Andrea Verdelli

NIKE reports their fiscal Q1 ’23 financial results after the closing bell on Thursday, September 29, ’22.

The sell-side consensus is expecting $0.94 in earnings per share on $12.3 billion in revenue for expected year-over-year growth of -19% and +1% respectively.

Fiscal Q2 ’22 per the current estimates is expecting $0.74 in EPS on $12 billion in revenue for expected growth of -11% and 6%, respectively.

The big challenge with Thursday night’s release is that Q1 ’23 is still facing a tough compare from Q1 ’22 when NIKE revenue grew 16% y.y, operating income +20%, and EPS +22 y.y.

The nice thing is NIKE’s next three quarters Q2 ’23 through Q4 ’23 face the following compares from 2022’s fiscal year:

| revenue | op inc | EPS | |

| q2 ’22 | +1% | -13% | +6% |

| q3 ’22 | +5% | -3% | -3% |

| q4 ’22 | -1% | -23% | -3% |

Source: valuation spreadsheet

Let’s Look at NIKE EPS and revenue revisions:

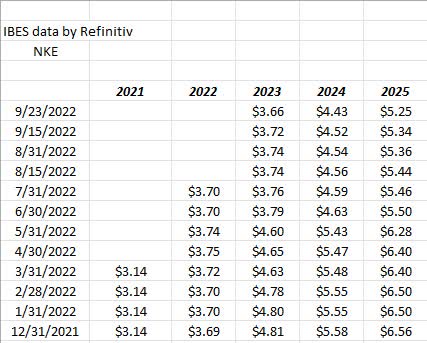

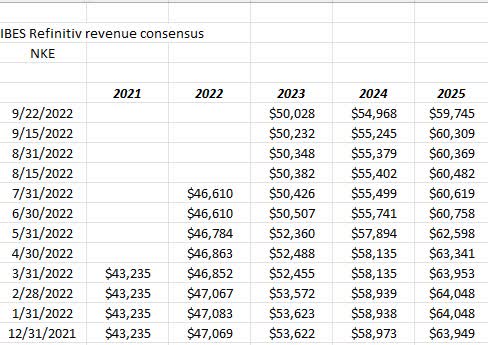

Nike EPS revisions (IBES data by Refinitiv) NIKE revenue revisions (IBES data by Refinitiv)

Here’s a table summarizing the erosion in NIKE’s EPS/revenue estimates:

| fiscal ’23 | fiscal ’24 | fiscal ’25 | |

| EPS | -24% | -20% | -20% |

| revenue | -7% | -7% | -7% |

This table shows the degree of negative revisions on EPS and revenue since 12/31/21 for fiscal years ’23, ’24, and ’25.

Full-year 2023 is currently expecting 12-month EPS growth of -3% on expected 7% revenue growth, and those expected growth rates will likely come down further this week.

Technical analysis:

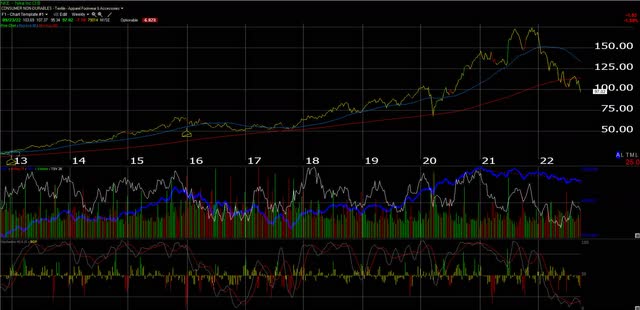

NIKE weekly chart (Worden Telechart)

This weekly chart shows the stock trading below both its weekly 200-day moving average and its early July ’22 low of $99 per share.

The stock is now oversold on a weekly chart but I also can’t tell you it won’t go significantly lower if we see a sharp market decline in the next 10 days.

The Covid, March ’20, lows were near $60 per share.

Valuation:

| Valuation metric | NKE at $97 per share |

| Avg exp 3-year EPS gro | 12% |

| Avg exp 3-year rev gro | 9% |

| Price-to-sales | 2.5x |

| PE ’23 and ’24 | 27x and 22x |

| Price-to-book | 10x bv |

| Price-to-cash-flow | 30x |

| Price-to-free cash flow | 35x |

| free-cash-flow yield | 3% |

| Morningstar intrinsic value | $133 |

Source: valuation spreadsheet

Summary / conclusion: Given the current pall over the US equity markets and around the globe, there is always the likelihood of more downside for what is one of the globe’s great global brands.

However, for a stock that is always expensively valued, bear markets are a great time to buy great brands at discounts to their fair value.

Clients currently own a small NIKE position, but the goal is to make it a larger position as fear grips the capital markets and distorts business valuations.

When things get really grim, the business valuation doesn’t change nearly as much as the stock valuation so you have to think about buying a great business at a discount.

NIKE isn’t without issues. Europe and the issues around Ukraine and the expected crushing price of natural gas this winter are going to decimate (or are expected to decimate) consumer spending, which would likely impact NIKE footwear and apparel. Western Europe is 27% of total NIKE revenue and 64% of NIKE EBIT (or operating income) while China is 13% and 22% of the same metrics, respectively.

Readers don’t often get a chance to buy a world-class brand down 44% from all-time highs as NIKE stock is today. If the US equity market gets grim, know which stocks you want to own in advance.

Be the first to comment