Sundry Photography

Tech and growth stocks continue to be under pressure from skittish investors as we made a very important retest of June lows last week. That has caused companies that intersect both tech and growth to remain under pressure, but not all tech growth stocks are created equal.

One stock that remains at the top of my list for those that I think will lead us out of this bear market is cloud data company Snowflake (NYSE:SNOW). I covered why I like the business model in my last update, so we needn’t go through that here. But my last piece in January was obviously just at the beginning of what would morph into this nasty bear market of 2022, so Snowflake has been obliterated since then. As an aside, this sort of thing is why it’s always critical to have a stop loss level in place in case a trade goes against you.

Back to today, Snowflake is outperforming its peers, and just about everything else, in the past couple of months. In fact, it is my belief Snowflake is already in an uptrend, and below, I’ll lay out why I think Snowflake is a strong buy in this terrible market.

Evidence of an uptrend in Snowflake stock

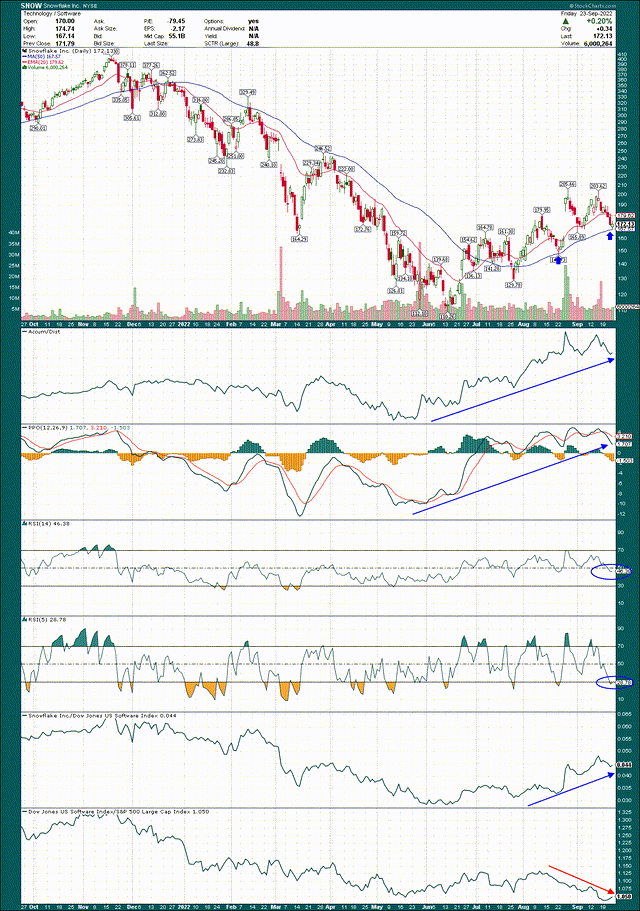

We’ll start with a look at the daily chart to get a sense of the price action since the broader market June low, given we’re retesting those lows now.

On the price chart we can see why I said I believe Snowflake is in an uptrend; we have a series of higher lows, and the stock has bounced beautifully off the 50-day simple moving average. That’s the behavior of a stock in an uptrend, with the only note of caution at the moment being the stock made a double top at $203/$205. That’s the level it needs to clear to confirm it’s in an uptrend, but that’s about thirty bucks over where we are today.

The good news outside of the chart itself is that the indicators are firmly in the bullish camp, in my view. This increases the odds of a retest and eventual break of that relative high at ~$204. The accumulation/distribution line remains quite elevated, even during selloffs. That means investors are buying dips, rather than selling rips.

The PPO is waffling about but it’s firmly in bullish territory, as you want to see during an uptrend. The 14-day RSI remains over 40, which is key during bull moves, as moves below 40 indicate there’s likely too much bearish pressure to sustain an uptrend. And finally, the 5-day RSI is in oversold territory as of Friday, meaning that in conjunction with the 50-day SMA test, the odds of a bounce here are much higher.

Longer-term, relative strength is outstanding for Snowflake against its peers, albeit with a peer group that continues to suffer. I’ve long held that software will be one of the groups that leads us out of this bear market, but that certainly has not occurred yet. The great news is that Snowflake is powering higher in the face of a terrible overall market, and software stocks that have been awful. Imagine how well this stock will do with a better market and strong software stocks.

