Paul Morigi

Snowflake (NYSE:SNOW) stock plunged after reporting third quarter earnings even though the company crushed consensus estimates and raised full-year guidance. These are notable achievements, but this is a stock which even after a crash from all-time highs still commands a rich valuation and large premium relative to more beaten-down tech peers. While I remain bullish on the long-term trajectory of its data warehouse business, the stock is likely to remain volatile in the near term as its valuation has not been “de-risked” nearly to the same extent as enterprise tech peers. I continue to find SNOW buyable for those looking for a strong secular story, though better opportunities are likely found elsewhere in the tech sector.

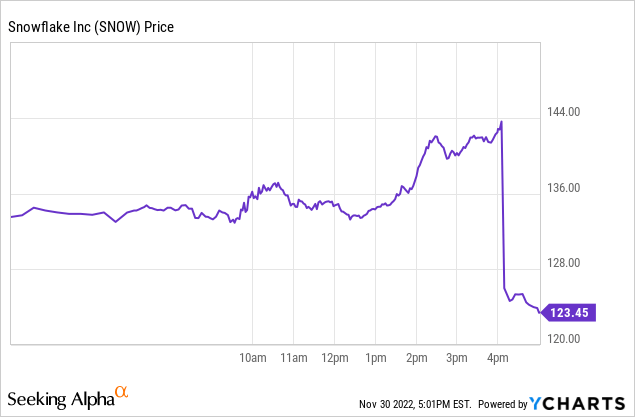

SNOW Stock Price

SNOW stock sank double-digits after hours soon after releasing results.

That reaction is not too surprising considering that cybersecurity tech stock CrowdStrike (CRWD) also sank double-digits in Wednesday’s trading. Both these stocks suffer from the same issue: valuation. Rich valuations lead to high expectations, and for these two top tier companies, beating and raising guidance is not enough. I last covered SNOW in October and the stock has since fallen over 20% (inclusive of the after-hour plunge). The stock was richly valued then and still commands a notable premium to peers even now.

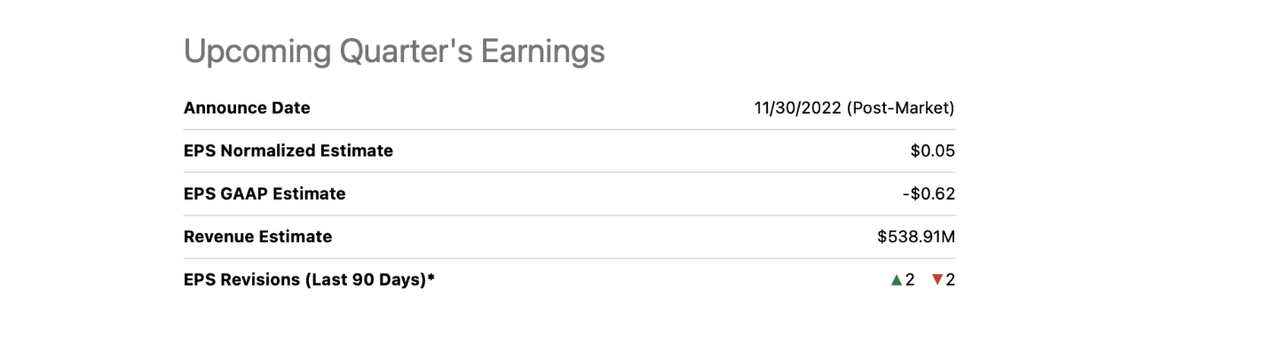

SNOW Stock Key Metrics

Consensus estimates called for $538.9 million in revenue and $0.05 in non-GAAP EPS.

Seeking Alpha

SNOW delivered $0.11 in non-GAAP EPS but I doubt many investors were focused on that metric. Revenue came in at $557 million, handily beating consensus estimates.

