courtneyk

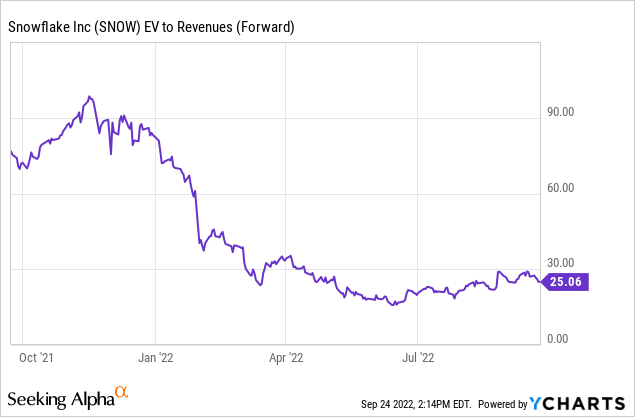

Snowflake (NYSE:SNOW) remains one of the most debated stocks in the market given their unique combination of 80%+ yoy revenue growth and one of the highest valuations at 25x forward revenue.

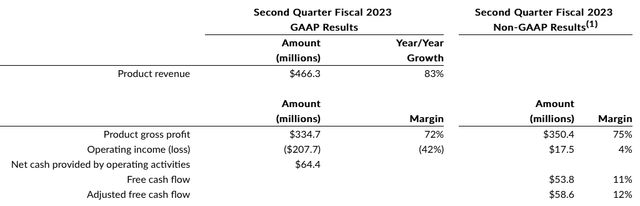

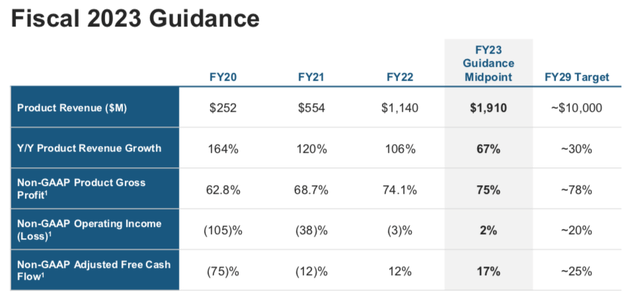

Not surpassingly, the company reported another strong Q2 report with revenue growth of 83% yoy coming in nicely above expectations for 75% yoy. While non-GAAP operating margin remains at 4%, strong gross margins of 75% given the company enough support to expand operating and FCF margins longer-term.

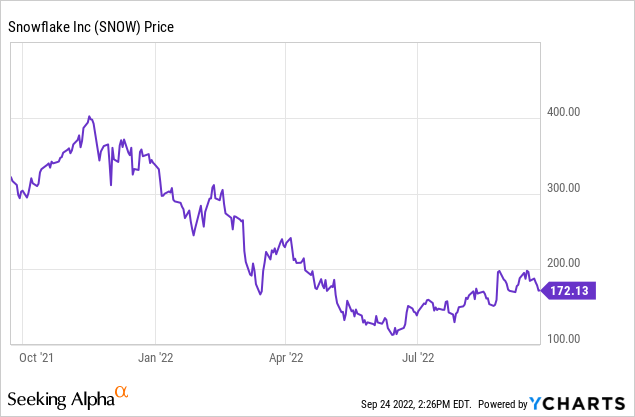

While the stock is up around 10% since reporting earnings in late August, SNOW remains down around 50% year to date. The combination of recession fears, rising interest rates, and a high valuation have caused a lot of volatility in the stock as investors try to figure out the appropriate valuation level.

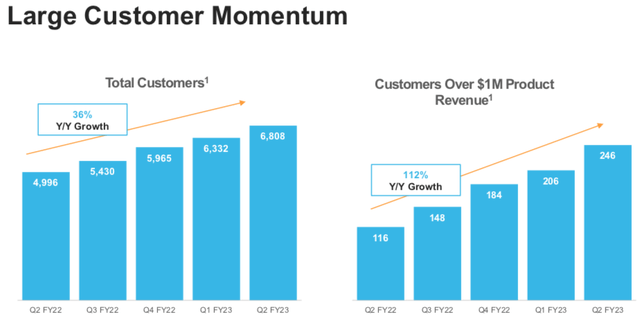

Not surprisingly, the company’s revenue growth will decelerate over the coming quarters given the law of large numbers, as the company’s $2 billion run-rate level is challenging to grow at the current 80%+ level. However, SNOW has seen significant traction within enterprise customers and with dollar-based net revenue retention remaining above 170%, there remains strong underlying demand trends from their existing customer base.

Yes, valuation remains expensive at 25x forward revenue, but the combination of revenue growth likely remaining above 50% for the next two years and operating/FCF margins continuing to expand are unparalleled. Long-term investors should continue to look at picking up shares during a dip and while shares likely remain volatile over the coming quarters, I believe there is a lot of long-term alpha yet to be captured.

Financial Review and Guidance

During Q2, the company reported revenue growth of 83% yoy to $497 million, which came in $30 million above consensus expectations for growth around 75%. In addition, remaining performance obligations came in at $2.7 billion, representing 78% yoy growth.