An enormous long-term opportunity

Snowflake’s position in the mega-trend of taking data from disparate sources and combining them to help businesses solve problems is quite enviable. Businesses today use data to make decisions about where, how, and when to interact with customers, as well as internal processes, more than ever before. The efficacy of doing so is well-proven, and that means leaders in collecting and aggregating this data stand to do extremely well in the years to come. That’s what Snowflake is doing, and why I think this one has legs for a very long time.

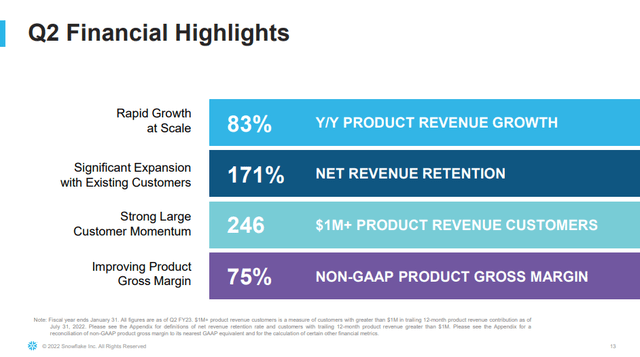

These stats from the most recent earnings report are very impressive; growth of 83% in the top line, 171% net revenue retention, 75% gross margins. These are all tremendous, and indicative of a leader. But more impressive is that Snowflake has continued to throw up numbers like this for a long time already, and it has many more years of it to come, if analyst estimates are to be believed.

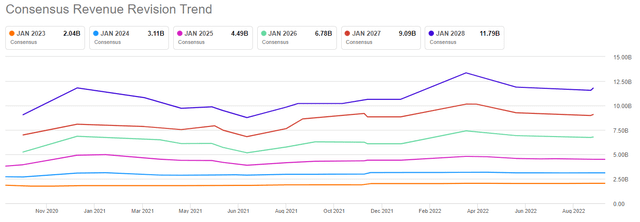

You may look at this and think there should be more upward movement in these numbers. However, consider the malaise the global economy has gone through in the past two years, and continues to face today; the fact that these estimates are anywhere close to what they were a year ago is evidence of Snowflake’s staying power. We’re starting to see early movement higher in revenue estimates, as out of the past 29 revisions, 25 of them were higher. There aren’t many companies getting upward revisions these days, and investors should ignore that at their own peril.

Snowflake should generate about $2 billion this fiscal year, which ends in January, and that’s up nicely from all prior years as the company grows by leaps and bounds. But you shouldn’t buy this stock based on $2 billion in revenue; you buy this stock because the opportunity is massive.

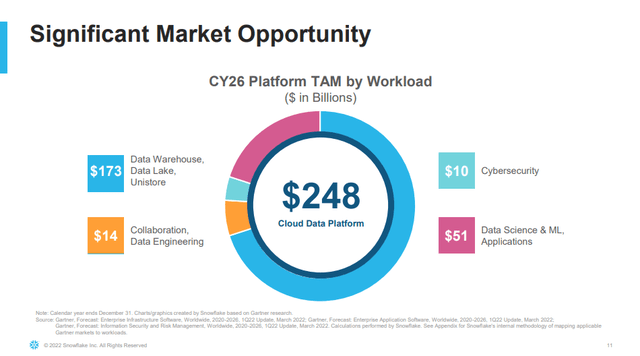

Snowflake reckons its total addressable market is $248 billion by 2026. Obviously there are a lot of companies vying for a piece of this pie, but at $2 billion of annual revenue, Snowflake has less than 1% of projected market share at the moment. And with the total pie growing every year, and Snowflake taking larger amounts of that pie, it’s no wonder analysts see 40% or 50% growth rates ahead.

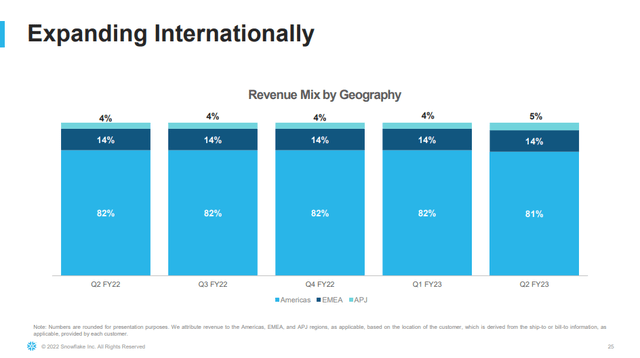

Snowflake is still a US-centric company, as we can see below.