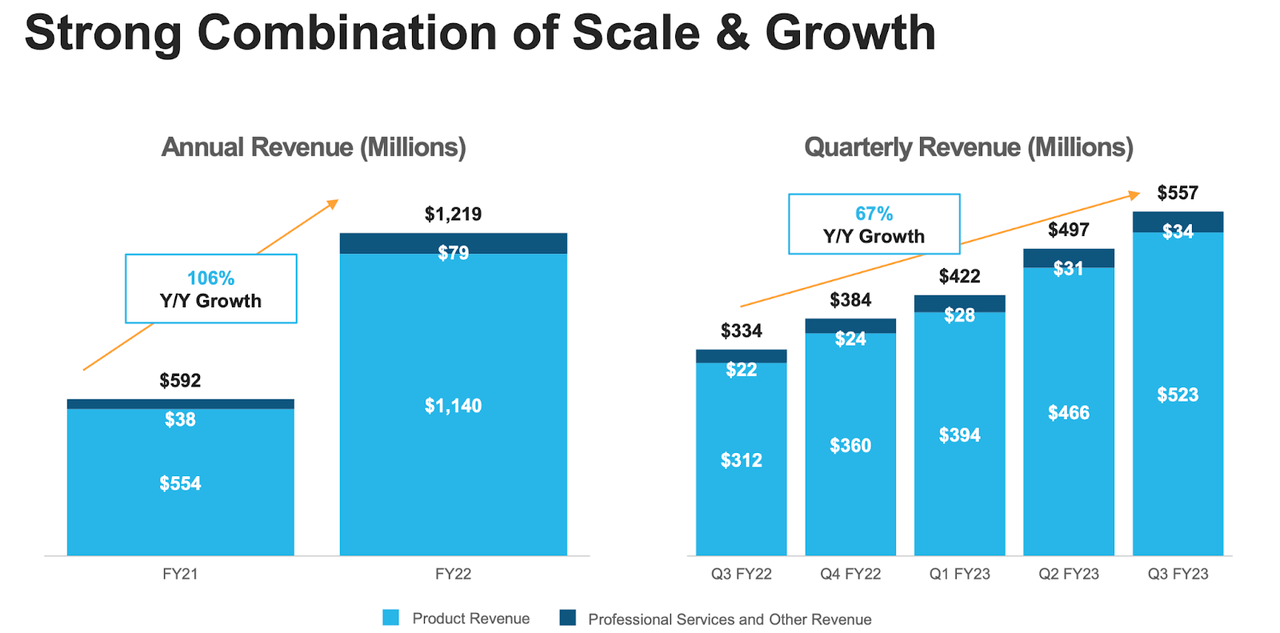

FY23 Q3 Presentation

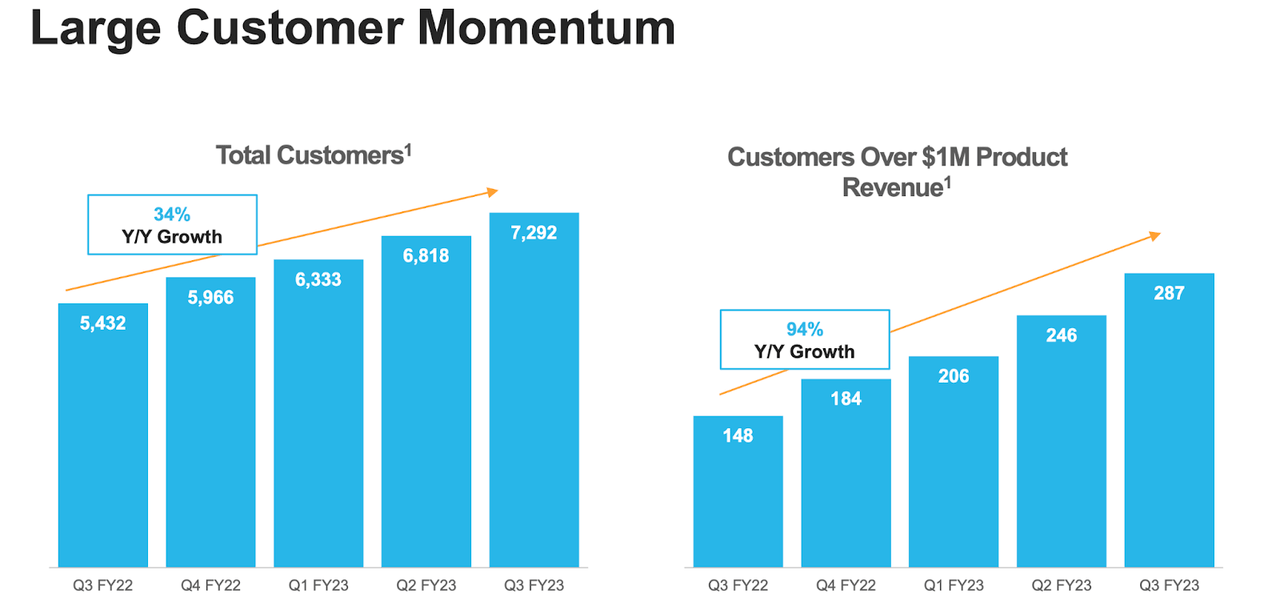

SNOW saw continued customer growth especially among the larger customers, with customers over $1 