AltoClassic/iStock via Getty Images

Snowflake (NYSE:SNOW) is cementing itself as among the handful of cloud software companies that can actually capture about a quarter of their TAM (Total Addressable Market), now presented as $90B or so. Theoretically, every enterprise above a moderate size could use data warehousing services, and the business execution by Snowflake so far indicates that the flywheel for growth is well oiled.

At the ~$145 range, SNOW makes sense as an investment for the long term – offering robust compounding potential for investors who stick through.

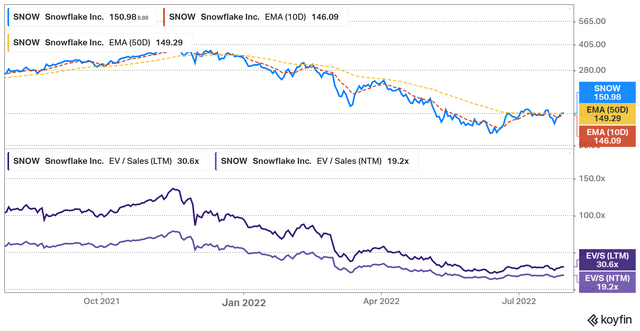

One might argue that this stock could head lower in an extended bear trend and that the valuation is still holding a little too much baked in. As I write this, SNOW is still valued at 19x on the Next Twelve Month EV/S multiple. This is a massive market valuation on a relative basis, considering the worsening baseline cost of equity that’s now a few points up. Regardless, I’d like to argue that it is an exceptional business that deserves the big sector premium and then some.

I had written an introductory article on the business after it went public more than a year ago and made the following remarks at a ~$250 price. There were a few comments from that:

When the market is already pricing in success, especially at this very nascent IPO stage, you aren’t being compensated enough for risk, volatility, drawdowns, and the very real possibility that the business falls short. Snowflake appropriately commands a high valuation for its business. I must admit, that I too scoffed at the price before diving deeper into the company. Upon further analysis, there seems to be more justification for its valuation than I previously hypothesized. It is stretched, but not absurd. There’s more downside than upside from here in the short-term and the price relative to the long-term prospects isn’t attractive enough to warrant a spot in my portfolio.

It’s now ~$145, and is attractive enough to warrant a substantial holding in my portfolio. I began nibbling a little at <$200 and increased my position significantly on the deeper dips in recent months. Meanwhile, the earnings reports have been strong as leading metrics outperformed expectations for the past few quarters. There will be some headwinds for short-term growth, but the reasoning behind the last earnings call appeared rational and under control. With a significant price drawdown, I sense an opportunity here. Even by extending today’s more modest valuation paradigm, there’s big upside potential.

Recap: Data Warehouse In Evolution

Snowflake, as many might know, is a modern data warehousing solution that charges customers on a pay-as-you-use basis. Organizing data, removing silos, and solving governance issues while making it available to whoever needs it, have been ongoing problems plaguing any modern enterprise at different points across the spectrum. Removing all the friction, maintenance, and extra management of it is key to unlocking intelligence from the data, and that’s where Snowflake comes in as a packaged solution that bridges the back end of data to the decision-making front.

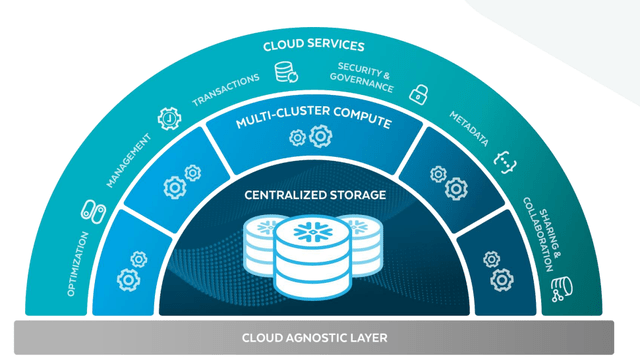

Snowflake Architecture (Snowflake Investor Presentation)

Snowflake rests upon the big infrastructure providers (i.e. Azure, AWS, GCP) by building a software solution that supercharges data management, and therefore insight and decision making.

