FG Trade/E+ via Getty Images

Investment Thesis

Snap (NYSE:SNAP) continues to find little love with investors. And I believe that in this instance, the market is right to take this stance on Snap. In fact, I’ll venture to say that although Snap is moving directionally down, still too much hope being priced in given all the macro uncertainty.

Hence, I continue to rate this stock a sell.

My Background With Snap

Author’s coverage

Back in April, I rated Snap a sell. I believed at the time that the story had changed substantially and that the stock would struggle to find support. Since that time, over the ensuing few months, Snap is down 50%.

That being said, I don’t believe that outlook has improved. If anything we are getting increasing glimmers that macro environment is plaguing advertising companies more significantly than we previously expected.

Snap’s Revenue Growth Rates Slow Down

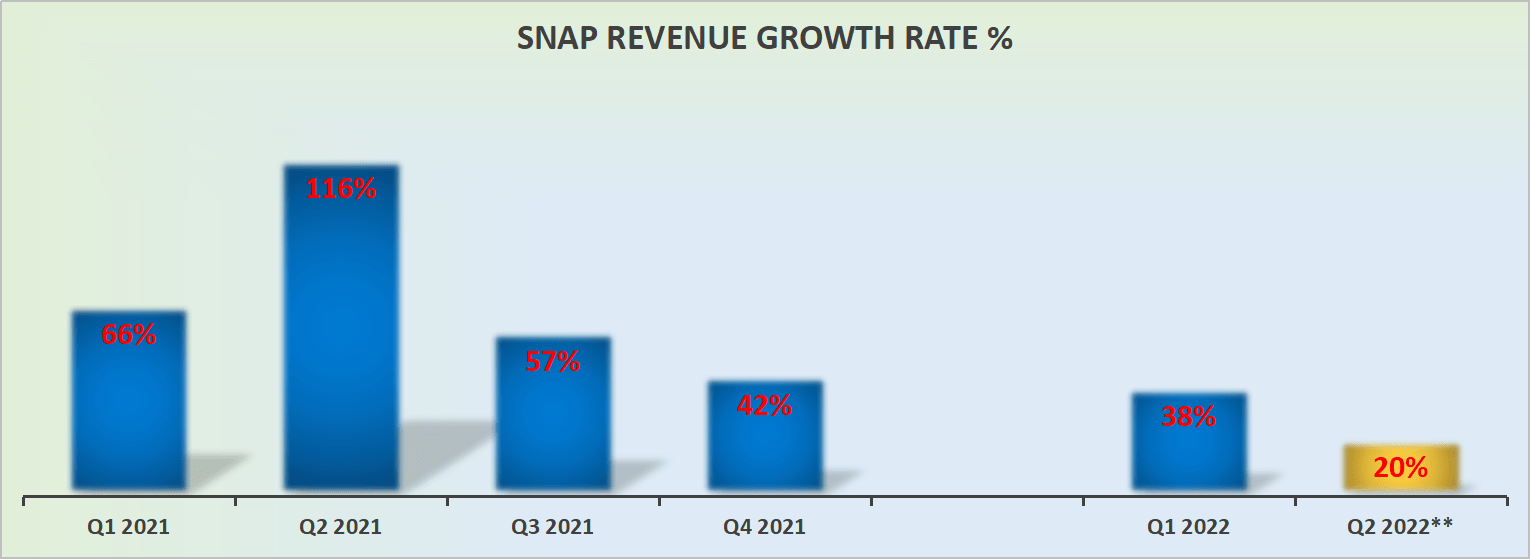

SNAP revenue growth rates

Recall that Snap was one of the first companies to come out early into the quarter and let their investor base know that they were struggling to grow in line with their previous guidance.

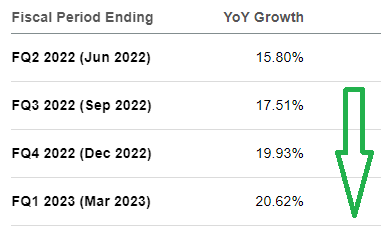

SNAP revenue estimates

Even though analysts have now downwards revised their Q2 revenue estimates, analysts remain demonstrably bullish that Q2 will mark the low point of 2022’s revenue growth rates.

In fact, looking out to Q3 and beyond analysts are expecting that Snap will manage to shake off this malaise and be back to 20% CAGR in no time.

