discussed, its past days of lucrative triple-digit growth are likely limited, if not over. Visibility into the company’s profitability trajectory also remains largely an uncertainty, making it difficult to justify the stock’s lofty valuation today. Despite being on track towards sustained non-GAAP profitability, supported primarily by its impressive gross profit margins on product segment sales, the company’s prospects for a positive GAAP-based bottom-line continue to be hindered by its massive stock-based compensation spend.

Although Snowflake remains well-positioned for further market share gains, as it continues to support the transition to digital with its next-generation Data Cloud solutions, the stock is expected to face a further downward valuation correction as lucrative expectations previously priced-in by investors start to normalize with added help from the current bear market that is expected to persist for a while longer.

The Near-Term Bear Case

Snowflake currently remains a valuation outlier against peers, as illustrated in the figures above. And two key themes in the business – namely, the recession-prone nature of its consumption-based sales recognition model and the company’s elevated stock-based compensation – currently draw question on whether the stock’s lofty valuation can weather through the deteriorating market climate, especially as risk sentiment grows on rising borrowing costs that stand to levy a heavier discount on the Snowflake’s future prospects.

As discussed in detail in our previous coverage on the stock, the consumption-based model that Snowflake is most reputable for puts its near-term revenue growth trajectory at risk given deteriorating macroeconomic conditions. While times of economic uncertainty encourages a greater shift in corporate decision makers’ preference for consumption-based models over fixed-fee SaaS models, the ensuing flexibility actually raises near-term pains for the service provider, driving stiff headwinds for Snowflake as IT spending slows:

What this flexible scale up / scale down benefit offered to customers for consumption-based software service providers like Snowflake is that its growth and margins would be the first to see a drastic adverse impact at the first sight of an economic downturn – even if they are seeing a higher number of customers. Recall that customer growth is not equivalent to immediate revenue growth for consumption-based software providers – customers can sign up today for an “x” amount of storage or compute capacity to secure long-term unit pricing discounts, but use less or not use it at all as they brave through the looming macro storm, subjecting consumption-based software providers to immense near-term revenue risks. This also means that [net revenue retention], the key performance metric for consumption-based software providers, will likely see drastic deceleration (or even declines) during early stages of a looming or confirmed recession.

Source: “Do You Really Understand Snowflake’s Revenue Model?”

This is consistent with continued deceleration in Snowflake’s product revenue growth reported for the fiscal third quarter, which is expected to persist as macroeconomic conditions stand to weaken further. Although the worst of rising price pressures experienced in the past year appears to have passed, they remain far from the Fed’s 2% target. This continues to encourage the Fed’s hawkish policy stance, with the committee doubling down on the inflation-reining campaign by reaffirming the need to keep rates “higher for longer” to ensure the economy slows. And now, recession fears are dialling up and have largely “replaced inflation angst” in the market, especially as corporate budgets stand to tighten further to safeguard bottom-lines.

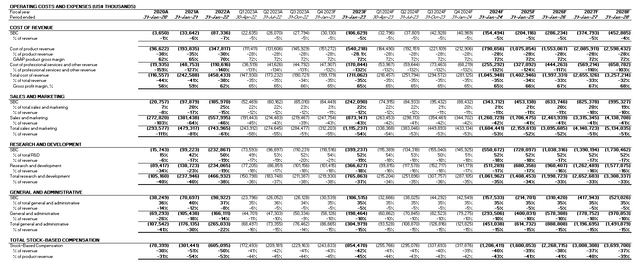

The other overhang for Snowflake is that it remains an unprofitable business under GAAP basis. Despite being a self-sufficient business with positive operating cash flows generated primarily from its product segment operations, stock-based compensation remains a significant portion of its cost of sales and operating expenses. Specifically, Snowflake’s stock-based compensation averaged close to 50% of revenues over the past six quarters, representing one of the highest levels of related spending in the industry.

Although Snowflake is likely to outpace its FY29 target for non-GAAP operating income of about 10%, considering some of the objectives like 75% non-GAAP product gross margin have already been met, elevated stock-based compensation will continue to slow its progress to GAAP-based profitability. Under the current risk-off market climate where investors are not only chasing growth but also profitability, the low visibility on Snowflake’s timeline to positive GAAP-based net income is becoming a problem. The elevated stock-based compensation figure also draws share dilution risk, which increases Snowflake’s vulnerability to further downward valuation adjustments ahead of the dour market climate:

Data cloud business Snowflake has one of the highest levels of stock-based compensation, at 54 per cent of revenue on average over the last six quarters. This translates into annualized dilution of 7.3 per cent on average over the same period, and has contributed to the 47 per cent fall in share price so far during 2022.