The company has expanded on the warehousing functionality with data science, engineering, apps, tools for more app development, and other new use cases. Ultimately, it’s not quite an app, but a platform, and one that has integrated years of hardcore engineering to function at the level of proficiency that made it into a multi-billion sales enterprise.

I’ve covered more on the warehousing-specific tech and its variations in my first article, but it’s worth noting the results Snowflake offers on hand that produce rapid ROI for its customers over time. The Total Economic Impact Study, independently carried out by Forrester noted a 600%+ ROI on an amalgamated group of previous Snowflake customers that agreed to participate in the study. One can take it with some salt, as the study was in 2020, but I’ve seen many of the primary benefits still hold true across today’s online customer reviews and studies:

- Cost savings from accelerated time to market

- Increased profits from faster time to market

- Improved decision-making support from faster access to data

- Simplified data operations

- Infrastructure and database management savings

The pay-as-you-use nature of the Snowflake business model provides convenience and ready elasticity, arbitraging the otherwise massive infrastructure costs if done independently without an intelligent optimization layer. Managing, allocating, and governing data from a host of silos have plagued most IT teams. It appears that Snowflake has built the platform to jump ahead on most of those issues toward frictionless data intelligence. When moving with the markets, responding to trends, product development, and deployment for any business depends on the speed in a hypercompetitive landscape – Snowflake offers the warehousing solution built for the cloud.

Why The Data Cloud Vision Matters

For a few quarters now, the company has been harping on about the “Data Cloud”. While it may sound like vague software jargon, there’s a real new vertical for Snowflake to capitalize on here.

As a host for data for a few thousand enterprises, and a fraction of the Fortune 2000, the data cloud seemingly opens up the possibilities for the cross-functionality of that data. To be more specific, they’re creating a unified marketplace for the silly amount of data already there to be used by any of their customers, controlled and governed by the original owners of it. The Data Cloud, at least to me, is about increasing the mobility of the complete amount of data on the Snowflake platform across enterprises and buyers.

That mobility is important. Snowflake, by virtue of this Data Cloud, is uniquely positioned to become one of the leading marketplaces of data anywhere in the world. With a quarter of the Forbes 2000 on the platform already, and an increasing number of third-party data providers, Snowflake leverages the optimization and cost efficiency of hosting all that data to build this marketplace which they’re looking to now monetize as of their last earnings call.

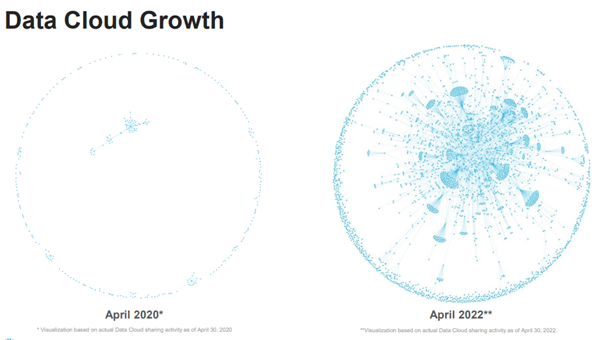

Data Cloud Visualization (Snowflake Investor Presentation)

The company visualized the growth of the Data Cloud using the graphics above. Unsurprisingly, the exchange of data has been exponential, enabling a whole host of analytics and insights that were previously not quite possible. And since Snowflake hosts it, the time to Extract, Transform, Load, or query the out-of-enterprise data one needs is extremely easy. It saves time and increases speed – doubly important for big data needs.

Such innovations that are not particularly meaningful on the financials, can have a large impact down the line. They also serve to differentiate Snowflake from its competitors such as Google’s BigQuery or Azure. I refer to these aspects of a company as “optionality” – an embedded call option that can come into money and boost financials down the line. Such things are often overlooked by analysts.

