Charday Penn/E+ via Getty Images

One of the most fascinating growth stories in recent years involves a company called Snowflake (NYSE:SNOW). As a play on big data and the cloud, it should come as no surprise that the company’s revenue has expanded at a rapid pace over the past few years. This includes the years leading up to the company going public. This year, that strong growth is expected to continue and what is most interesting is that while the company’s stock is near a 52-week low, it is finally showing signs of turning cash flow positive. The market has put a high price on this kind of growth, leading to the enterprise to being worth $43.1 billion as of this writing despite issues regarding profitability. But at the end of the day, the market is merely trying to price in what all of this future growth will lead to. This can be a dangerous way for investors to approach an opportunity. However, the growth story and prospects for the enterprise is truly compelling and its future, operationally speaking, looks quite bullish. At the end of the day, as a value investor, I do not have much appreciation for a bet on future growth. This might lead other value investors to rate the enterprise a ‘sell’, but I have decided, based on how the company operates and the speed at which it continues to expand, to assign it a ‘hold’ designation at this time.

A play on data

As I mentioned already, Snowflake is a play on big data and the cloud. According to management, the company’s primary product is a network that the business has named Data Cloud. On this network, customers, partners, data providers, and data consumers can break down data silos in order to better organize and analyze data in a secure, governed, and compliant manner. Using this technology, the company empowers its customers to gather additional value from the data that they collect, as well as to build data-driven applications aimed at optimizing that data, and to even share that data.

These activities solve the problem that many companies with data have experienced since time immemorial. While having data is excellent, it can only truly be optimized when you have a platform that allows you to easily break it down, organize it, analyze it, and then use it for whatever purpose makes the most sense. To illustrate just how strong demand is for a feature like this, we need only consider how much data the company processed in the month of January of this year. During that month, the company processed an average of just under 1.5 billion daily queries across all of its customer accounts. One year earlier, this number was only 777 million.

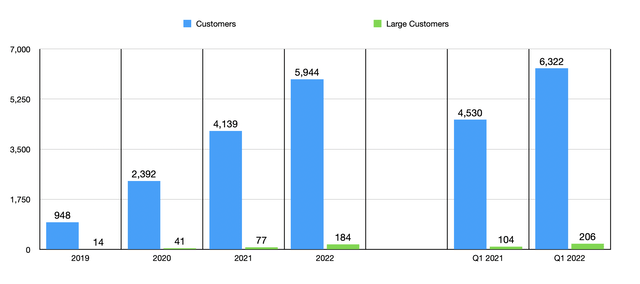

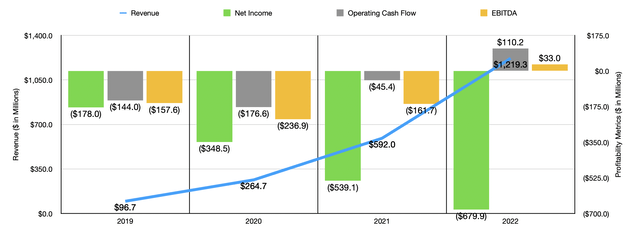

The company’s financial performance has been truly remarkable in recent years. Consider revenue from 2019 through 2022. During this time frame, sales of the business skyrocketed from just $96.7 million to $1.22 billion. This increase was driven by a surge in the number of customers the company has. Back in 2019, the company ended that year with 948 customers. By the end of its 2022 fiscal year, this number had risen to 5,944. The company has also seen a significant rise in the number of customers paying it $1 million or more over a 12-month window. In 2019, this number was just 14. By the end of its 2022 fiscal year, it had grown to 184. Put another way, while the total number of customers the company has increased by 527% over this four-year window, the number of customers paying the company a significant amount of money jumped by 1,214%.

Unfortunately, not everything has been great for the enterprise. Growth is expensive and that can be seen when looking at the company’s profitability. Even as revenue has grown, the firm’s net loss has widened considerably. In 2019, the company generated a loss of $178 million. By 2022, this number had skyrocketed to $679.9 million. At first glance, this may lead some investors to run for the hills. However, it is worth noting that a significant portion of the company’s cost structure has been the payment of stock to employees in exchange for their services. A more appropriate measure of the company’s success would be cash flow. Over the same four-year timeframe, operating cash flow went from a negative $144 million to a positive $110.2 million. A similar trend can be seen when looking at EBITDA. This metric ultimately went from a negative $157.6 million in 2019 to a positive $33 million last year. Of course, the road for this was not smooth. The worst year was the company’s 2020 fiscal year when it generated negative EBITDA in the amount of $236.9 million.