Source: “Stock-Based Comp Exacerbates Tech Selloff, Aussies Not Immune”, Financial Review

Longer-Term Bull Case

Yet, Snowflake’s NRR has remained resilient so far and is largely consistent with its historical trends. Recall from our previous coverage on the stock, NRR is viewed as one of the most reliable performance metrics for companies running a consumption-based revenue recognition model. This is because revenue recognition under the consumption-based model is inherently choppy in nature with low level predictability, making traditional performance metrics for software companies like “annual recurring revenues” (“ARR”) inadequate. Meanwhile, NRR, which compares revenue growth changes between same groups of customers in different periods, provides a better picture of whether the service is really being used, or if demand is stagnate. With Snowflake’s NRR still consistent with historical trends despite growing signs of IT spending weakness this year, there is reasonable validation that its Data Cloud solutions, among other products offered, remain in high demand.

Resilient NRR also suggests potential for sustained market share gains for Snowflake over the longer-term amid a secular demand environment buoyed by digital transformation trends. Businesses are becoming increasingly digital, generating vast troves of data that will need to be integrated, processed and analyzed to drive key decision-making processes. And with only 4% of the corporate landscape claiming to have a “highly sophisticated approach to leveraging data”, Snowflake’s Data Cloud solutions stand to benefit from massive growth headroom still.

And despite decelerating sales growth amid mounting macroeconomic uncertainties, Snowflake’s contracted revenue base remains robust, thanks to the appeal of its flexible consumption-based model to diminishing IT budgets under today’s operating environment. The company’s RPO continues to expand strongly at high double-digits, providing visibility into its longer-term top-line growth prospects. This is also complementary to the consumption-based model’s likelihood of faster recovery when macroeconomic conditions improve, driving potential reacceleration in sales growth given the anticipated rebound in usage of Snowflake’s Data Cloud solutions:

A consumption-based model company is also likely to be the first to benefit from an economic recovery, given there is no time-lag in re-ramping up revenue (e.g. no wait time for subscription-based customers to rehire previously laid-off talent). And considering the anticipated increase in new customer volume acquired over the looming economic downturn due to the shift in demand preferences from subscription-based to consumption-based, Snowflake will likely be in an advantageous position once macro headwinds clear.

Source: “Do You Really Understand Snowflake’s Revenue Model?”

Fundamental and Valuation Analysis

Despite Snowflake’s favourable growth prospects into the longer-term, we remain concerned over the sustainability of the stock’s lofty valuation. Not only does Snowflake’s sizable valuation premium exposes its shares to greater volatility as investors’ confidence in risky assets weaken on deteriorating macroeconomic prospects in the near-term, the company’s foggy pathway to profitability is also another top concern.

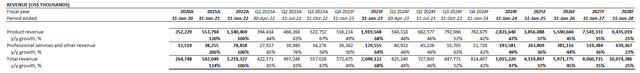

In our base case fundamental forecast for Snowflake, we have assumed a ~40% CAGR to its contracted revenue base over the forecast period. While the figure is substantial, it remains reasonably supported by the company’s historical growth trends, the estimated TAM (total addressable market) for cloud-based data analytics/storage/management solutions over the forecast period, and the nascent nature of digital transformation trends still that warrant robust demand for related solutions over coming years. This accordingly translates to estimated product revenue expansion at a 38% CAGR over the forecast period based on Snowflake’s historical NRR rate, and the anticipation for pent up usage of contracted capacity by customers once recession fears fade. The estimates are also consistent with management’s target timeline to $10 billion in product sales by FY29.

Snowflake Revenue Projections (Author)

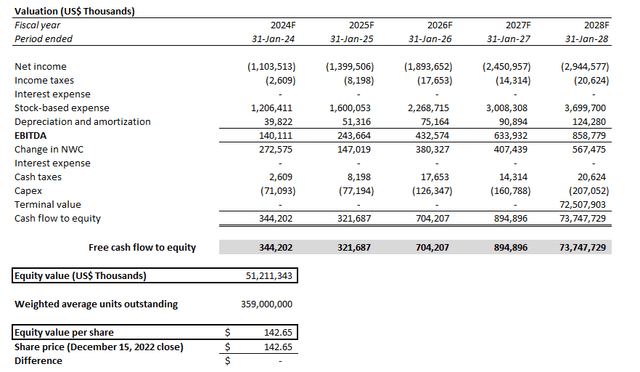

However, our base case forecast does not expect GAAP-based profitability within the next five years. While we remain optimistic that Snowflake will hit its FY29 non-GAAP objectives, the company’s high volume of stock-based compensation spend continues to shed uncertainty over its GAAP-based profit outlook over the forecast period. The lack of management guidance on anticipated stock-based compensation spend and if it would decline towards more normalized levels soon is also starting to draw greater investors’ focus on when Snowflake might be able to appease investors’ growing appetite for real profitability.