Growth Amidst Competition

As of the last quarter, note the latest growth metrics:

- 178% YoY Net Revenue Retention Rate, increasing sequentially over the last few quarters

- 102% Revenue Growth

- 139% Customer count growth for >$1m annual product revenue

Source: Quarterly Financials

If the general cloud tech moves fast on growth, Snowflake has moved faster. The retention rate is leading the entire pack among mid-large public software companies. This is primarily due to the pay-as-you-go model, which still appears underappreciated in some aspects.

While software investors are used to predictable annual recurring revenues and forecasting, Snowflake’s business model is tied to a variable, but ultimately secular growth trend of the amount of net total data across enterprises. While companies will optimize for the data storage and warehousing they need, it is seemingly inevitable that the amount of data any modern enterprise would need will keep growing exponentially over the long term. That factor translates to excess top-line double-digit percentage growth should Snowflake entirely stop acquiring new customers altogether. On account of the long-term, this mechanism is what will enable the company to expand faster and longer on a financials-basis. In my view, such a business model demands an appropriately high premium to the regular SaaS model on valuation. There’s a virtual inevitability to data growth, recession or not.

Competition exists, of course, coming from data-warehousing solutions provided by the big cloud infrastructure businesses: AWS Redshift, Azure, and Google’s BigQuery. On the more innovative front, Databricks offers datalake solutions that may be less directly competitive now, but will increasingly overlap in use cases with data-warehousing as the space evolves.

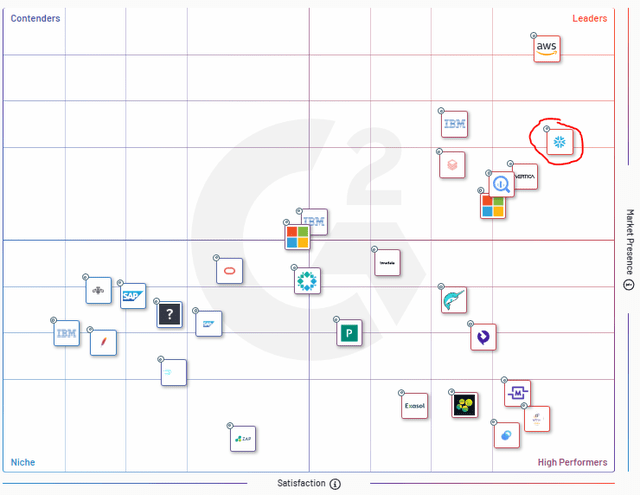

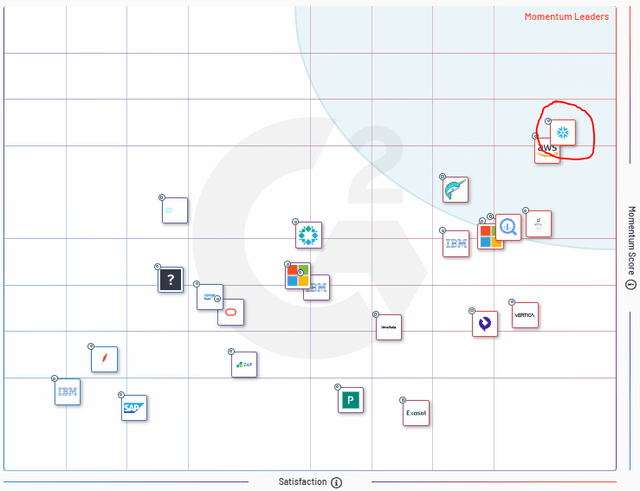

According to G2 Crowd, Snowflake has the highest customer satisfaction score for Data Warehousing, and is high up in market presence, right behind AWS RedShift, and IBM’s solution.

G2 Crowd Grid for Data Warehousing (G2 Crowd Website)

Factoring in current trends on G2 reviews, Snowflake is experiencing higher momentum compared to Amazon’s Redshift and other counterparts. G2 grabs their Momentum scores from customer review counts, but one could infer that Snowflake is gaining market share ahead of the competition, going by this rather imperfect data. If it is true, this works in investors’ favour as economies of scale and pricing power come along as well.