million in product revenue growing at an astounding 94% clip.

FY23 Q3 Presentation

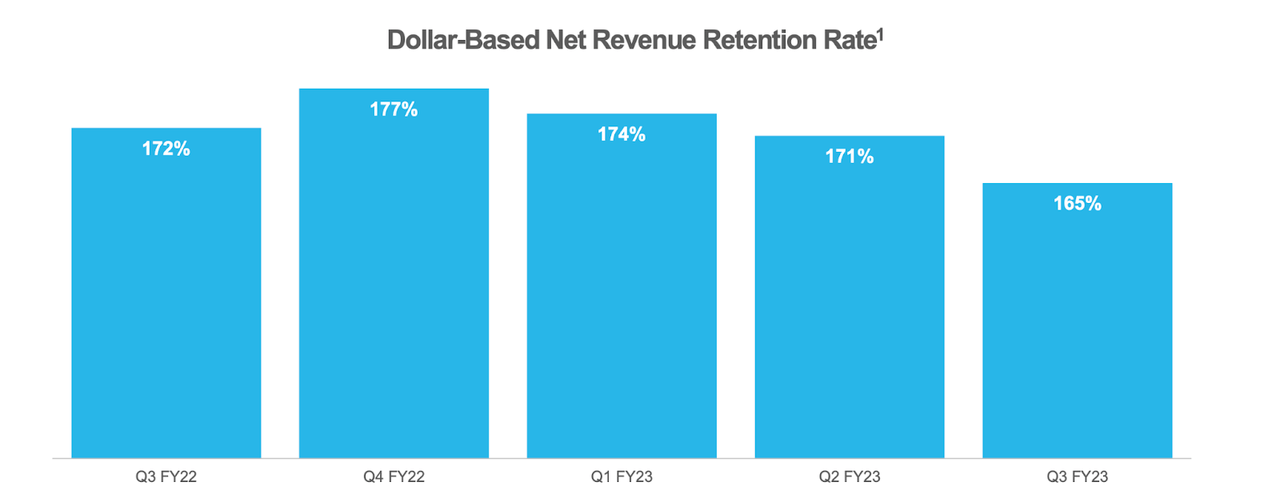

SNOW saw dollar-based net revenue retention dip but remain top tier at 165%.