However, I don’t believe that to be the case, and here’s why.

Thinking Through the Environment We Are In

Any serious investor in the advertising space knows the name Laura Martin of Needham. She is arguably the biggest bull when it comes to ad tech companies. She is incredibly insightful and extremely experienced.

Yet recently, in a note to clients, Needham notes that Meta (META) is struggling under the weight of competition. But one thing we can be sure about, Meta knows better than most companies how to monetize advertising. Can we say the same about Snap?

Ultimately, the environment that we are in is affecting all advertising companies, it’s not only about Meta. At its core, it’s a question of what level of advertising budget will companies support?

After all, we know that there is a myriad of macro headwinds that businesses are having to navigate right now, from higher interest rates, inflationary concerns, higher energy costs, and geopolitical tensions, to name a few.

Indeed, Barclays’ Ross Sandler also notes a challenging environment and lower spending across the whole advertising space.

To put it concisely, this is not the sort of environment that advertising companies will perform well.

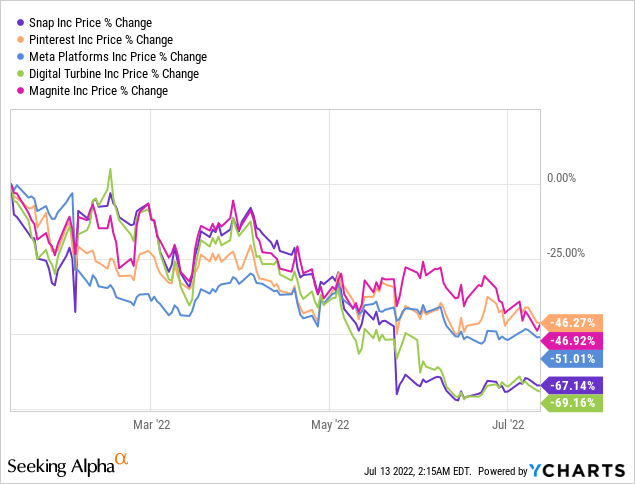

Furthermore, as you can see below, the market is signaling this too.

I’ve chosen a broad range of advertising companies, from social media platforms to ad tech companies, yet the performance is largely the same. The market has wanted nothing to do with this space in the past 6 months.

And I declare that the market has got this one right, particularly when it comes to Snap.

SNAP Stock Valuation – 4x Next Year’s Sales

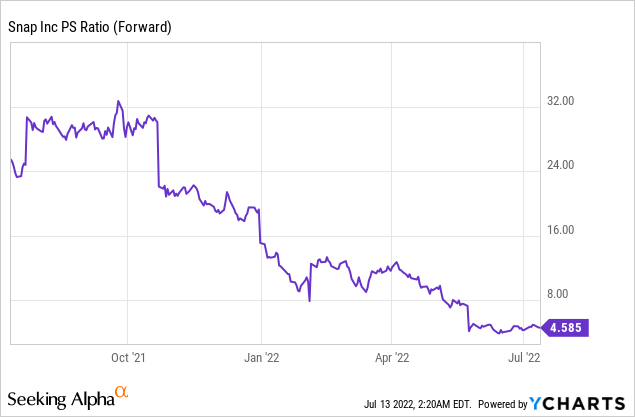

Snap has never been a particularly cheap stock. And there’s no question that being priced at 4x next year’s sales is a massive drop in its multiple relative to the same period a year ago.

As you can see above, Snap was priced at 30x forward sales this time last year. Right now, looking out to 2023, Snap is priced at 4x next year’s revenues.

However, keep this in mind. Multiples don’t have to stop compressing just because they are down a lot.

Until investors believe that they have some sort of confidence in Snap’s near-term sustainable growth rates, Snap will struggle to find a meaningful bid in the market.

The Bottom Line

To sum it up, there’s too much risk in investing in Snap, as the stock remains overvalued relative to near-term prospects.

Investors have been indoctrinated into always buying the dip. Previously, this trading strategy worked out very successfully and investors didn’t have to give much consideration to the environment that advertising companies were in.

And that made a lot of sense. Over the past 10 years, buying every dip worked out tremendously well. But this time it’s different. Snap today is a lot more mature and with fewer secular tailwinds to its back and a lot of structural headwinds and competition. In short, avoid this name.

Be the first to comment