G2 Crowd Momentum Grid For Data Warehousing (G2 Crowd)

It is worth remarking on Snowflake’s relationship with Amazon Web Services. AWS and Snowflake both cooperate and compete with each other. The cooperation involves a partnership on co-sales where AWS sells Snowflake to its existing and new customers. The competition comes across with AWS Redshift, also a data-warehousing solution. At least for now, Amazon appears to have partnered with the best of the breed and is overlooking immediate competition on warehousing to sell the bigger picture for customers – thereby offering a more competitive solution to set itself apart from Azure and GCP. This wasn’t the case two years ago, but I’d take it as a massive vote of confidence from the most complete cloud infrastructure provider out there at the moment. That said, it’s also a risk, should AWS choose to push through Redshift (the in-house warehousing solution).

Financials

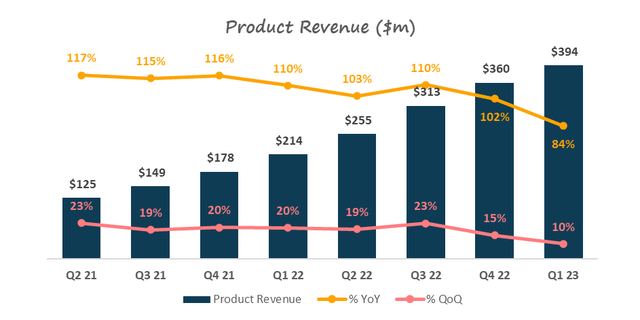

Product Revenue & Growth (Author, Snowflake Quarterly Results)

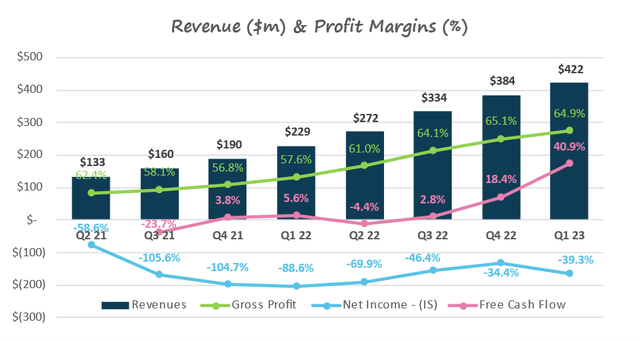

Financial Performance Chart (Author, Quarterly Results Data)

Snowflake will quickly record a $2B annual sales run rate, probably by the end of the year. While sales have been on a decelerating growth trend, the company remains one of the fastest growing software businesses around and one of the largest high-growers too. Macro headwinds do exist, as CEO Frank Slootman mentioned on the last earnings call – the headwinds involve a shift in focus from enterprise customers from expansionary contracts to optimization. This is a clear short-term negative, but one ought to consider the long-term scope of the Snowflake opportunity and addressable market. The macro-environment has indeed shifted and will lead to altered spending patterns. The Q1 results and FY2022 guide earlier this year, along with the general tech crash, have been quick to take in these risks and compress the stock price. That presents an opportunity.

Snowflake has impressively generated substantial Free Cash Flow along with its high growth. Reading between the lines, this represents disciplined cash management but also an ability to exercise pricing power. More than any other metric, FCF generation indicates that Snowflake can and has been going toe to toe with the big infrastructure players. In an environment where the cost of capital has increased dramatically and many software businesses are far below the breakeven line, Snowflake stands alongside very few names in the space. One should expect the 40.9% margin to moderate quite a bit, with management guiding in the teens for FY22. The profitability has been helped by an improving gross margin, and if things do go a little wrong, Snowflake has accumulated $4B in liquidity on its balance sheet. In summation, the high growth and cash generation will continue as before, even through a recession.

Valuation Multiples & The Long Term

Sales Multiples (Koyfin)

The EV/S multiple on the next twelve-month basis of 19.2x accounts for a slightly in-line analyst consensus estimate for FY23 (growth of 65.9% vs 65-7% YoY on guided sales). This is all fine, but one ought to account for the long-term product revenue roadmap of $10B in product sales with a 25% FCF margin.