FY23 Q3 Presentation

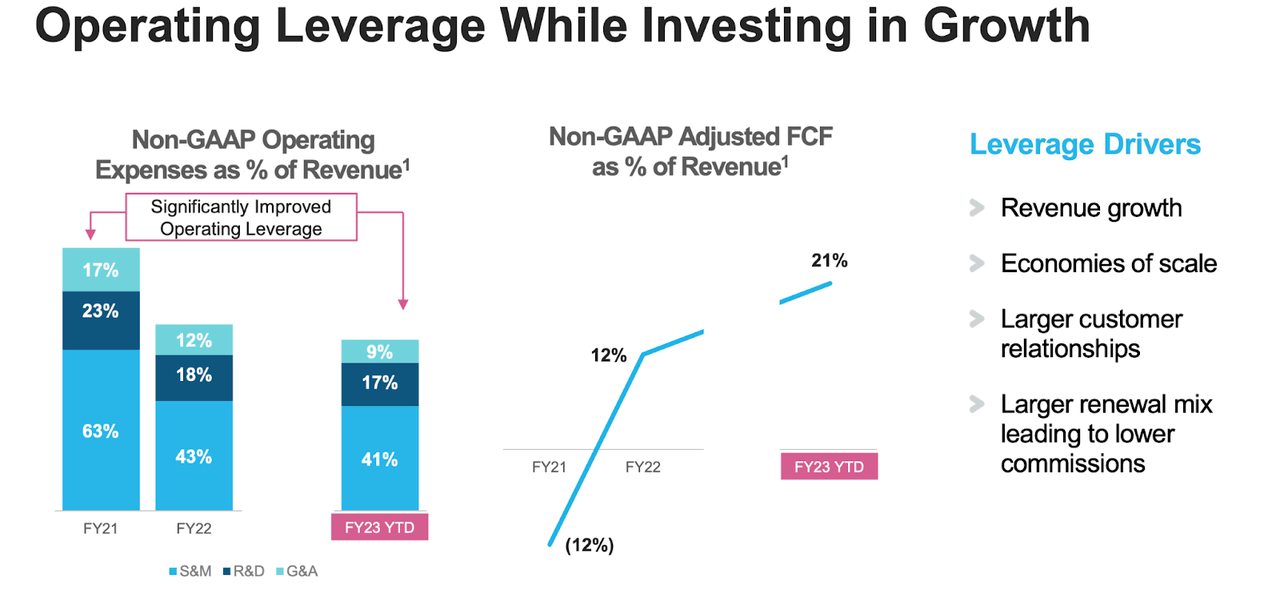

SNOW has driven operating leverage with its free cash flow margin now standing at 21% – compare that with the negative 12% margin 2 years prior.

FY23 Q3 Presentation

SNOW ended the quarter with $3.9 billion in cash versus no debt, representing a strong balance sheet.

Why Did Snowflake Stock Fall After Earnings?

These are stellar results. Why did the stock fall? Blame guidance.