Companies across the globe need data to compete and that opens up even more revenue opportunities as the years go on. It will almost certainly always derive most of its revenue from the US, but the international market is very small for Snowflake right now. Over time, I would expect that market to open up and for Snowflake to have further opportunities to boost its revenue. In other words, this is not a US story; the cloud data mega-trend is global.

Looking forward

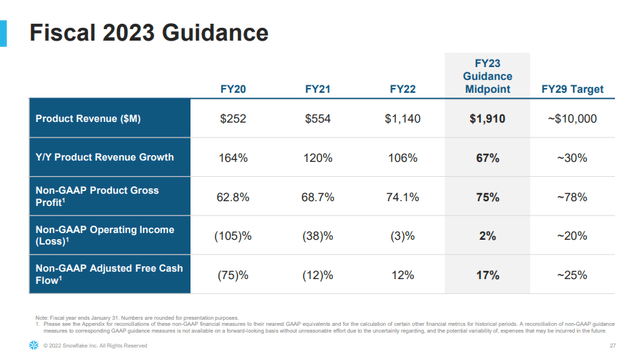

Snowflake provides long-term guidance, which is great for those of us that want to analyze the stock. Here’s the latest iteration of that guidance.

The company sees $10 billion in revenue by fiscal 2029, which is just over six years from now. That implies average revenue growth of ~32% between here and there, but given the company’s history and the runway it has today, that number looks low. In fact, analysts have fiscal 2029 revenue at ~$15 billion, and I think it’s going to be much closer to the latter than the former.

That’s good news because more is better when it comes to revenue, but the guidance for operating income above of 20% of revenue also has upside. Software companies have notoriously high margins because their product margins are generally in the 70s (or better), but SG&A is largely unchanged based upon higher revenue. In other words, if a software company sells to 100 companies or 1,000 companies, it doesn’t necessarily change the cost structure that much. So more and more of that incremental revenue flows to the bottom line through operating leverage, and given that, if there’s upside to revenue, there’s upside to operating margins.

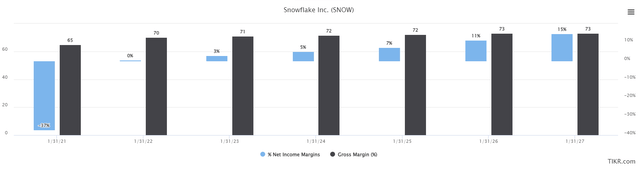

Below we have estimates for gross margins and net income margins for the next several years to illustrate this.

Fiscal 2021 saw 65% gross margins, but -37% net income margin. Leverage improved significantly last year, and operating margin was 0% on 70% gross margin. I won’t read the chart to you but basically, every year net income margin improves not because of gross margin expansion, but because of leveraging of costs. The higher revenue goes, the quicker this process. It won’t be long before Snowflake is making a lot of money.

Valuations across tech and growth – and just about everything else – have come way down this year. Some stocks will likely never see the valuations they enjoyed in 2021, but for leaders like Snowflake, this indiscriminate selling has created opportunities for the bold.

We’ll use price-to-sales given earnings aren’t meaningful at the moment, and we can see above just how cheaply Snowflake is valued today. The stock goes for 22X forward sales, and while I can hear the groans of Benjamin Graham followers, the fact is that leading software companies enjoy multiples much higher than 22X sales. Snowflake is an indisputable software leader, and I think investors will look back on this period and wish they’d bought at 22X forward sales.

I said Snowflake was cheap back in January, and at the time I felt it was. I was wrong, and I won’t try to get around that fact. Snowflake is even cheaper today, and has shown throughout 2022 it can continue to grow in the face of whatever the economy throws at it.

The two risks I see are with respect to the valuation, and competitive threats. On the valuation, if we continue to see sharply rising rates and/or risk-off behavior from investors, stocks like Snowflake are going to struggle when it comes to valuations. This has been true in 2022, and it could continue; just because we’ve had a tough time this year doesn’t mean it cannot get tougher.

The second one I see as less of a threat, comparatively. This is partially because the pie of potential revenue grows every year, but also because Snowflake has a huge head start in the space. It’s already a massive player and very well respected, with its dozens of marquee clients. While competition is always going to be a threat, in this case, I see it as less so than needing the valuation to remain robust over time.

We have a bullish looking chart, a stock that is cheap on a relative basis, and one that is leading its peers by a mile. Snowflake is one you can buy and forget, and right now, it looks very attractive to me.

Be the first to comment