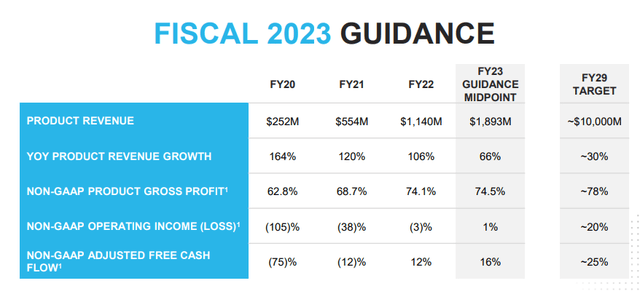

Snowflake Guidance (Snowflake Q1 Presentation)

FY29 ends in January 2029, about 5.5 years from now. In my internal forecasts, I’ve been a little more aggressive and have pegged the target for about $10B in Product Revenue (with $11B in Total Revenue) for FY28. To me, management has historically been conservative, consistently beaten earnings, and is executing on business demands extremely well under the proven leadership of Frank Slootman (ex-CEO of ServiceNow) at the helm. With a forecast of about 32% YoY growth in FY28, and an exit 45x FCF multiple at 25% margin, and 10% share-count dilution, I get about 19% IRR potential from current prices for 5+ years. To provide some context, mid/high-20% YoY growers with $7B+ annual sales such as ServiceNow (NOW) are priced higher on today’s FCF multiples.

To me, my forecasts provide a reasonable basis for the long-term and enough compounding potential to warrant a sizeable stake. This isn’t the highest return potential around amidst tech, but I’d urge investors to look at the complete quality of the business and what that implies for downside risk. Snowflake had raised its long-term FCF margin targets in 2021 from 15% to 25%. Once thought of as an up-and-comer to infrastructure providers, it is now sophisticated enough to partner with, instead of compete with Amazon. And the business model offers a flywheel like no other in the software space, recording signs of eating market share everywhere against the best offerings in the industry. Solid balance sheet too with tightly run profitability. Then there’s Frank Slootman, who is likely one of the best Silicon Valley operators out there; the now-behemoth ServiceNow owes a lot to him for what they are today at a near $100B market cap. Quality growth that ticks all the boxes is rare and Snowflake appears to be one such business.

Risks

Macro: The most obvious risk for perhaps any growth-oriented stock on the market for the next 12-18 months. The company has made an adjustment in the last two quarters to cull some expectations on growth while re-instating its long-term target of $10B in Product Revenue in a few years. Enterprises will appropriately reduce their spending on fresh software but it appears that the data-warehousing adoption trend is still one that should cut through a recession on sales alone. That said, more pronounced downside risks for near-term financials can lead to a deeper selloff in the stock price. One thing the market has hated this year is decelerating growth. If enough of that deceleration has not been priced, there could be some pain.

Competition: Redshift, Databricks with datalakes, and BigQuery. Snowflake isn’t the clear leader in the space and will have to compete. Should other options spruce up as more competitive, Snowflake’s long-term prospects on market capture may be culled.

Reliance on AWS: Amazon harbours some leverage over Snowflake’s expansion on their infrastructure services. This forms a sort of partnership risk that could turn sour in the future.

Financial Risks: Increasing costs of cloud infrastructure and provision would directly impact the gross margin of Snowflake. Margin compression impacts bottom line profitability. With the commodity cycle elevated again, one could see the financials hurdle lower in the short term. As with any growth company, a tightening on cash slows down re-investment in market capture.

Conclusion

Snowflake is one of the few software companies that can actually meet its lofty ambitions. I say that because of the multiple signs of product excellence, innovation-based optionality, market share taking, and financials that are ready to withstand a recession. Unlike other software players, Snowflake doesn’t have to radically change its growth strategy to account for a shortage of cash because they’re already free cash flow generative. This factor only reinforces the story as a sign of early pricing power and the platform’s value proposition for customers. At a $145 price, SNOW is a long-term Buy.

Be the first to comment