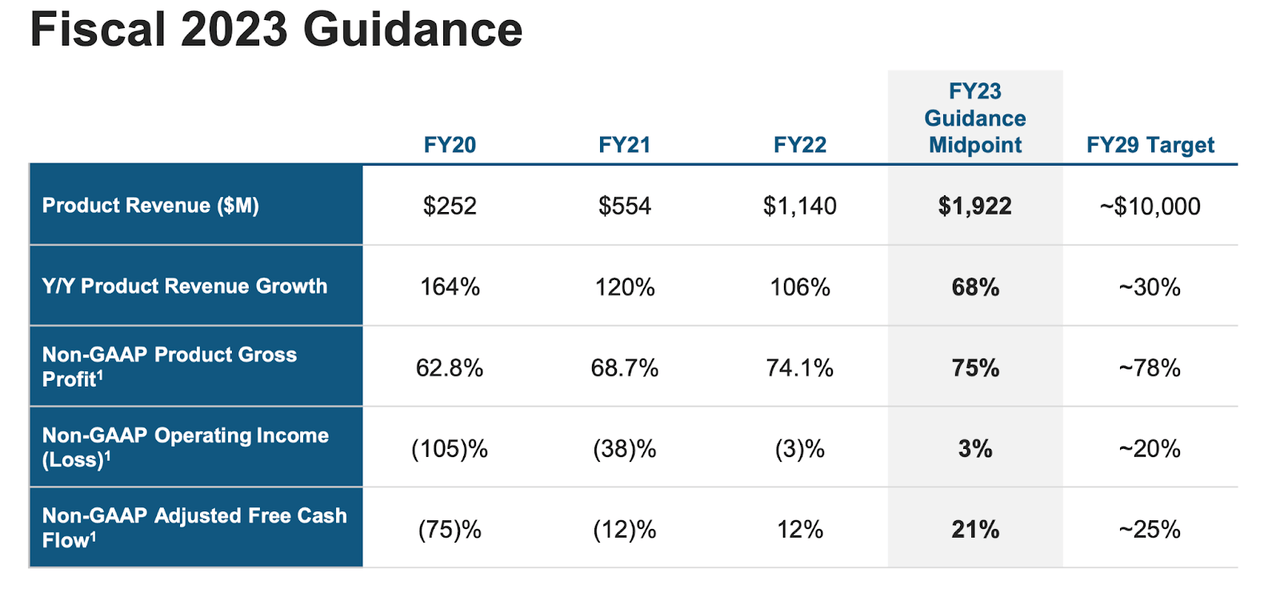

While SNOW had previously guided for $1.91 billion in full-year revenues, SNOW increased that number to $1.922 billion. Perhaps Wall Street was disappointed as the sizable third quarter beat implies fourth quarter revenues will grow by only 3.1% sequentially.

FY23 Q3 Presentation

When your stock trades over 20x sales, such guidance is not enough.

Is SNOW Stock a Buy, Sell, or Hold?