Snowflake Cost Projections (Author) Snowflake Financial Forecast (Author)

Snowflake_-_Forecast_Financial_Information.pdf

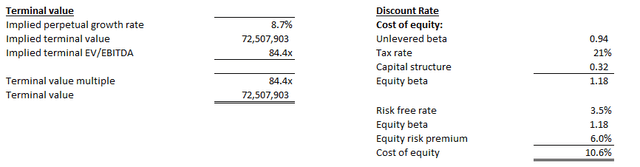

Applying a discounted cash flow analysis in conjunction with our base case fundamental forecast for Snowflake and a WACC in the 10% range consistent with the company’s capital structure and risk profile, its current market value at $142.65 apiece (as of December 15 close) implies a perpetual growth rate of almost 9%.

Snowflake Valuation Analysis (Author) Snowflake Valuation Analysis (Author)

Although the company does demonstrate favourable prospects of maintaining robust double-digit growth over coming years, a 9% perpetual growth rate is a substantial premium to anticipated economic expansion across Snowflake’s core operating markets, primarily the U.S., followed by EMEA and Asia-Pacific and Japan (“APJ”). Recall that GDP is a key benchmark to gauging perpetual growth prospects for various industries and businesses:

The perpetual growth rate is typically determined by using GDP as a key benchmark, adjusted for maturity of the industry as well as other company-specific factors such as market leadership and/or market share. Companies operating in industries that are higher growth in nature are typically valued at a perpetual growth rate closer to or more than GDP, given their greater contributions to economic growth.

Source: “Shorting Tesla: Bridging the Lofty Valuation to Economics”

This accordingly makes it difficult to justify Snowflake’s valuation premium, despite being already traded down close to 60% this year. And as discussed in earlier sections, the stock also boasts a hefty premium on a relative basis to peers with a similar growth and profitability profile. Taken together with faltering macroeconomic conditions still, the stock remains at high risk for further susceptibility to the volatile market climate over coming months.

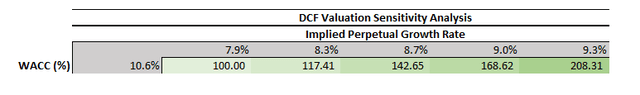

To gauge the extent of which Snowflake’s valuation could fall further, considering rising interest rates and demand weakness in the near-term, we have performed a sensitivity analysis on its estimated perpetual growth rate:

Snowflake Valuation Sensitivity Analysis (Author)

If the stock drops another 30% to the $100-level per share, the implied perpetual growth rate would still be in the 8% range. This would still be a substantial premium when punt against the economic growth prospects in Snowflake’s core operating regions.

Admittedly, another 30% decline to Snowflake’s market value today would drive a 70% year-to-date wipe-out, and would likely require a drastic shift in investors’ sentiment and confidence in the stock – similar to market’s adverse response on signs of structural growth and profitability stagnation at tech bellwethers like Netflix (NFLX) and Meta Platforms (META) earlier in the year. Yet, the risks of a similarly adverse sentiment shift happening to Snowflake within the foreseeable future remains possible in our opinion, given the near-term slowdown in IT spend and the company’s unprofitable nature are becoming ever more frowned upon in the increasingly risk-off market climate. Particularly, the surging cost of capital continues to shy investors from funding long-duration businesses like Snowflake, with the substantial portion of its free cash flows still being the farthest out from realization, even though it continues to benefit from a robust demand environment.

Risks to Consider

Although fragile market sentiment and Snowflake’s valuation premium do not bode well together, there is potential that contracting multiples on long-duration stocks are starting to normalize. Specifically, 10-year Treasury yield has come down significantly from the 4% level in October to now at the 3.5% range, reducing the risk-free rate used to discount long-end free cash flows, despite sensitivity still on front-end borrowing with the rate hike cycle expected to last through at least 1H23. With a moderating risk-free rate and Snowflake’s debt-free capital structure, which reduces its exposure to impact from surging borrowing costs in the near-term, its long-duration free cash flows could potentially benefit from less heavy discounting going forward as the pace of Fed monetary policy tightening potentially slows on easing inflationary pressures.

Final Thoughts

Despite Snowflake’s favourable long-term demand environment, there are still weaknesses to the quality of its fundamentals – namely, the protracted losses, its business model’s inherent sensitivity to recession risks, and substantial stock-based compensation spend – that could potentially cause the stock’s lofty valuation premium to buckle on increasingly fragile market sentiment. With a myriad of moving pieces (e.g. Fed policy, inflation, recession, etc.) in the macro backdrop that have yet to play out their influence on broader market valuations, we continue to caution the downside risks of investing in Snowflake at current levels.

Be the first to comment