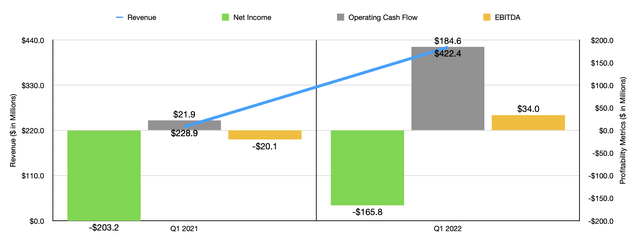

The company’s growth has continued into the current fiscal year. Revenue in the first quarter totaled $422.4 million. That’s 84.5% above the $228.9 million generated one year earlier. Naturally, a significant driver for this was a rise in the number of customers the company has. This number increased from 4,530 to 6,322 year over year. The growth experienced for significant customers, once again those generating $1 million or more in annualized revenue for the company, rose from 104 to 206. That’s an increase of 98.1%. For the 2023 fiscal year as a whole, management expects product revenue to be between $1.885 billion and $1.90 billion. At the midpoint, that would translate to a year-over-year growth rate of 65.9%. This excludes revenue associated with professional services and other activities. However, those sources comprised just 6.5% of the company’s sales for its 2022 fiscal year. So overall revenue for 2023 should not be significantly different. Just as has been the case in prior years, profitability has also followed revenue. The company’s net loss narrowed from $203.2 million in the first quarter of 2022 to $165.8 million the same time this year. Operating cash flow went from $21.9 million to $184.6 million, while EBITDA turned from a negative $20.1 million to a positive $34 million.

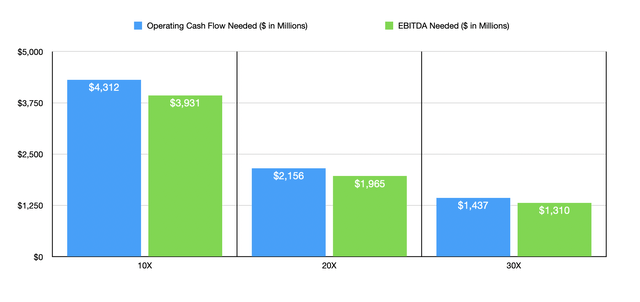

One of the most difficult things about analyzing a rapidly growing enterprise, particularly one where its bottom line is changing at a significant pace, is that valuing the business is incredibly tricky. I have found, over the years, that a better way to frame the valuation question is to ask what the company would need to achieve in order to be worth at least what it’s trading for today. For instance, if we assume the company is ultimately worth 10 times its operating cash flow and 10 times its EBITDA, then these metrics would need to be $4.31 billion and $3.93 billion, respectively. At 20 times, we are looking at $2.16 billion and $1.97 billion, respectively, while at 30 times these numbers are $1.44 billion and $1.31 billion, respectively.

Based on current revenue projections for this year, these members are far and away from being realistic in the near term. However, if we assume that the business will continue to expand at an annualized rate of around 30% for the next five years, and apply an EBITDA margin of 20%, A reading for that metric would be around $1.50 billion. Though at the high end of the EV to EBITDA multiple range, this is still in the ballpark of being realistic. Even if revenue grows at closer to 20%, we are still looking at EBITDA of around $1.01 billion. Of course, this is contingent on margins continuing to improve. The most recent EBITDA margin for the company was 8%, but as I showed already, the company’s bottom line does continue to improve from year to year. Likewise, if margins are even stronger, then the amount of growth needed to justify the company’s current valuation would drop.

Takeaway

Based on the data provided, I must say that I am impressed with the track record achieved by Snowflake and I believe the future for the business, operationally speaking, is bright. Given how pricey shares are today, I do not think that the company is a great prospect to buy into right now. However, I could see a scenario where this price is eventually justified in the next few years. Because of the rapid growth the business is experiencing, I have decided to rate the business a ‘hold’ for now.

Be the first to comment