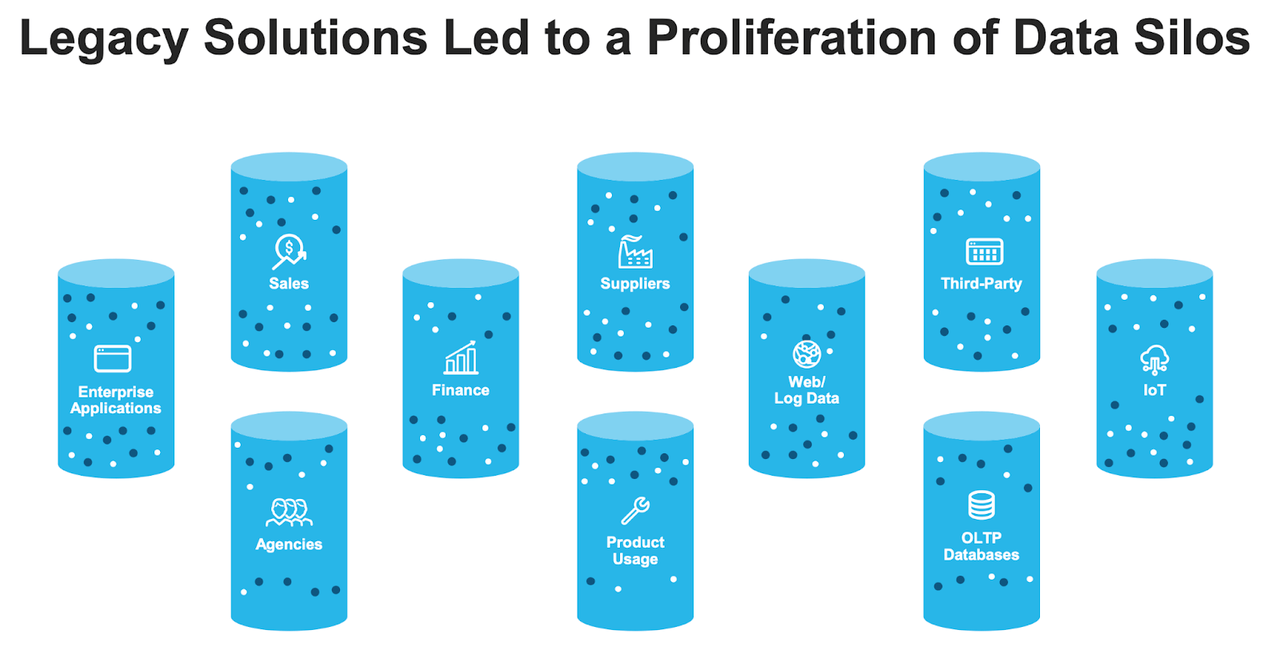

The long-term opportunity remains promising. As the world continues its digital transformation, there is now a proliferation of data silos.

FY23 Q3 Presentation

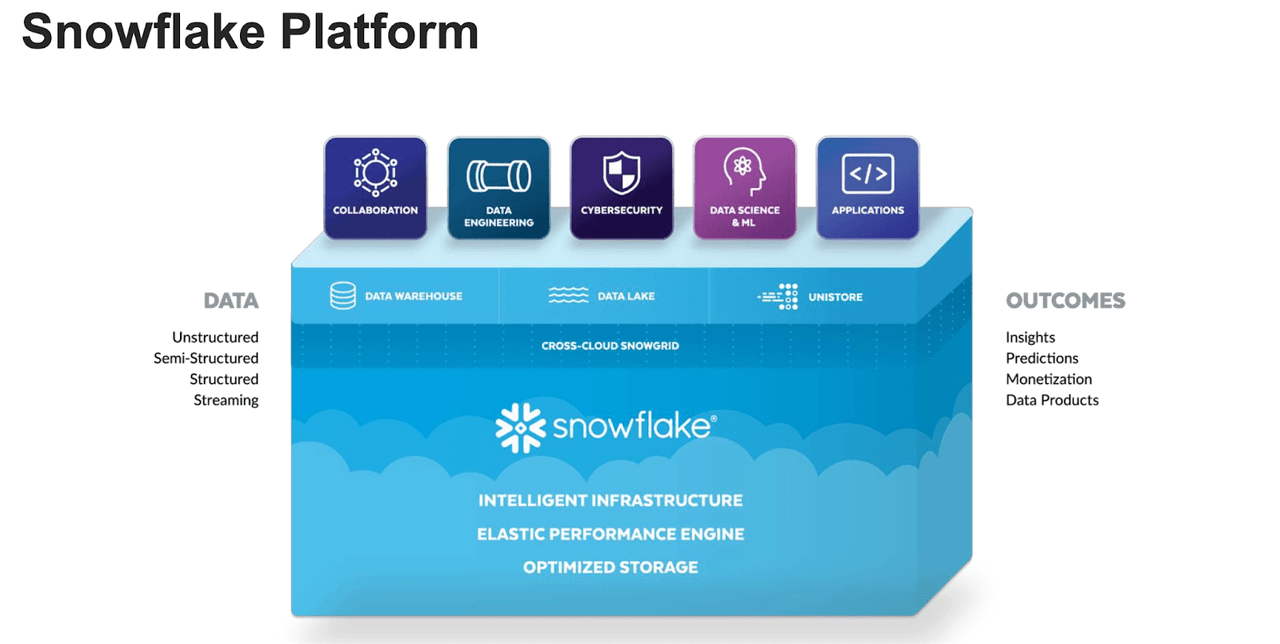

SNOW allows its customers to tap the power of its data, regardless of where it comes from. SNOW can be thought of as a direct investment in the growth of data.

FY23 Q3 Presentation

That is an attractive investment proposition and undoubtedly helps to explain the rich multiple. It also doesn’t hurt that Warren Buffett’s Berkshire Hathaway (BRK.A) (BRK.B) owns an over $800 million stake in the company.