To no surprise, we should start seeing the company’s revenue growth decelerate considering they are currently at a $2 billion run-rate level and just grew 83% yoy. As I will touch on guidance later on, this deceleration, especially given the ongoing macro challenges, is a natural occurrence for companies that operate at this level of scale.

As revenue growth naturally decelerates, investors will start to place more focus on profitability metrics. During Q2, non-GAAP gross profit remained very healthy at 75% and while non-GAAP operating margin currently stands at only 4%, there is a long run-way of expansion remaining.

Given the company’s software and consumption based operating model, gross margins will continue to be very strong and provide enough support for operating margins to expand over time. Like many other fast-growth software companies, high revenue growth is often met with very high operating expenses. However, as Snowflake continues to scale, they will be able to better leverage their operating expense base, thus helping with margin expansion.

On the bright side, adjusted FCF margin came in at 12% during the quarter, which should be viewed as a positive. While FCF margin likely has room to improve over the coming quarters and years, having a positive margin in the current environment is an achievement.

One of the biggest drivers of growth has been the company’s ability to further penetrate into large enterprise customers. For example, during Q2 total customer growth was 36% yoy to 6,808. However, customers with >$1 million of product revenue grew 112% yoy, demonstrating the company’s ability to drive scale within existing customers.

Typically, the more a customer spends on a software solution, the less likely they are to leave. In other words, by scaling enterprise businesses, revenue attrition may become lower over time, thus providing increased visibility and stickiness to growth.

Additionally, dollar-based net revenue retention came in at 171% during the quarter, which further demonstrates the company’s ability to grow their wallet share within existing customers. In fact, this metric has remained above 170% for the past four quarters, implying that even with only the company’s current customer base, revenue growth would remain above 70%.

For Q3, the company is expecting product revenue of $500-505 million, representing growth of 60-62% yoy. Yes, this does reflect a decent amount of deceleration from the 83% yoy growth reported in Q2, however as I noted above, the company is currently operating at a $2 billion run-rate level. Naturally, growth will decelerate as companies become larger, due to the law of large numbers. Snowflake typically beats their guidance, and I would expect a similar outcome during Q3.

For the full-year, the company is expecting product revenue of $1,905-1,915 million, representing growth of 67-68% and implies a little bit of deceleration in Q4. Combined with my discussion above, the ongoing macroeconomic challenges are weighing on growth a little bit, though the long-term trends remain healthy. Guidance for the full year also includes operating margin of 2% and adjusted FCF margin of 17%.

When asked about the company’s guidance framework, management noted that they remain prudent in their outlook.

Nothing has changed in our guidance philosophy since the time we went public. And what I would say is Q3 of last year was unusually high. So, it’s not a good year-over-year comparison. And as I said, there is uncertainties in the macro environment right now and I think the guidance is prudent that we put out.

Given that management admitted they are being prudent and the deceleration for Q3 is partially being driven by difficult growth comparisons, I remain confident in the company’s underlying growth trends.

Valuation

After reporting earnings, the stock quickly popped almost 30% over the following days as investors applauded the company’s very strong revenue growth during Q2 and prudent guidance. Yes, revenue growth will decelerate, but given the ongoing macro factors, the company’s updated was likely better than initially feared.

However, ongoing weakness in the broader software technology market has caused SNOW to pullback a little bit. Fears of a potential recession and ongoing rising interest rates continue to be headwinds for stocks to start recovering, and SNOW is not immune to these pressures.

With the stock currently trading at 25x forward revenue, SNOW remains one of the most expensive stocks in the market. It is not surprise to constantly see SNOW’s name being brought up as one of the more controversial stocks in the market. Yes, revenue growth was just reported at 83% yoy and FCF margin was 12%, but with valuation among the higher in the market, investors are surely asking who the incremental buyer will be.

Even with a Rule of 40 score coming in at 95 during their most recent quarter, concerns of high valuation can be an impediment for the stock to rise. However, it’s encouraging that SNOW has put out FY29 targets and while this remains 5+ years away, it’s a positive signal regarding the company’s confidence.

For FY29, SNOW is expecting product revenue around $10 billion with product revenue still growing 30% yoy non-GAAP operating margin ~20% and FCF margin ~25%. Since this is so far away, it’s difficult to attribute a valuation to the company’s long-term guidance.

SNOW currently has a market cap ~$55 billion and with net cash/investments of ~$5 billion, enterprise value currently stands ~$50 billion. Just for reference, this implies a FY29 revenue multiple of just 5x, though not many investors are likely looking at the stock this way.

Nevertheless, I do believe investors need to look at the long-term growth potential when framing valuation. Yes, the stock remains among the most expensive in the market at 25x forward revenue, but revenue growth likely remains around 50% over the next two years and would imply a FY25 revenue multiple closer to ~10x. While this is still an expensive multiple to pay, not many companies have a clear path of 30%+ revenue growth for the next 5+ years on top of strong margin expansion potential.

Given the stock’s relative weakness over the past few weeks, I believe long-term investors could find this dip as an attractive entry point. Admittedly, SNOW will likely trade with heightened volatility over the coming quarters as investors battle with recession fears, rising interest rates, and a high valuation. Though I do believe those who stick through this volatility will be rewarded long-term.

Be the first to comment