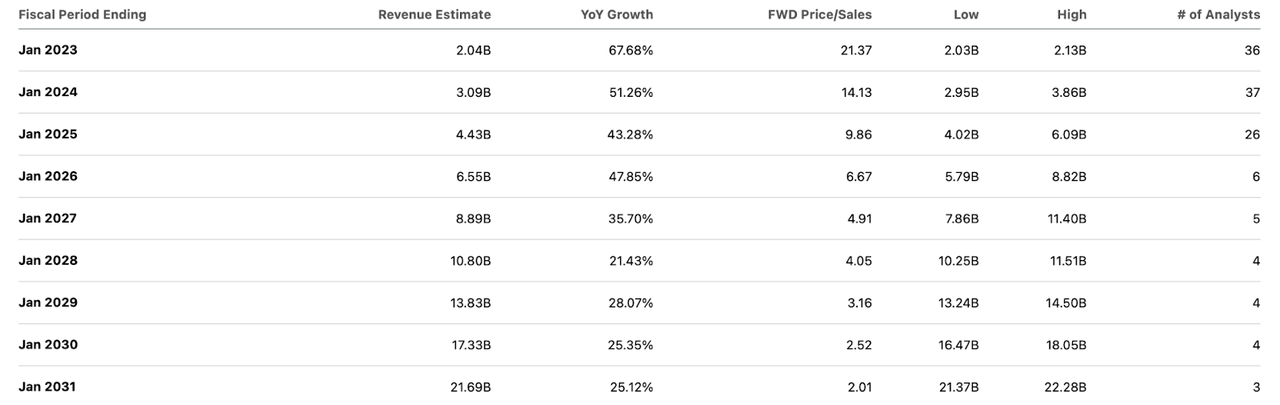

Before the after-hours plunge, SNOW was trading at above 21x this year’s sales. That’s a rich multiple, even for a company expected to grow at a 51% clip the next year. SNOW reiterated long term guidance for $10 billion in product revenues by fiscal year 2029. Consensus estimates remain optimistic, expecting $13.8 billion in total revenues then. I note that professional service revenues make up only 5% to 7% of total revenues, so that does not fully explain the discrepancy. Wall Street analysts think that SNOW is “sandbagging” long-term projections – even if it represents a long 6-year outlook.

Seeking Alpha

There aren’t many companies that are confidently guiding for 31% compounded average growth over the next 6 years even in the face of a recessionary macro environment. Yet SNOW’s valuation arguably already reflects much of that future growth. As I stated in my prior report:

Assuming $10 billion of product revenues by fiscal 2029, 25% long-term net margins, and a 1.5x price to earnings growth ratio (‘PEG ratio’), SNOW might trade at 11.3x sales by then, representing a stock price of $351 per share.

Inclusive of the after-hours plunge in the stock price, this represents 18% compounded annual returns over the next 6 years. That should be enough to beat the market, but is it enough to justify the risk? SNOW is clearly being viewed as a lower-risk name in enterprise tech, but it still is not profitable on a GAAP basis and the underlying assumptions are arguably quite aggressive. It is possible that customers pull back spending in a recession – I’d expect the stock to face significant near-term volatility on any hiccup in growth rates. What’s more, like seemingly every other enterprise tech company, SNOW is faced with competitive threats including that from mega-cap titan Microsoft (MSFT). One could argue that the stock is priced for perfection, even if it is buyable here. As discussed with subscribers to Best of Breed Growth Stocks, I view a portfolio of high quality, beaten-down tech stocks as being the optimal strategy to take advantage of the tech crash. SNOW can fit in as a higher-quality name in such a basket, but I can see the argument that it isn’t quite high enough quality to justify this valuation and it isn’t offering quite enough prospective returns for the risk. Readers are likely to find more compelling investment propositions elsewhere.

Be the first to comment